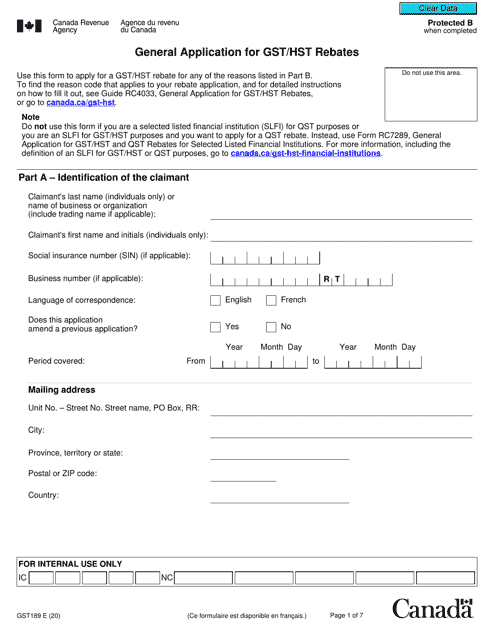

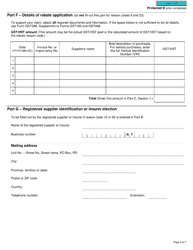

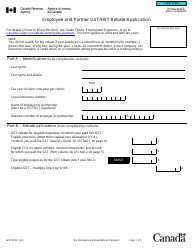

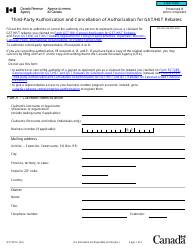

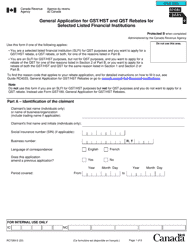

Form GST189 General Application for Gst / Hst Rebates - Canada

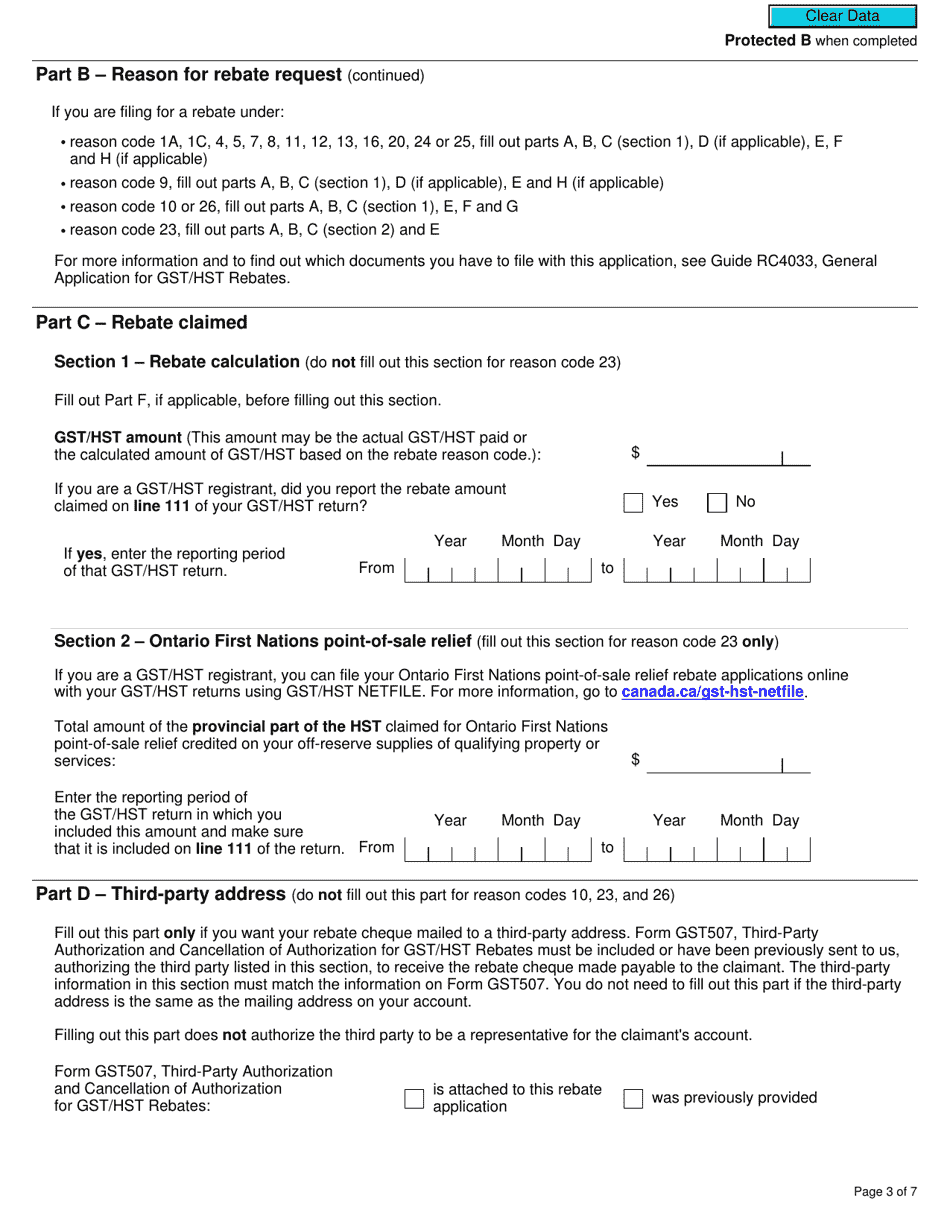

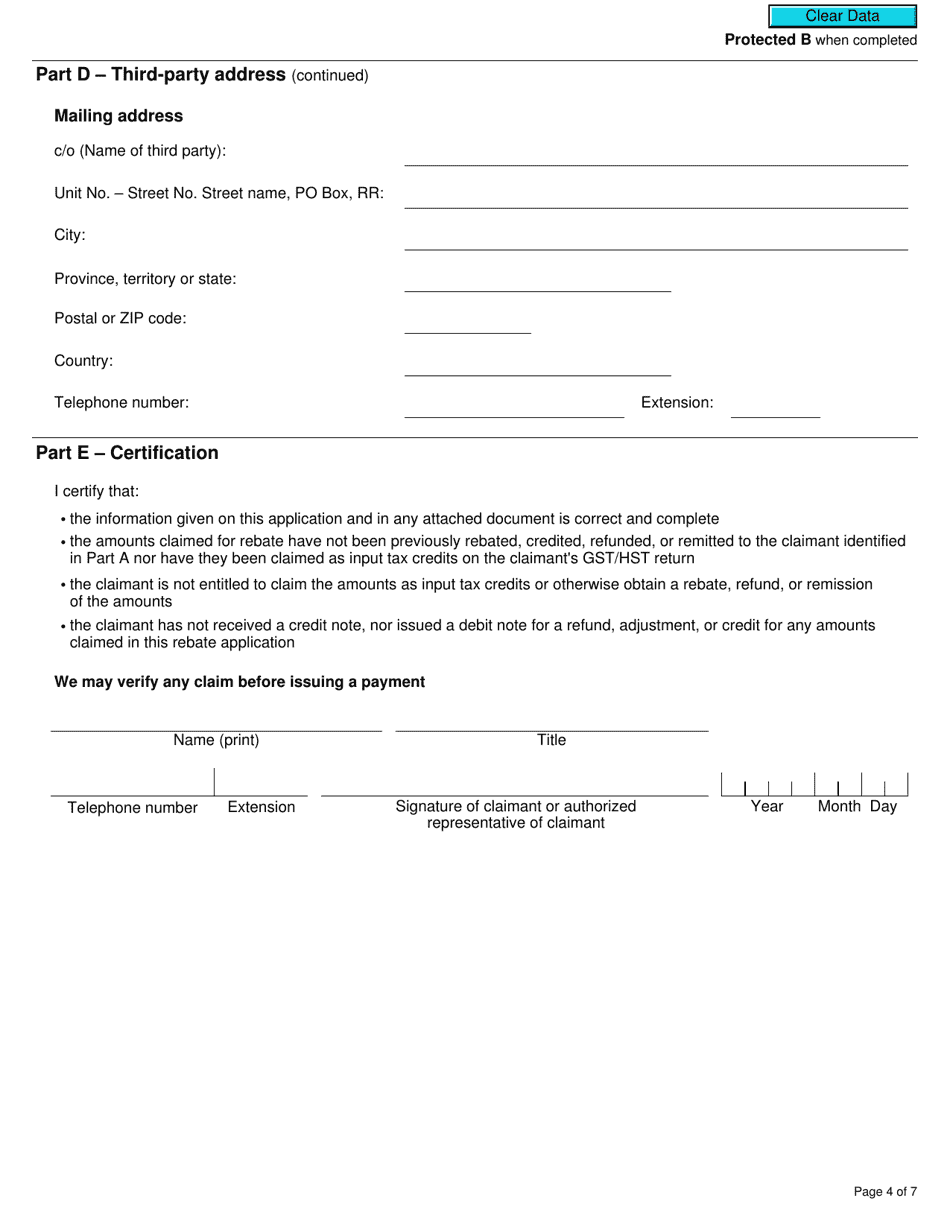

