This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST189

for the current year.

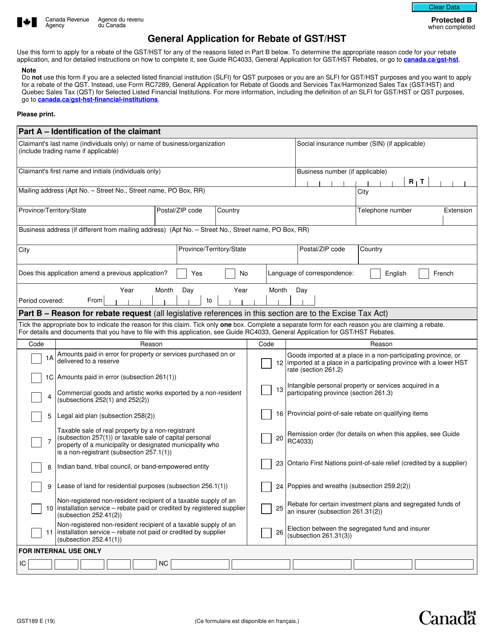

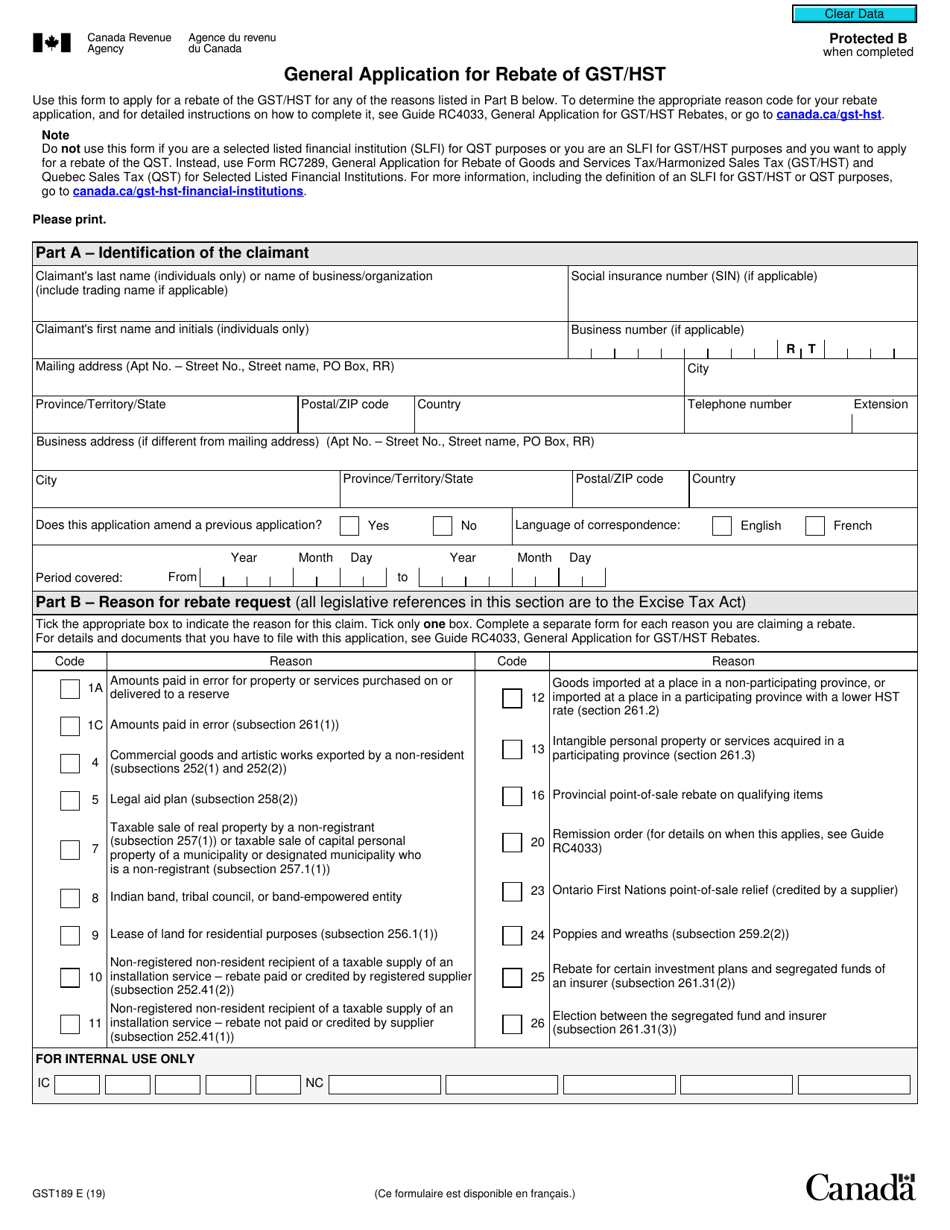

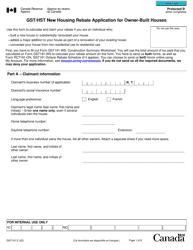

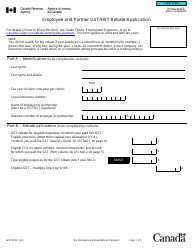

Form GST189 General Application for Rebate of Gst / Hst - Canada

Form GST189, General Application for Rebate of GST/HST, is used in Canada to claim a rebate of the Goods and Services Tax (GST) or Harmonized Sales Tax (HST). It can be used by individuals, businesses, or non-residents to recover taxes paid on eligible goods or services.

The Form GST189 General Application for Rebate of GST/HST in Canada is typically filed by individuals or businesses who are eligible for a rebate of Goods and Services Tax (GST) or Harmonized Sales Tax (HST) paid on certain goods and services.

FAQ

Q: What is GST189?

A: GST189 is a General Application for Rebate of GST/HST in Canada.

Q: Who can use GST189?

A: Individuals, organizations, and businesses can use GST189 to apply for a rebate of the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) paid in Canada.

Q: What is the purpose of GST189?

A: GST189 is used to request a rebate of the GST or HST paid on eligible goods and services in Canada.

