This version of the form is not currently in use and is provided for reference only. Download this version of

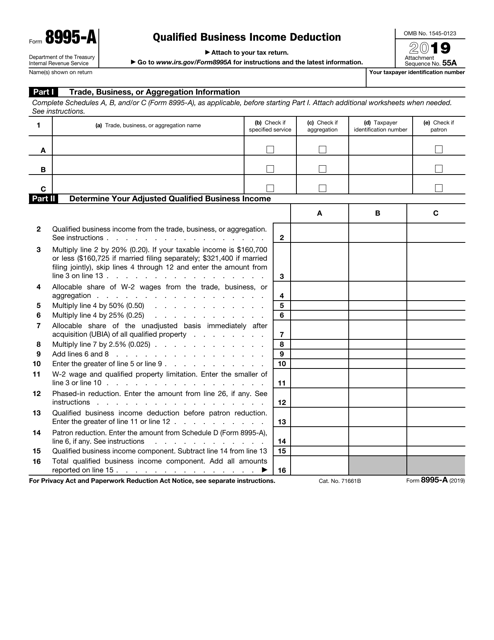

IRS Form 8995-A

for the current year.

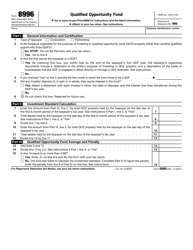

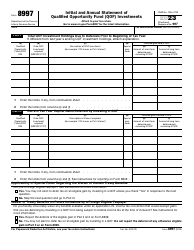

IRS Form 8995-A Qualified Business Income Deduction

What Is IRS Form 8995-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8995-A?

A: IRS Form 8995-A is a tax form used to calculate the Qualified Business Income Deduction.

