This version of the form is not currently in use and is provided for reference only. Download this version of

Form DTE105A

for the current year.

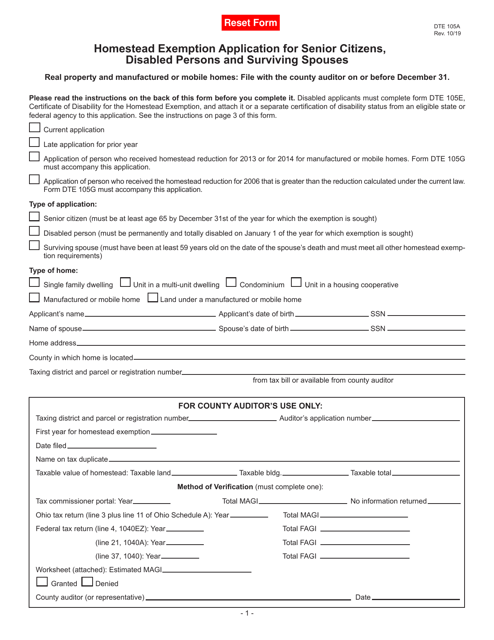

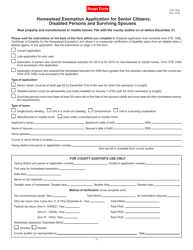

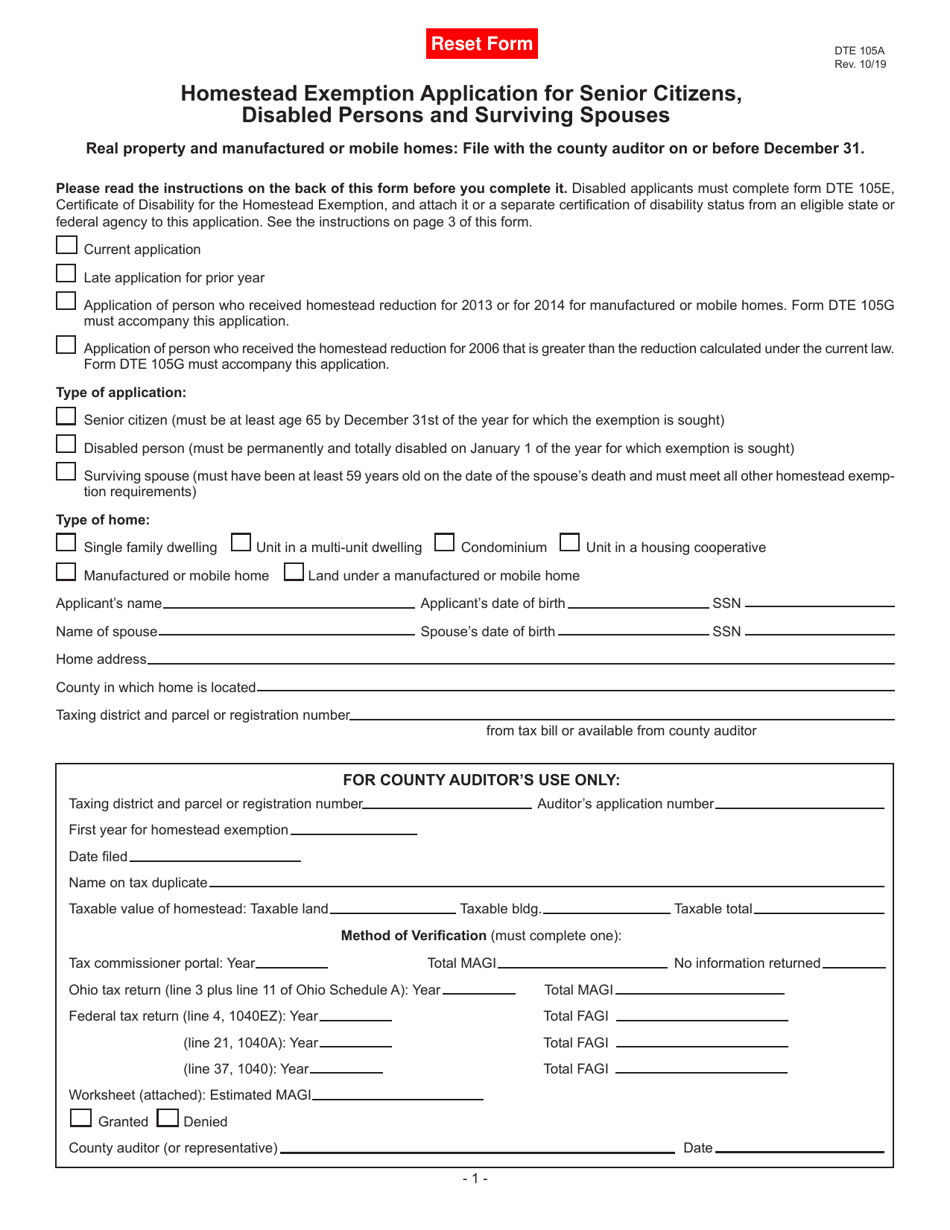

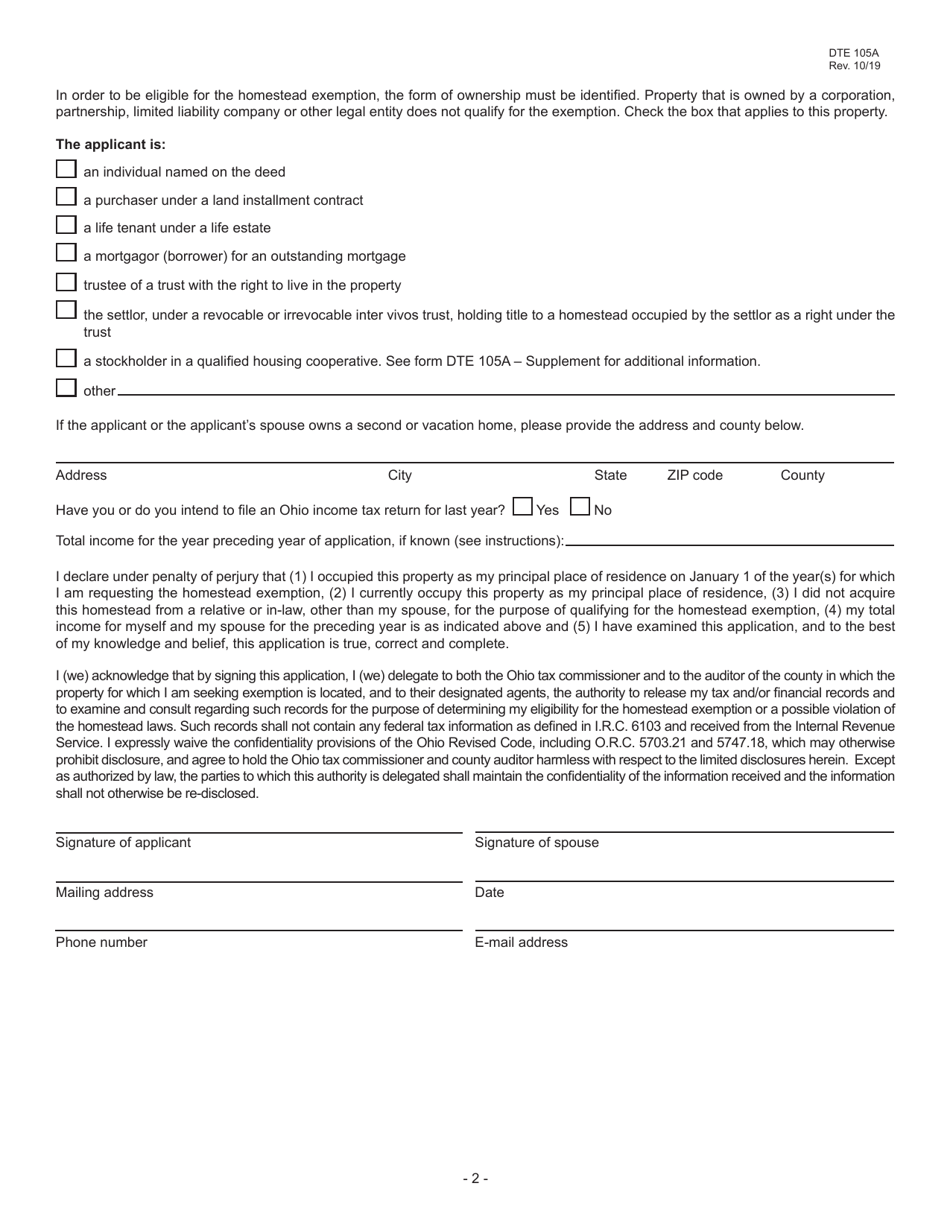

