This version of the form is not currently in use and is provided for reference only. Download this version of

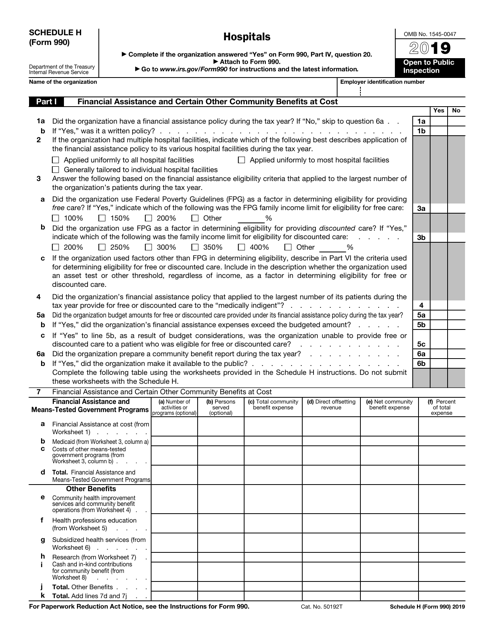

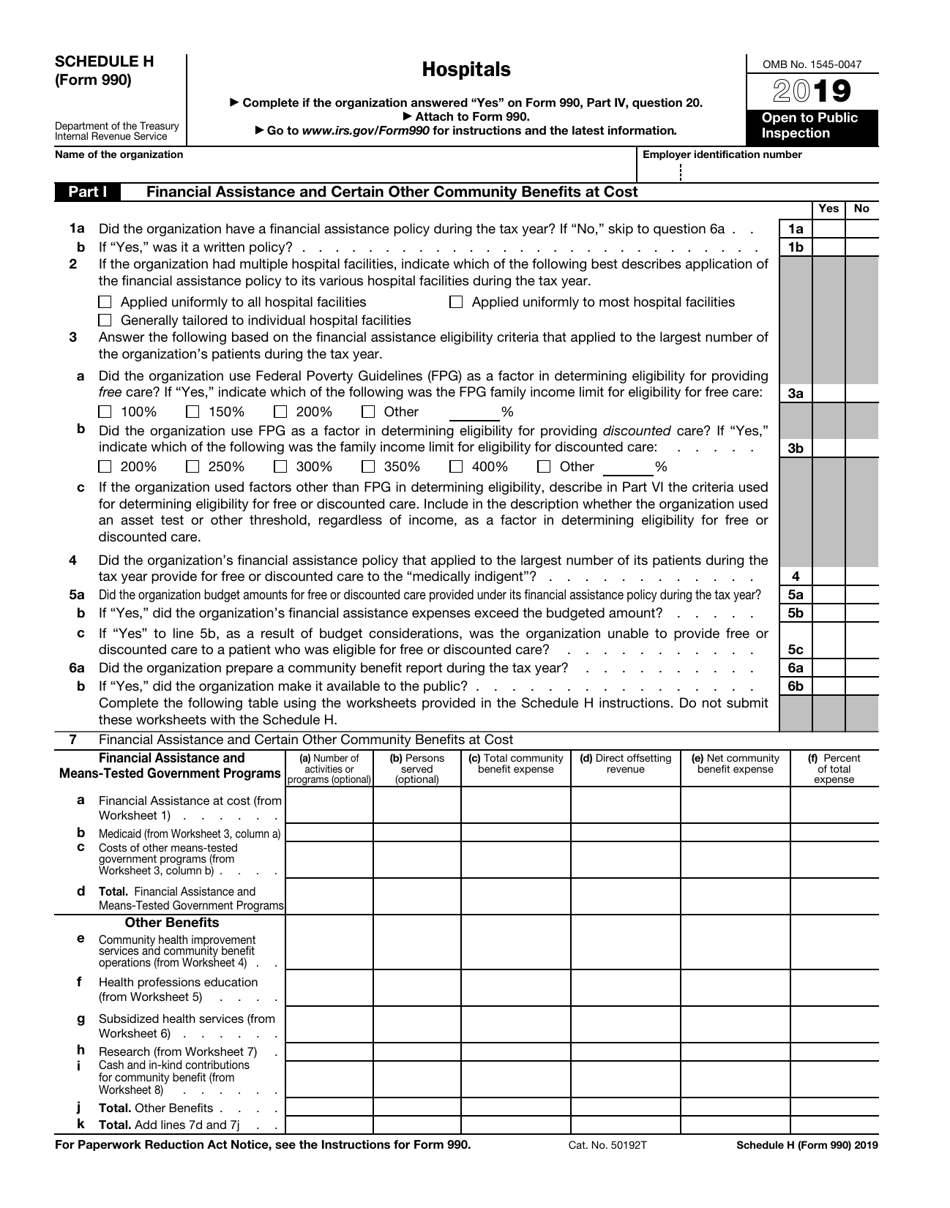

IRS Form 990 Schedule H

for the current year.