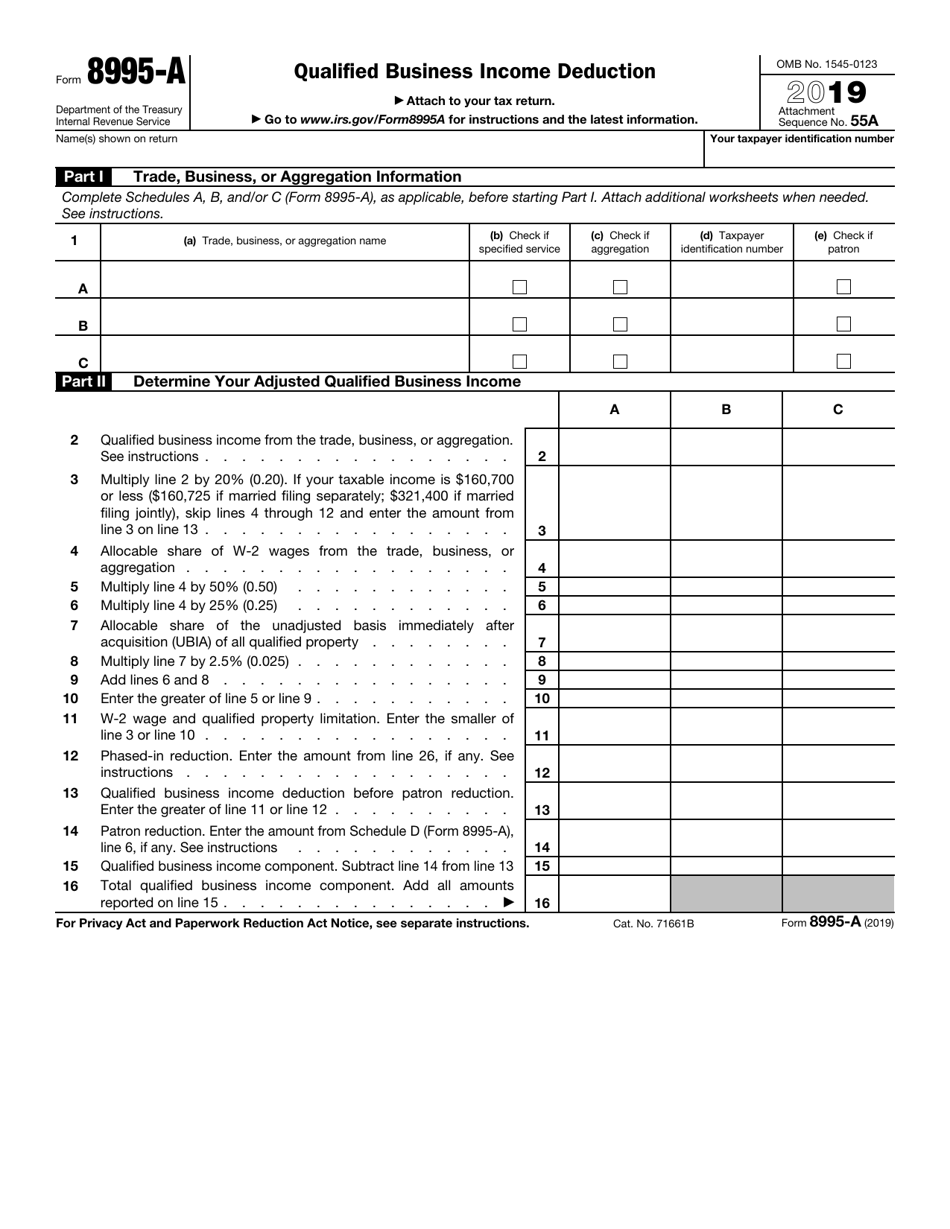

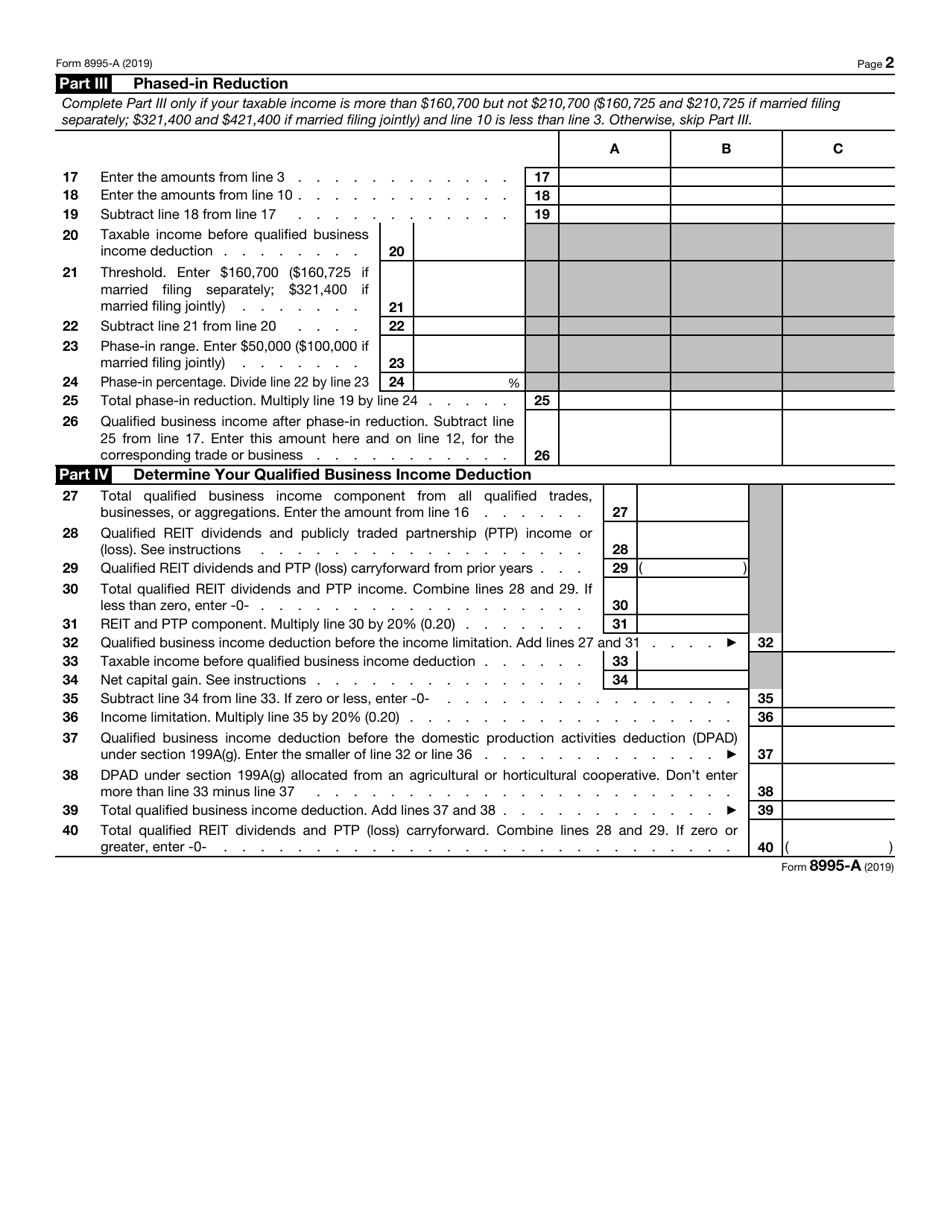

Q: What is the Qualified Business Income Deduction?

A: The Qualified Business Income Deduction is a deduction available to certain business owners to reduce their taxable income.

Q: Who is eligible for the Qualified Business Income Deduction?

A: Sole proprietors, partnerships, S corporations, and some trusts and estates may be eligible for the Qualified Business Income Deduction.

Q: What types of income qualify for the deduction?

A: Qualified business income from a domestic business, qualified REIT dividends, and qualified publicly traded partnership income may qualify for the deduction.

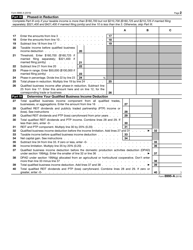

Q: How do I fill out IRS Form 8995-A?

A: You need to provide information about your business income, deductions, and other relevant details. It is advisable to consult a tax professional or refer to the instructions provided by the IRS.

Q: When is the deadline to file IRS Form 8995-A?

A: The deadline to file IRS Form 8995-A is typically the same as your tax return deadline, which is usually April 15th, unless an extension has been granted.

Q: Is the deduction available in both the United States and Canada?

A: The Qualified Business Income Deduction is available in the United States, but it may not be applicable in Canada. You should consult with a tax professional familiar with Canadian tax laws for information regarding this deduction in Canada.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8995-A through the link below or browse more documents in our library of IRS Forms.