This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC391

for the current year.

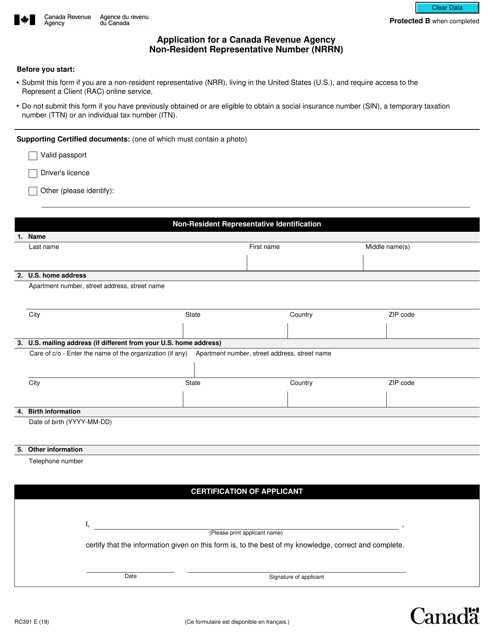

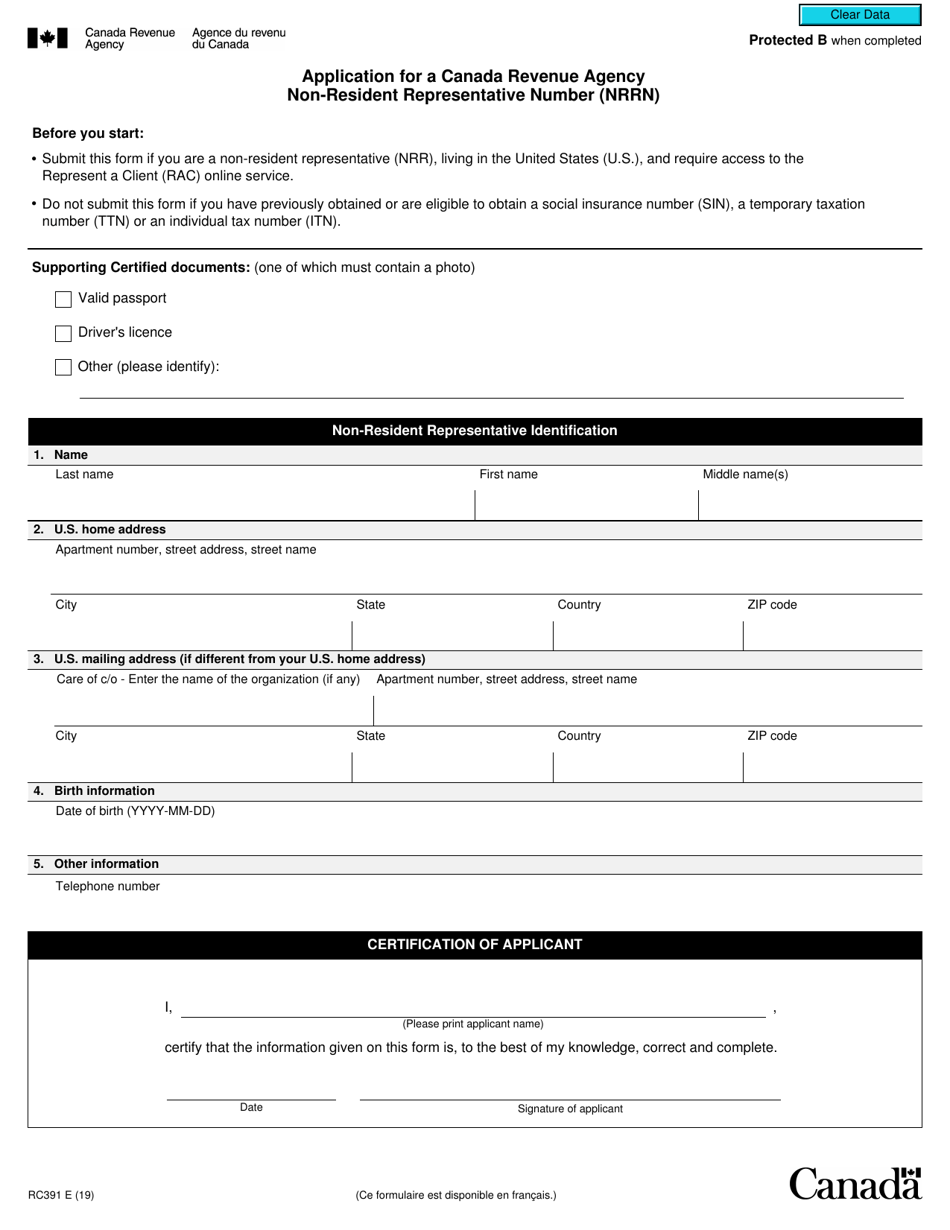

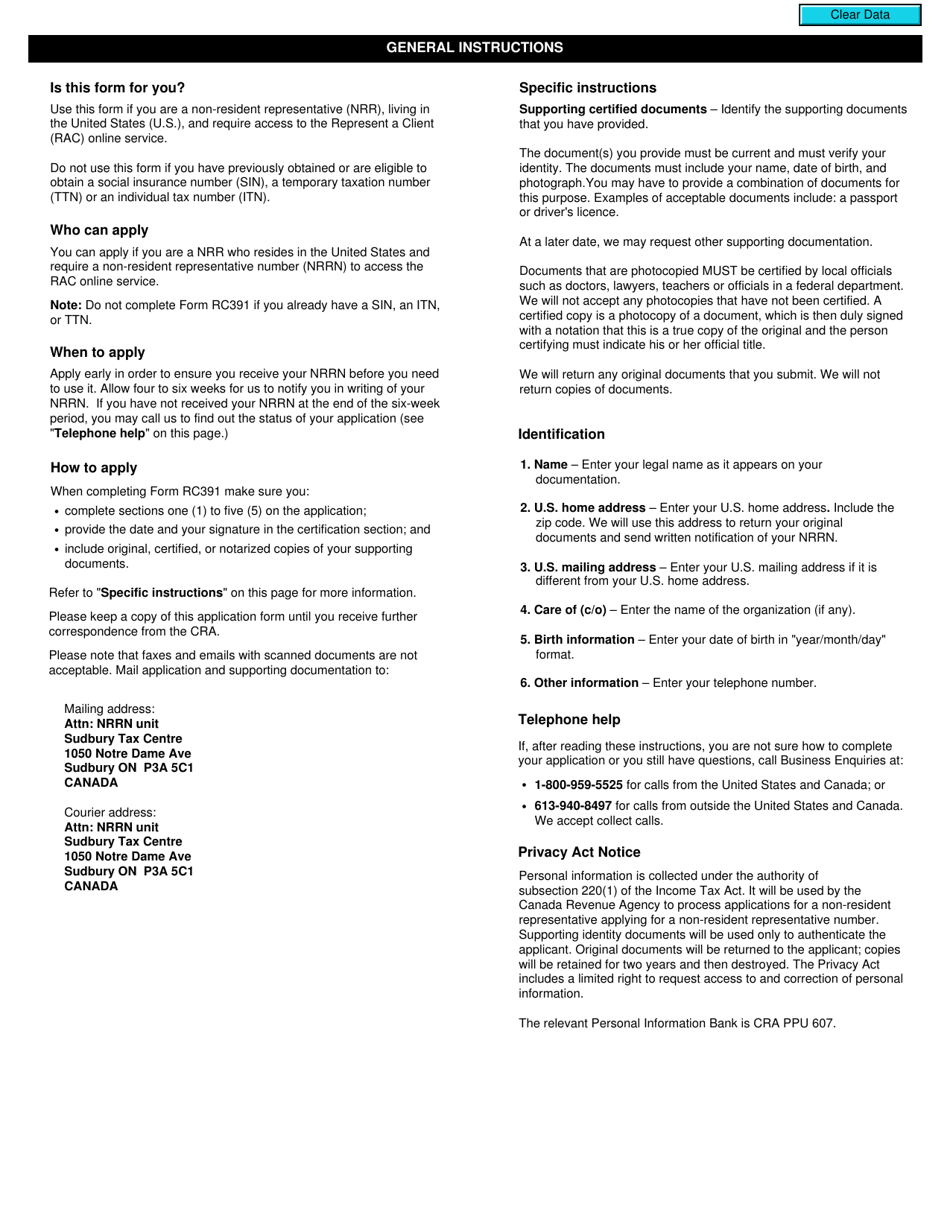

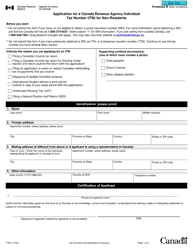

Form RC391 Application for a Canada Revenue Agency Non-resident Representative Number (Nrrn) - Canada

Form RC391, Application for a Canada Revenue Agency Non-resident Representative Number (NRRN) is used to apply for a non-resident representative number in Canada. This number is required if you are a non-resident taxpayer or a non-resident estate, trust, corporation, or partnership that is required to file a Canadian tax return. It allows you to appoint a representative to act on your behalf for tax matters in Canada.

The Form RC391 Application for a Canada Revenue Agency Non-resident Representative Number (NRRN) in Canada can be filed by non-resident individuals or entities who need a Representative Number for tax purposes.

FAQ

Q: What is Form RC391?

A: Form RC391 is the Application for a Canada Revenue Agency Non-resident Representative Number (NRRN) in Canada.

Q: Who should use Form RC391?

A: Form RC391 should be used by non-residents who need to appoint a representative in Canada for tax purposes.

Q: What is a Non-resident Representative Number (NRRN)?

A: A Non-resident Representative Number (NRRN) is a unique identifier for the representative appointed by a non-resident taxpayer in Canada.

Q: Why would someone need to apply for an NRRN?

A: Someone would need to apply for an NRRN to authorize a representative to act on their behalf for tax matters in Canada.

Q: Are there any fees to apply for an NRRN?

A: No, there are no fees to apply for an NRRN.

Q: How long does it take to process Form RC391?

A: The processing time for Form RC391 may vary, but it typically takes several weeks.

Q: What supporting documents are required when submitting Form RC391?

A: The required supporting documents may vary depending on the specific circumstances, but generally include identification documents and a completed authorization form.

Q: What should I do if I have questions about Form RC391?

A: If you have questions about Form RC391 or the application process, you can contact the CRA directly for assistance.