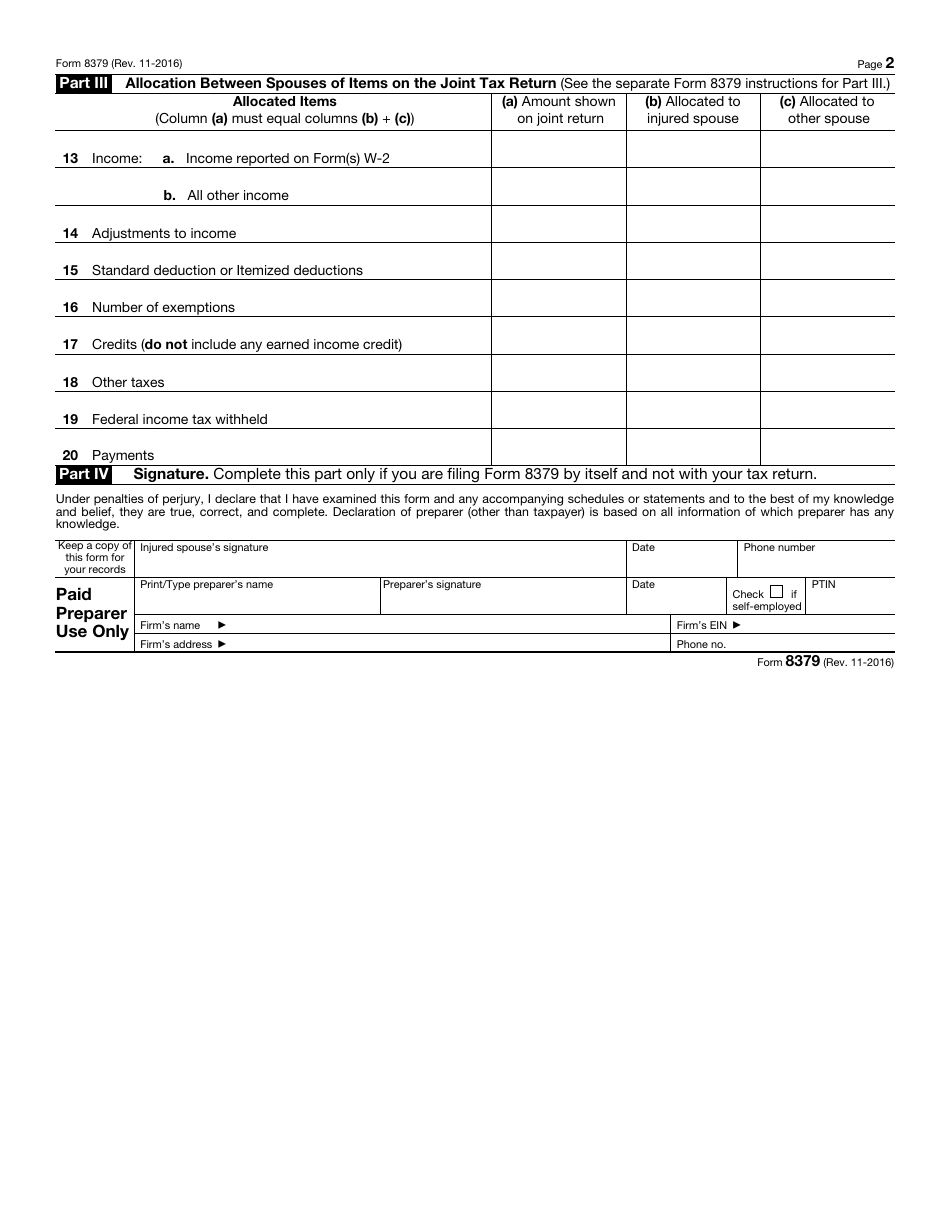

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8379

for the current year.