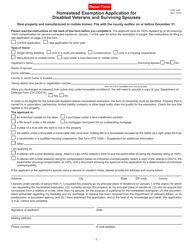

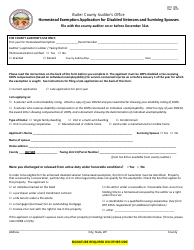

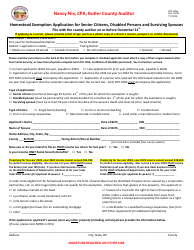

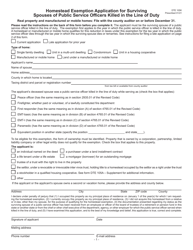

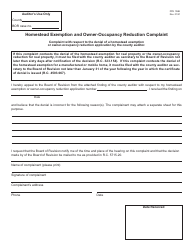

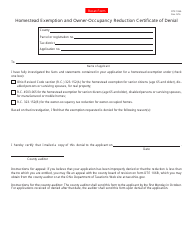

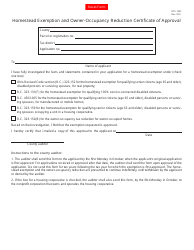

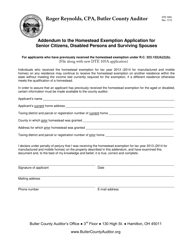

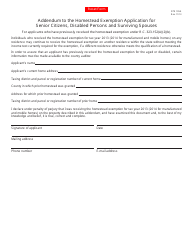

Form DTE105A Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses - Ohio

What Is Form DTE105A?

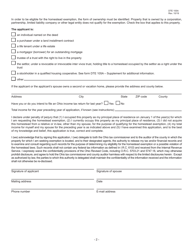

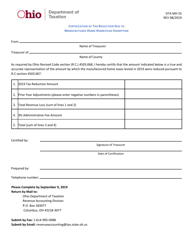

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. Check the official instructions before completing and submitting the form.

