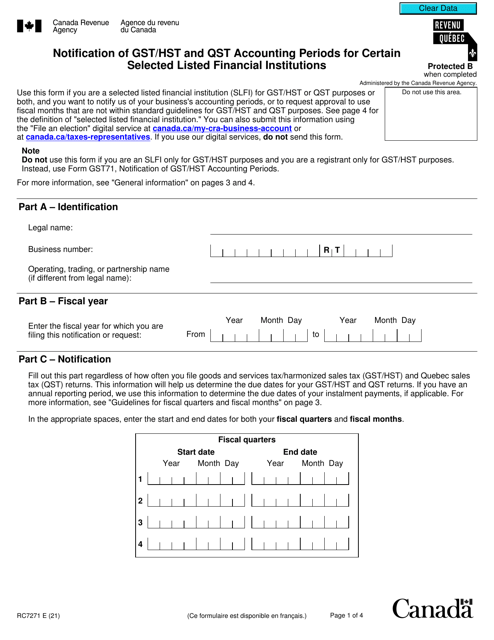

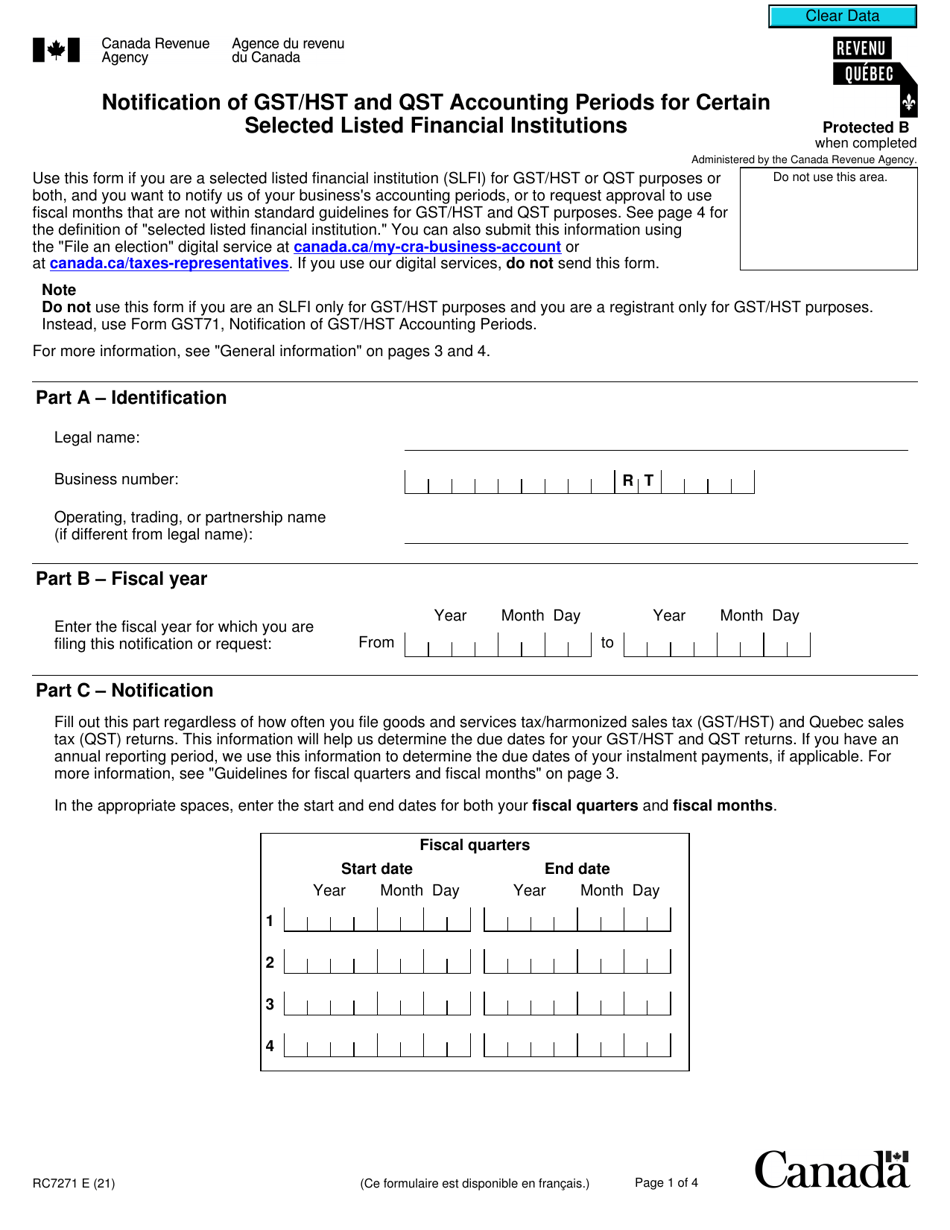

Form RC7271 Notification of Gst / Hst and Qst Accounting Periods for Certain Selected Listed Financial Institutions - Canada