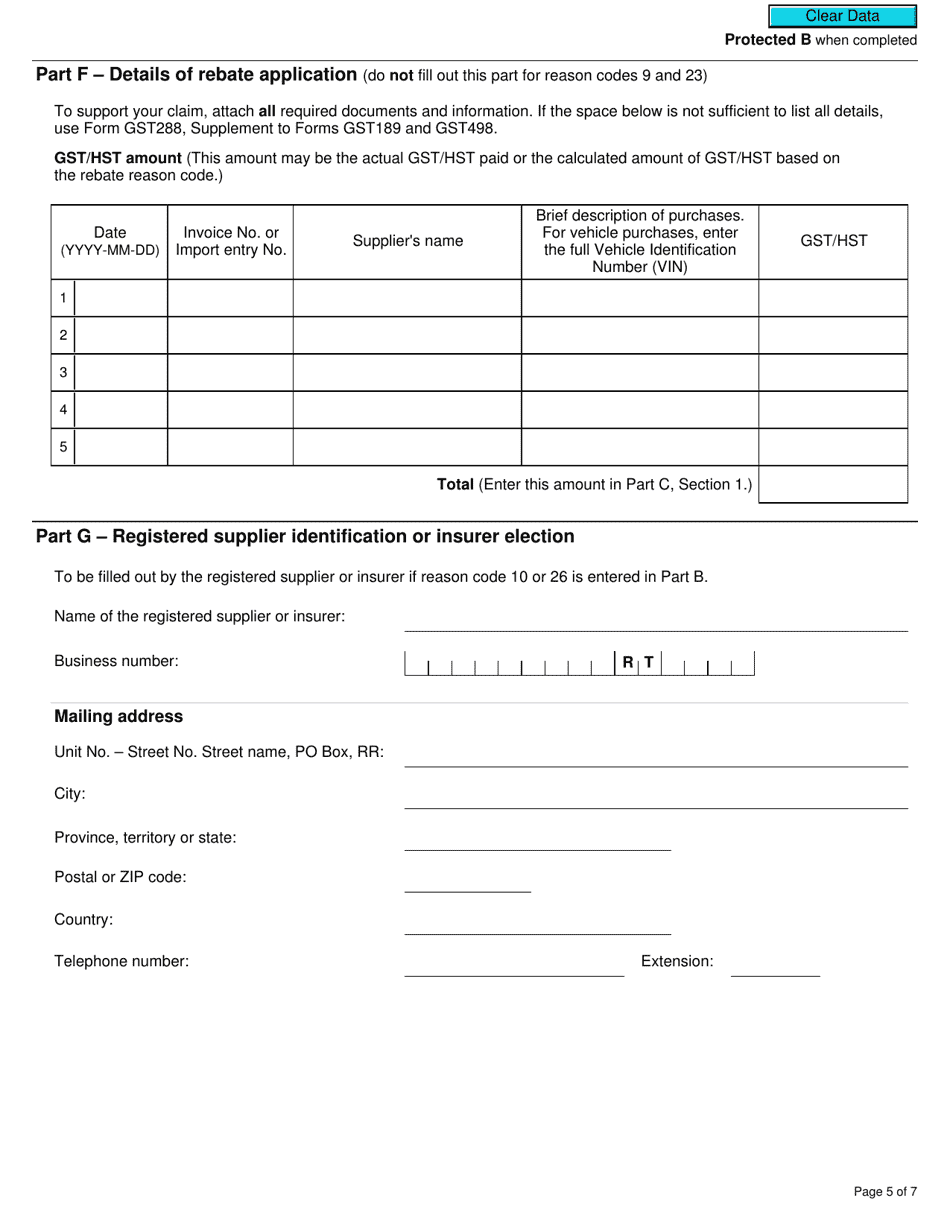

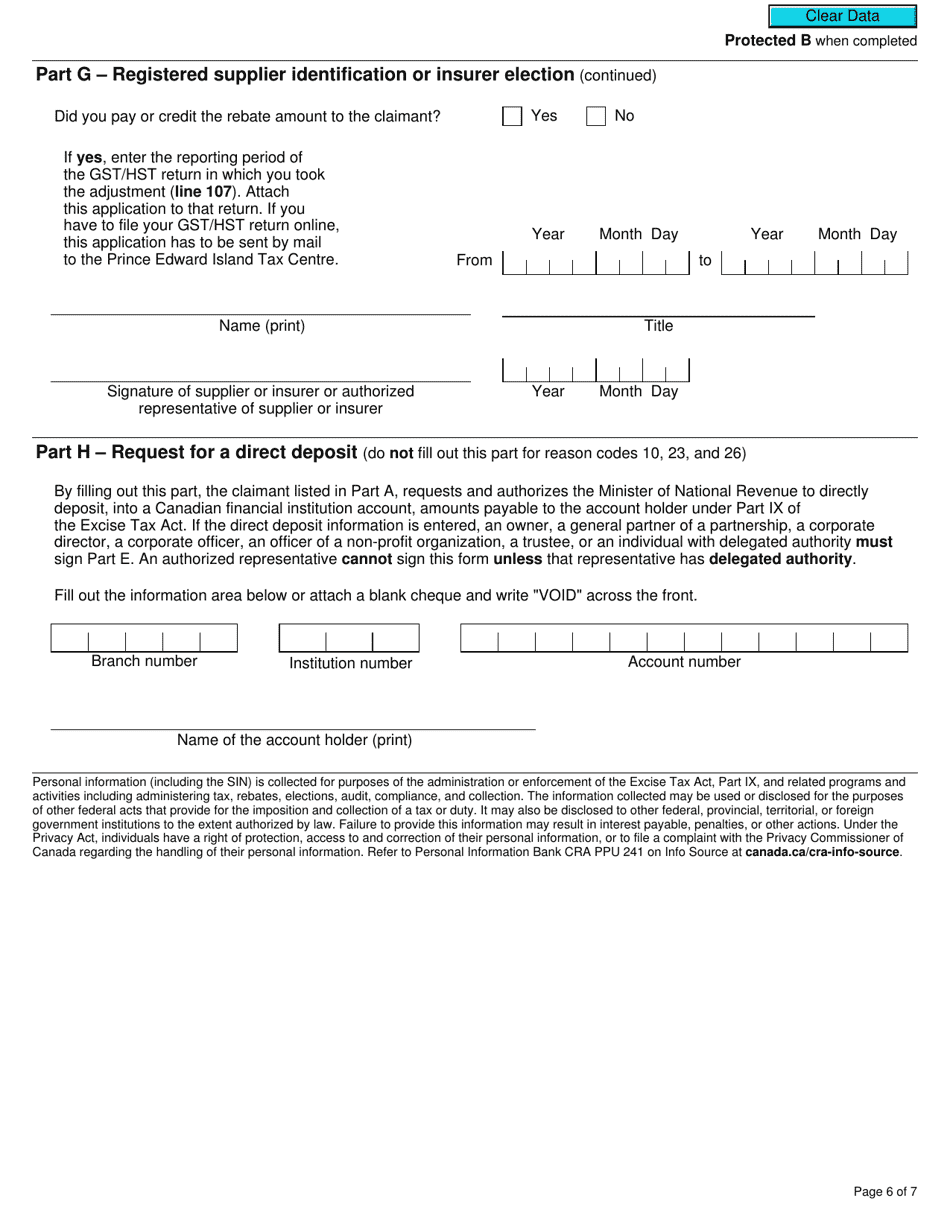

Form GST189 General Application for GST/HST Rebates in Canada is used to claim a refund of the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) paid on eligible purchases or expenses. It is primarily for individuals and businesses to request a rebate of the taxes they have paid.

The Form GST189 General Application for GST/HST Rebates in Canada can be filed by individuals, partnerships, corporations, and other organizations that are eligible to claim a GST/HST rebate.

Form GST189 General Application for Gst/Hst Rebates - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST189? A: Form GST189 is the General Application for GST/HST Rebates in Canada.

Q: Who can use Form GST189? A: Any individual or business in Canada who is eligible for a GST/HST rebate can use Form GST189.

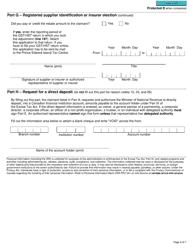

Q: What is the purpose of Form GST189? A: The purpose of Form GST189 is to apply for a rebate of the GST/HST paid or owed on eligible purchases.

