This version of the form is not currently in use and is provided for reference only. Download this version of

Form NC-478G

for the current year.

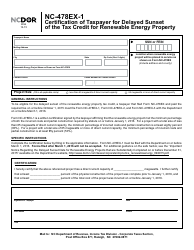

Form NC-478G Tax Credit for Investing in Renewable Energy Property - North Carolina

What Is Form NC-478G?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NC-478G?

A: Form NC-478G is a tax form for claiming tax credits for investing in renewable energy property in North Carolina.

Q: What is the purpose of Form NC-478G?

A: The purpose of Form NC-478G is to allow taxpayers to claim tax credits for investments in renewable energy property in North Carolina.

Q: Who can use Form NC-478G?

A: Taxpayers who have made investments in renewable energy property in North Carolina can use Form NC-478G.

Q: What is considered renewable energy property?

A: Renewable energy property includes solar energy property, wind energy property, hydroelectric energy property, and biomass property.

Q: What type of tax credit can be claimed using Form NC-478G?

A: Taxpayers can claim a credit equal to 35% of the cost of renewable energy property investments.

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are limitations and restrictions on the tax credit, including a maximum credit amount and a carryforward provision if the credit exceeds the taxpayer's tax liability.

Q: When is the deadline for filing Form NC-478G?

A: The deadline for filing Form NC-478G is typically the same as the individual income tax return deadline in North Carolina, which is April 15th.

Q: Can I e-file Form NC-478G?

A: Yes, Form NC-478G can be e-filed if you are filing your North Carolina individual income tax return electronically.

Q: Is there any additional documentation required with Form NC-478G?

A: Yes, taxpayers must include supporting documentation such as invoices, receipts, and other evidence of the costs incurred for renewable energy property investments.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-478G by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.