This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8379

for the current year.

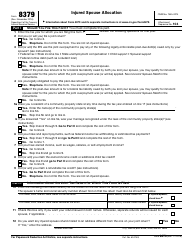

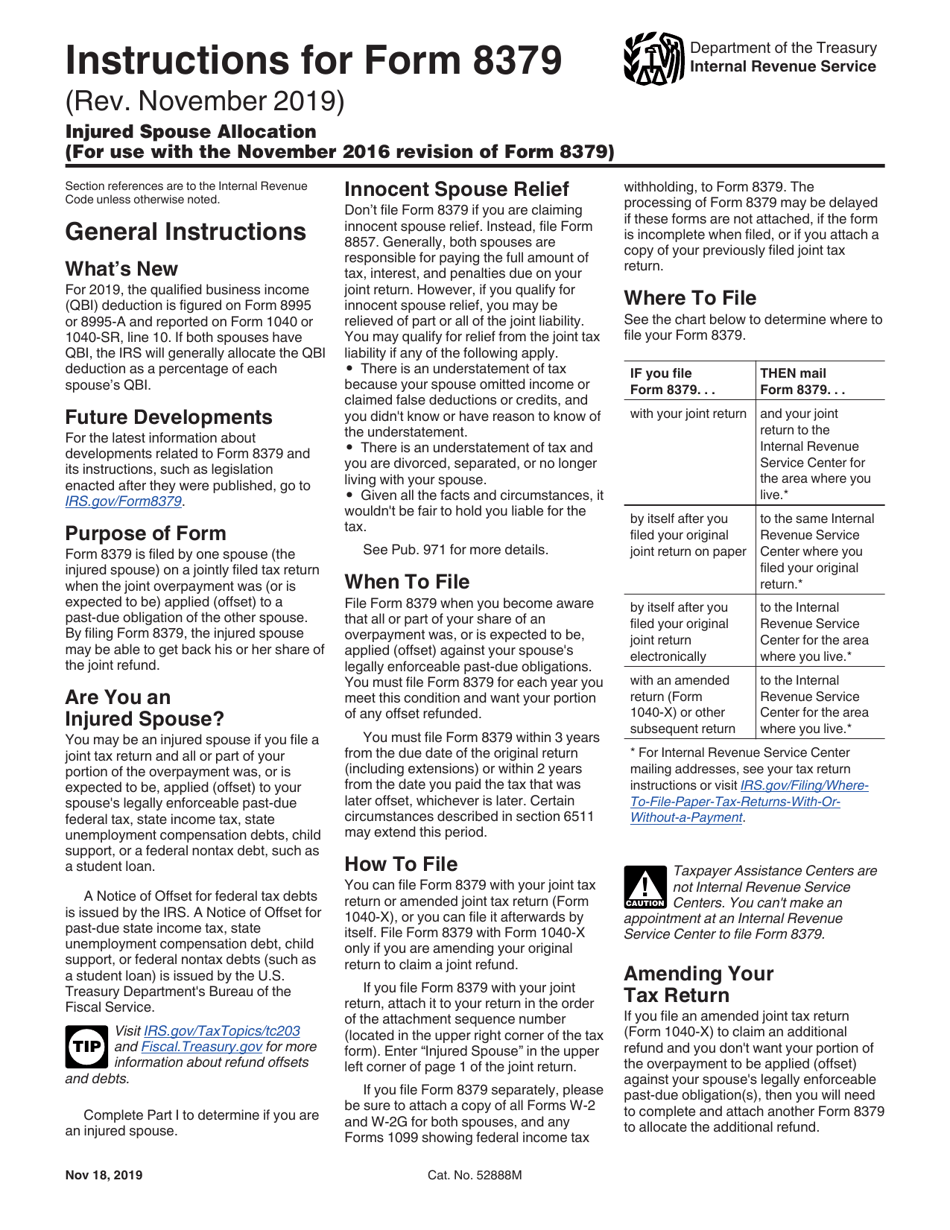

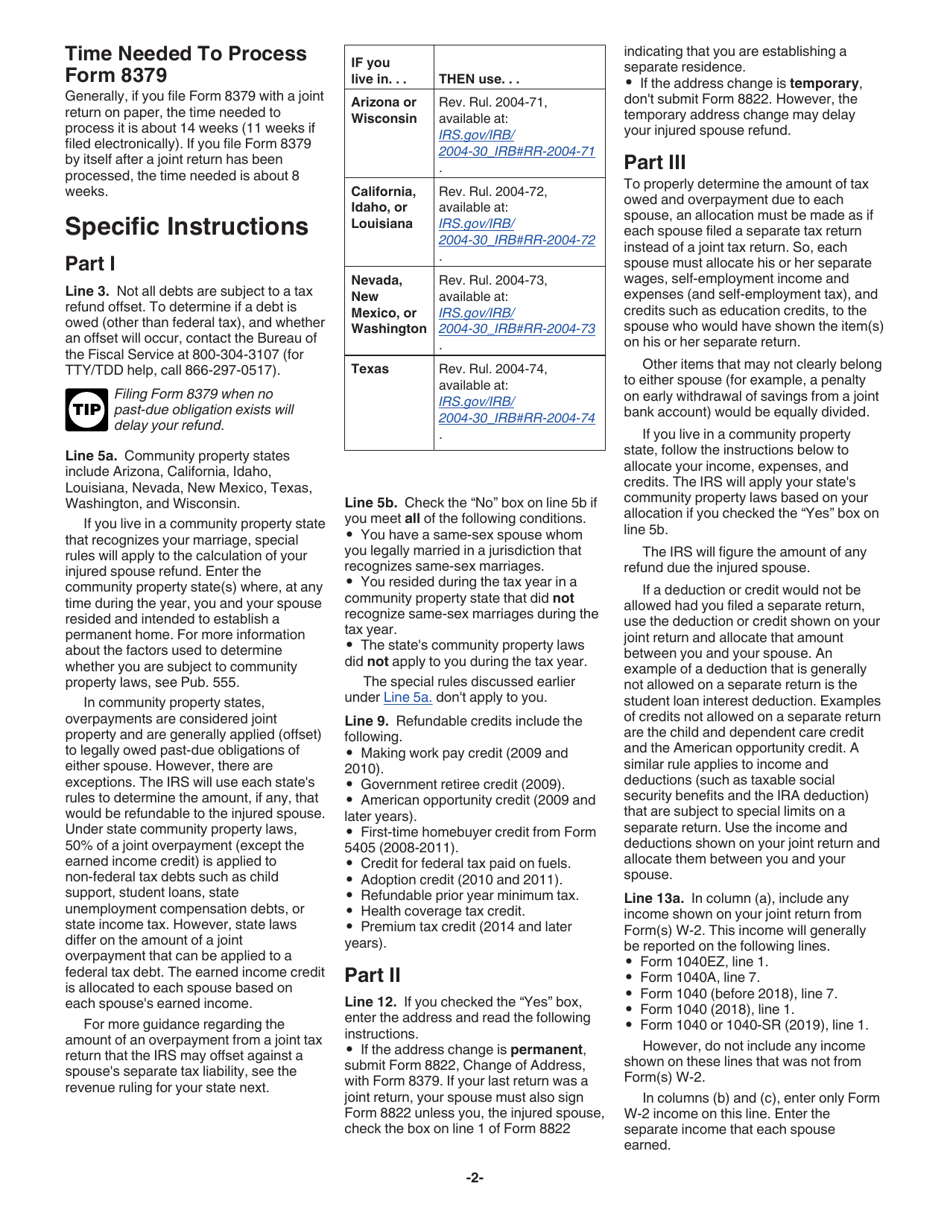

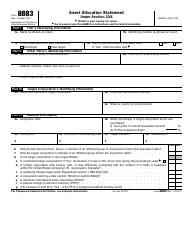

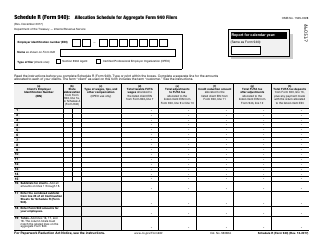

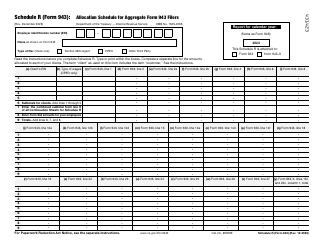

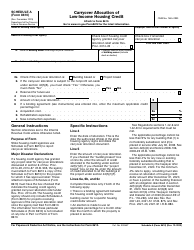

Instructions for IRS Form 8379 Injured Spouse Allocation

This document contains official instructions for IRS Form 8379 , Injured Spouse Allocation - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8379 is available for download through this link.

FAQ

Q: What is IRS Form 8379?

A: IRS Form 8379 is the Injured Spouse Allocation form.

Q: What is the purpose of Form 8379?

A: Form 8379 is used to allocate a joint tax refund when one spouse has past-due obligations.

Q: Who can file Form 8379?

A: You can file Form 8379 if you are an injured spouse who wants to protect your share of a joint refund.

Q: What is an injured spouse?

A: An injured spouse is someone whose portion of a joint tax refund could be used to pay the past-due obligations of their spouse.

Q: When should I file Form 8379?

A: You should file Form 8379 as soon as you become aware of your spouse's past-due obligations.

Q: Is there a fee to file Form 8379?

A: No, there is no fee to file Form 8379.

Q: How long does it take to process Form 8379?

A: Processing time for Form 8379 can vary, but it typically takes about 11 weeks.

Q: Can I e-file Form 8379?

A: Yes, you can e-file Form 8379 if you are also e-filing your tax return.

Q: Can Form 8379 be used for state tax refunds?

A: No, Form 8379 is specifically for federal tax refunds only.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.