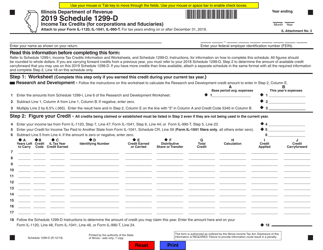

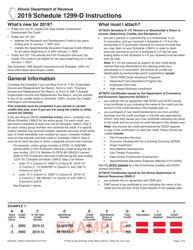

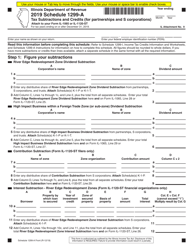

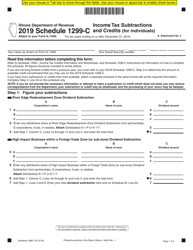

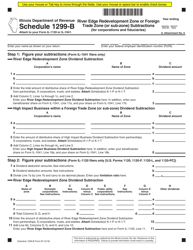

Instructions for Schedule 1299-B River Edge Redevelopment Zone or Foreign Trade Zone (Or Sub-zone) Subtractions (For Corporations and Fiduciaries) - Illinois

This document contains official instructions for Schedule 1299-B , River Edge Redevelopment Zone or Foreign Trade Zone (Or Sub-zone) Subtractions (For Corporations and Fiduciaries) - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Schedule 1299-B?

A: Schedule 1299-B is a form used in Illinois for corporations and fiduciaries to claim subtractions related to River Edge Redevelopment Zones or Foreign Trade Zones (or Sub-zones).

Q: Who can use Schedule 1299-B?

A: Corporations and fiduciaries in Illinois who are eligible for subtractions related to River Edge Redevelopment Zones or Foreign Trade Zones (or Sub-zones) can use Schedule 1299-B.

Q: What are River Edge Redevelopment Zones?

A: River Edge Redevelopment Zones are designated areas in Illinois where redevelopment efforts are encouraged to stimulate economic growth and create jobs.

Q: What are Foreign Trade Zones?

A: Foreign Trade Zones are designated areas in the United States where businesses can import, export, and process goods with certain advantages like duty exemption or deferral.

Q: What is the purpose of Schedule 1299-B?

A: The purpose of Schedule 1299-B is to allow eligible corporations and fiduciaries in Illinois to claim subtractions related to activities in River Edge Redevelopment Zones or Foreign Trade Zones (or Sub-zones).

Q: What types of subtractions can be claimed on Schedule 1299-B?

