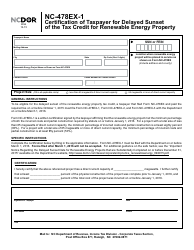

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form NC-478G

for the current year.

Instructions for Form NC-478G Tax Credit for Investing in Renewable Energy Property - North Carolina

This document contains official instructions for Form NC-478G , Tax Credit for Investing in Renewable Energy Property - a form released and collected by the North Carolina Department of Revenue. An up-to-date fillable Form NC-478G is available for download through this link.

FAQ

Q: What is Form NC-478G?

A: Form NC-478G is a tax form for individuals or businesses to claim a tax credit for investing in renewable energy property in North Carolina.

Q: What is the purpose of Form NC-478G?

A: The purpose of Form NC-478G is to provide taxpayers with a way to claim a tax credit for eligible investments in renewable energy property in North Carolina.

Q: Who can use Form NC-478G?

A: Both individuals and businesses who have made eligible investments in renewable energy property in North Carolina can use Form NC-478G.

Q: What qualifies as renewable energy property?

A: Renewable energy property includes solar energy equipment, wind energy equipment, geothermal energy equipment, and other eligible renewable energy technologies.

Q: How much is the tax credit?

A: The tax credit amount varies depending on the type and size of the renewable energy property, as well as other factors. Consult the instructions for details.

Q: What are the eligibility requirements?

A: To be eligible for the tax credit, the renewable energy property must meet certain criteria outlined in the instructions. Additionally, the taxpayer must have written certification from the North Carolina Department of Environmental Quality.

Q: What other documents are needed to complete Form NC-478G?

A: Taxpayers will need to provide supporting documentation such as receipts, invoices, and other evidence of the renewable energy property investment.

Q: When is the deadline to file Form NC-478G?

A: The deadline to file Form NC-478G is typically the same as the individual or business income tax return deadline, which is usually April 15th.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.