This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7271

for the current year.

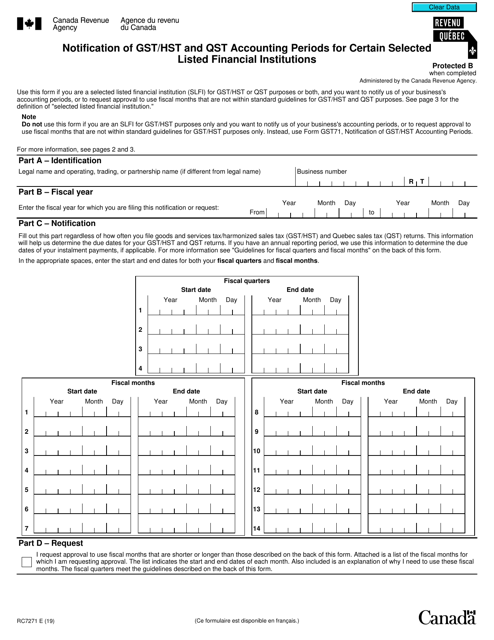

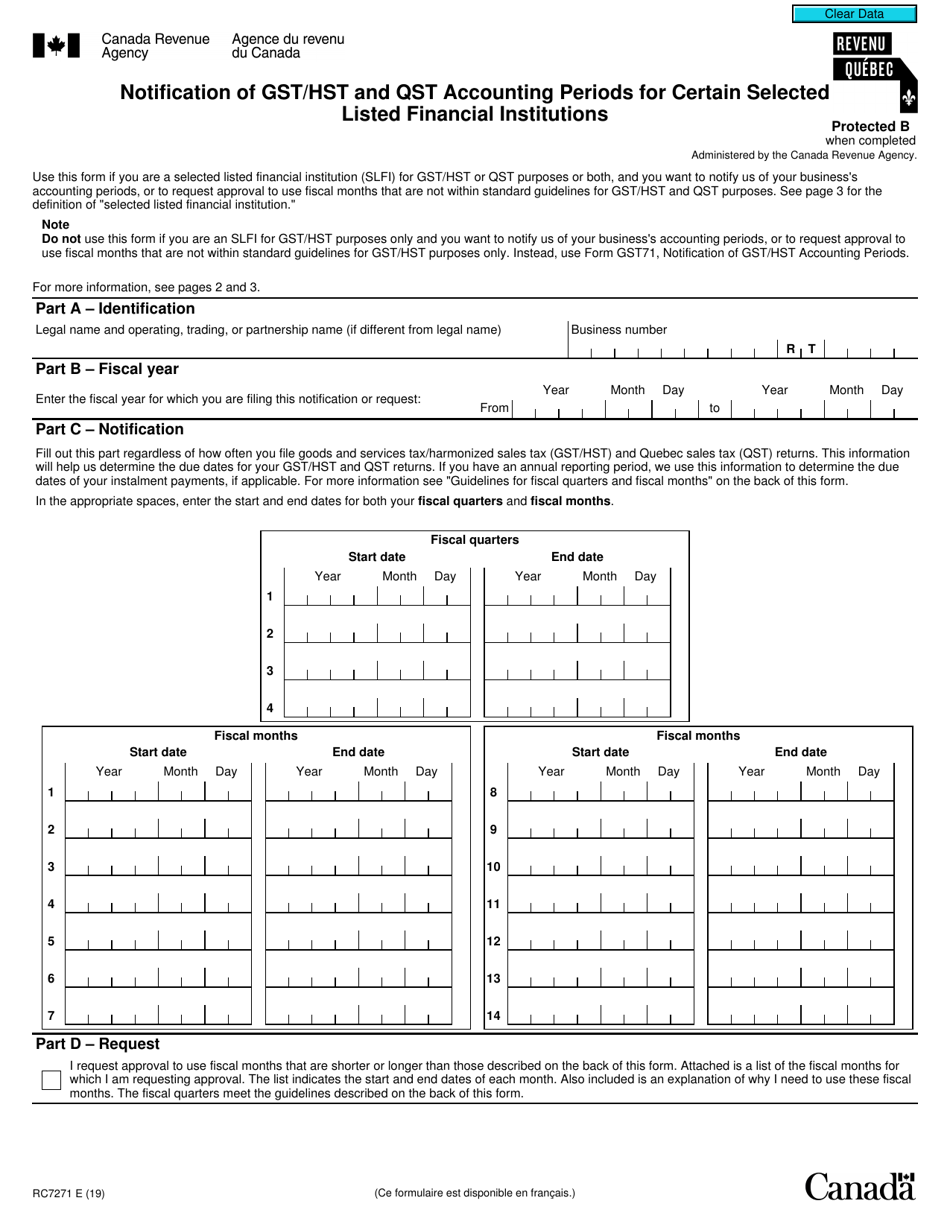

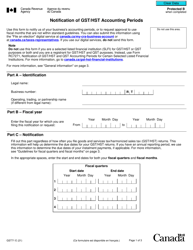

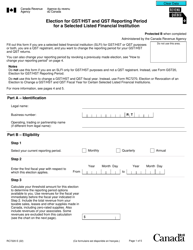

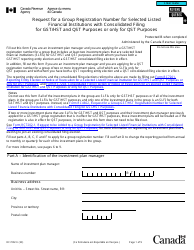

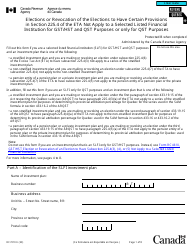

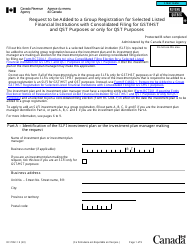

Form RC7271 Notification of Gst / Hst and Qst Accounting Periods for Certain Selected Listed Financial Institutions - Canada

