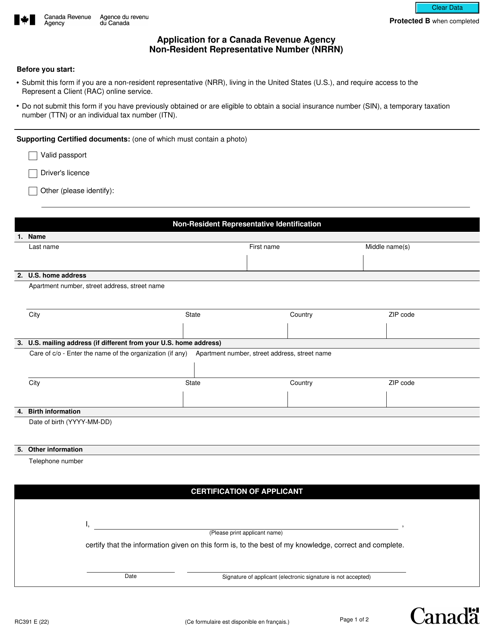

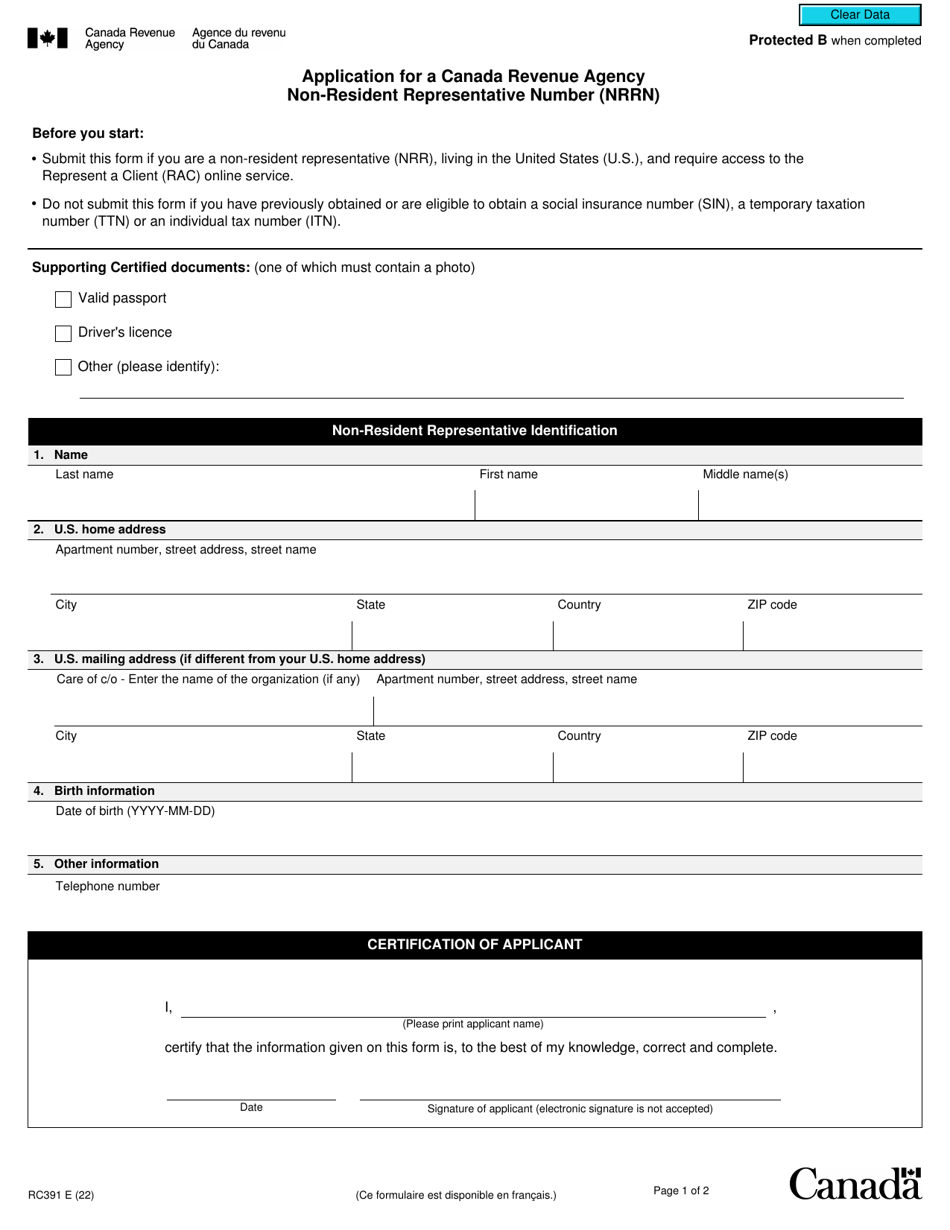

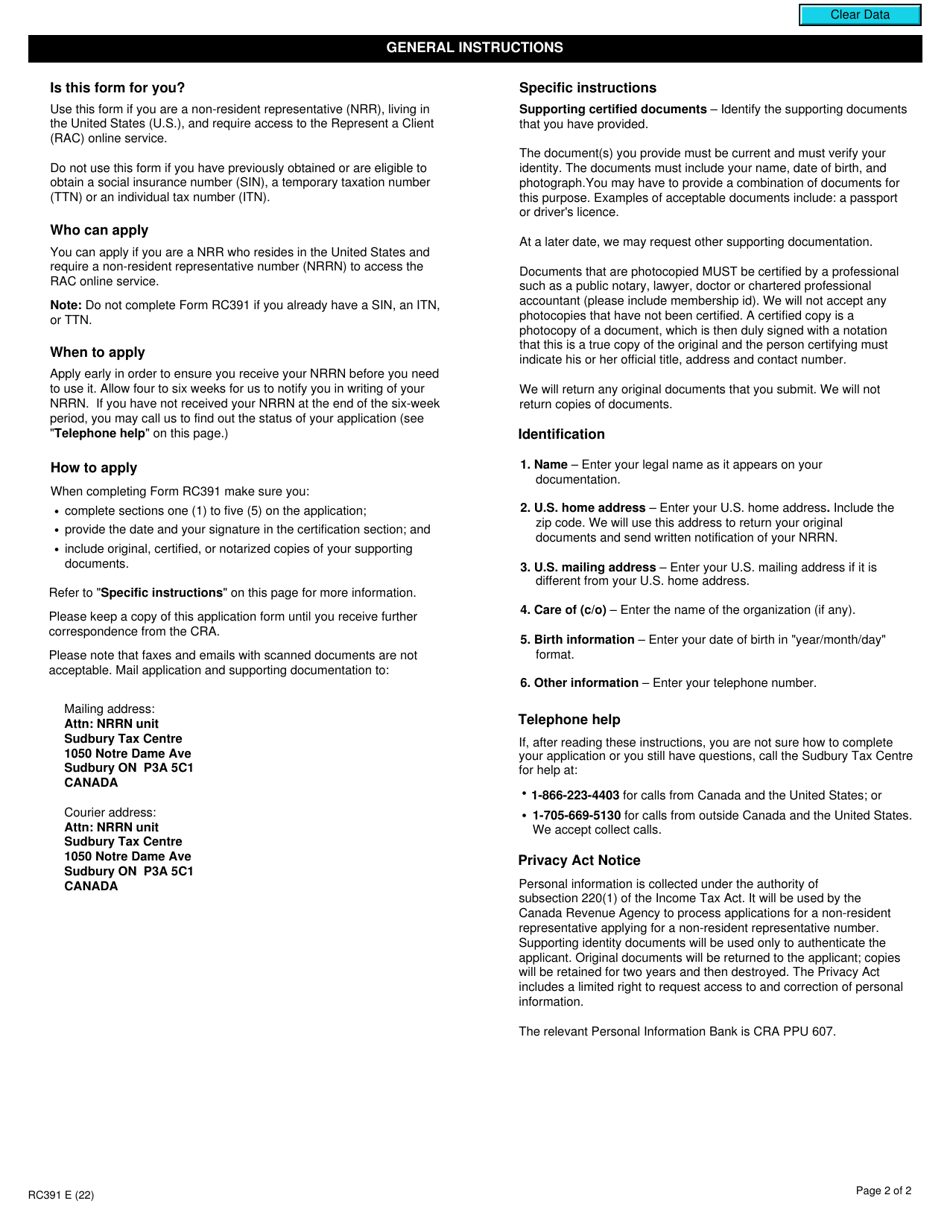

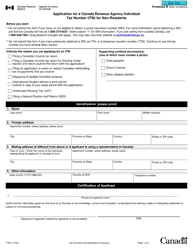

Form RC391 Application for a Canada Revenue Agency Non-resident Representative Number (Nrrn) - Canada

Form RC391, Application for a Canada Revenue Agency Non-resident Representative Number (NRRN), is used by non-residents of Canada who wish to appoint a representative to act on their behalf for tax matters with the Canada Revenue Agency (CRA). The NRRN is a unique identifier that allows the representative to communicate with the CRA on behalf of the non-resident. It is primarily used to facilitate tax compliance and communication between non-residents and the CRA.

The Form RC391 Application for a Canada Revenue Agency Non-resident Representative Number (NRRN) should be filed by non-resident individuals or entities that wish to appoint a representative in Canada for tax purposes. This form allows them to establish their authorized representative and ensure proper communication with the Canada Revenue Agency (CRA).

Form RC391 Application for a Canada Revenue Agency Non-resident Representative Number (Nrrn) - Canada - Frequently Asked Questions (FAQ)

Q: What is an NRRN and why do I need it?

A: A Non-resident Representative Number (NRRN) is required for non-residents who want to authorize a representative to deal with the Canada Revenue Agency (CRA) on their behalf. It allows the representative to access the non-resident's tax information and handle tax-related matters.

Q: Who is eligible to apply for an NRRN?

A: Non-residents who are required to file a Canadian income tax return or have to fulfill obligations under the Canadian tax laws but cannot personally do so can apply for an NRRN.

Q: How can I apply for an NRRN?

A: You can apply for an NRRN by completing and submitting Form RC391 to the CRA. The form requires you to provide personal and contact information, as well as details of your representative.

Q: Are there any fees associated with applying for an NRRN?

A: No, there are no fees for applying for an NRRN. It is a free service provided by the CRA.

Q: How long does it take to process the NRRN application?

A: The processing time for an NRRN application varies, but it typically takes around 8 to 10 weeks. It is advisable to submit the application well in advance to ensure timely processing.

Q: Can I authorize multiple representatives with the same NRRN?

A: Yes, you can authorize multiple representatives to deal with the CRA using the same NRRN. However, each representative must be listed on the application form.

Q: Can I apply for an NRRN if I am a resident of Canada?

A: No, the NRRN is specifically for non-residents of Canada who need to assign a representative to handle their tax matters.

Q: Can I cancel or update my NRRN?

A: Yes, you can cancel or update your NRRN by completing and submitting a new Form RC391 to the CRA. Make sure to provide the updated information or indicate the cancellation request clearly.