This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8962

for the current year.

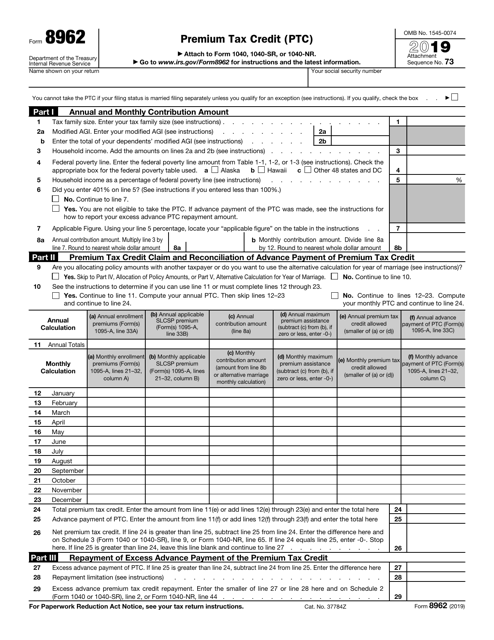

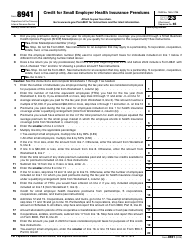

IRS Form 8962 Premium Tax Credit (Ptc)

What Is Form 8962?

IRS Form 8962, Premium Tax Credit (PTC) , is a legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year. It allows taxpayers to make up for the money spent on Marketplace health insurance premiums and save on income taxes. Form 8962 contains detailed instructions and serves as a Premium Tax Credit Calculator so you can see how much of your premium will be reimbursed by the government or how much you will have to pay yourself.

This form was released by the Internal Revenue Service (IRS) . The latest version of IRS Form 8962 was issued in 2019 with all previous editions obsolete. A fillable Form 8962 is available for download below.

What Is the Advanced Premium Tax Credit?

An Advanced Premium Tax Credit is a federal tax credit for eligible individuals that helps them reduce the amount of payment for monthly health insurance premiums when they purchase health insurance on the Marketplace. It is sent to health insurance companies that insure eligible taxpayers. Since this type of tax credit is not a direct payment, individuals who receive it do not pay the full amount of their monthly health insurance premium - instead, they pay the discounted amount. However, if at the end of the year you have taken more APTC in advance than you are due based on your final income, you need to pay back the excess when submitting your annual tax return.

