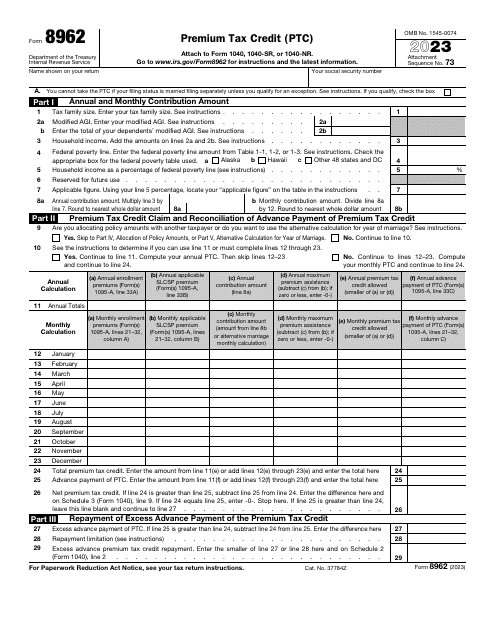

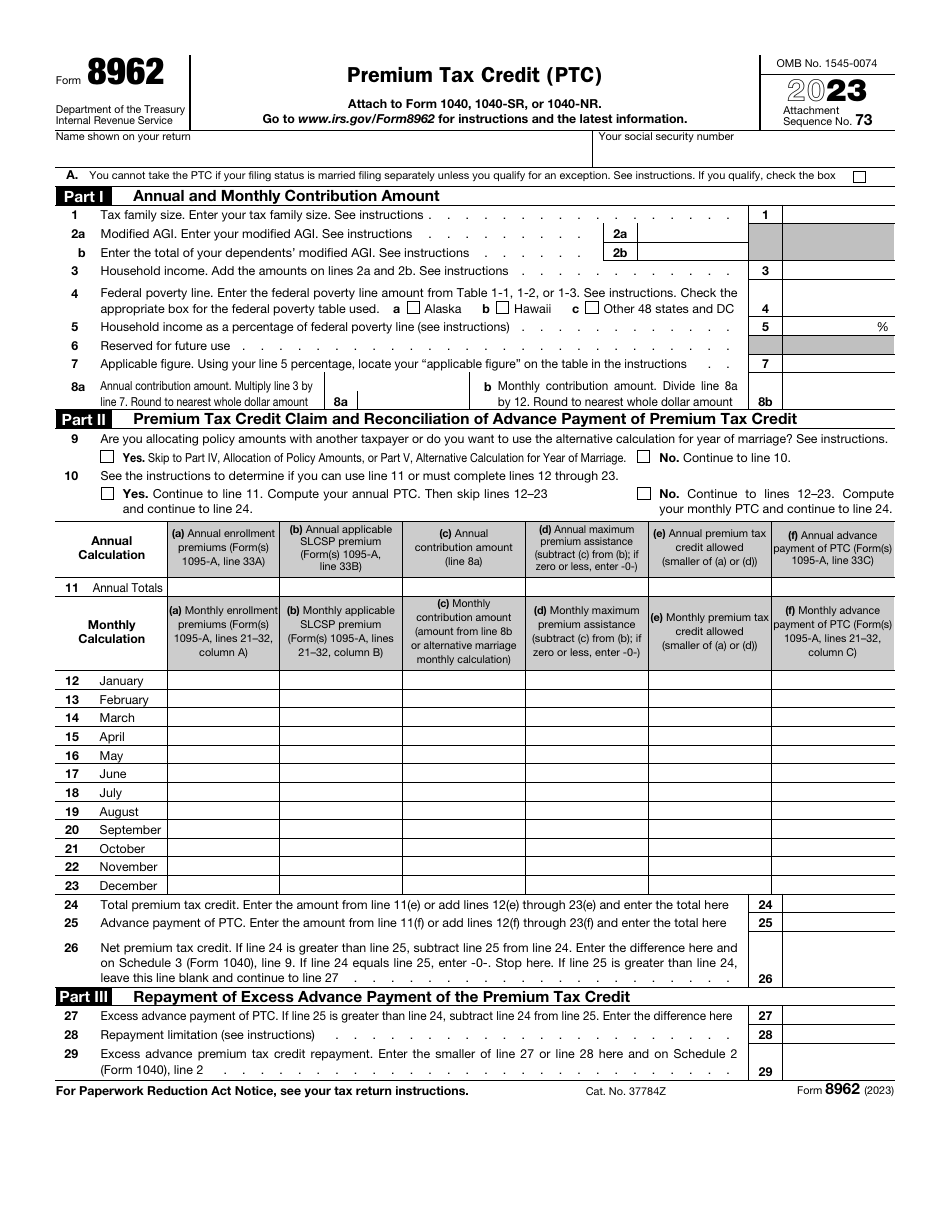

IRS Form 8962 Premium Tax Credit (Ptc)

What Is Form 8962?