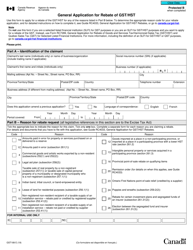

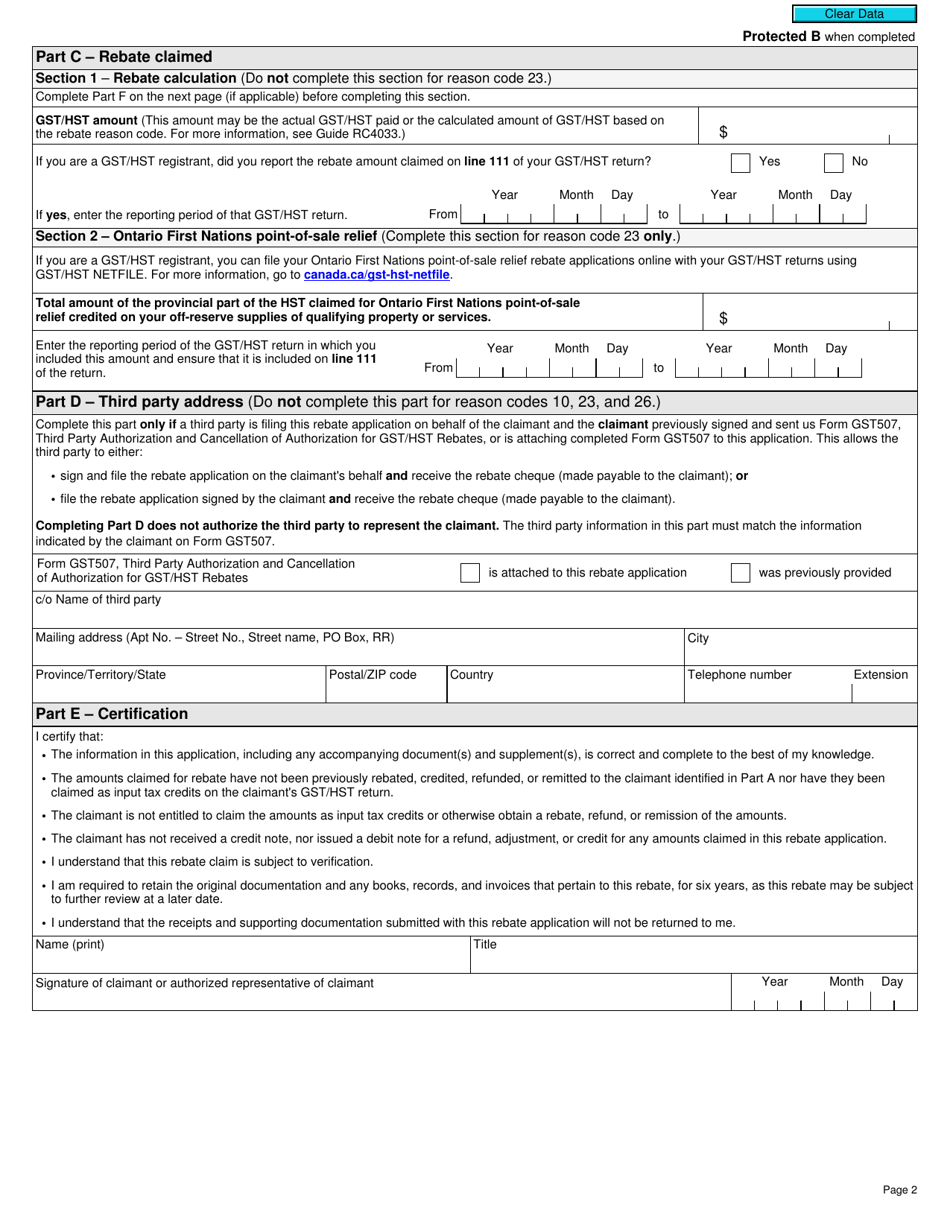

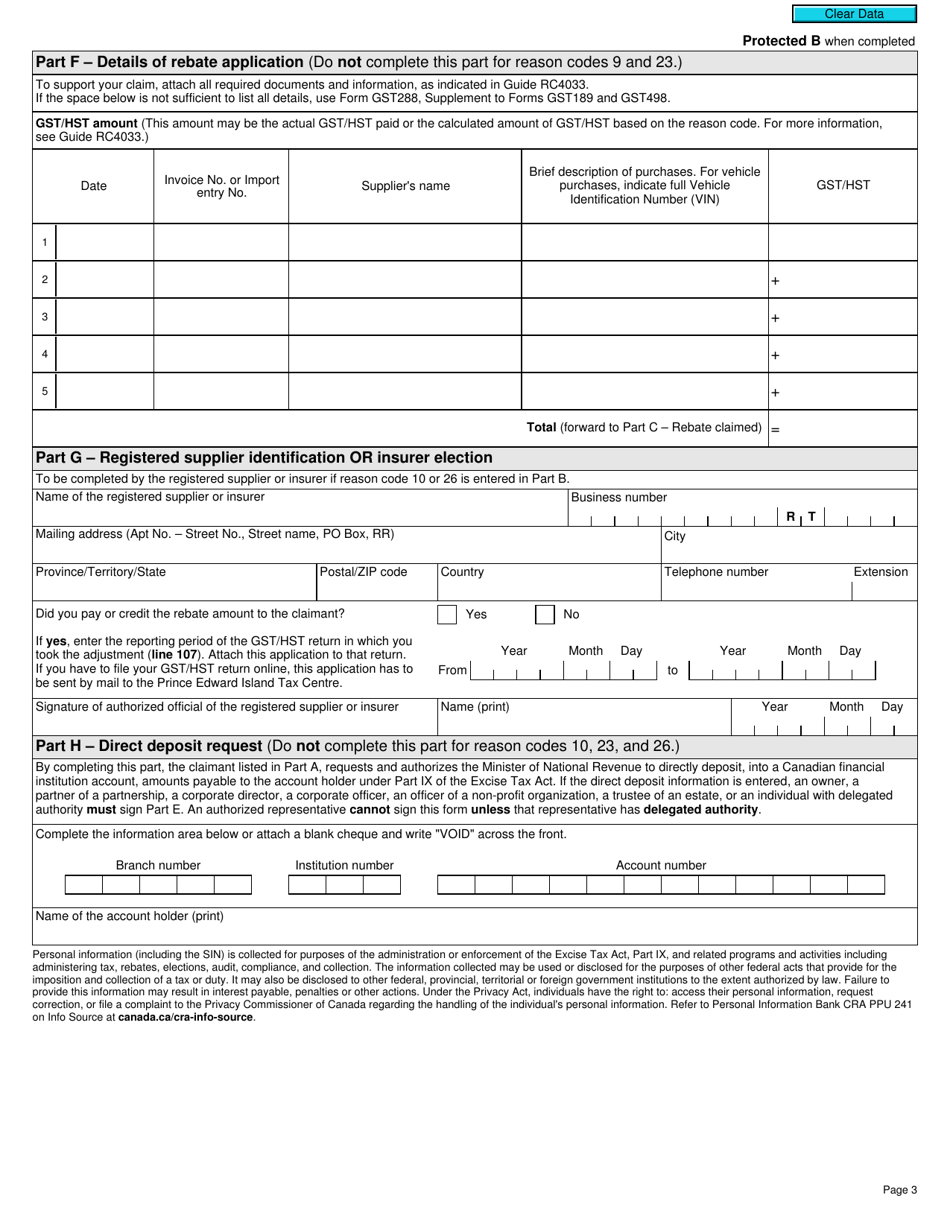