Form 8962 Instructions

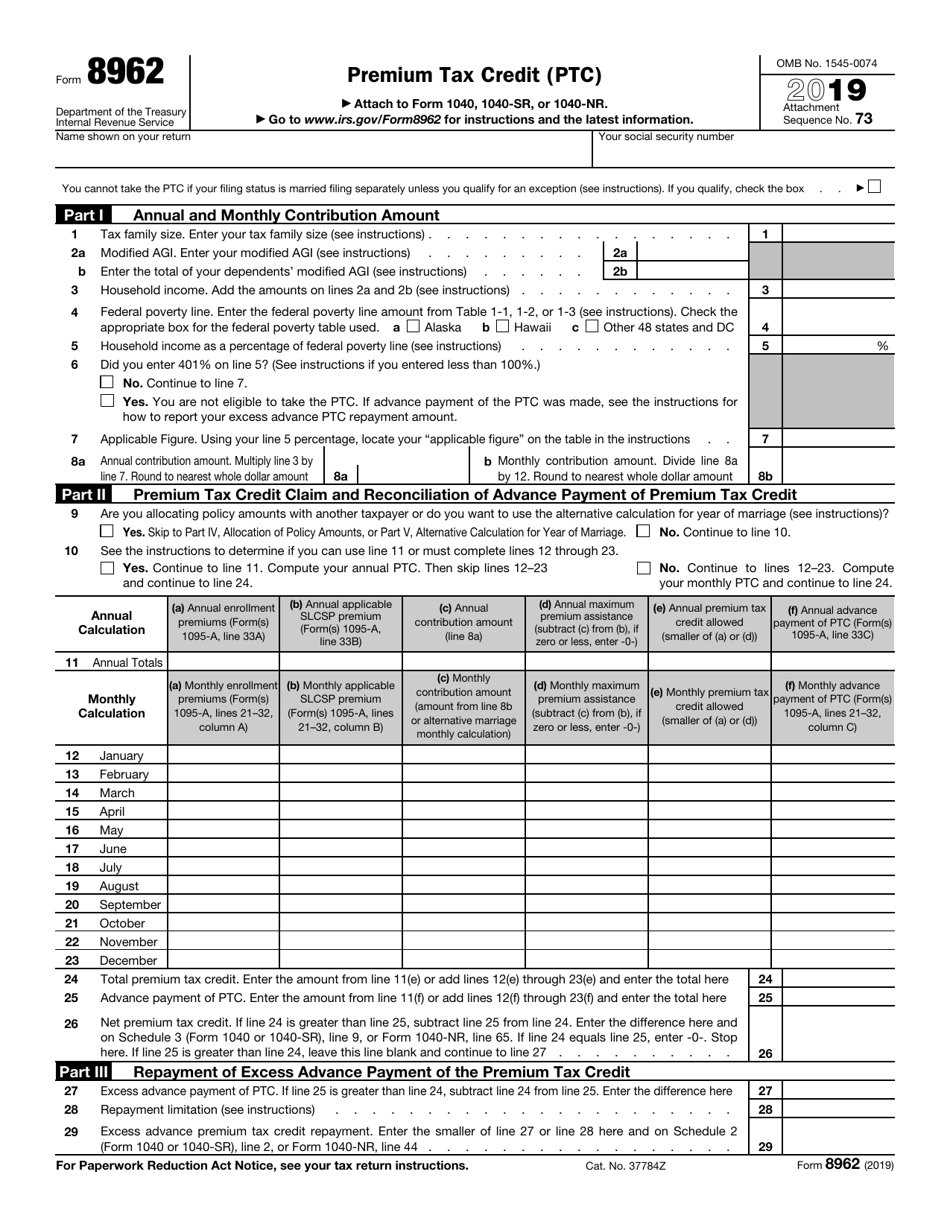

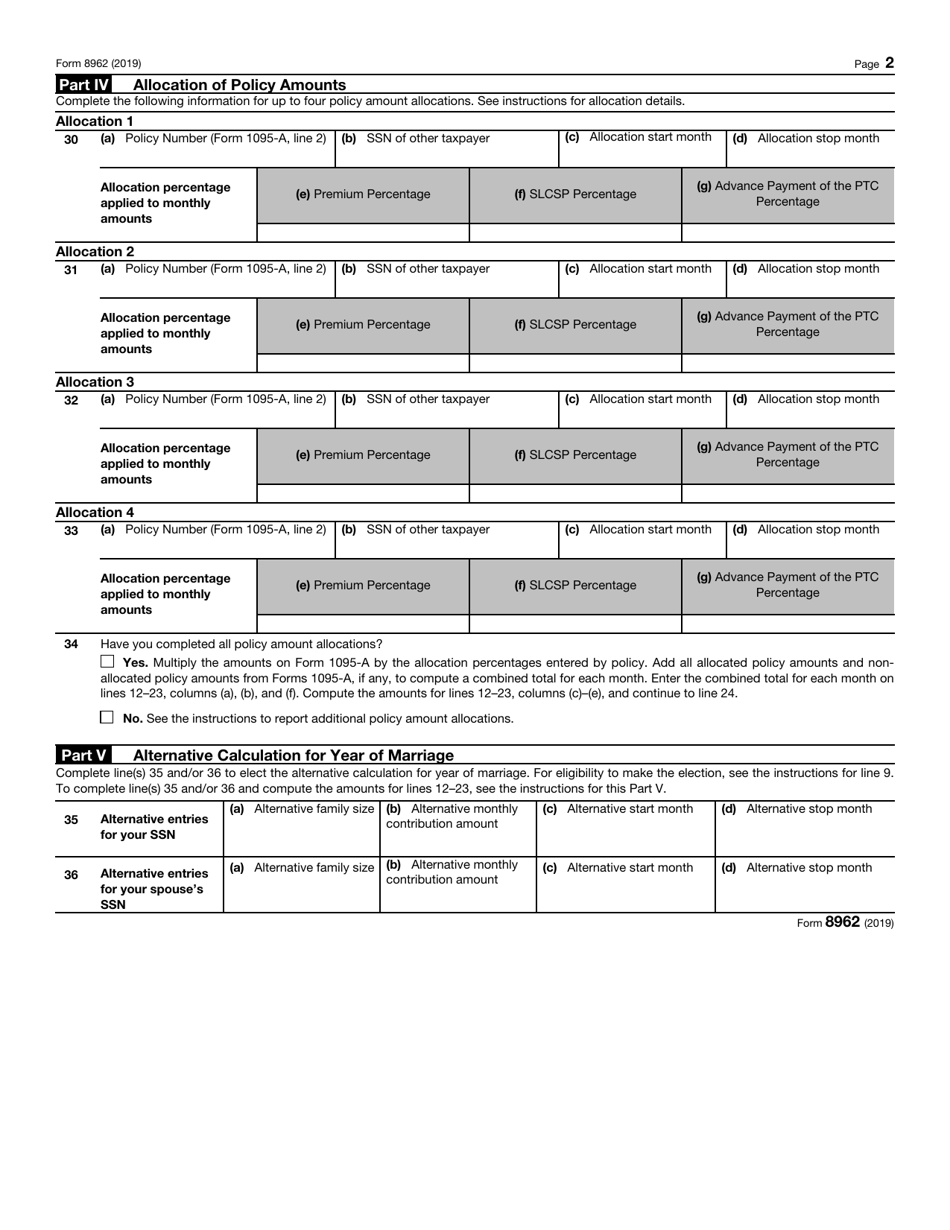

Follow these steps to fill out Form 8962 Premium Tax Credit:

- Write down your name and social security number. Make sure your filing status allows you to be eligible for the PTC and check the appropriate box to confirm your eligibility.

- Indicate your tax family size. Record the modified adjusted gross income from your individual tax return. State your household income as a percentage of the federal poverty line. Enter your annual and monthly contribution amounts.

- Figure out the PTC you are eligible for and compare it against the APTC paid on your behalf. Calculate the total PTC, the APTC amount, and the Net Premium Tax Credit.

- If the APTC is greater than the PTC, enter their difference. State the repayment limitation and figure out the excess APTC repayment - this is the amount you owe to the IRS.

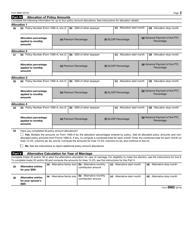

- Allocate policy amounts (enrollment premiums, Second Lowest Cost Silver Plan premiums, and APTC) between two tax families if your policy covered at least one individual in your tax family and another tax family and you received IRS Form 1095-A including your tax family member or wrongly representing the members of your tax family. Enter the policy number, social security number of the other taxpayer, the first and the last month you are allocating policy amounts. Record your allocation percentage applied to monthly amounts.

- Use the alternative calculation for year of marriage to repay less excess APTC if you got married during the reporting year and the APTC was paid for an individual in your tax family. Enter the alternative family size, monthly contribution amount, start and stop month for you and your spouse's social security numbers.

