This version of the form is not currently in use and is provided for reference only. Download this version of

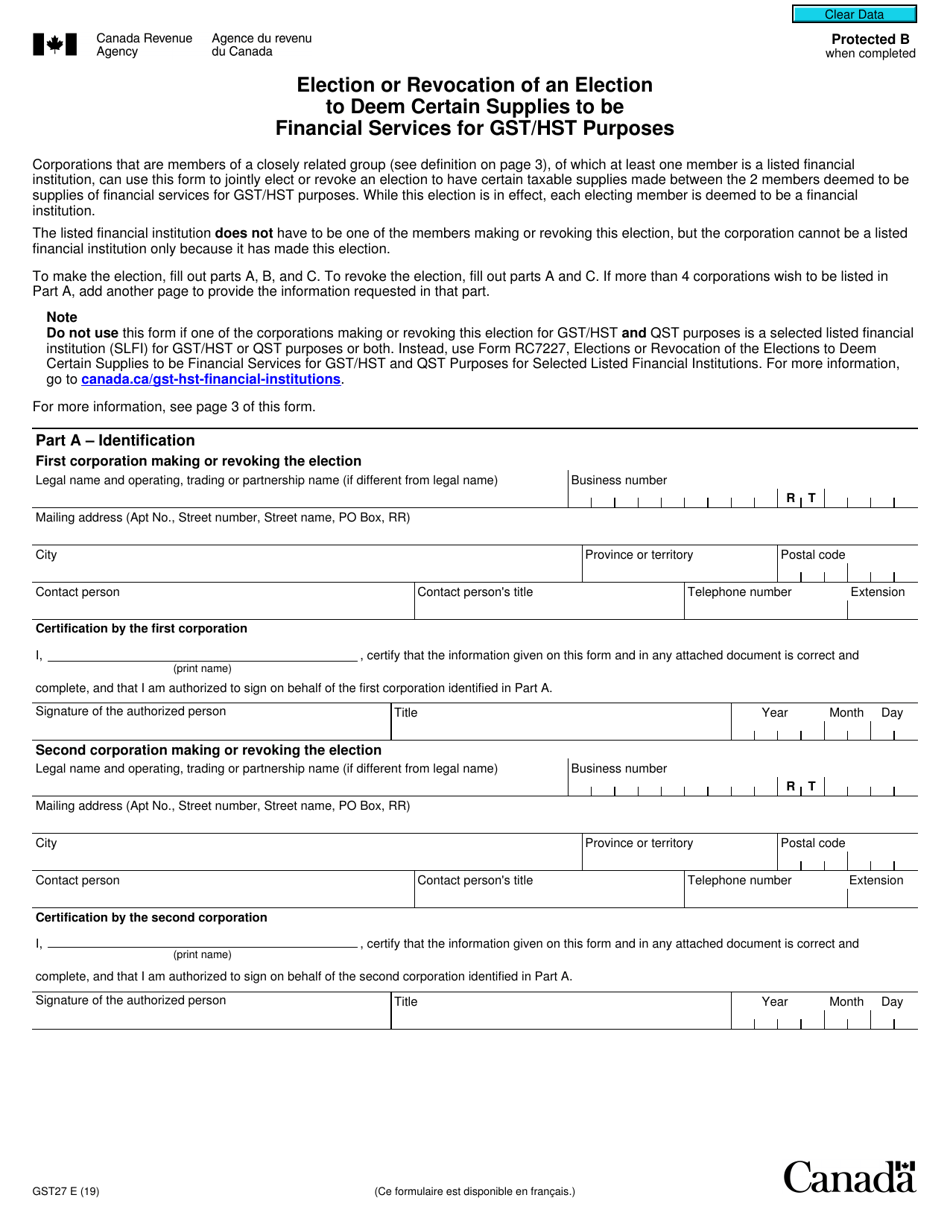

Form GST27

for the current year.

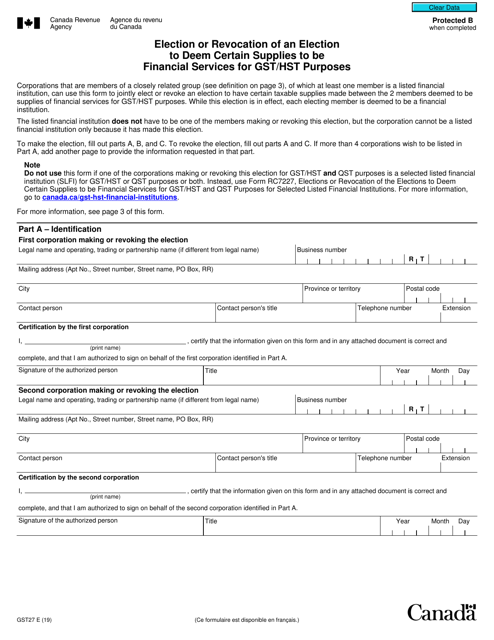

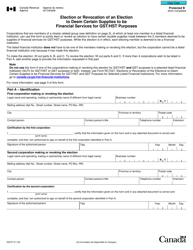

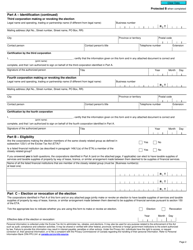

Form GST27 Election or Revocation of an Election to Deem Certain Supplies to Be Financial Services for Gst / Hst Purposes - Canada

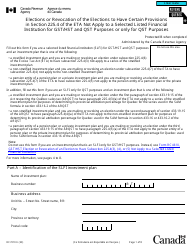

Form GST27 is used in Canada for the election or revocation of an election to deem certain supplies to be financial services for GST/HST purposes. This form is used by businesses to make a decision on whether certain supplies they make should be considered financial services for the purpose of Goods and Services Tax (GST) and Harmonized Sales Tax (HST). It allows businesses to elect or revoke an election to treat specific supplies as financial services, which can have implications on the tax treatment of those supplies.

The Form GST27 for Election or Revocation of an Election to Deem Certain Supplies to Be Financial Services for GST/HST purposes in Canada is filed by the taxpayer or business making the election or revoking an election.

FAQ

Q: What is GST27?

A: GST27 is a form in Canada used for Election or Revocation of an Election to Deem Certain Supplies to Be Financial Services for GST/HST purposes.

Q: Who needs to complete the GST27 form?

A: Any individual or business in Canada that wants to elect or revoke an election to deem certain supplies as financial services for GST/HST purposes needs to complete the GST27 form.

Q: What is the purpose of the election?

A: The purpose of the election is to treat certain supplies as financial services for GST/HST purposes, which may have different tax implications.

Q: When should the GST27 form be filed?

A: The GST27 form should be filed before the first day of the reporting period in which the election or revocation is to take effect.

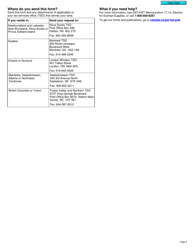

Q: Are there any fees associated with filing the GST27 form?

A: No, there are no fees associated with filing the GST27 form.

Q: What are the consequences of electing or revoking the election?

A: Electing or revoking the election can impact the tax treatment of certain supplies and may require adjustments in reporting and remitting GST/HST.