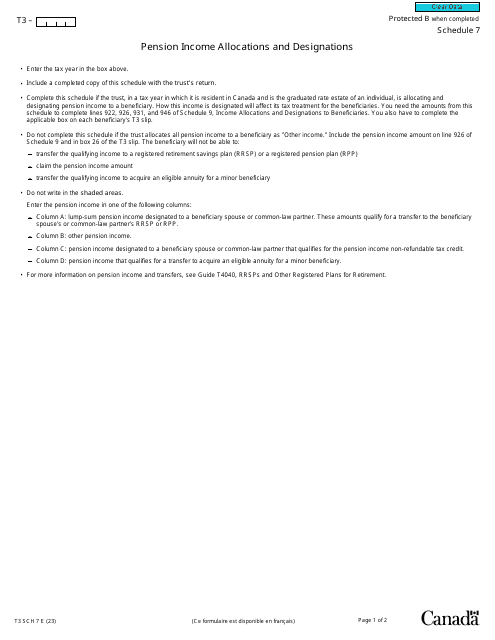

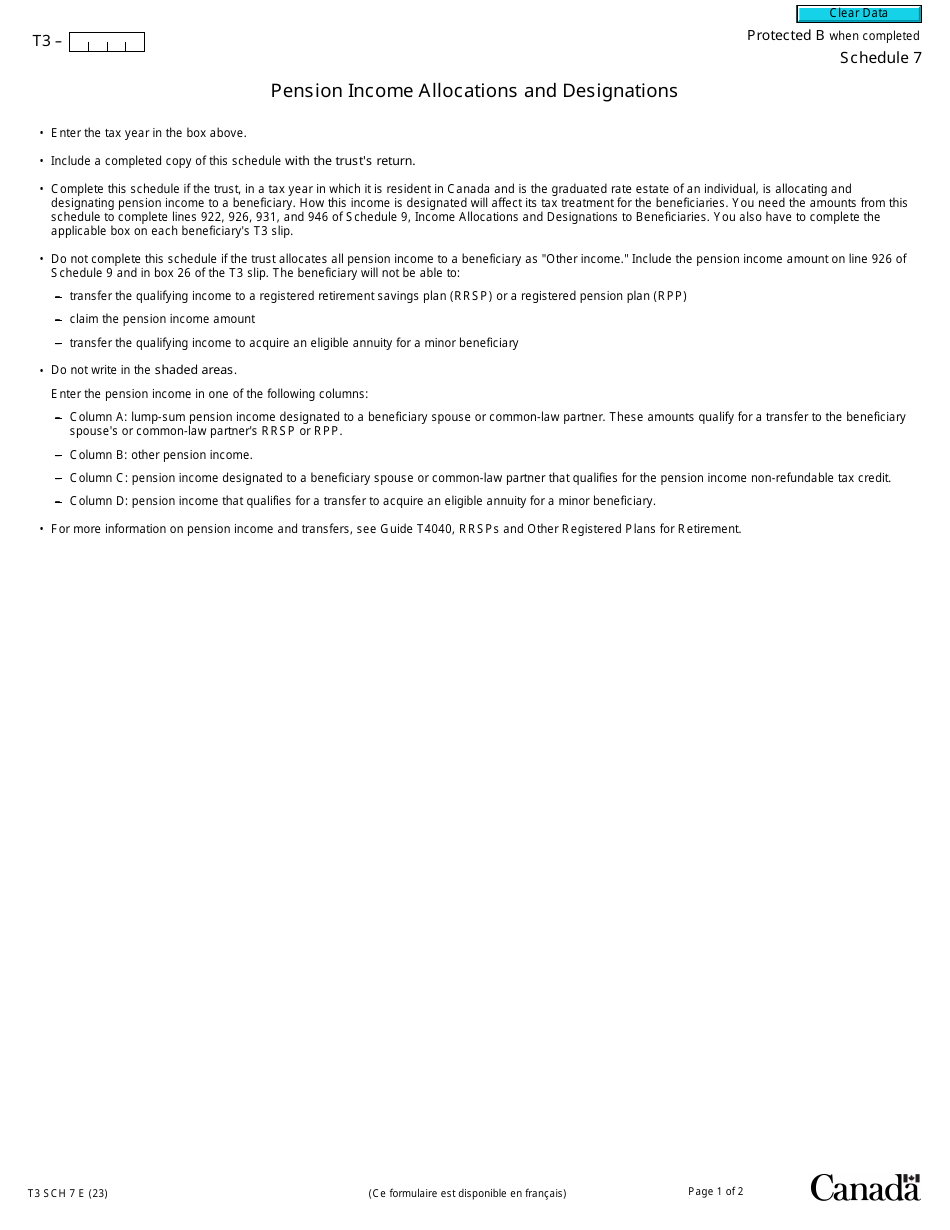

Form T3 Schedule 7 Pension Income Allocations and Designations - Canada

Form T3 Schedule 7 Pension Income Allocations and Designations in Canada is used to allocate and designate pension income received from a deceased person's estate. This form helps determine how this income should be distributed among beneficiaries.

