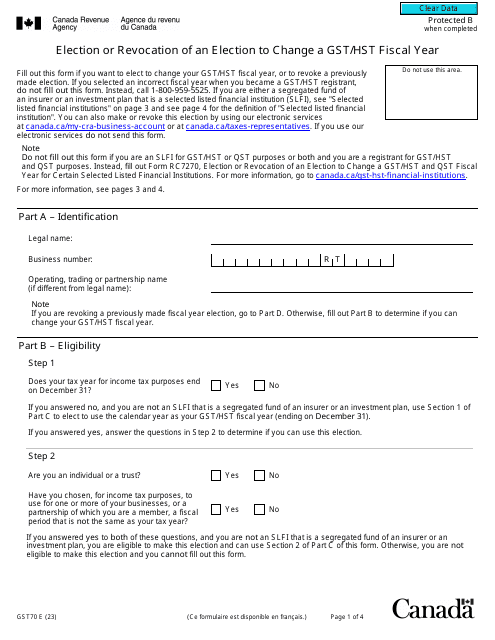

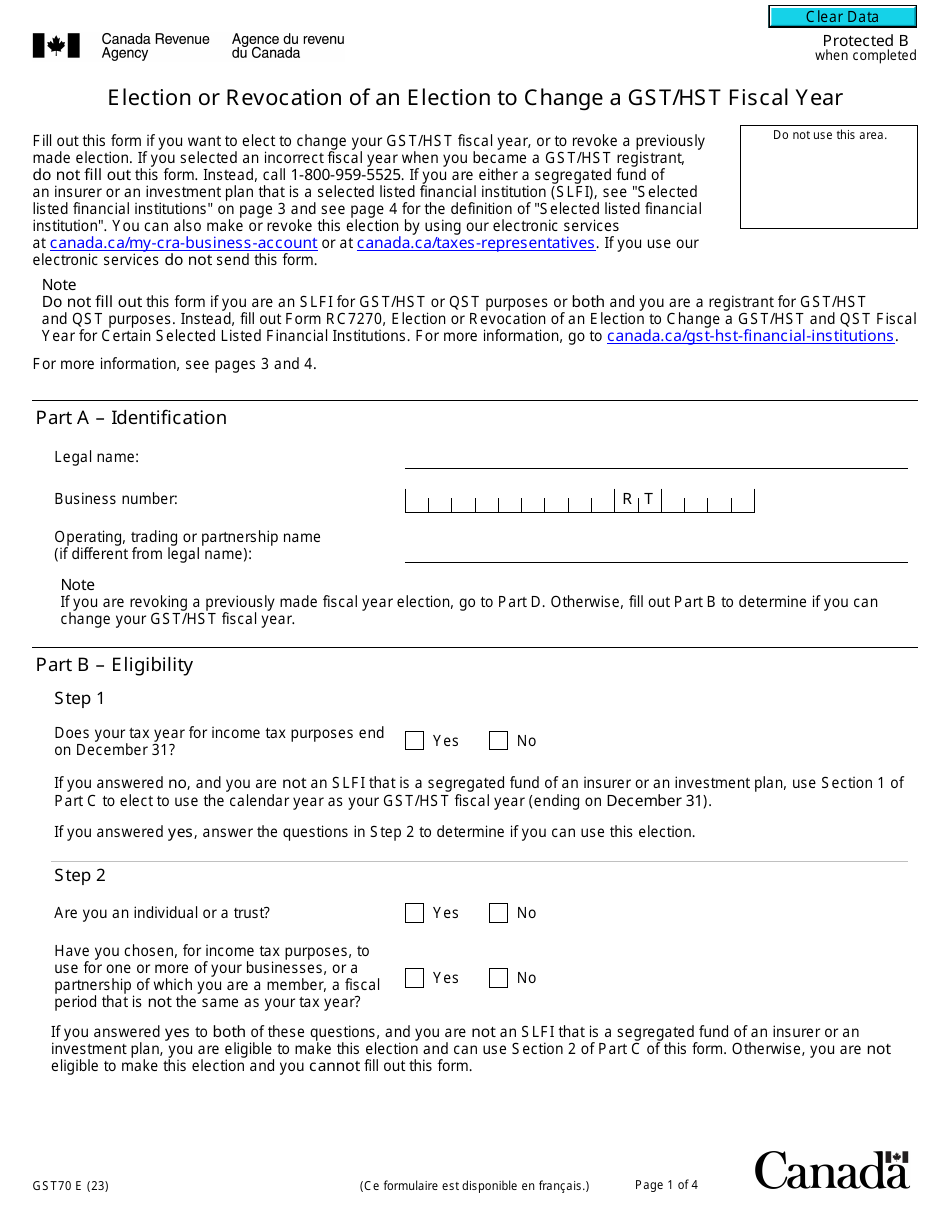

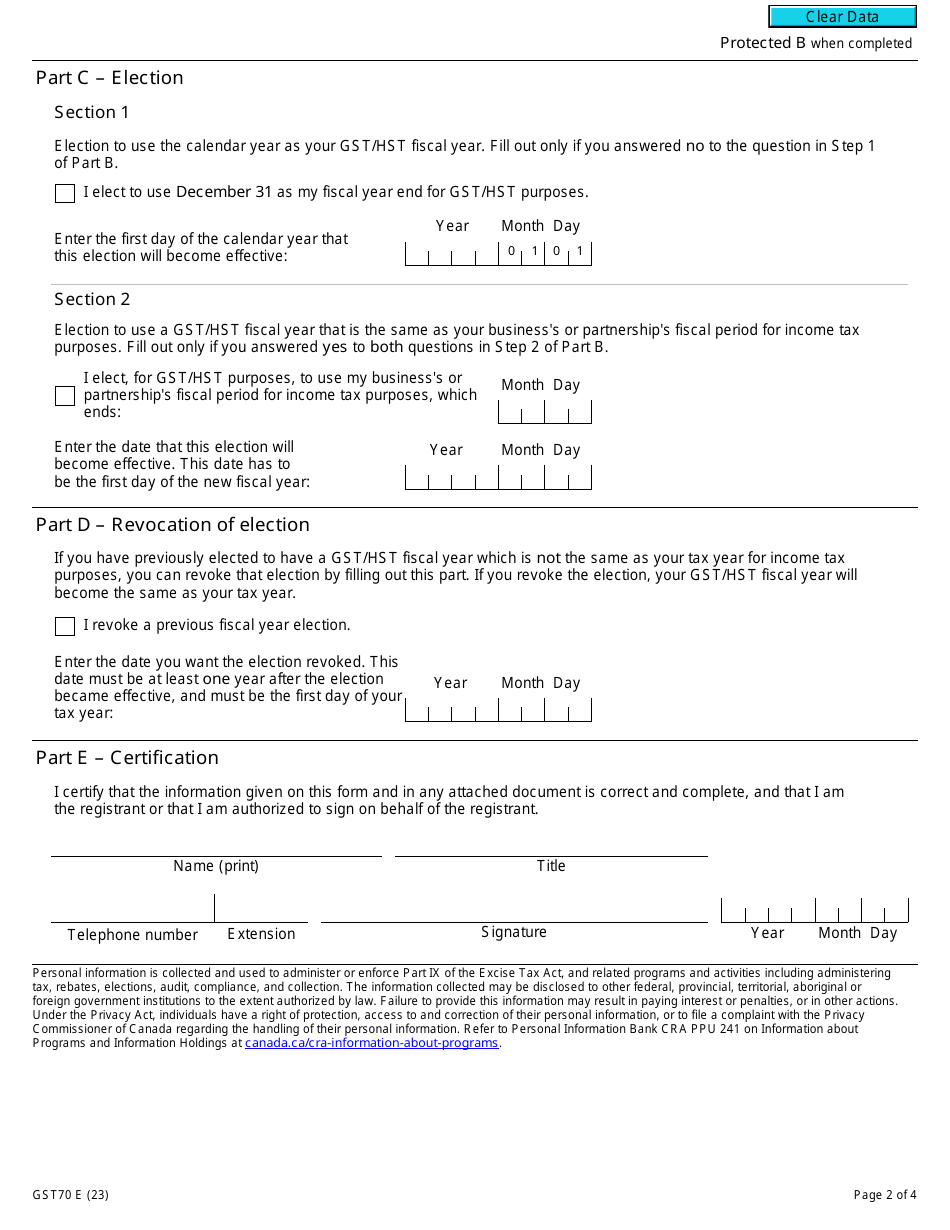

Form GST70 Election or Revocation of an Election to Change a Gst / Hst Fiscal Year - Canada

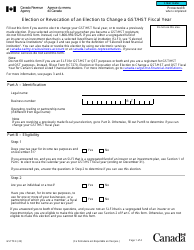

Form GST70 Election or Revocation of an Election to Change a GST/HST Fiscal Year in Canada is used to either elect or revoke an election to change the fiscal year for reporting Goods and Services Tax/Harmonized Sales Tax (GST/HST) in Canada.

The business or organization that wishes to change their GST/HST fiscal year files the Form GST70 - Election or Revocation of an Election to Change a GST/HST Fiscal Year in Canada.

Form GST70 Election or Revocation of an Election to Change a Gst/Hst Fiscal Year - Canada - Frequently Asked Questions (FAQ)

Q: What is GST70?

A: GST70 is the form used in Canada to elect or revoke an election to change the GST/HST fiscal year.

