This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 150-101-195 Schedule OR-WFHDC

for the current year.

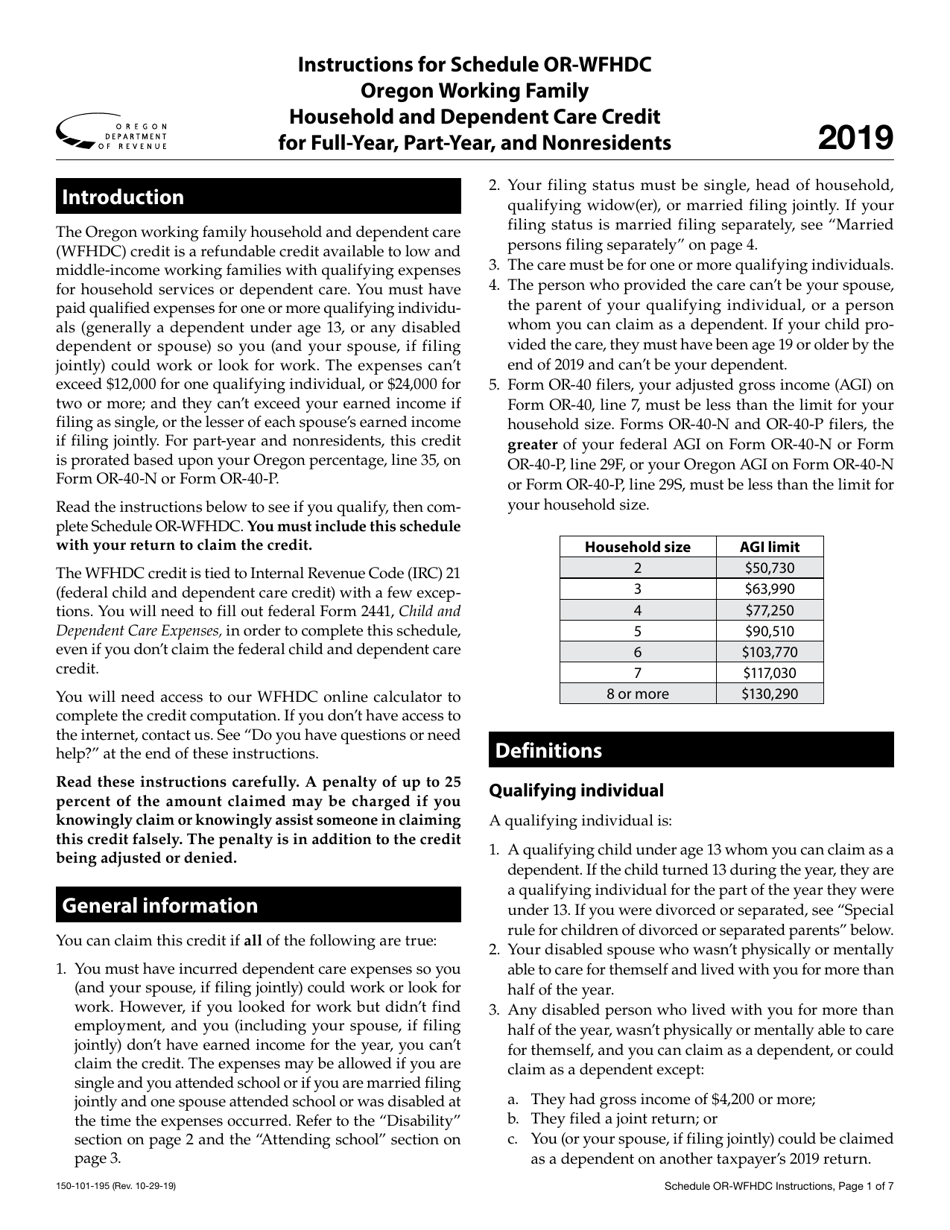

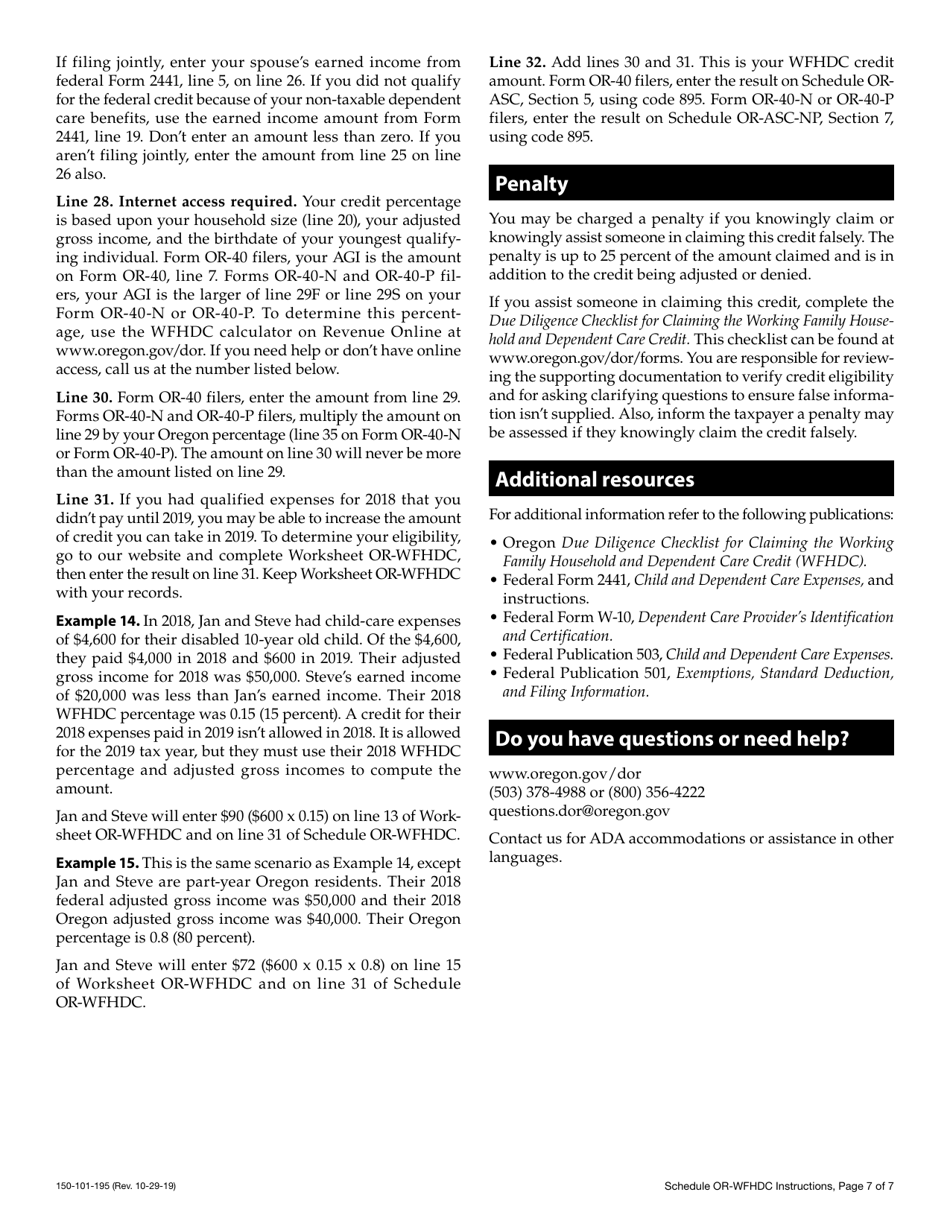

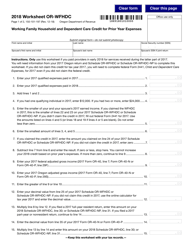

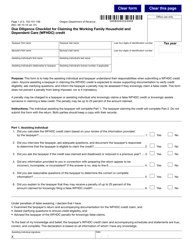

Instructions for Form 150-101-195 Schedule OR-WFHDC Oregon Working Family Household and Dependent Care Credit for Full-Year, Part-Year, and Nonresidents - Oregon

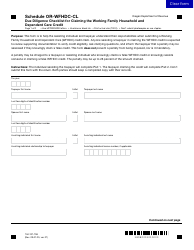

This document contains official instructions for Form 150-101-195 Schedule OR-WFHDC, Oregon Dependent Care Credit for Full-Year, Part-Year, and Nonresidents - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-101-195 Schedule OR-WFHDC is available for download through this link.

FAQ

Q: What is Form 150-101-195?

A: Form 150-101-195 is the schedule for claiming the Oregon Working Family Household and Dependent Care Credit.

Q: Who can use Form 150-101-195?

A: Residents, part-year residents, and nonresidents of Oregon who wish to claim the Working Family Household and Dependent Care Credit.

Q: What is the purpose of the Oregon Working Family Household and Dependent Care Credit?

A: The credit is designed to provide financial assistance to taxpayers who pay for eligible child and dependent care expenses.

