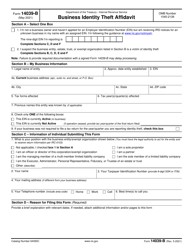

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 4684

for the current year.

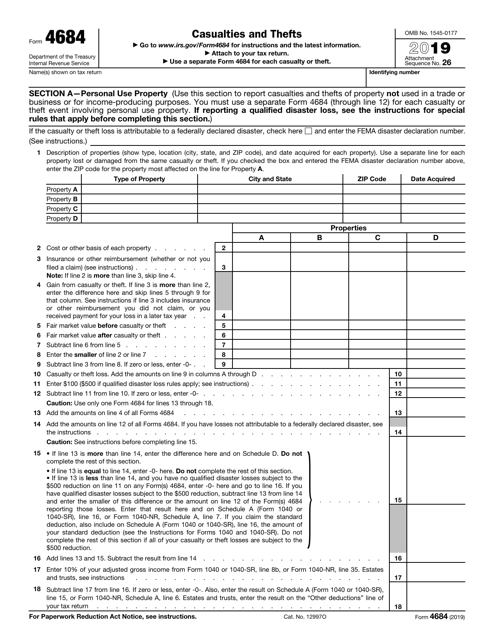

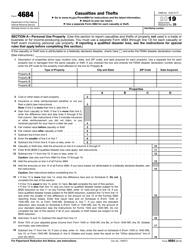

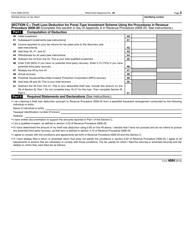

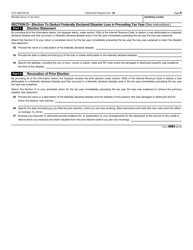

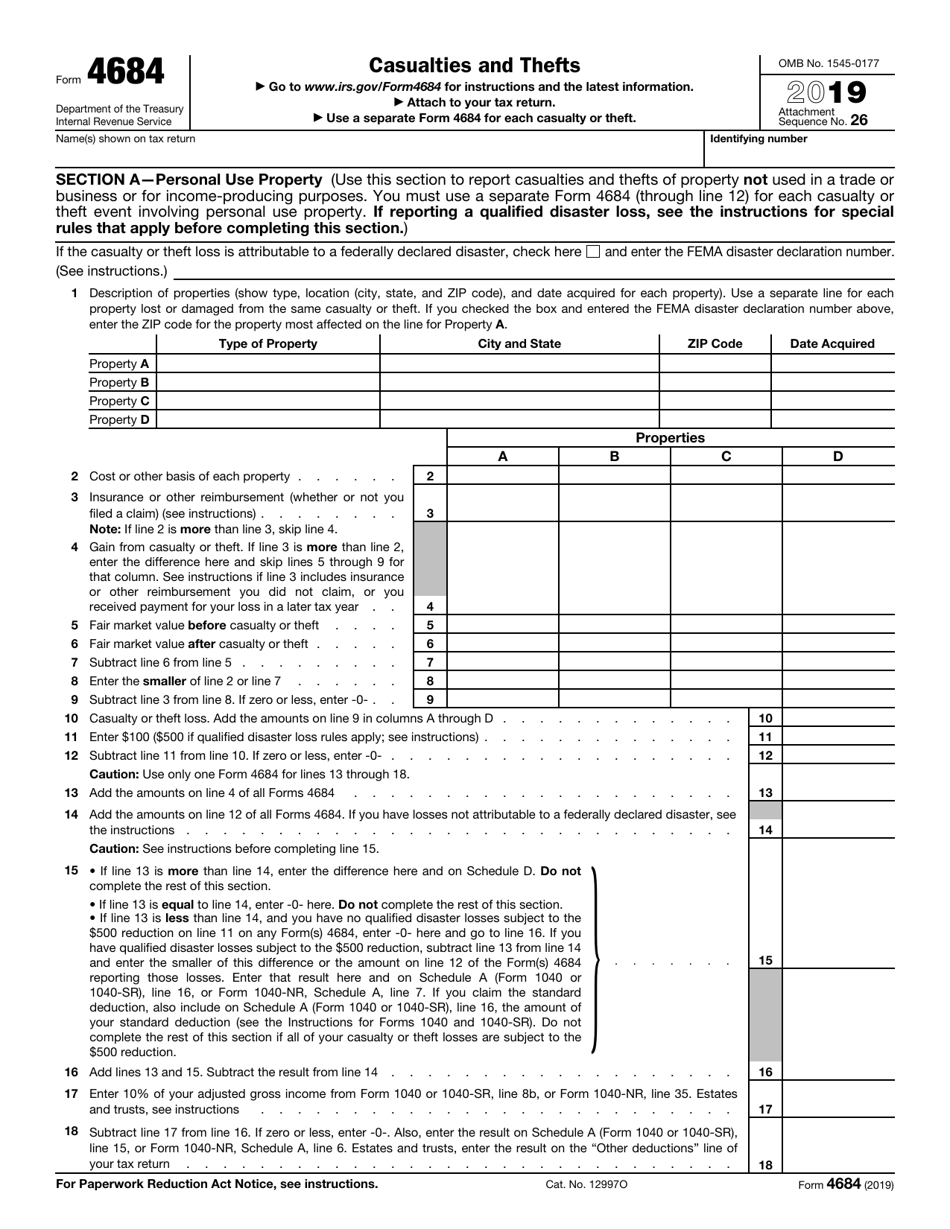

IRS Form 4684 Casualties and Thefts

What Is IRS Form 4684?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 4684?

A: IRS Form 4684 is used to report casualties and thefts for tax purposes.

Q: What does IRS Form 4684 cover?

A: IRS Form 4684 covers losses from casualties or thefts of personal property.

Q: Who should use IRS Form 4684?

A: Individuals, partnerships, corporations, and estates can use IRS Form 4684 to report casualty and theft losses.

Q: What is considered a casualty loss?

A: A casualty loss is the damage, destruction, or loss of property resulting from an identifiable event that is sudden, unexpected, or unusual.

Q: What is considered a theft loss?

A: A theft loss is the unlawful taking and removing of money or property with the intent to deprive the owner of its possession or use.

Q: How do I fill out IRS Form 4684?

A: You must provide information about the property, the event causing the loss, and the amount of the loss on IRS Form 4684.

Q: Can I deduct casualty and theft losses on my tax return?

A: Yes, you may be able to deduct casualty and theft losses on your tax return, subject to certain limitations.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4684 through the link below or browse more documents in our library of IRS Forms.