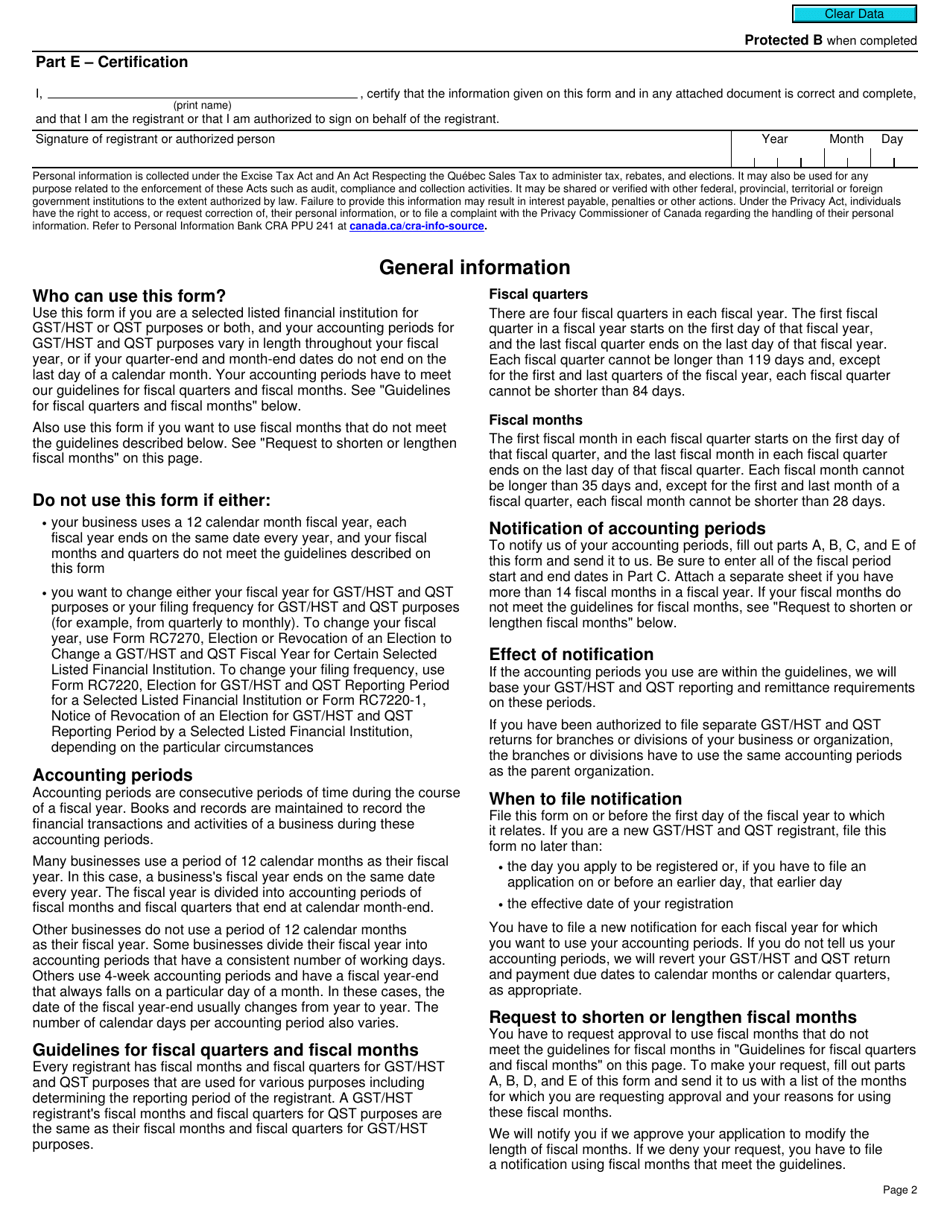

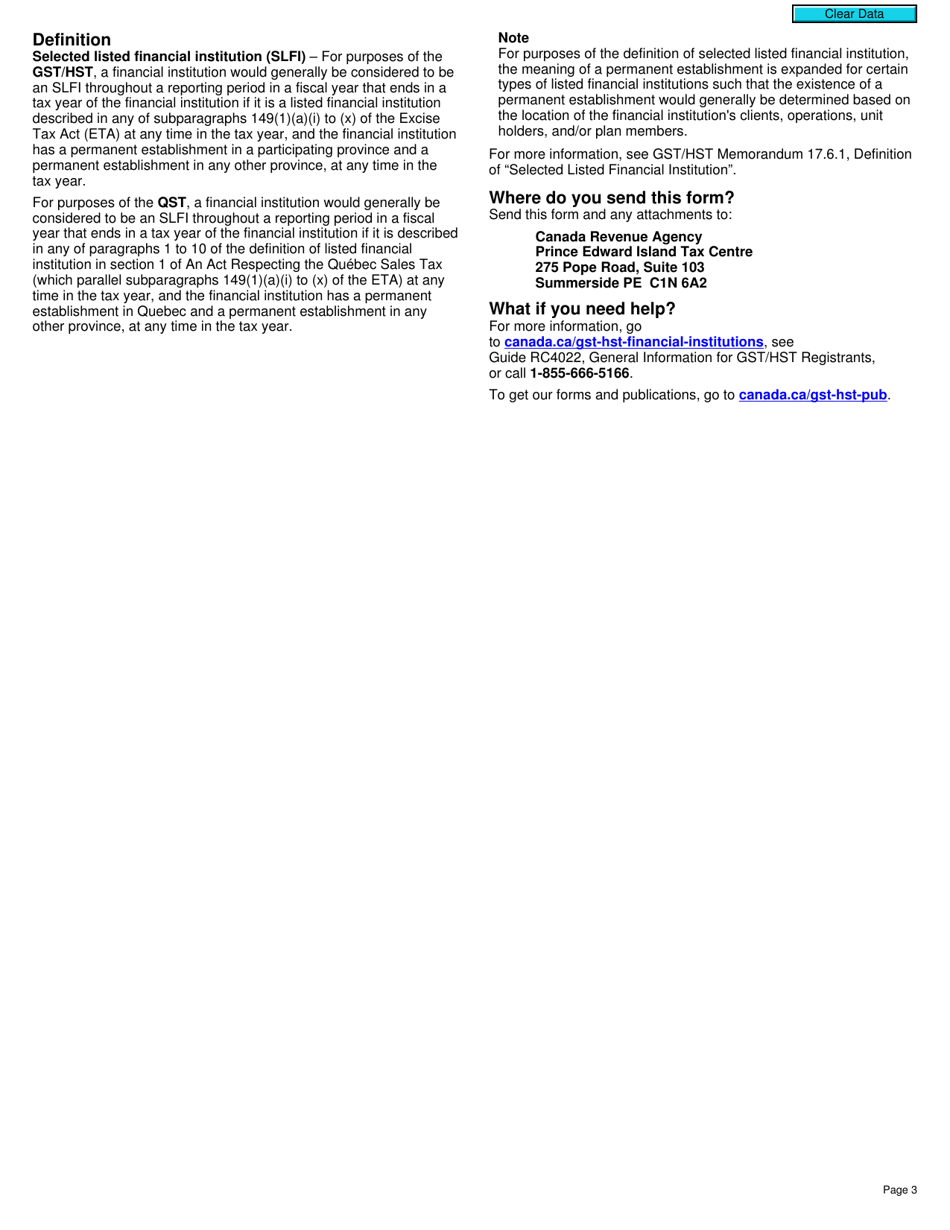

Form RC7271, Notification of GST/HST and QST Accounting Periods for Certain Selected Listed Financial Institutions, is used by certain selected listed financial institutions in Canada to notify the Canada Revenue Agency (CRA) of their accounting periods for the purposes of reporting and remitting GST/HST and QST (Quebec Sales Tax). This form is used for specific financial institutions that have been designated by the Minister of National Revenue in accordance with the excise tax legislation.

The selected listed financial institutions in Canada are responsible for filing the Form RC7271, Notification of GST/HST and QST Accounting Periods.

FAQ

Q: What is Form RC7271?

A: Form RC7271 is a notification form for GST/HST and QST accounting periods for certain selected listed financial institutions in Canada.

Q: Who needs to complete Form RC7271?

A: Selected listed financial institutions in Canada need to complete Form RC7271.

Q: What is the purpose of Form RC7271?

A: The purpose of Form RC7271 is to notify the Canada Revenue Agency (CRA) of the GST/HST and QST accounting periods for certain selected listed financial institutions.

Q: Are there any deadlines for submitting Form RC7271?

A: Yes, selected listed financial institutions must submit Form RC7271 within 10 calendar days after the end of the selected reporting period.

Q: What happens if I don't submit Form RC7271?

A: Failure to submit Form RC7271 may result in penalties or other enforcement actions by the CRA.

Q: Do I need to submit supporting documents with Form RC7271?

A: No, you don't need to submit supporting documents with Form RC7271. However, you should keep them for your records in case of an audit.