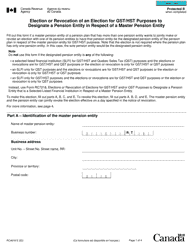

This version of the form is not currently in use and is provided for reference only. Download this version of

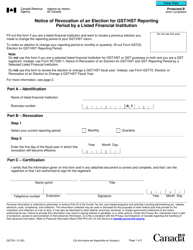

Form GST70

for the current year.

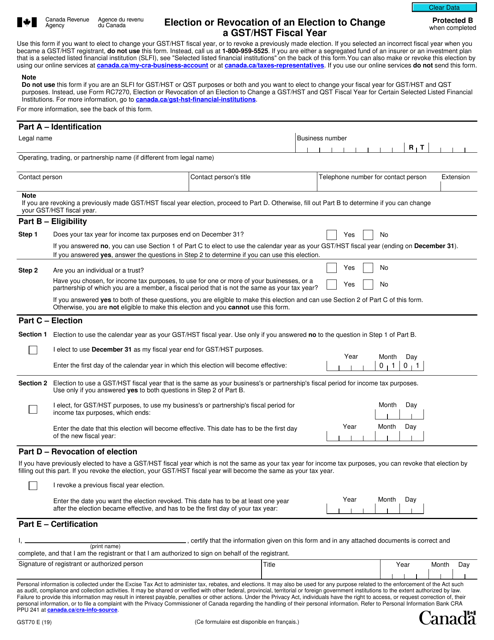

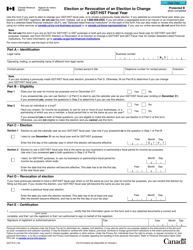

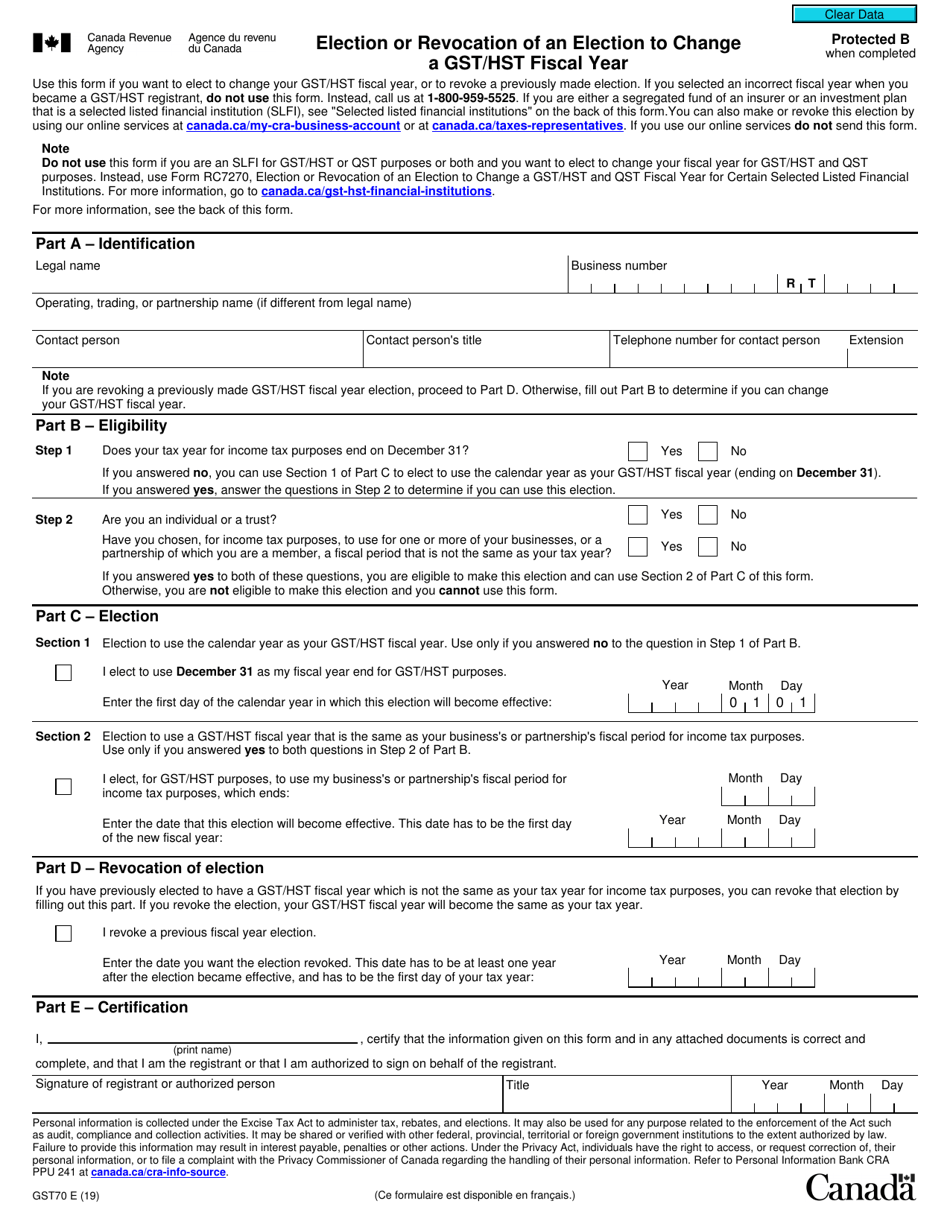

Form GST70 Election or Revocation of an Election to Change a Gst / Hst Fiscal Year - Canada

Form GST70 Election or Revocation of an Election to Change a GST/HST Fiscal Year in Canada is used to request a change in the fiscal year for reporting GST/HST (Goods and Services Tax/Harmonized Sales Tax) in Canada. This form is applicable to businesses that want to align their reporting period with the calendar year or make changes to their existing fiscal year.

The Form GST70 Election or Revocation of an Election to Change a GST/HST Fiscal Year in Canada is typically filed by businesses that want to change their fiscal year for GST/HST purposes.

FAQ

Q: What is Form GST70?

A: Form GST70 is a document used in Canada to elect or revoke an election to change a GST/HST fiscal year.

Q: What is a GST/HST fiscal year?

A: A GST/HST fiscal year is a tax year for reporting and remitting GST/HST in Canada.

Q: Who should file Form GST70?

A: Any business in Canada that wants to change its GST/HST fiscal year or revoke a previous election.

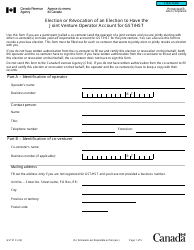

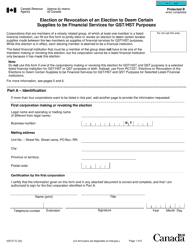

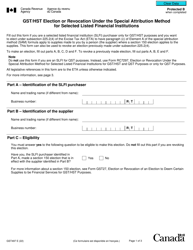

Q: What information is required on Form GST70?

A: Form GST70 requires details about your business, the current GST/HST fiscal year, the proposed new fiscal year, and the reason for the election or revocation.

Q: When should I file Form GST70?

A: You should file Form GST70 at least 90 days before the start of the proposed new GST/HST fiscal year or the date you want to revoke the previous election.

Q: Are there any fees to file Form GST70?

A: No, there are no fees to file Form GST70.

Q: Can I make changes to my GST/HST fiscal year after filing Form GST70?

A: Yes, you can request changes to your GST/HST fiscal year by filing a separate request with the CRA.

Q: How long does it take for the CRA to process Form GST70?

A: The processing time for Form GST70 varies, but you should expect a response from the CRA within a few weeks.