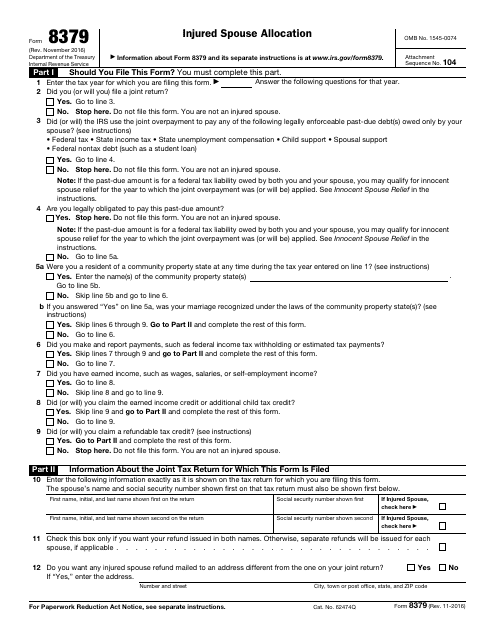

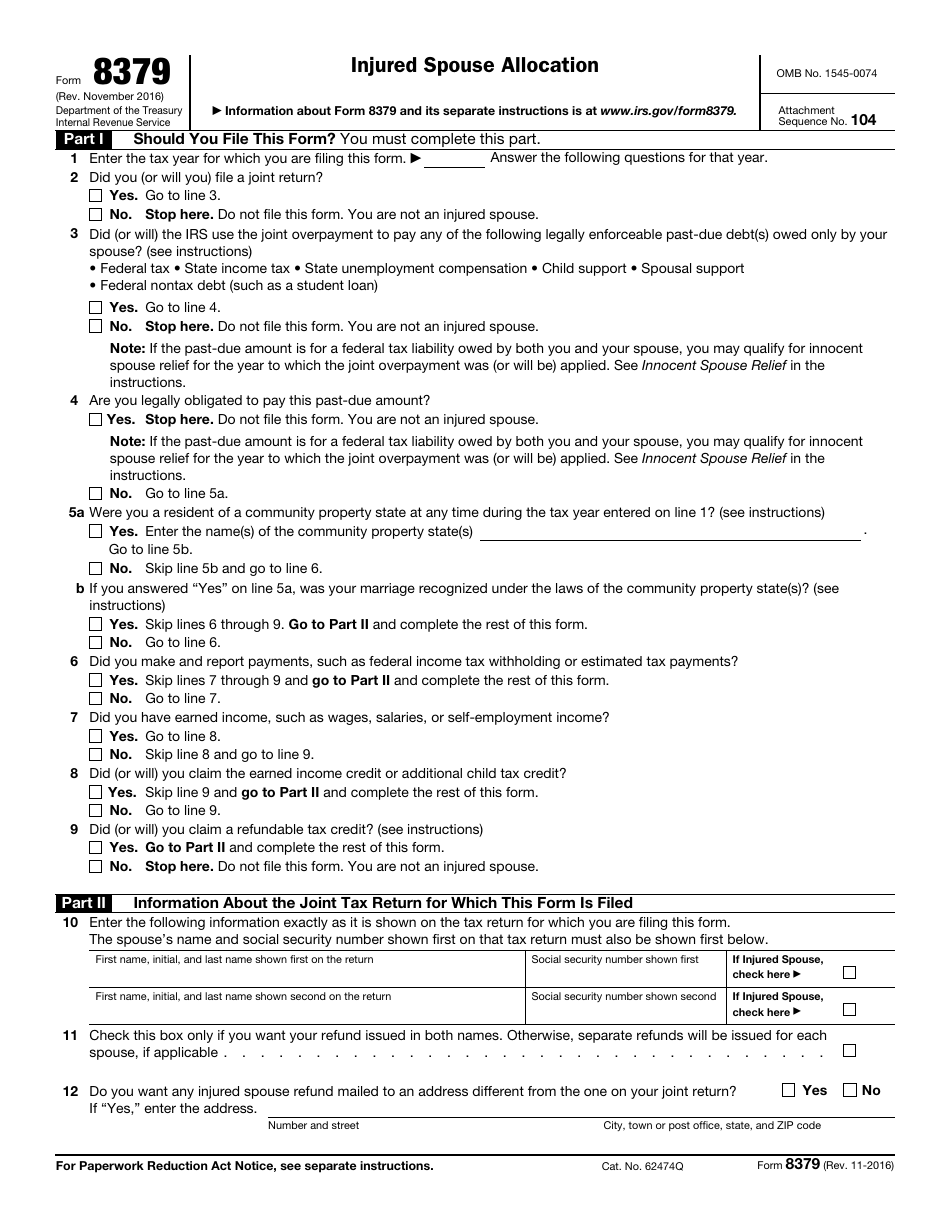

IRS Form 8379 Injured Spouse Allocation

What Is IRS Form 8379?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2016. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8379?

A: IRS Form 8379 is the Injured Spouse Allocation form.

Q: What is the purpose of IRS Form 8379?

A: The purpose of IRS Form 8379 is to allocate income, exemptions, deductions, and credits between a couple when the IRS applies a refund due to one spouse to a debt owed by the other spouse.

Q: Who should use IRS Form 8379?

A: IRS Form 8379 should be used by a taxpayer who is considered an injured spouse, meaning they expect a portion of their tax refund to be applied to their spouse's past-due debts.

Q: How does IRS Form 8379 help an injured spouse?

A: IRS Form 8379 helps an injured spouse by allowing them to claim their share of the refund and potentially receive it, instead of it being applied to their spouse's outstanding debts.

Q: When should I file IRS Form 8379?

A: You should file IRS Form 8379 at the same time you file your federal tax return if you know you are an injured spouse.

Q: Are there any eligibility requirements for using IRS Form 8379?

A: Yes, there are eligibility requirements for using IRS Form 8379. For example, you must have reported income on a joint tax return, and your spouse must have past-due debts.

Q: Can I e-file IRS Form 8379?

A: Yes, you can e-file IRS Form 8379 along with your federal tax return.

Q: How long does it take to process IRS Form 8379?

A: The processing time for IRS Form 8379 can vary, but it generally takes about 8-12 weeks.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8379 through the link below or browse more documents in our library of IRS Forms.