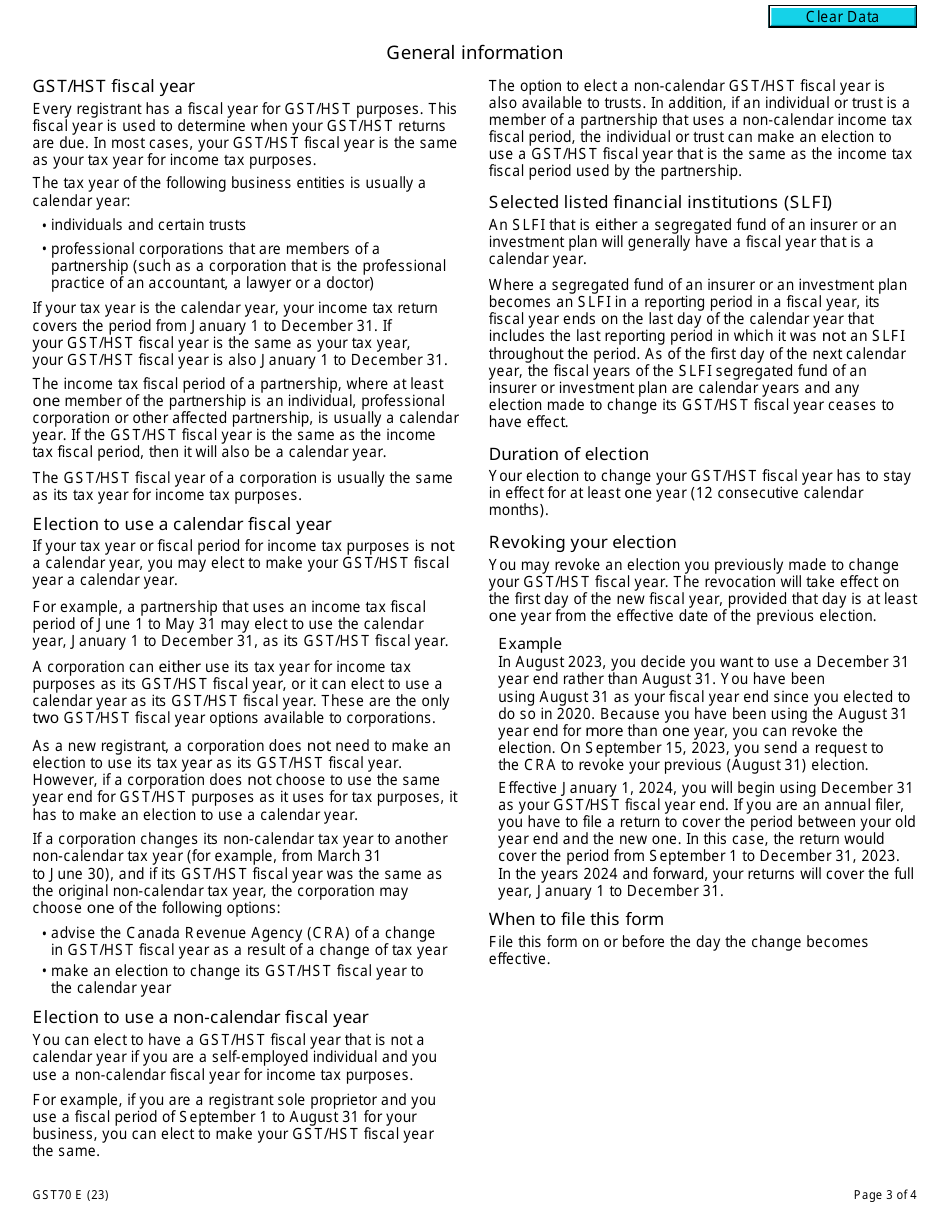

Q: What is a GST/HST fiscal year?

A: A GST/HST fiscal year is the 12-month period for which a business calculates and reports its GST/HST.

Q: When should I use GST70?

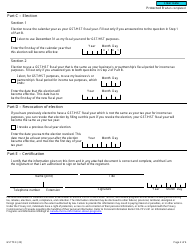

A: You should use GST70 if you want to change your GST/HST fiscal year or revoke a previously made election.

Q: What information is required on GST70?

A: GST70 requires information about your business, including the current GST/HST fiscal year and the proposed new fiscal year.

Q: What are the deadlines for filing GST70?

A: The deadline for filing GST70 to elect or revoke a GST/HST fiscal year is the same as the deadline for filing your GST/HST return for that fiscal year.

Q: Can I change my GST/HST fiscal year more than once?

A: Yes, you can change your GST/HST fiscal year multiple times, but there are restrictions and requirements for doing so.

Q: What are the consequences of changing my GST/HST fiscal year?

A: Changing your GST/HST fiscal year may affect your reporting obligations and the timing of when you collect and remit GST/HST.

Q: Can I cancel a previously made election to change my GST/HST fiscal year?

A: Yes, you can cancel a previously made election by using the GST70 form to revoke the election.

Q: Do I need to consult with a tax professional before filing GST70?

A: While it is not mandatory, consulting with a tax professional can be helpful in understanding the implications and requirements of changing your GST/HST fiscal year.