This version of the form is not currently in use and is provided for reference only. Download this version of

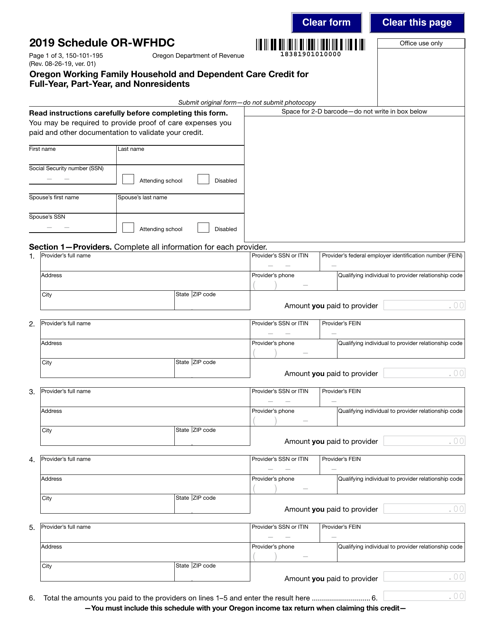

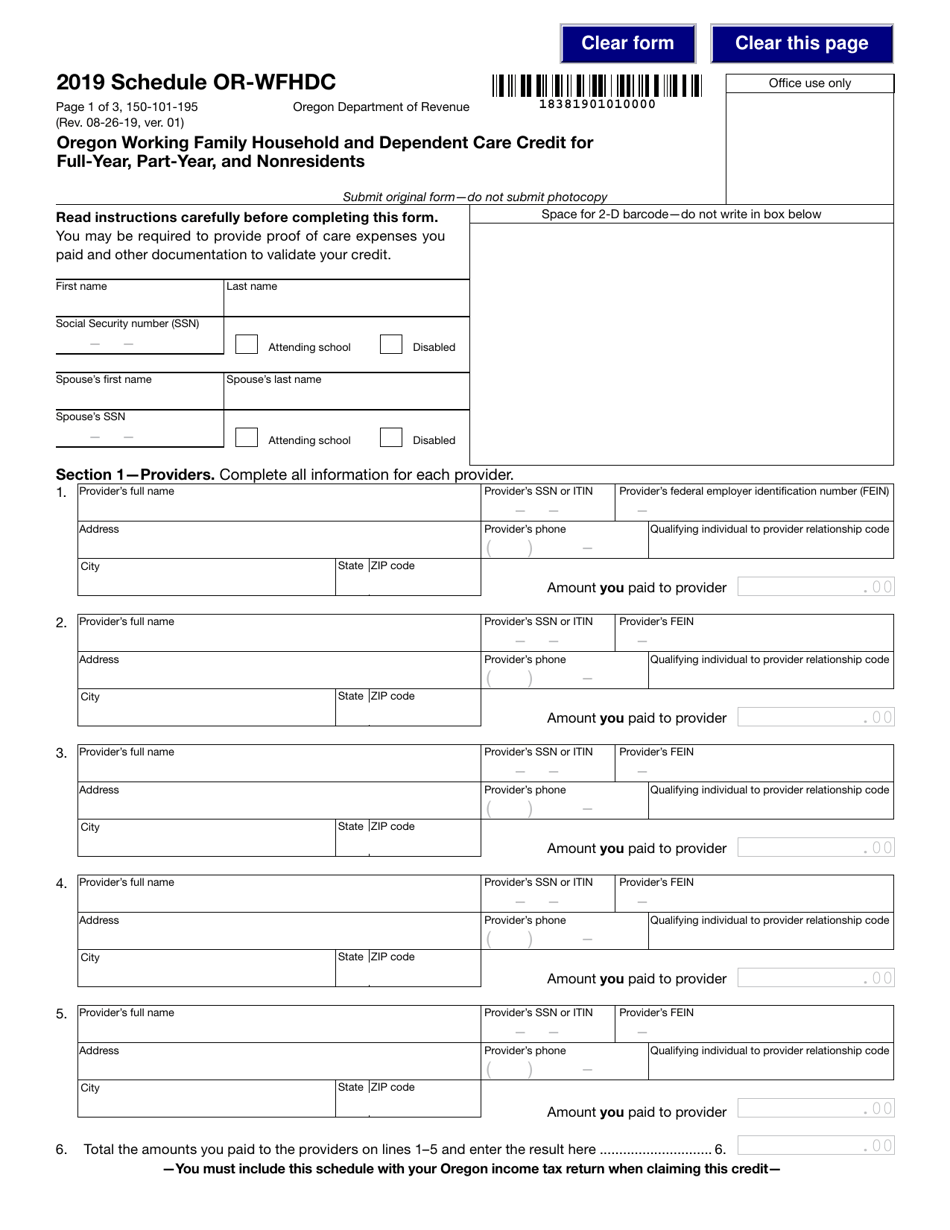

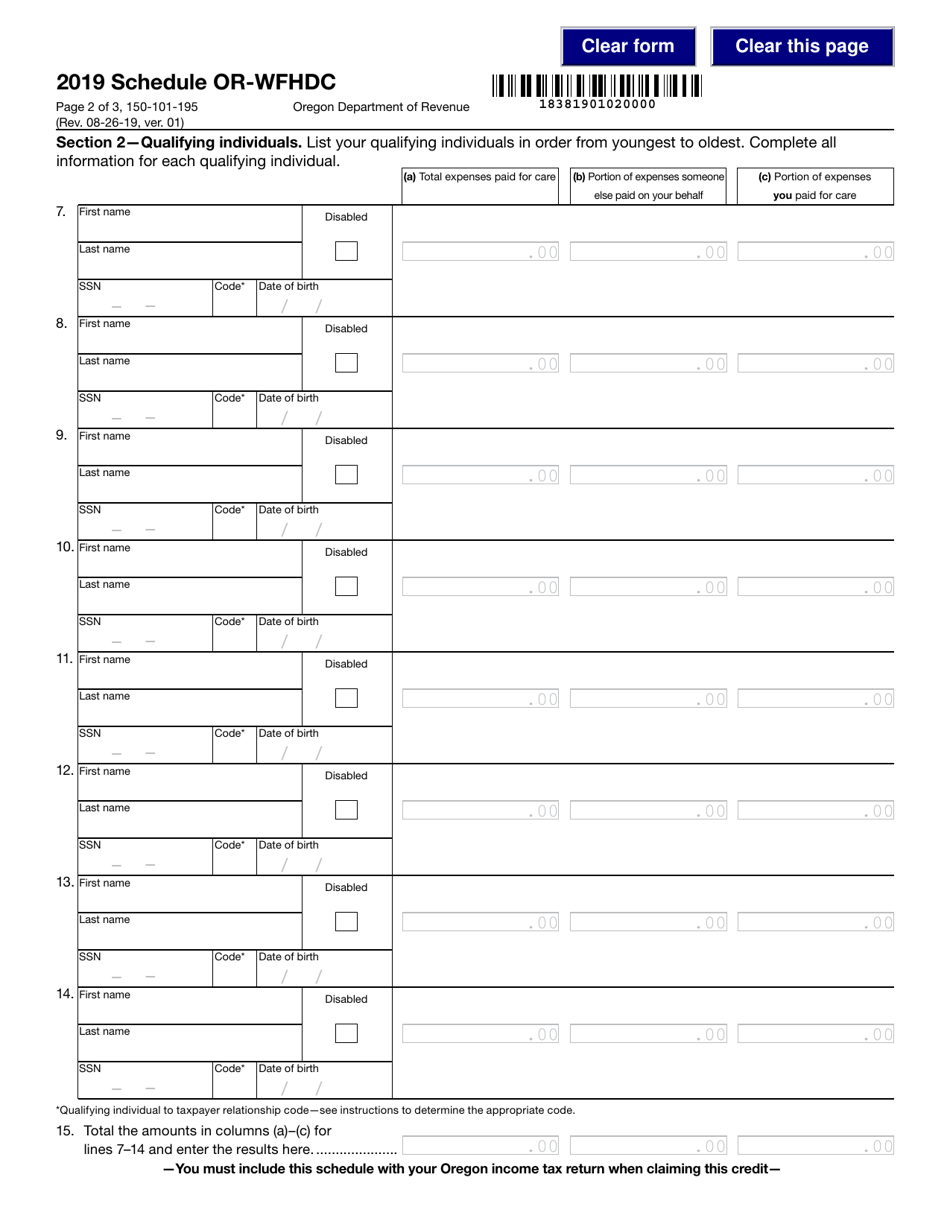

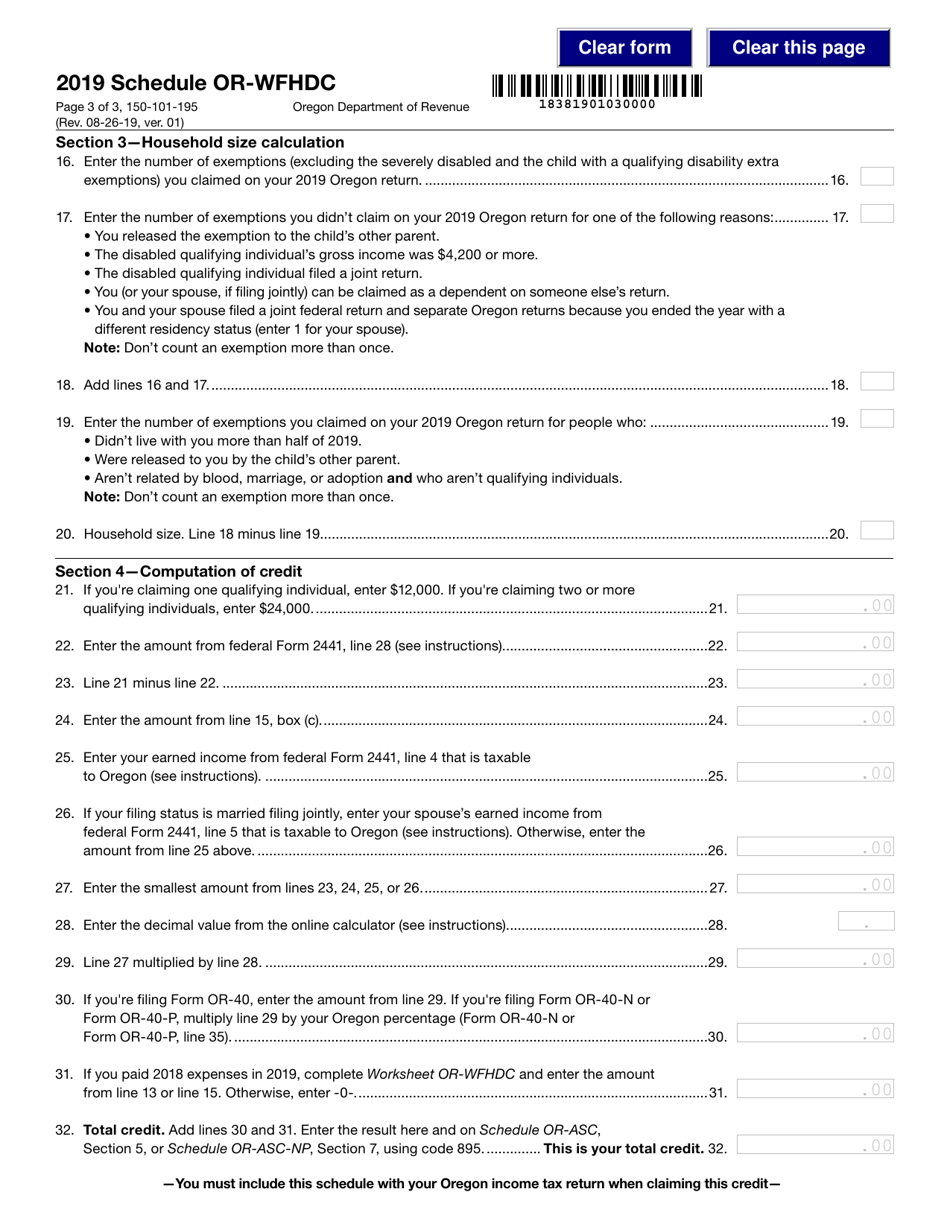

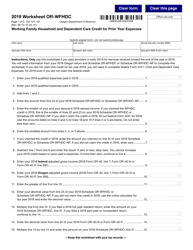

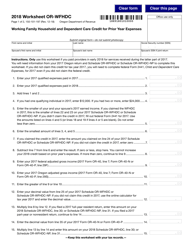

Form 150-101-195 Schedule OR-WFHDC

for the current year.

Form 150-101-195 Schedule OR-WFHDC Oregon Working Family Household and Dependent Care Credit for Full-Year, Part-Year, and Nonresidents - Oregon

What Is Form 150-101-195 Schedule OR-WFHDC?

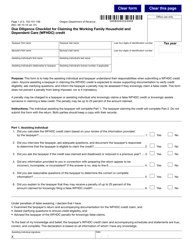

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-195?

A: Form 150-101-195 is a schedule for claiming the Oregon Working Family Household and Dependent Care Credit.