FAQ

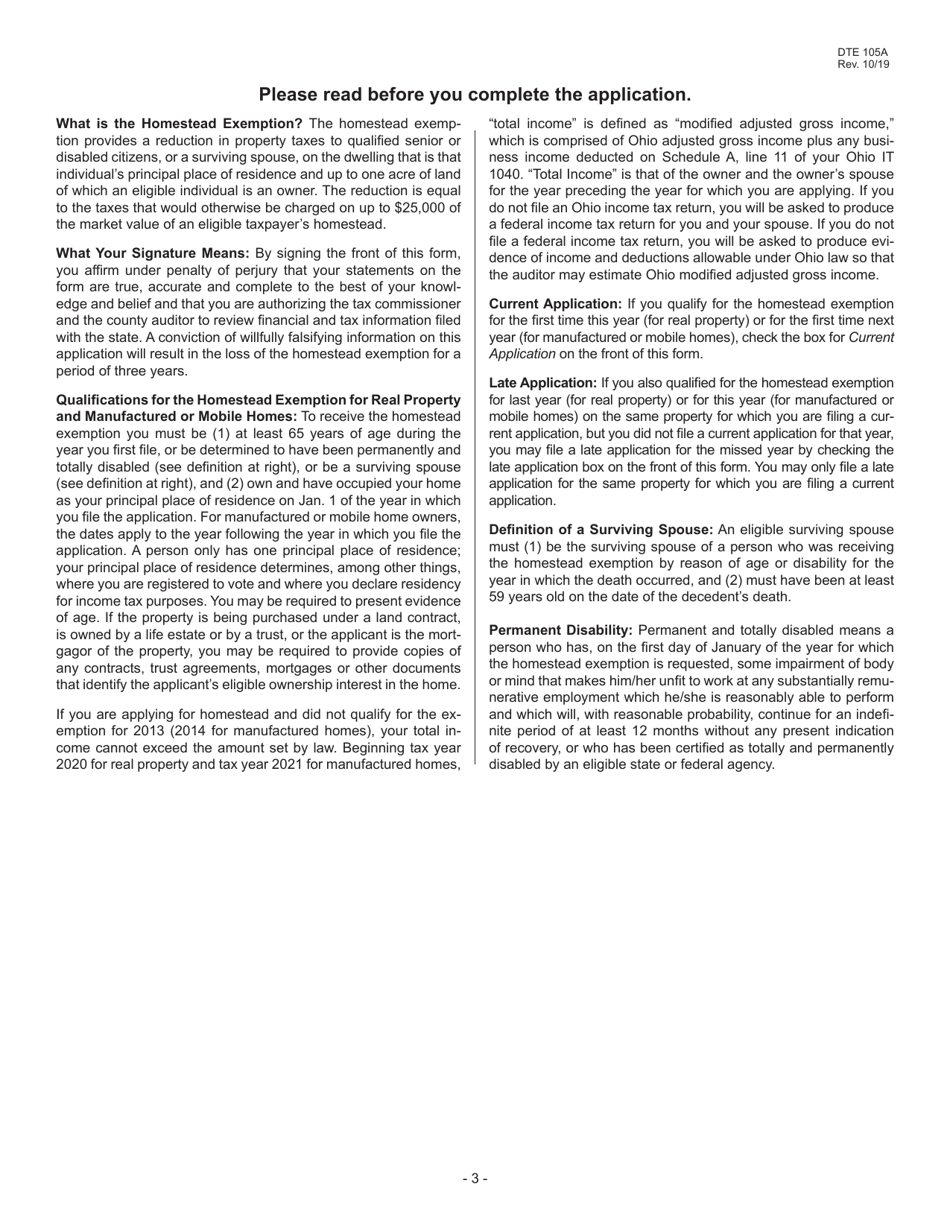

Q: Who is eligible for the Homestead Exemption in Ohio?

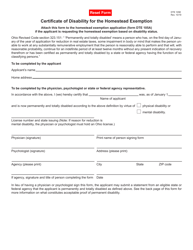

A: Senior citizens, disabled persons, and surviving spouses may be eligible.

Q: What is the purpose of the Homestead Exemption?

A: The Homestead Exemption helps eligible individuals reduce their property tax burden.

Q: How can I apply for the Homestead Exemption in Ohio?

A: You can apply by completing Form DTE105A, the Homestead Exemption Application for Senior Citizens, Disabled Persons, and Surviving Spouses.

Q: What documents do I need to include with the application?

A: You may need to provide proof of age, disability, or marriage as applicable.

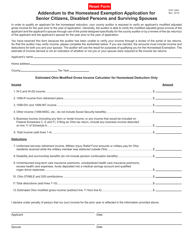

Q: Is there an income limit to qualify for the Homestead Exemption?

A: Yes, there is an income limit. It may vary each year, so it's best to check the latest guidelines.

Q: When is the deadline to apply for the Homestead Exemption?

A: The deadline is typically the first Monday in June each year.

Q: What are the benefits of the Homestead Exemption?

A: The Homestead Exemption can provide a reduction in property taxes and help eligible individuals stay in their homes.

Q: Can I receive the Homestead Exemption on multiple properties?

A: No, the Homestead Exemption is only available for your primary residence.

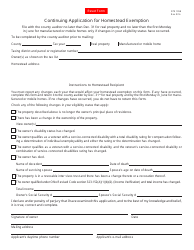

Q: How long does the Homestead Exemption last?

A: Once approved, the Homestead Exemption continues until the property owner no longer qualifies or the property ownership changes.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE105A by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.