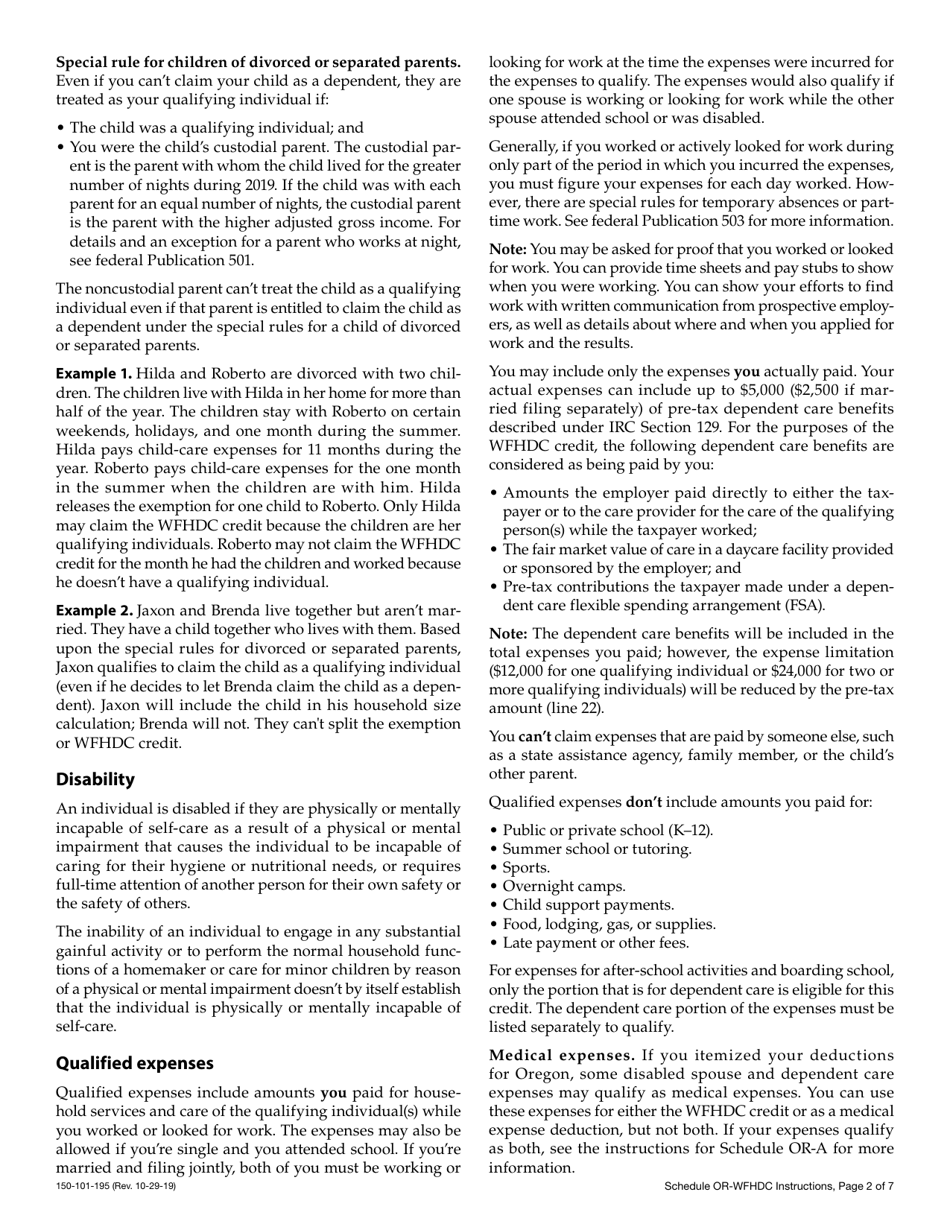

Q: What are eligible child and dependent care expenses?

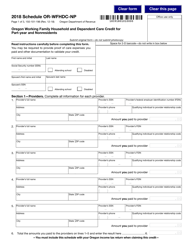

A: Eligible expenses include costs paid to a licensed child care provider, expenses related to caring for a disabled spouse or dependent, and other qualifying expenses.

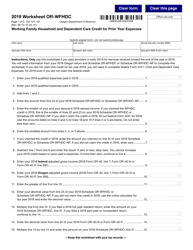

Q: How do I calculate the credit amount?

A: The credit is based on a percentage of your eligible expenses, up to certain maximum limits. The percentage and limits vary depending on your income.

Q: Do I need to submit any supporting documentation with Form 150-101-195?

A: Yes, you must include a copy of federal Form 2441 and any other supporting documents that verify your eligible expenses.

Q: When is the deadline for filing Form 150-101-195?

A: The deadline for filing Form 150-101-195 is the same as the deadline for filing your Oregon state income tax return.

Q: Can I e-file Form 150-101-195?

A: Yes, you can e-file Form 150-101-195 if you are also e-filing your Oregon state income tax return.

Instruction Details:

- This 7-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.