Q: Who can use Form 150-101-195?

A: Residents, part-year residents, and nonresidents of Oregon can use Form 150-101-195 to claim the Oregon Working Family Household and Dependent Care Credit.

Q: What is the purpose of the Oregon Working Family Household and Dependent Care Credit?

A: The credit is designed to provide financial assistance to working families in Oregon who incur expenses for child or dependent care.

Q: What expenses are eligible for the credit?

A: Expenses for the care of a child or dependent who is under the age of 13, disabled, or incapable of self-care may be eligible for the credit.

Q: How do I calculate the credit?

A: The credit is based on a percentage of your eligible expenses, up to a maximum credit amount.

Q: When is the deadline for filing Form 150-101-195?

A: The deadline for filing Form 150-101-195 is the same as the deadline for filing your Oregon tax return, typically April 15th.

Q: Can I e-file Form 150-101-195?

A: Yes, you can e-file Form 150-101-195 if you are filing your Oregon tax return electronically.

Q: Are there any income limits for claiming the credit?

A: Yes, there are income limits that determine the maximum credit amount you can claim.

Q: Is the credit refundable?

A: No, the credit is nonrefundable, meaning it can only be used to offset your tax liability.

Form Details:

- Released on August 26, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-195 Schedule OR-WFHDC by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.