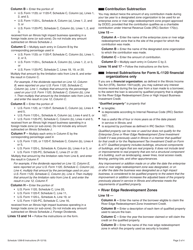

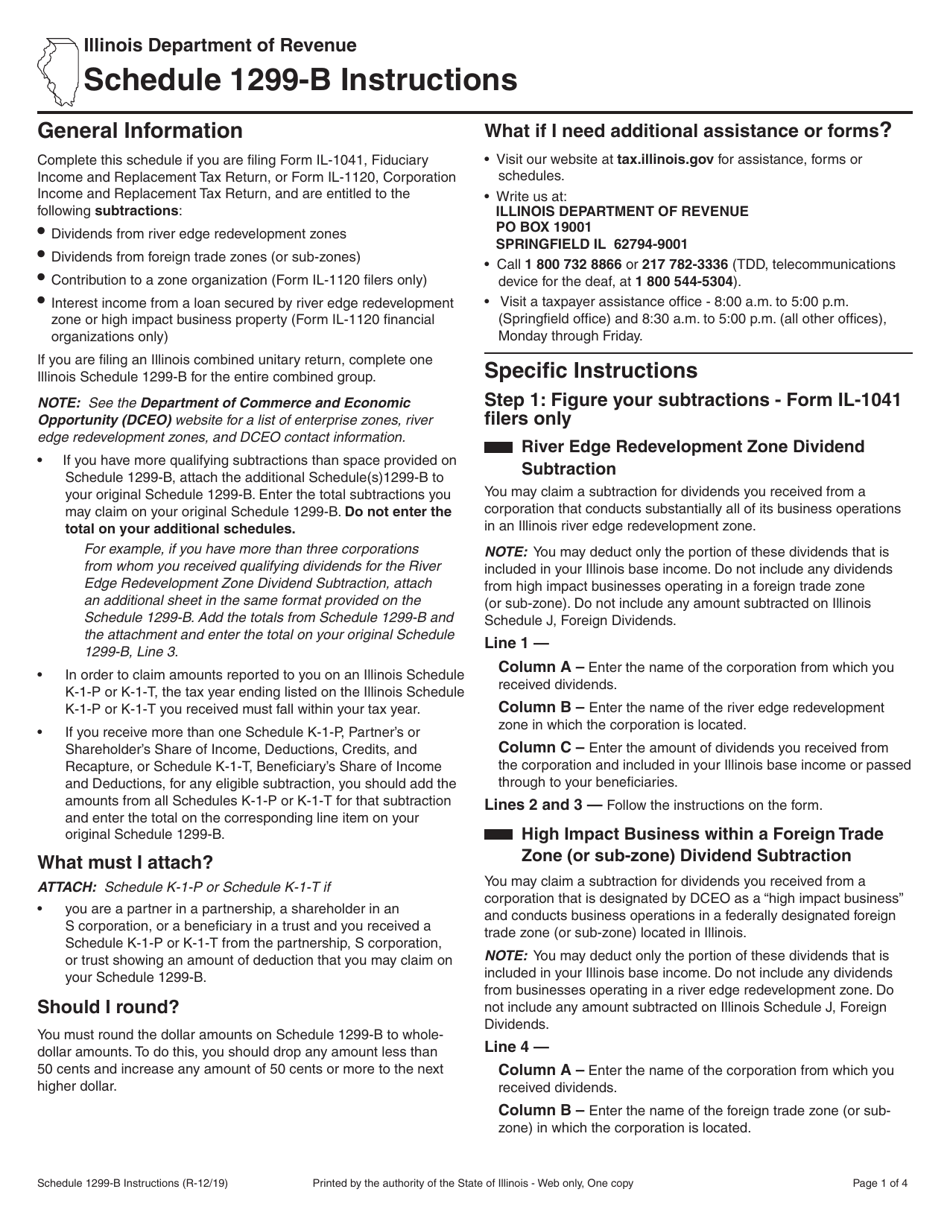

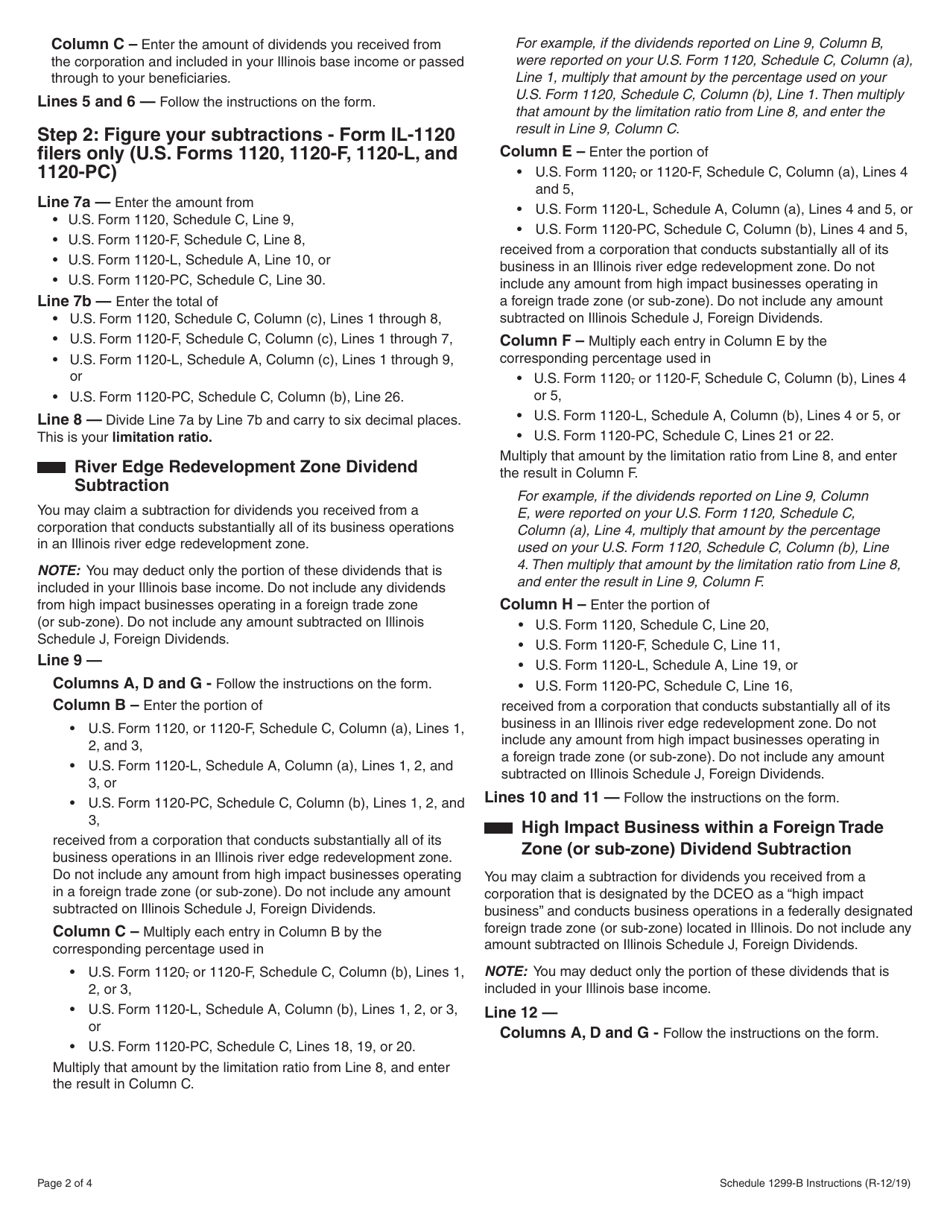

A: On Schedule 1299-B, corporations and fiduciaries can claim subtractions for income attributable to qualified property, wages paid to qualified employees, and other specified subtractions related to the designated zones.

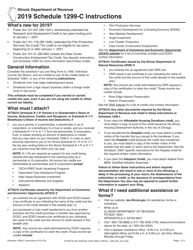

Q: Are there any limitations or conditions for claiming subtractions on Schedule 1299-B?

A: Yes, there are certain limitations and conditions for claiming subtractions on Schedule 1299-B. It is important to review the instructions and guidelines provided by the Illinois Department of Revenue to determine eligibility and requirements.

Q: What should be done with Schedule 1299-B once completed?

A: Once completed, Schedule 1299-B should be attached to the corporation or fiduciary's Illinois income tax return, along with any other required forms or documentation.

Q: Is professional tax assistance recommended for completing Schedule 1299-B?

A: While it is not mandatory, professional tax assistance is recommended for completing Schedule 1299-B to ensure accurate and compliant reporting of subtractions.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.