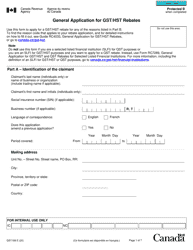

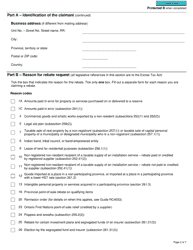

Q: What types of rebates can be claimed using Form GST189? A: Form GST189 can be used to claim rebates for a variety of categories, such as public service bodies, charities, nonprofit organizations, and First Nations individuals or bands.

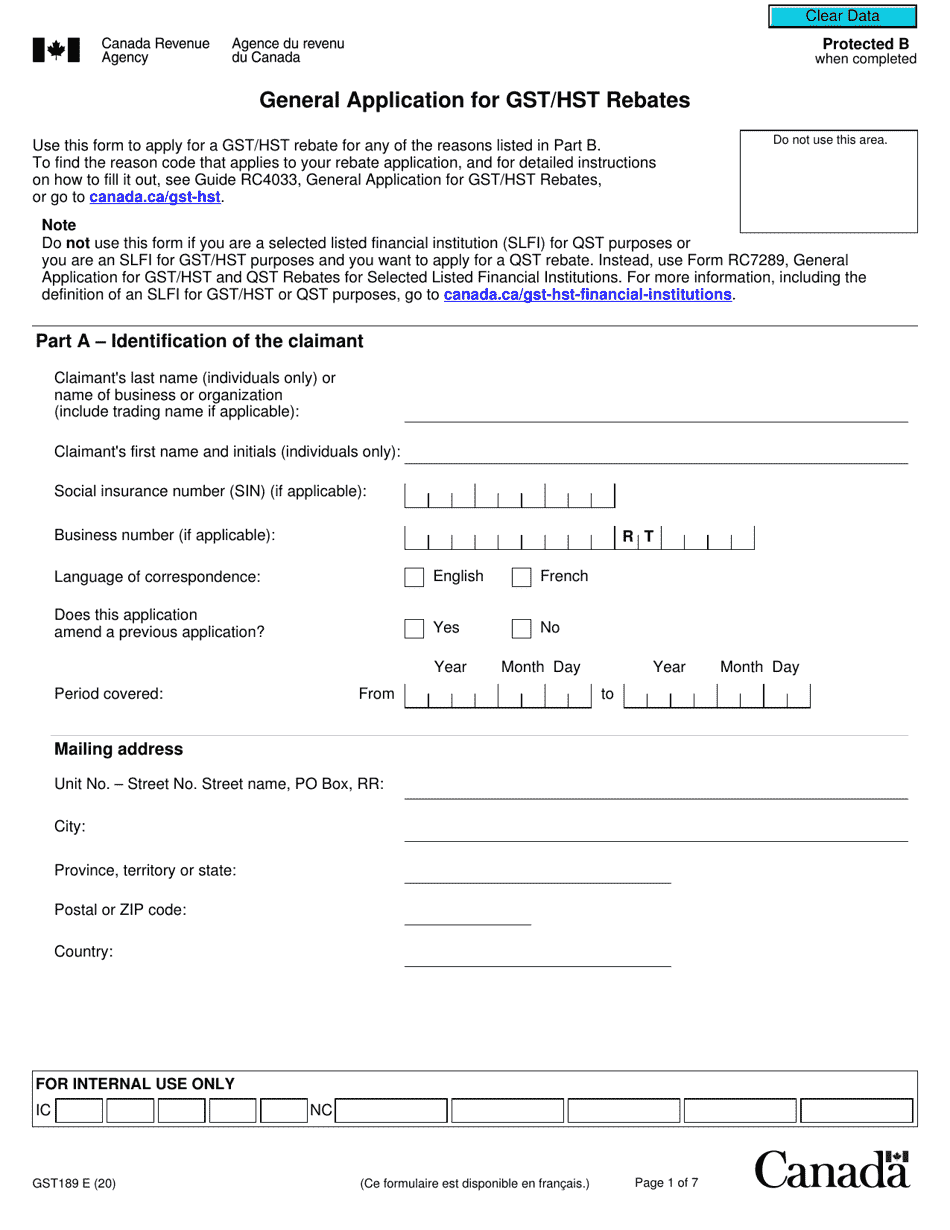

Q: What supporting documents are required to be submitted with Form GST189? A: The specific supporting documents required may vary depending on the type of rebate being claimed. Generally, you will need to provide proof of eligibility and documentation supporting your claim.

