This version of the form is not currently in use and is provided for reference only. Download this version of

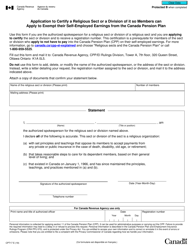

Form CPT16

for the current year.

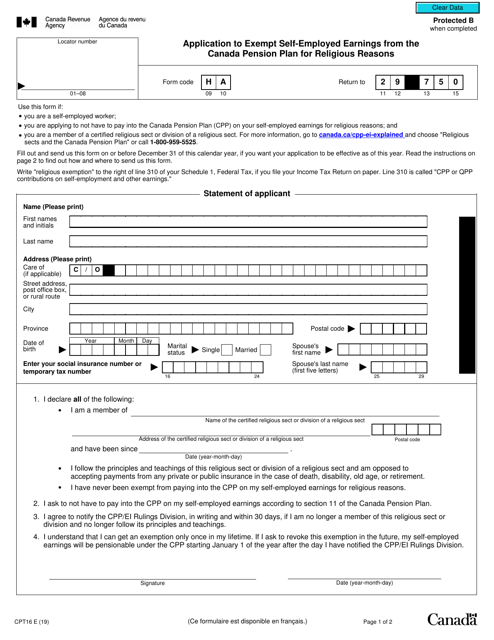

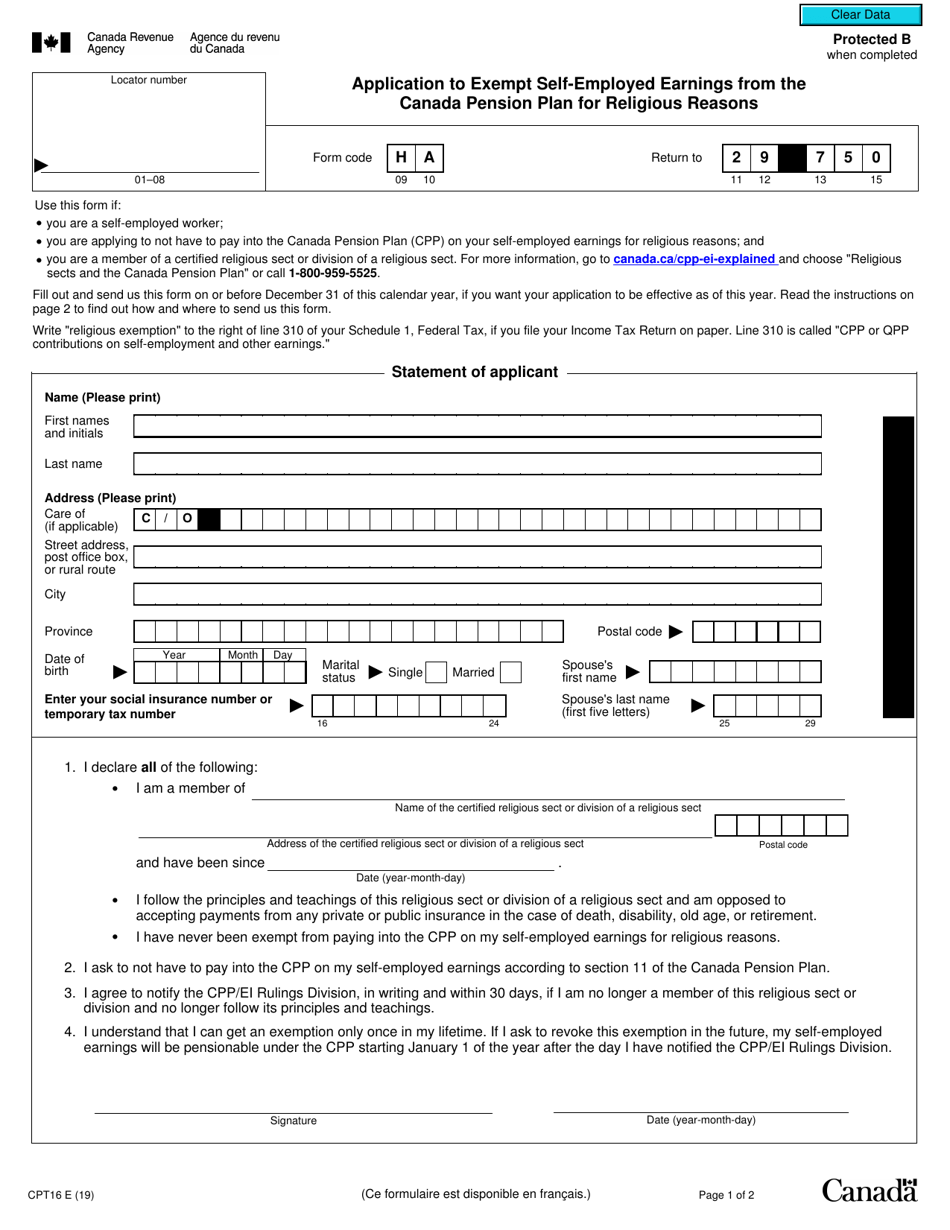

Form CPT16 Application to Exempt Self-employed Earnings From the Canada Pension Plan for Religious Reasons - Canada

Form CPT16 is used in Canada for individuals who are self-employed and wish to apply for an exemption from the Canada Pension Plan (CPP) contributions due to religious reasons. By completing this form, self-employed individuals can request an exemption from contributing to the CPP based on their religious beliefs.

The Form CPT16 application to exempt self-employed earnings from the Canada Pension Plan for religious reasons is typically filed by individuals who have religious beliefs that prevent them from participating in the pension plan.