IRS Form 8962, Premium Tax Credit (PTC), is a formal document completed by a taxpayer that has to learn the precise amount of PTC they qualify for and coordinate the number with the insurance payments they can report for a certain tax period.

Alternate Names:

- Premium Tax Credit Form;

- Tax Form 8962;

- Federal Form 8962.

This tool lets single and married individuals alike get back some of the funds they contributed to their insurance lowering the amount of income tax they end up owing annually. Use this form and worksheets featured in the instructions to figure out if you are eligible for this refundable tax benefit taking your household income and insurance payments into account.

This instrument was issued by the Internal Revenue Service (IRS) in 2023, making older editions of the form outdated. You can find an IRS Form 8962 fillable version through the link below.

What Is Form 8962 Used For?

The objective of the Premium Tax Credit Form is to notify fiscal authorities about your right to receive the PTC - as long as you meet the requirements set by the IRS, you will be allowed to claim the credit. When you are filling out Form 8962, confirm your household income is within the thresholds and certify you buy your health insurance to have a chance to reduce your essential insurance payments throughout the year.

It is also possible to obtain the credit when you send your annual tax return. Some taxpayers discover they benefit from the PTC without coordinating the amount with their taxable income - they will need to deal with the repayment of the credit; on the other hand, many people find out they used less credit which gives them the right to request a refund when they file their tax documentation.

What Is Advanced Premium Tax Credit?

An Advanced Premium Tax Credit can be defined as a specific subsidy paid to the person throughout the tax period in advance, unlike numerous other credits the individual must claim and wait for. The taxpayer will be able to lower the amount they are obliged to pay towards their health insurance on a monthly basis upon purchasing health insurance.

The information about the credit is computed and conveyed directly by the federal authorities to insurance providers - the credit amount is based on the income of the taxpayer which means you will get a discount when a payment is requested from you. You will not obtain this credit automatically - it is necessary to get the insurance policy and compute the credit disclosing information about yourself and your insurance coverage; alternatively, you can apply for a credit when you submit your tax return for the previous calendar year.

Form 8962 Instructions

Follow these Form 8962 Instructions to claim a PTC:

-

Write down the name you put on your tax return and your social security number. Confirm you meet the qualification requirements to file the document in question by checking the box.

-

Specify the number of people in your tax family, indicate your adjusted gross income, and calculate the income of your household. Use the official instructions released by the IRS to define your household income through the federal poverty line percentage and state your monthly and annual contribution amounts using the formulas listed in the form.

-

Provide a breakdown of your contributions month by month and combine the results to find out how big the annual payments, insurance reimbursement, and PTC are. The instrument also has to contain the amount of advance payment of PTC and the calculation of the net PTC.

-

If you owe Form 8962 taxes and are obliged to repay the excess advance PTC, it must be showcased in the document. Refer to the table in the official instructions to figure out the repayment limitation that applies in your case and record the result - do not forget to replicate the number on Schedule 2 you will attach to your tax return.