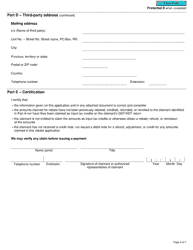

Q: What is the deadline for submitting Form GST189? A: The deadline for submitting Form GST189 is generally within four years from the end of the reporting period in which the rebate relates to.

Q: Can I file multiple rebates on one Form GST189? A: Yes, you can file multiple rebates on one Form GST189 as long as they are for the same reporting period and apply to the same type of rebate.

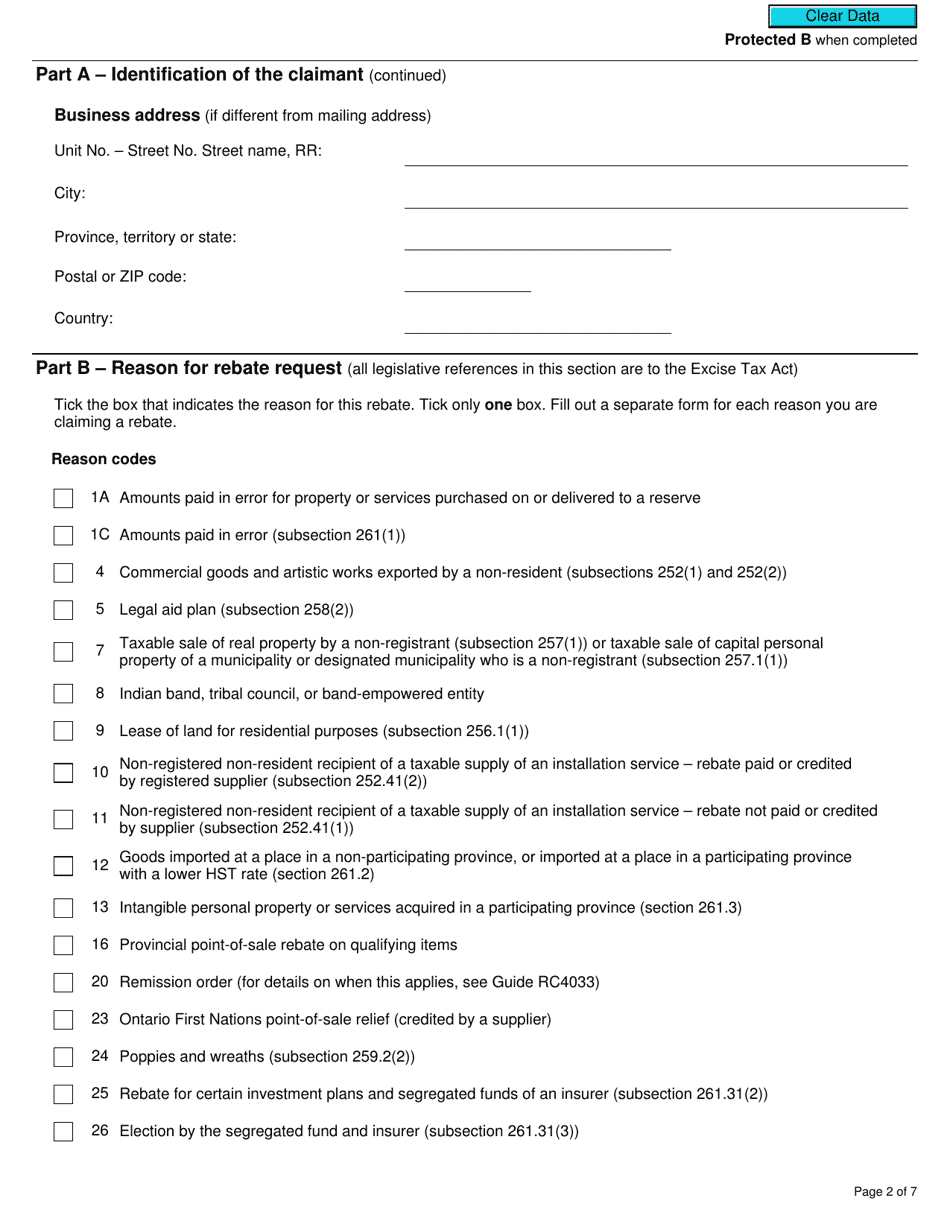

Q: What happens after I submit Form GST189? A: After submitting Form GST189, the CRA will review your application and determine your eligibility for the rebate. If approved, you will receive the rebate amount or a notice explaining any adjustments or denials.