This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-SA, 5498-SA

for the current year.

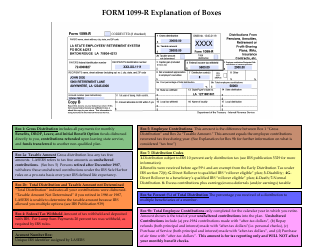

Instructions for IRS Form 1099-SA, 5498-SA Distributions From an Hsa, Archer Msa, or Medicare Advantage Msa, and Hsa, Archer Msa, or Medicare Advantage Msa Information

This document contains official instructions for IRS Form 1099-SA , and IRS Form 5498-SA . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

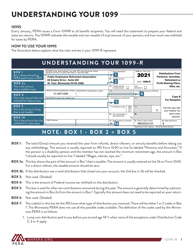

Q: What is IRS Form 1099-SA?

A: IRS Form 1099-SA is a tax form used to report distributions from Health Savings Accounts (HSA), Archer Medical Savings Accounts (Archer MSA), or Medicare Advantage Medical Savings Accounts (Medicare Advantage MSA).

Q: What is IRS Form 5498-SA?

A: IRS Form 5498-SA is a tax form used to report contributions to Health Savings Accounts (HSA), Archer Medical Savings Accounts (Archer MSA), or Medicare Advantage Medical Savings Accounts (Medicare Advantage MSA).

Q: What are HSA, Archer MSA, and Medicare Advantage MSA?

A: HSA stands for Health Savings Account, Archer MSA stands for Archer Medical Savings Account, and Medicare Advantage MSA stands for Medicare Advantage Medical Savings Account. These are tax-advantaged accounts that allow individuals to save and pay for medical expenses.

Q: What information is required to complete Form 1099-SA?

A: To complete Form 1099-SA, you will need to provide the recipient's name, address, and Social Security Number (or Taxpayer Identification Number), the total distribution amount, and information about the type of account from which the distribution was made.

Q: What information is required to complete Form 5498-SA?

A: To complete Form 5498-SA, you will need to provide the recipient's name, address, and Social Security Number (or Taxpayer Identification Number), the total contributions made to the account, and information about the type of account. You may also need to report the fair market value of the account at the end of the year.

Q: Who needs to file Form 1099-SA?

A: Form 1099-SA must be filed by any person or entity who makes distributions from an HSA, Archer MSA, or Medicare Advantage MSA. This includes banks, trustees, and custodians of these accounts.

Q: Who needs to file Form 5498-SA?

A: Form 5498-SA must be filed by any person or entity who contributes to an HSA, Archer MSA, or Medicare Advantage MSA. This includes individuals, employers, and financial institutions.

Instruction Details:

- This 3-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.