-

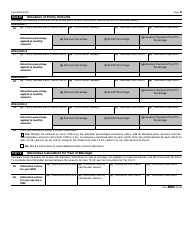

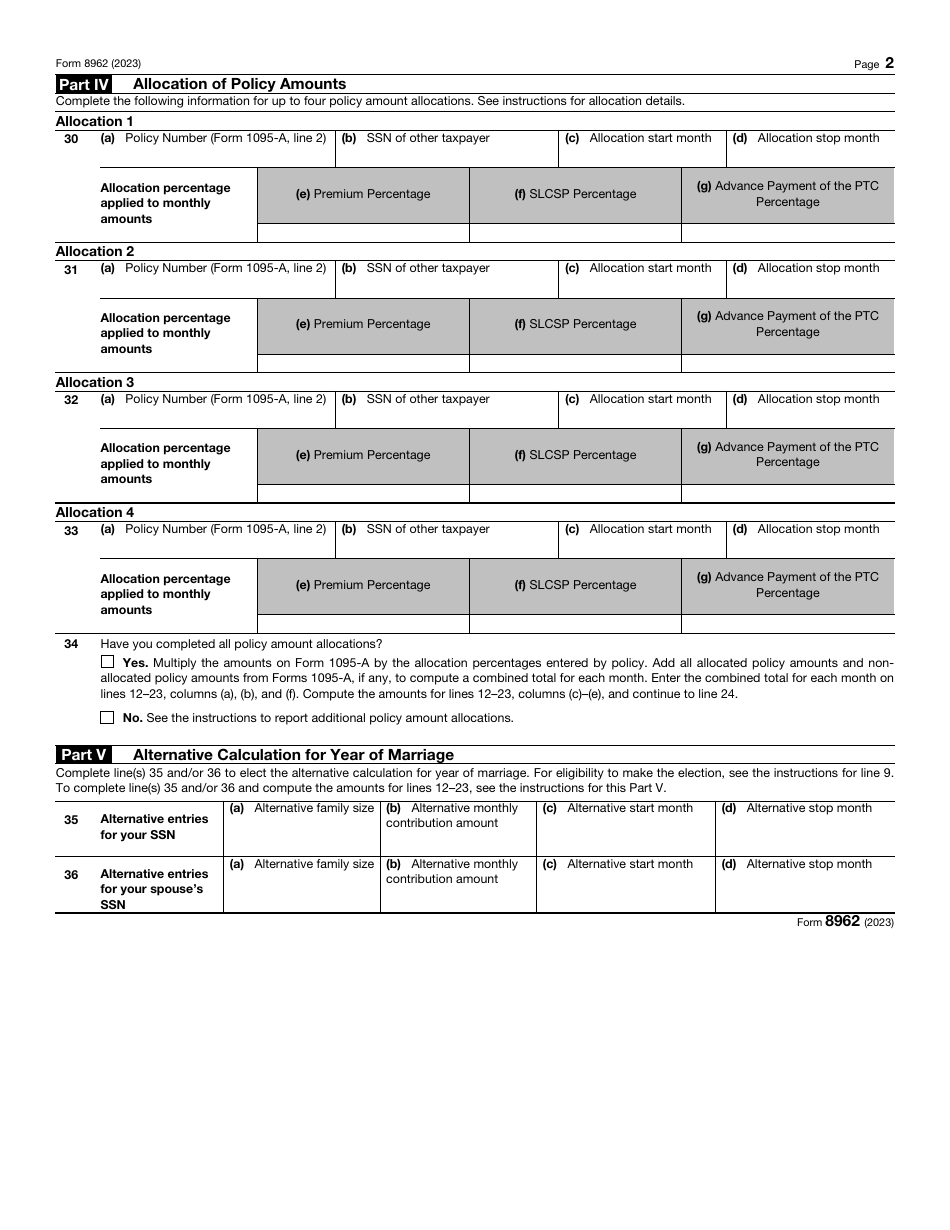

Fill out the part of the form that outlines policy amount allocations if you need to do it with another taxpayer. Write down the number of the policy, enter the social security number of the other person, and clarify when the allocation starts and stops. As for the percentage of allocation, it is required to list the percentage of the payment, the percentage of the second lowest cost Silver plan, and the percentage of the PTC advance payment. Answer whether you completed all the allocations and check whether you have to report additional information in line with the current regulations.

-

Opt for the alternative computation if you were not married at the start of the fiscal period. Disclose information about the size of your tax family, the amount of contribution, and the start and stop of the period when the contribution was reduced. List the same details for your current spouse.

Who Qualifies for the Premium Tax Credit?

A taxpayer will qualify for the PTC if they or their family member (spouse or dependent) had health insurance coverage for one month or more, the payments were made before the deadline of their income statement came, the household income of the person was within the established limits, they did not file a tax return separately from their spouse, and they were not identified as dependent on anyone else's income statement.

As for the income requirement, the household income for the previous year has to be at least 100% of the federal poverty threshold set for a family of your size. Those who can still qualify for Medicaid or health insurance sponsored by their employers cannot claim this tax credit.

What Happens if I Don't File Form 8962?

Fiscal authorities expect taxpayers to submit Form 8962 every year when they receive PTC. If you do not do it on time, the IRS will not be able to coordinate the amount of the PTC with the advance payment of the credit in question. It is likely you will not get an opportunity to claim PTC in the upcoming years - besides, filers are warned about their duty to coordinate the PTC for two tax years in a row otherwise they will be found ineligible to obtain the payment in the future.

Where to Mail Form 8962?

Once you filled out the Tax Form 8962, you need to attach it to your annual income statement - IRS Form 1040, U.S. Individual Income Tax Return, IRS Form 1040-SR, U.S. Tax Return for Seniors, or IRS Form 1040-NR, U.S. Nonresident Alien Income Tax Return - and send the paperwork to the address of the IRS processing center closest to your current location. The due date for the document is the same - April 15 for people whose fiscal year ends on December 31.

Related Premium Tax Credit Forms:

- Form 1095-A, Health Insurance Marketplace Statement, informs the IRS about the people enrolled in qualified health plans through the Health Insurance Marketplace;

- Form 1095-B, Health Coverage, names employees that have minimum essential coverage and do not pay the individual shared responsibility payment;

- Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, also contains information about employees enrolled in health coverage, but it is filled out by employers with fifty or more employees;

- Form 8965, Health Coverage Exemptions, is completed by individuals who can claim a coverage exemption on their tax returns or have a coverage exemption granted by the Marketplace.