Who Qualifies for the Premium Tax Credit?

You qualify for a Premium Tax Credit if you meet the following requirements:

- Your household income is at least 100 and no more than 400 percent of the federal poverty line for your family size;

- You are not married filing separately;

- You are not claimed as a dependent by another individual;

- You or your family member had Health Insurance Marketplace coverage for at least a month. Additionally, this individual was not able to get an employer-sponsored plan coverage or government program coverage. It is also required to pay the share of premiums not covered by advance credit payments.

Related Premium Tax Credit Forms:

- Form 1040, U.S. Individual Income Tax Return, Is the standard individual tax return form used by taxpayers to submit their annual income tax returns;

- Form 1040-NR, U.S. Nonresident Alien Income Tax Return, is a tax return completed by nonresident aliens who earned income in the U.S. throughout the tax year;

- Form 1095-A, Health Insurance Marketplace Statement, informs the IRS about the people enrolled in qualified health plans through the Health Insurance Marketplace;

- Form 1095-B, Health Coverage, names employees that have minimum essential coverage and do not pay the individual shared responsibility payment;

- Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, also contains information about employees enrolled in health coverage, but it is filled out by employers with fifty or more employees;

- Form 8965, Health Coverage Exemptions, is completed by individuals who can claim a coverage exemption on their tax returns or have a coverage exemption granted by the Marketplace.