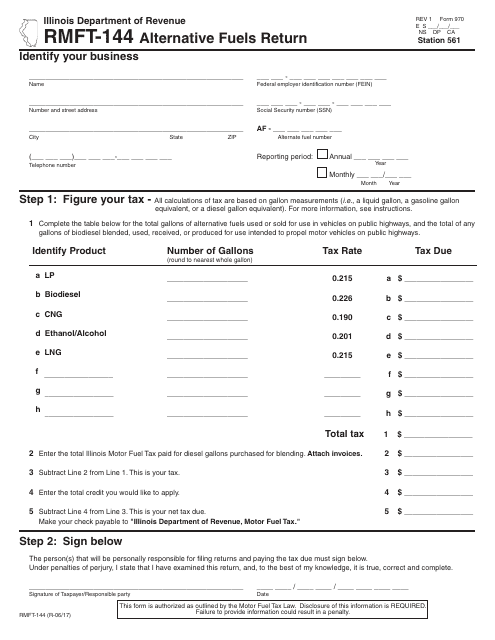

Form RMFT-144 Alternative Fuels Return - Illinois

What Is Form RMFT-144?

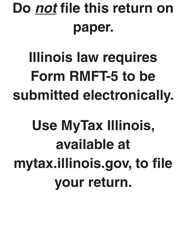

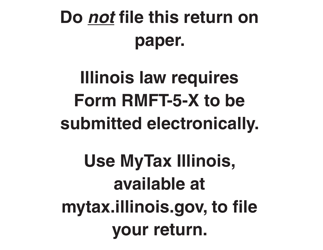

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is RMFT-144?

A: RMFT-144 is the form used to file the Alternative Fuels Return in Illinois.

Q: What is the Alternative Fuels Return?

A: The Alternative Fuels Return is a tax return that must be filed by anyone who sells or uses alternative fuels in Illinois.

Q: Who is required to file the Alternative Fuels Return?

A: Anyone who sells or uses alternative fuels in Illinois is required to file the Alternative Fuels Return.

Q: What are alternative fuels?

A: Alternative fuels are non-traditional fuels that can be used to power vehicles, such as biodiesel, ethanol, and natural gas.

Q: Are there any exemptions from filing the Alternative Fuels Return?

A: Yes, certain exempt entities, such as the federal government, are not required to file the Alternative Fuels Return.

Q: When is the Alternative Fuels Return due?

A: The Alternative Fuels Return is due on a monthly basis, with a due date of the 20th of the following month.

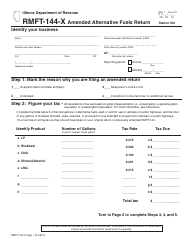

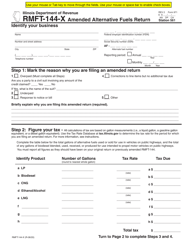

Q: What information is required to complete the Alternative Fuels Return?

A: The Alternative Fuels Return requires information such as the amount of alternative fuels sold or used, the type of alternative fuel, and the total tax due.

Q: Are there any penalties for not filing the Alternative Fuels Return?

A: Yes, failure to file the Alternative Fuels Return or pay the required tax can result in penalties and interest being assessed by the Illinois Department of Revenue.

Q: Is there any additional documentation required to be submitted with the Alternative Fuels Return?

A: No, additional documentation is not required to be submitted with the Alternative Fuels Return.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-144 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.