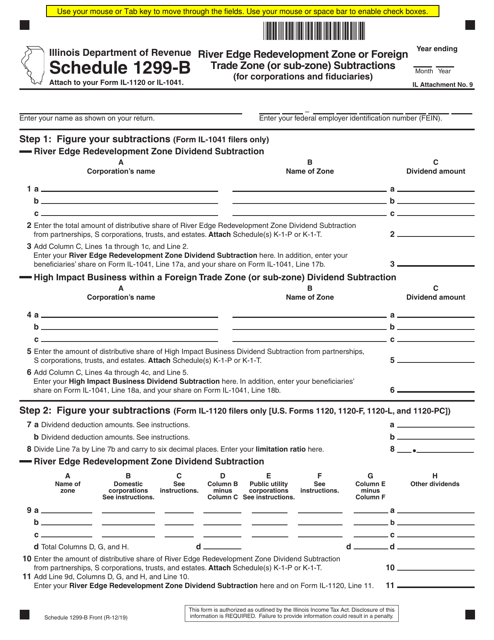

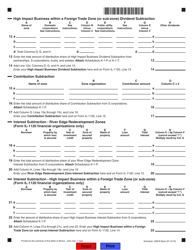

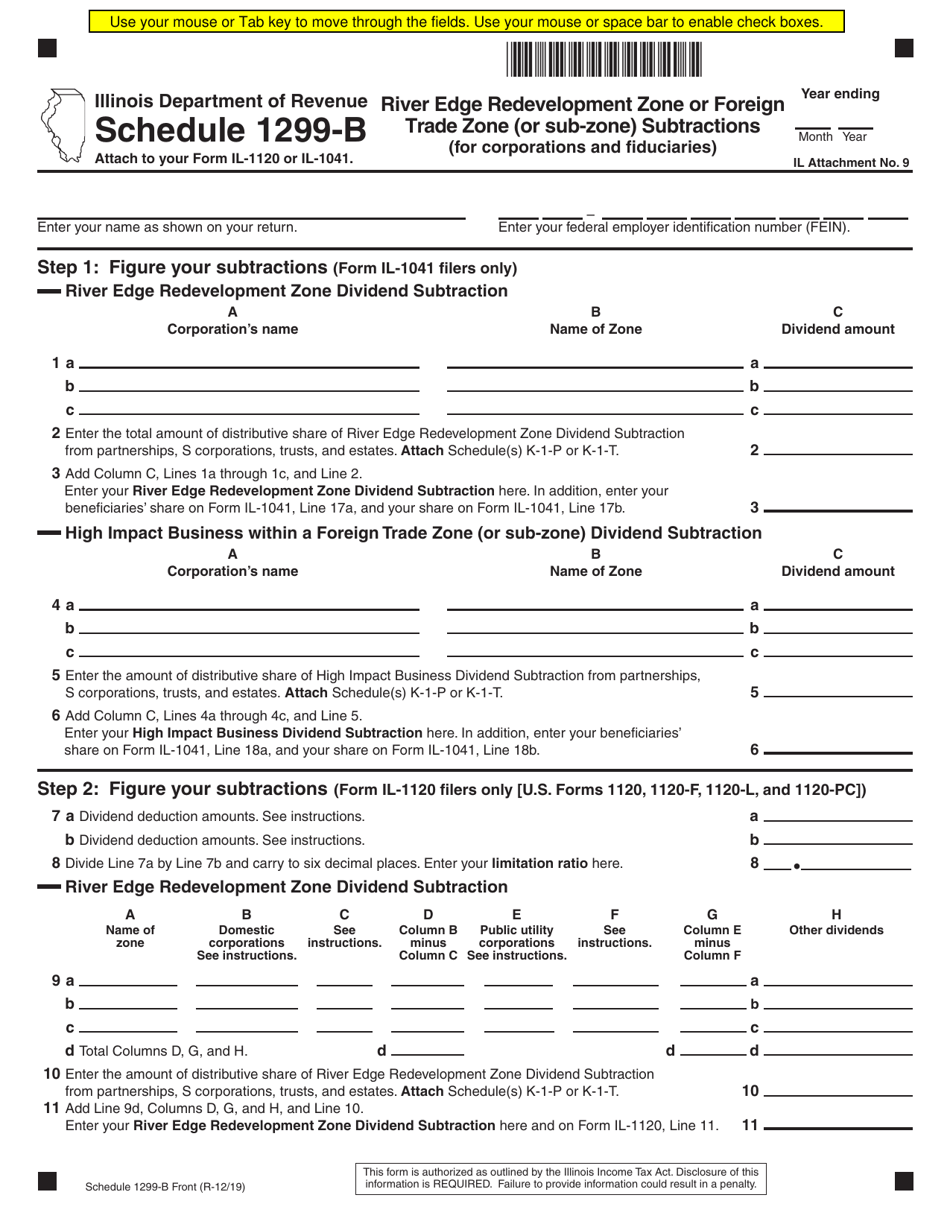

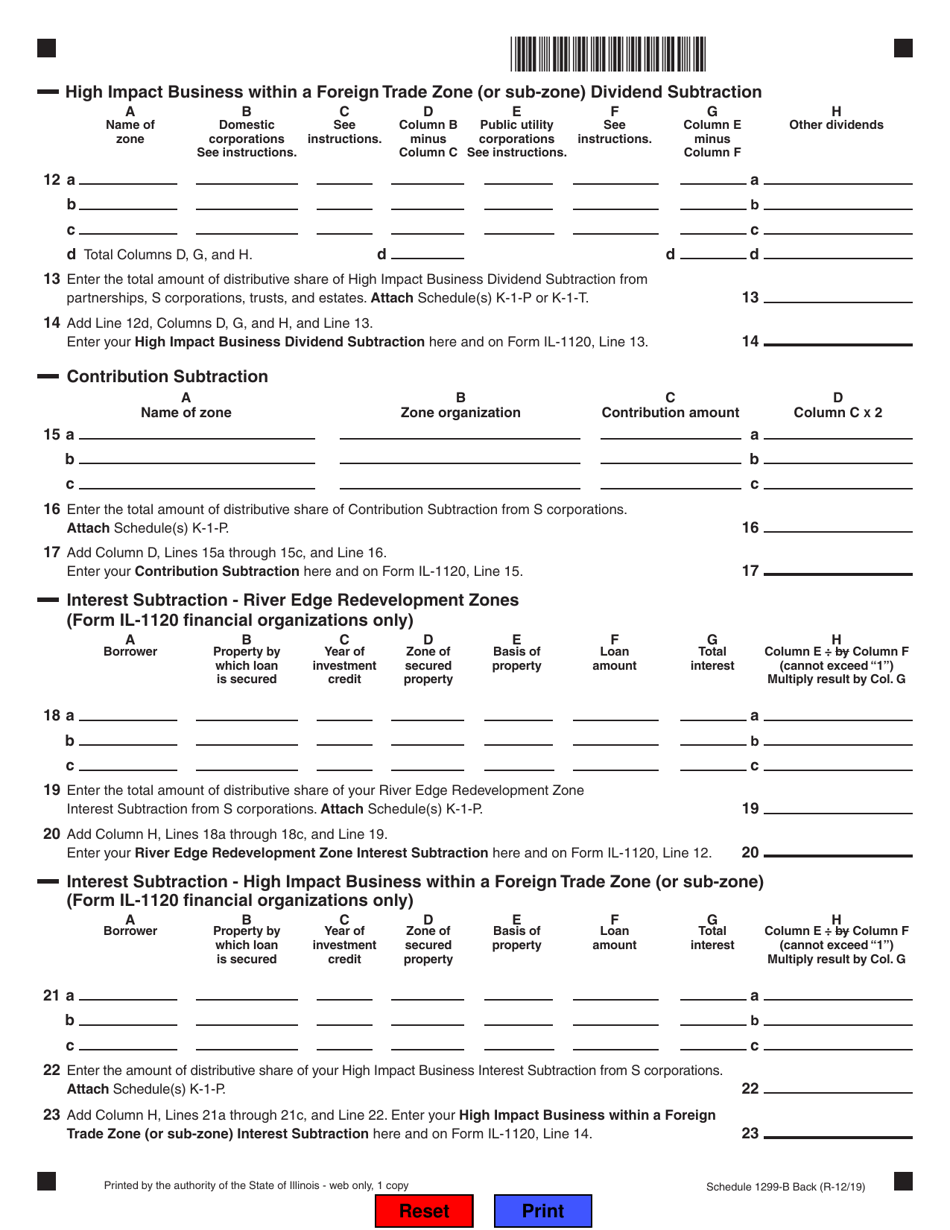

Schedule 1299-B River Edge Redevelopment Zone or Foreign Trade Zone (Or Sub-zone) Subtractions (For Corporations and Fiduciaries) - Illinois

What Is Schedule 1299-B?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 1299-B?

A: Schedule 1299-B is a tax form used in Illinois.

Q: What is a River Edge Redevelopment Zone?

A: A River Edge Redevelopment Zone is an area designated for economic development along the banks of certain rivers in Illinois.

Q: What is a Foreign Trade Zone (FTZ)?

A: A Foreign Trade Zone is an area within the United States that is considered outside of U.S. Customs territory for the purpose of tariff and customs duty regulations.

Q: What are Subtractions for Corporations and Fiduciaries?

A: Subtractions for Corporations and Fiduciaries refer to certain deductions or exemptions that can reduce the taxable income of corporations and fiduciaries in Illinois.

Q: What is the purpose of Schedule 1299-B?

A: The purpose of Schedule 1299-B is to report and calculate any subtractions related to River Edge Redevelopment Zones or Foreign Trade Zones that may apply to corporations and fiduciaries in Illinois.

Q: Who needs to file Schedule 1299-B?

A: Corporations and fiduciaries in Illinois who have subtractions related to River Edge Redevelopment Zones or Foreign Trade Zones need to file Schedule 1299-B.

Q: Are there any specific eligibility requirements for claiming deductions on Schedule 1299-B?

A: Yes, there may be specific eligibility requirements for claiming deductions on Schedule 1299-B for River Edge Redevelopment Zones or Foreign Trade Zones, which can be found in the instructions accompanying the form.

Q: When is the deadline for filing Schedule 1299-B?

A: The deadline for filing Schedule 1299-B is typically the same as the deadline for filing the applicable tax return for corporations and fiduciaries in Illinois.

Q: What should I do if I have questions or need assistance with Schedule 1299-B?

A: If you have questions or need assistance with Schedule 1299-B, you should contact the Illinois Department of Revenue for guidance.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 1299-B by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.