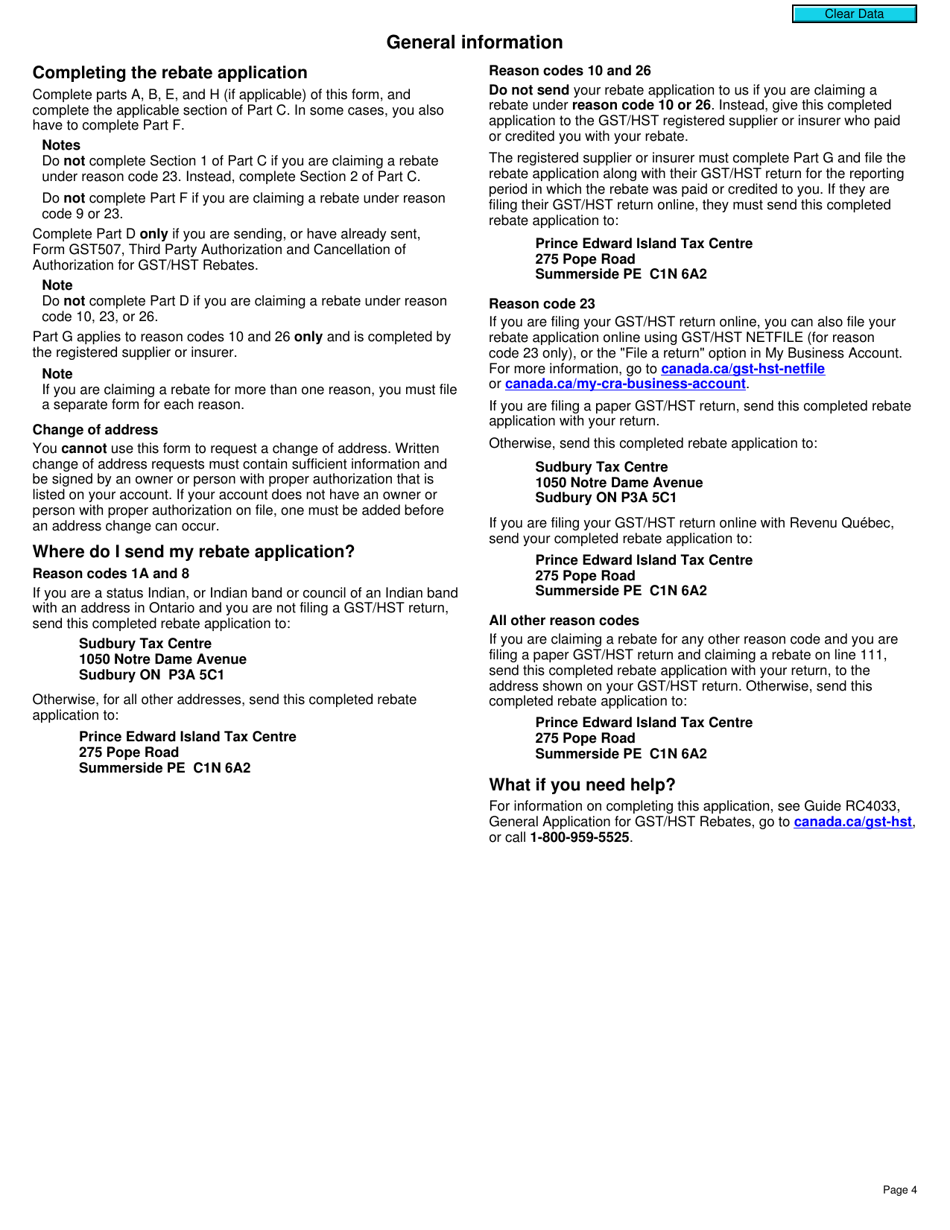

Q: How do I fill out GST189?

A: Fill out GST189 by providing your personal or business information, details of the GST/HST paid, and supporting documentation as required.