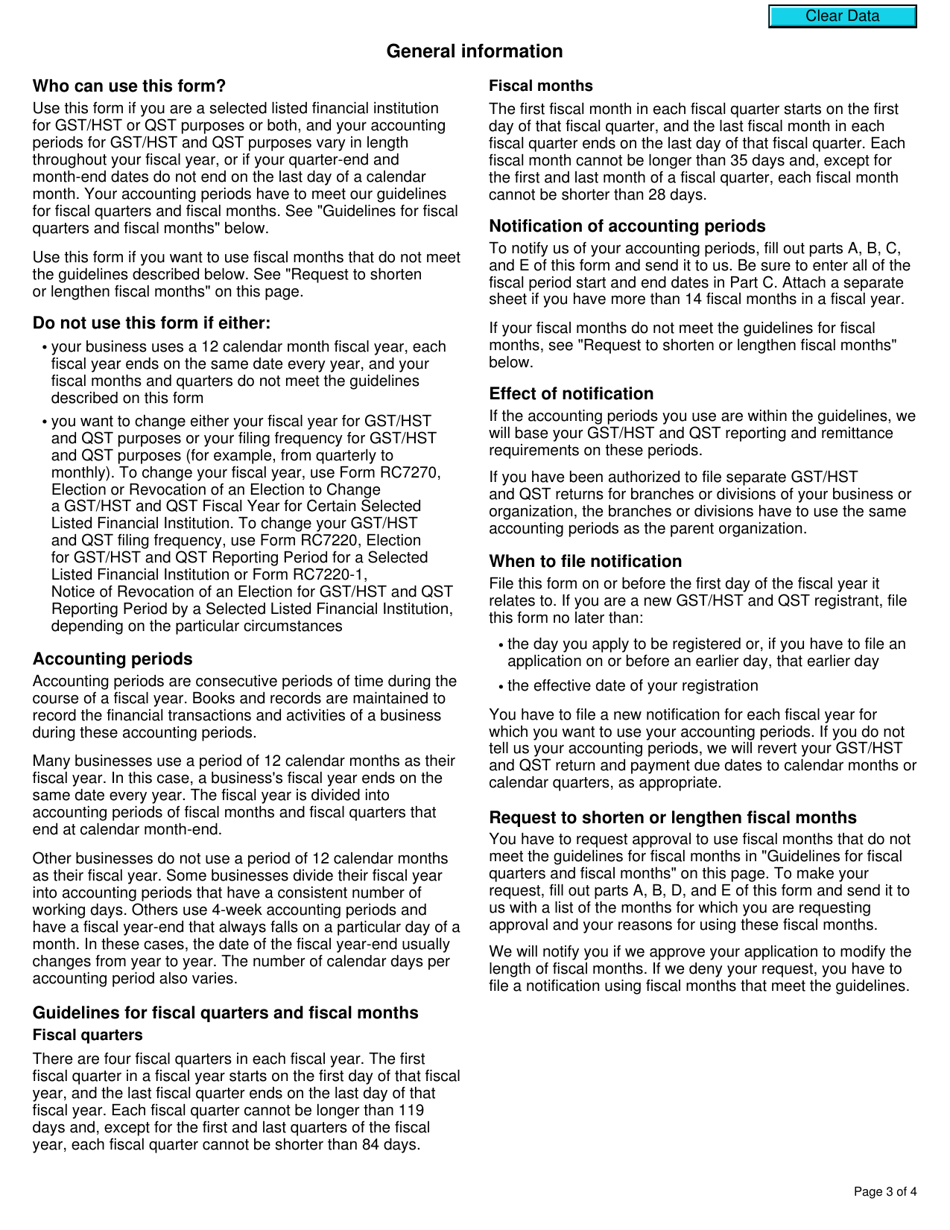

Form RC7271 Notification of GST/HST and QST Accounting Periods for Certain Selected Listed Financial Institutions in Canada is used to notify the Canada Revenue Agency (CRA) about the accounting periods for certain financial institutions regarding Goods and Services Tax (GST), Harmonized Sales Tax (HST), and Quebec Sales Tax (QST). This form is specifically for selected listed financial institutions to report their accounting periods for tax purposes.