The taxpayer who receives pension income in Canada would typically file Form T3 Schedule 7 to report any allocations or designations related to their pension income.

Form T3 Schedule 7 Pension Income Allocations and Designations - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3 Schedule 7?

A: Form T3 Schedule 7 is a tax form used in Canada to report pension income allocations and designations.

Q: Who needs to fill out Form T3 Schedule 7?

A: Individuals who receive pension income and want to allocate or designate certain amounts of that income must fill out this form.

Q: What is the purpose of Form T3 Schedule 7?

A: The purpose of this form is to allocate or designate certain amounts of pension income received to another person or organization.

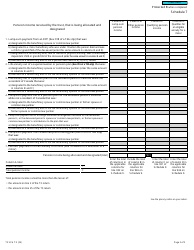

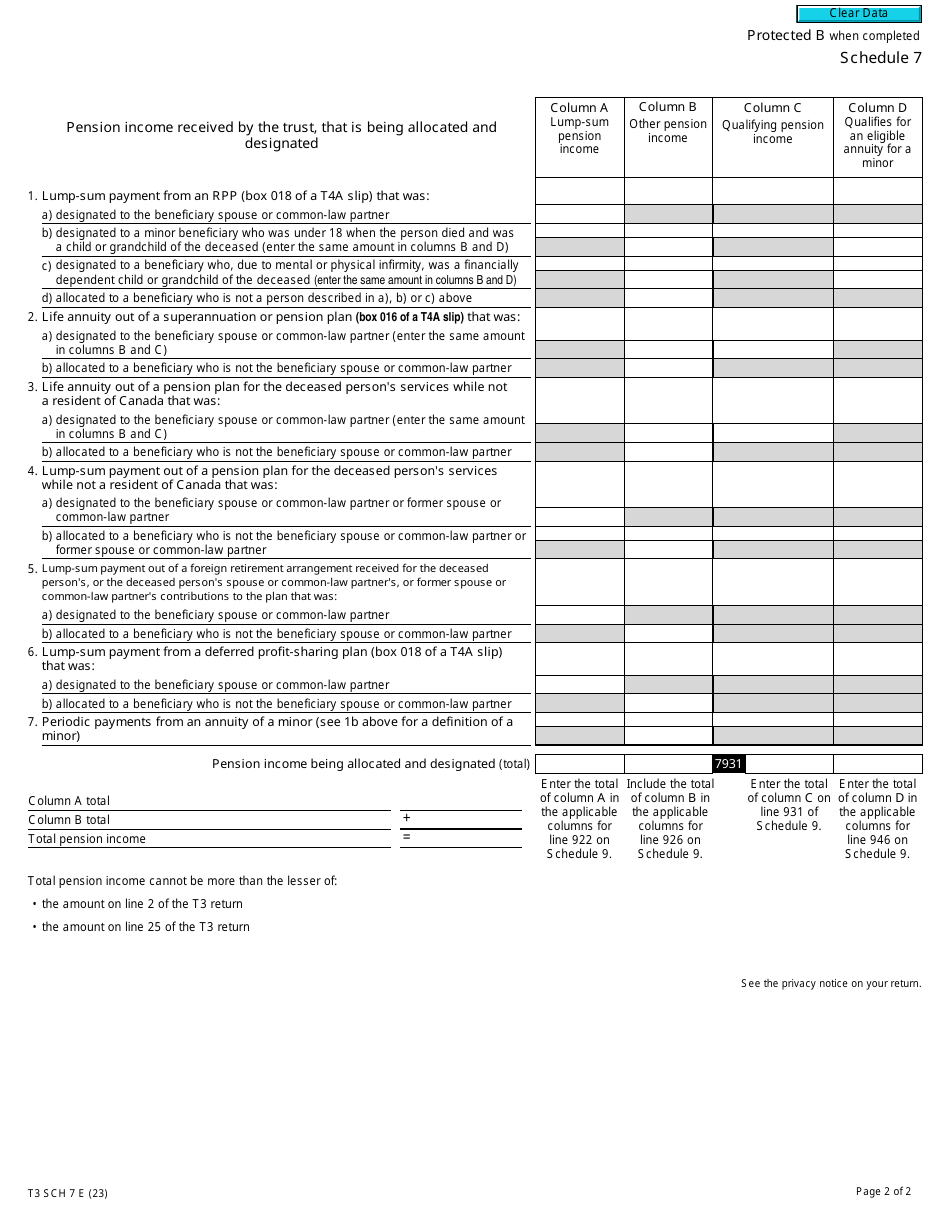

Q: How do I fill out Form T3 Schedule 7?

A: You must provide your personal information, details of the pension income, and indicate the allocation or designation amounts.

Q: When is the deadline to file Form T3 Schedule 7?

A: The deadline to file this form is the same as the deadline for filing the T3 return, which is 90 days after the end of the taxation year.