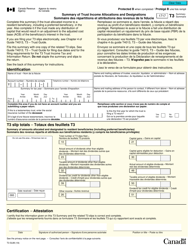

This version of the form is not currently in use and is provided for reference only. Download this version of

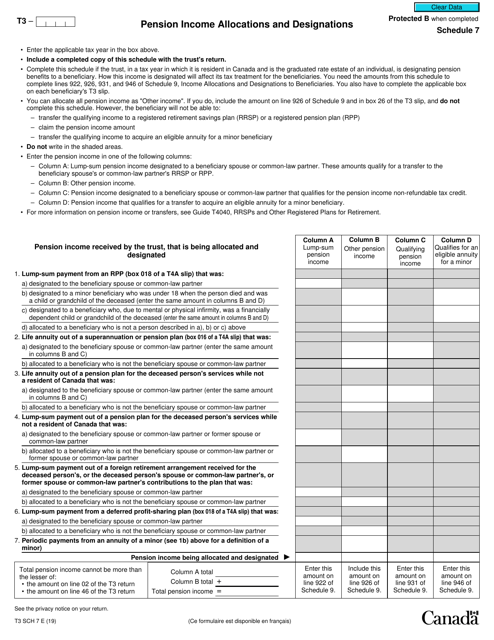

Form T3 Schedule 7

for the current year.

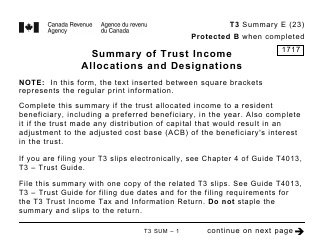

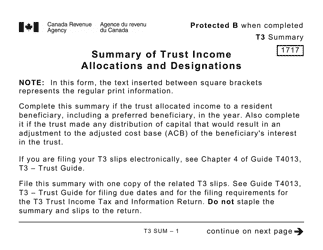

Form T3 Schedule 7 Pension Income Allocations and Designations - Canada

Form T3 Schedule 7 Pension Income Allocations and Designations in Canada is used to allocate and designate pension income among individuals for tax purposes. It helps determine how much pension income each individual should include on their tax return.

The individual who receives the pension income files Form T3 Schedule 7 - Pension Income Allocations and Designations in Canada.

FAQ

Q: What is Form T3 Schedule 7?

A: Form T3 Schedule 7 is a tax form used in Canada to report pension income allocations and designations.

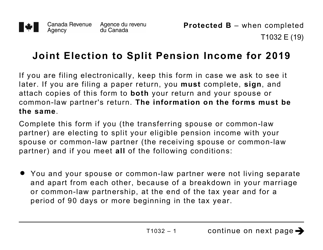

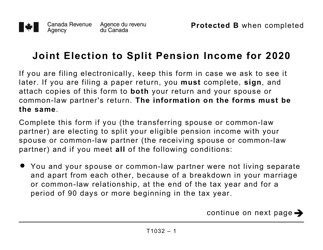

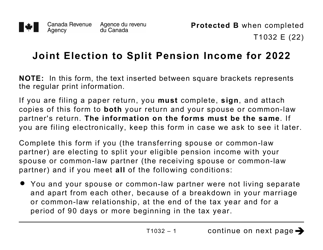

Q: What is pension income allocation?

A: Pension income allocation refers to the process of dividing pension income between a taxpayer and their spouse or common-law partner for tax purposes.

Q: Why do I need to complete Form T3 Schedule 7?

A: You need to complete Form T3 Schedule 7 if you received pension income and want to allocate a portion of it to your spouse or common-law partner for tax purposes.

Q: How do I complete Form T3 Schedule 7?

A: To complete Form T3 Schedule 7, you will need to provide information about your pension income, specify the allocation you want to make, and indicate your spouse or common-law partner's social insurance number (SIN).

Q: What is the deadline for filing Form T3 Schedule 7?

A: The deadline for filing Form T3 Schedule 7 is the same as the filing deadline for your T3 tax return, which is usually April 30th of the following year.

Q: Can I allocate pension income to my spouse or common-law partner if they don't have any income?

A: Yes, you can allocate pension income to your spouse or common-law partner even if they don't have any income.

Q: Is there a specific threshold for pension income allocation?

A: No, there is no specific threshold for pension income allocation. You can allocate any portion of your pension income to your spouse or common-law partner.

Q: Do I need to submit supporting documents with Form T3 Schedule 7?

A: Generally, you don't need to submit supporting documents with Form T3 Schedule 7. However, it's recommended to keep all relevant documents in case of an audit.

Q: Can I make changes to my pension income allocation after filing Form T3 Schedule 7?

A: No, once you have filed Form T3 Schedule 7, you cannot make changes to your pension income allocation.