FAQ

Q: What is Form CPT16?

A: Form CPT16 is an application to exempt self-employed earnings from the Canada Pension Plan for religious reasons.

Q: Who can use Form CPT16?

A: Form CPT16 can be used by individuals who are self-employed and have religious reasons for not participating in the Canada Pension Plan.

Q: What is the purpose of Form CPT16?

A: The purpose of Form CPT16 is to apply for an exemption from paying Canada Pension Plan contributions on self-employed earnings due to religious reasons.

Q: What information do I need to complete Form CPT16?

A: To complete Form CPT16, you will need to provide your personal information, details about your self-employment, and a statement explaining your religious reasons for applying for the exemption.

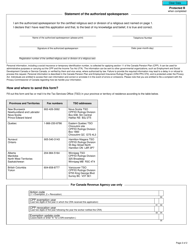

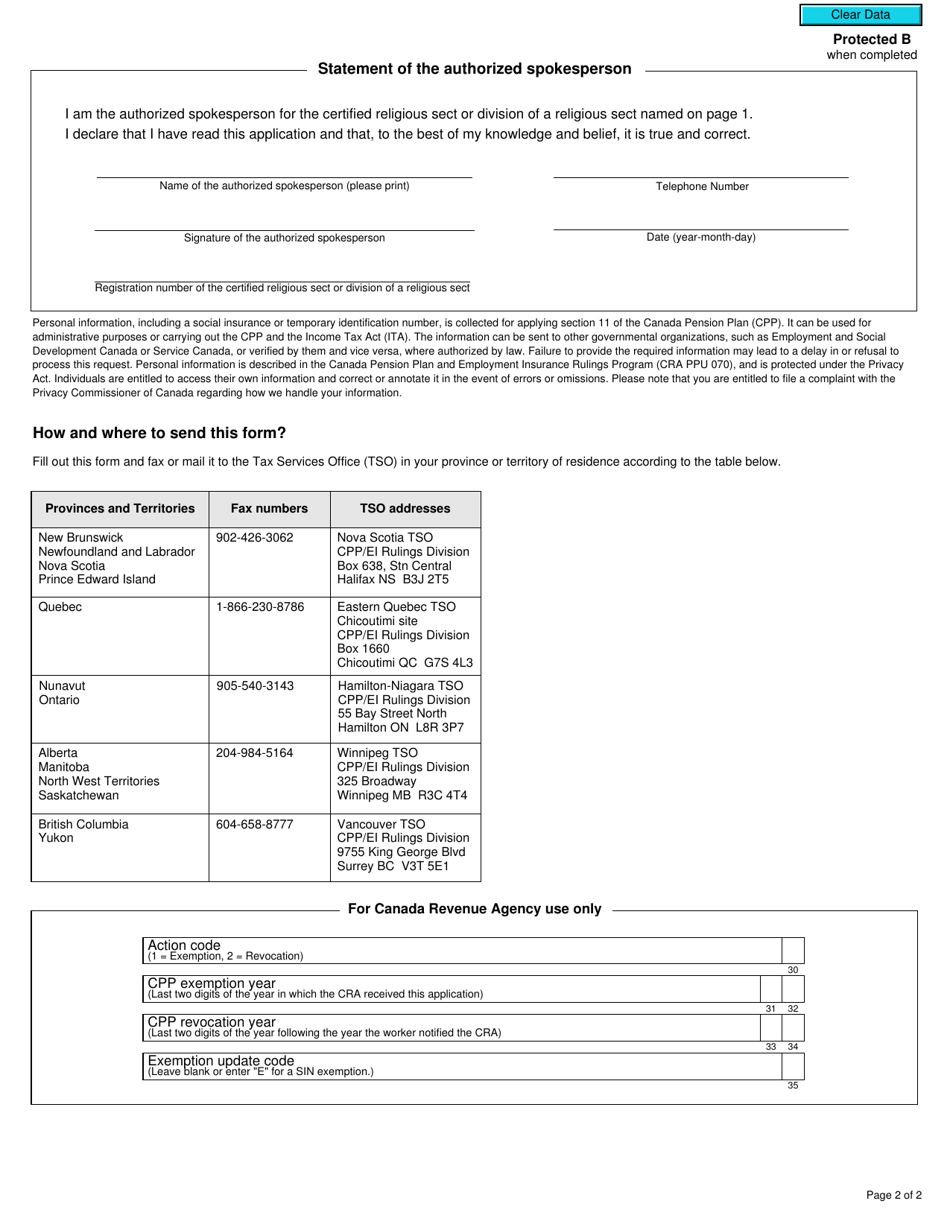

Q: What should I do after completing Form CPT16?

A: After completing Form CPT16, you should send it to the CRA for review and processing.

Q: Is there a deadline for submitting Form CPT16?

A: There is no specific deadline for submitting Form CPT16, but it is recommended to submit it as soon as possible to ensure timely processing of your exemption application.

Q: Can I change my mind after submitting Form CPT16?

A: Once you have submitted Form CPT16 and received approval for the exemption, it is generally not possible to change your mind and start paying Canada Pension Plan contributions on your self-employed earnings.

Q: What happens if my Form CPT16 application is approved?

A: If your Form CPT16 application is approved, you will be exempt from paying Canada Pension Plan contributions on your self-employed earnings for religious reasons.

Q: What happens if my Form CPT16 application is denied?

A: If your Form CPT16 application is denied, you will be required to pay Canada Pension Plan contributions on your self-employed earnings as per the regular rules and regulations.