The Form RC7271 Notification of GST/HST and QST Accounting Periods for Certain Selected Listed Financial Institutions in Canada is filed by the financial institutions themselves.

Form RC7271 Notification of Gst/Hst and Qst Accounting Periods for Certain Selected Listed Financial Institutions - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC7271?

A: Form RC7271 is a notification form used by selected listed financial institutions in Canada to report their GST/HST and QST accounting periods.

Q: Who needs to use Form RC7271?

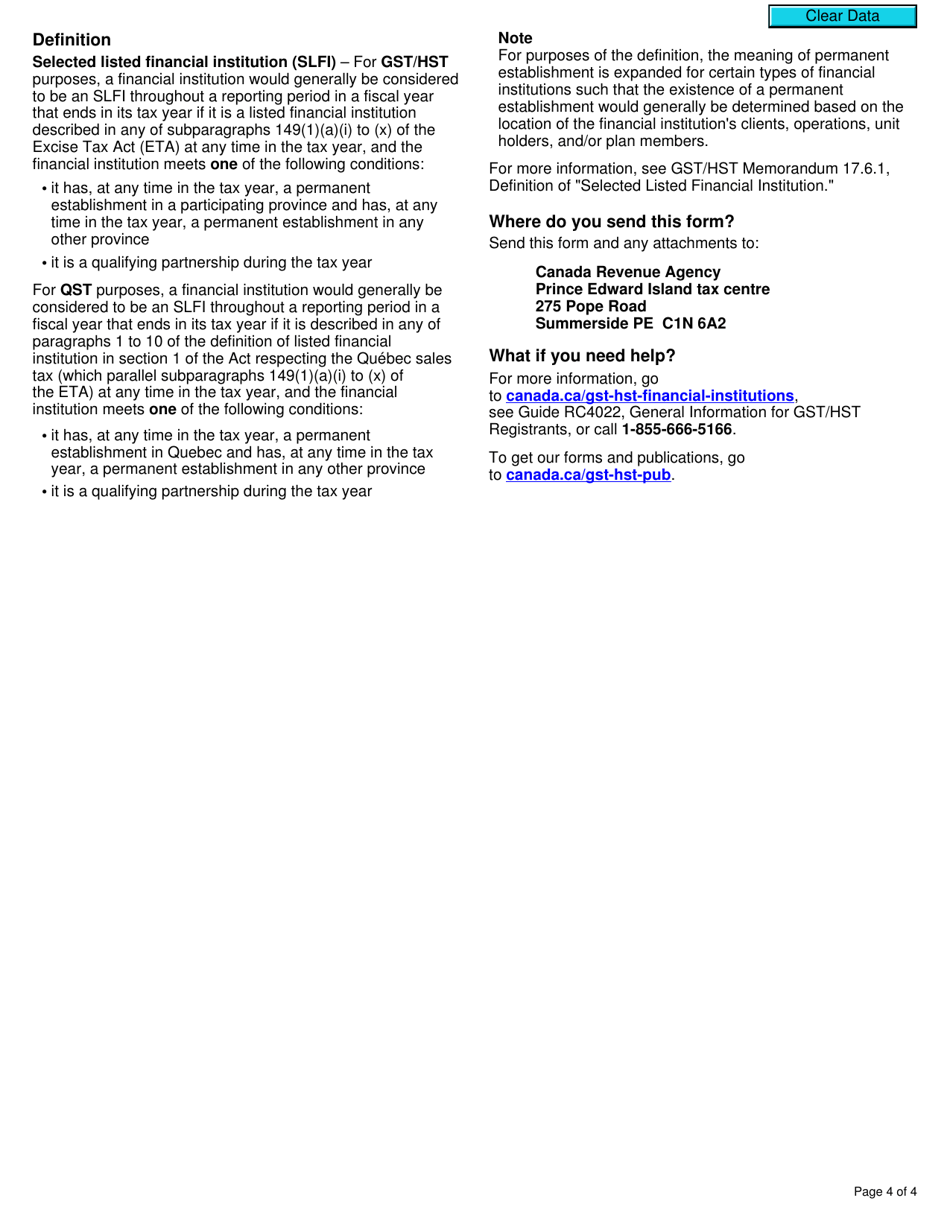

A: Selected listed financial institutions in Canada need to use Form RC7271 to report their GST/HST and QST accounting periods.

Q: What is the purpose of Form RC7271?

A: The purpose of Form RC7271 is to provide selected listed financial institutions with a means to notify the Canada Revenue Agency (CRA) of their GST/HST and QST accounting periods.

Q: How do I fill out Form RC7271?

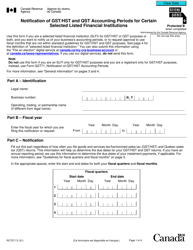

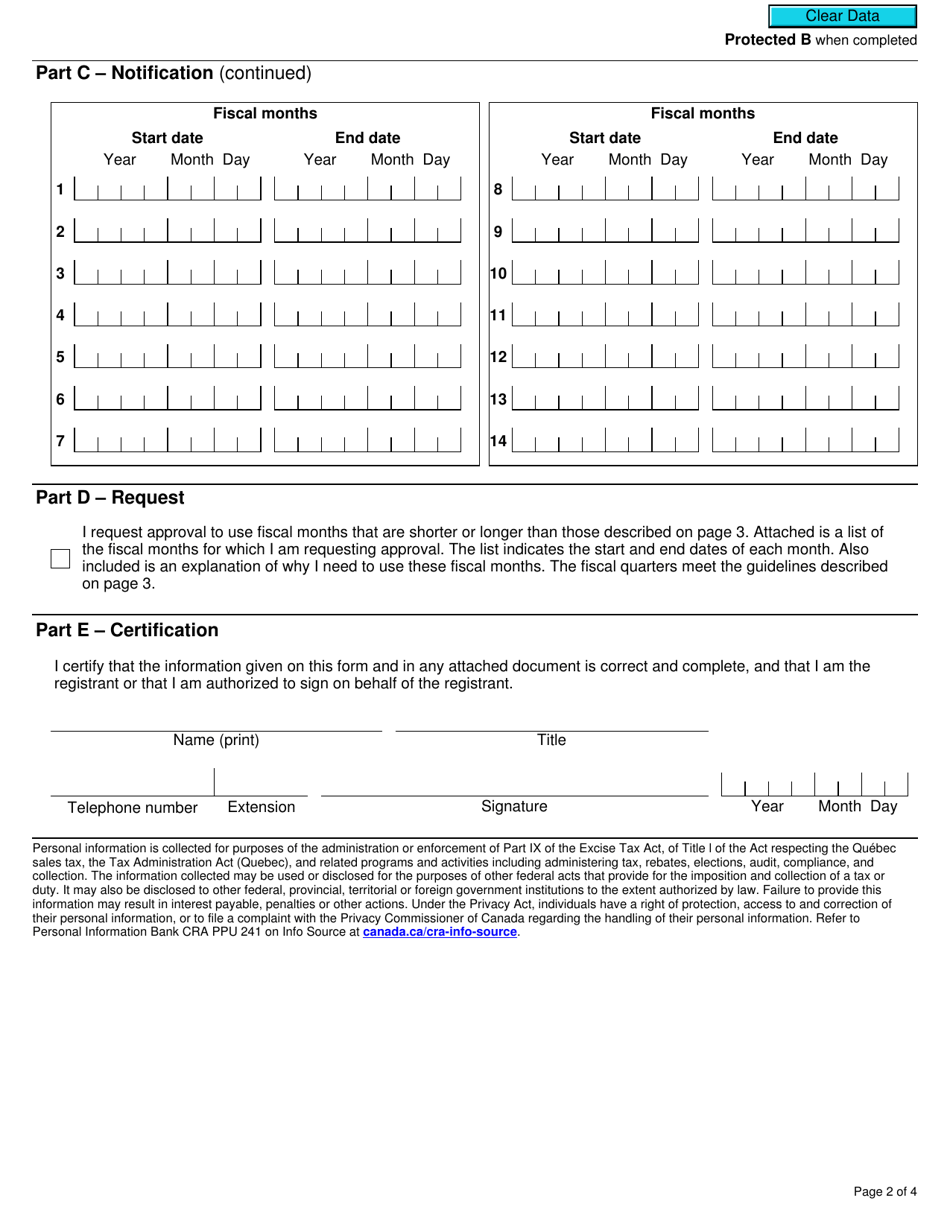

A: You can fill out Form RC7271 by providing the required information, such as the name and business number of the financial institution, the taxation years, and the GST/HST and QST accounting periods.