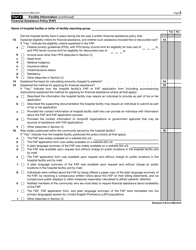

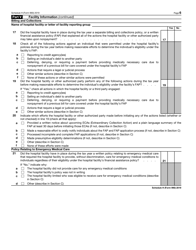

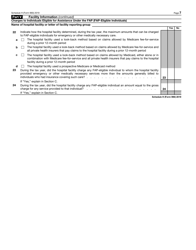

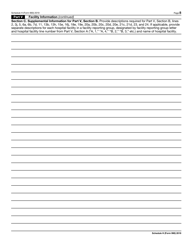

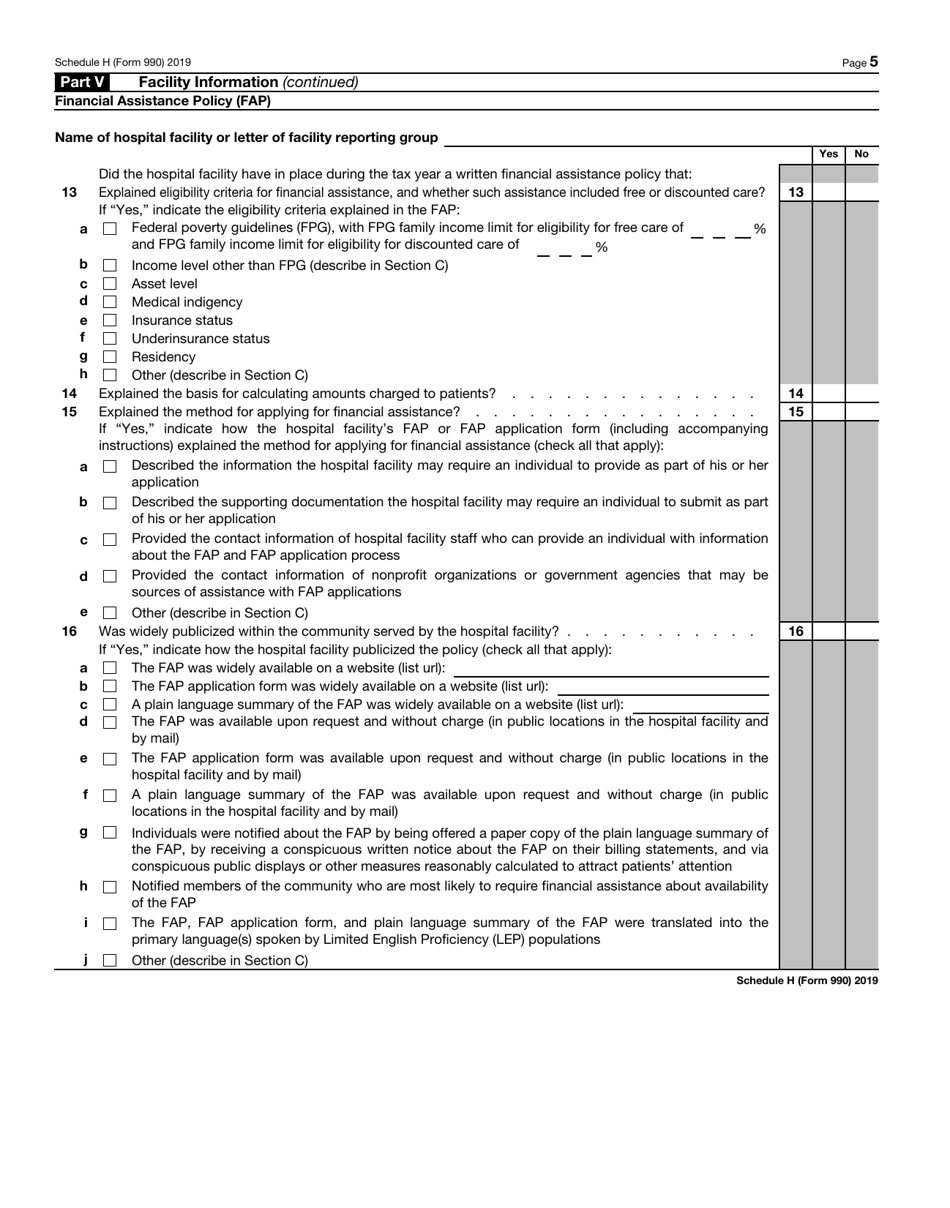

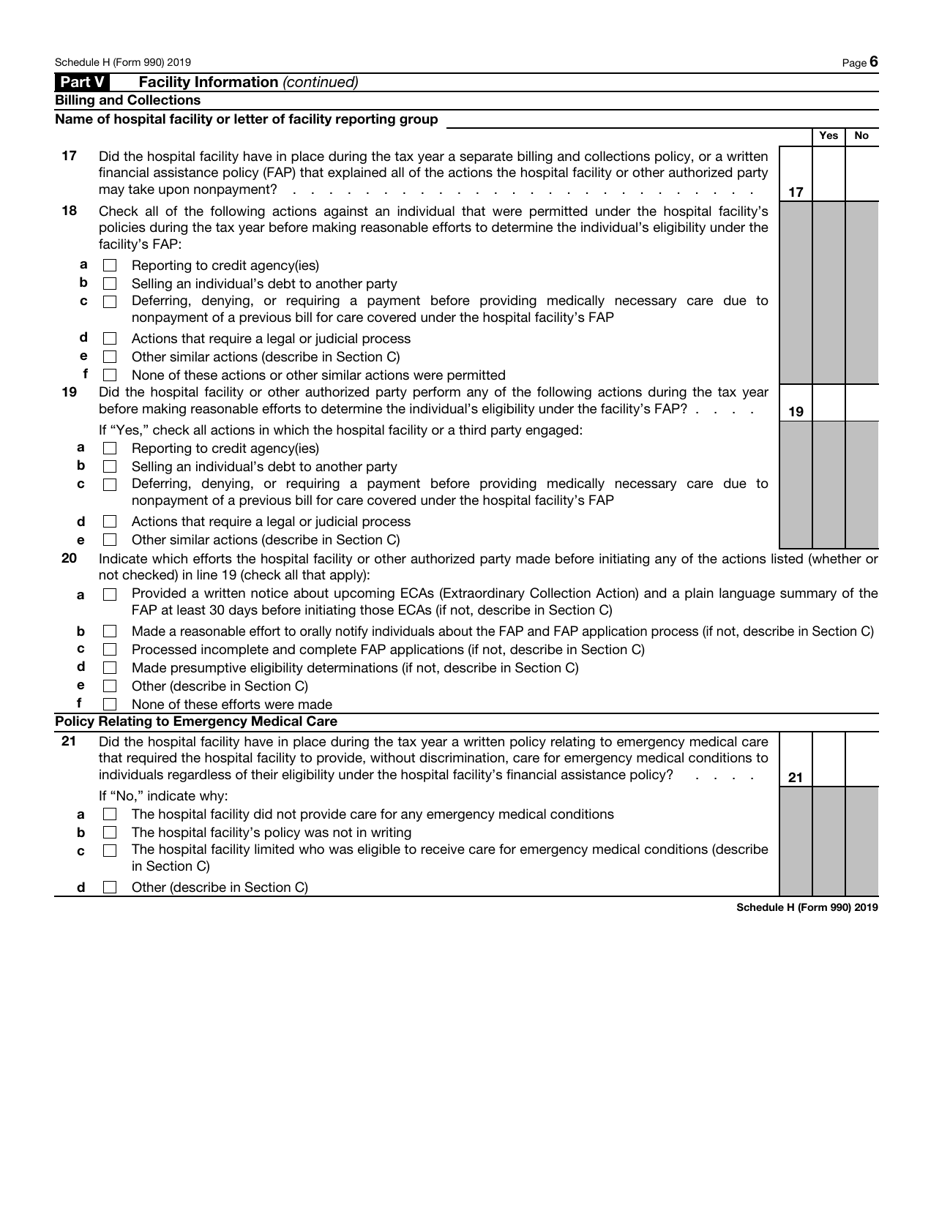

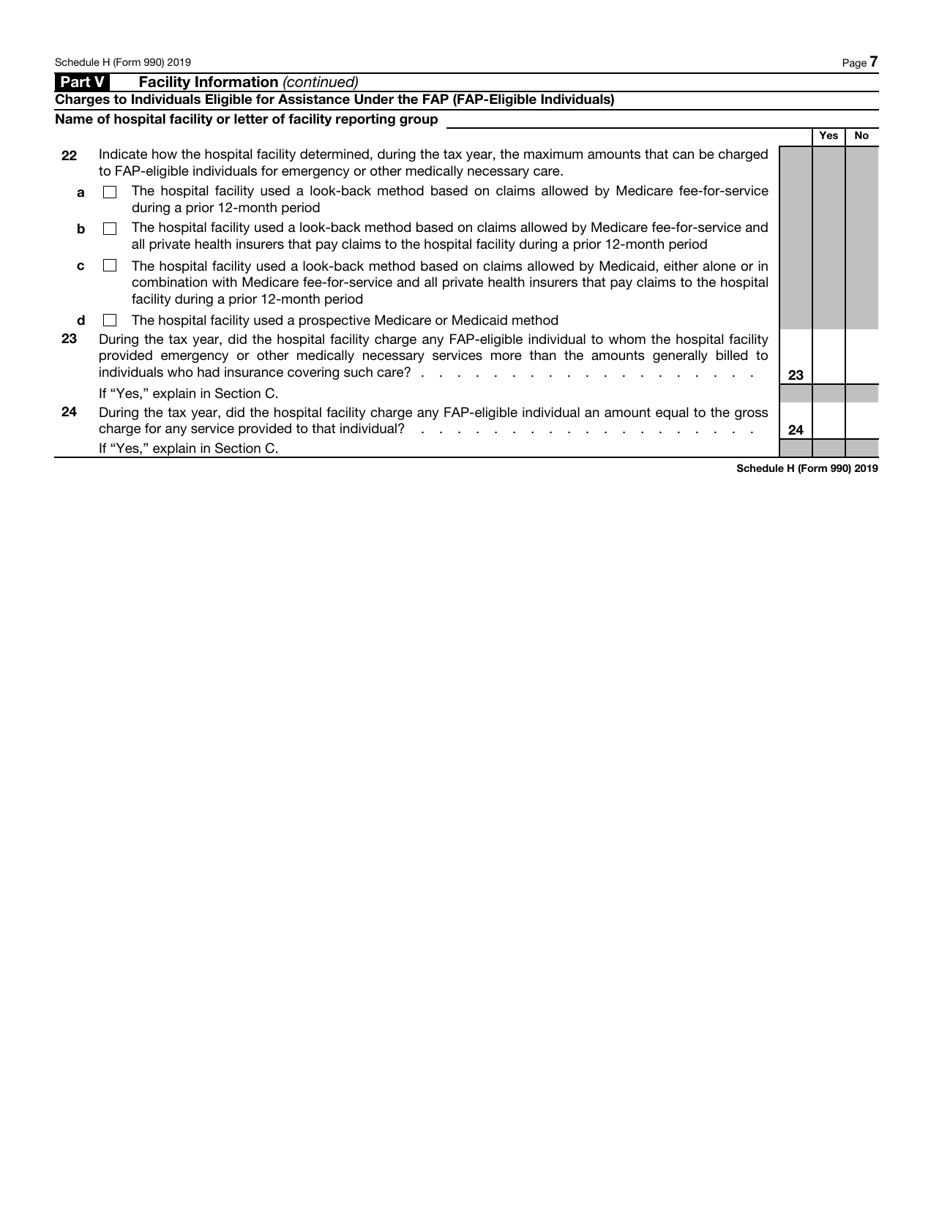

IRS Form 990 Schedule H Hospitals

What Is IRS Form 990 Schedule H?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule H?

A: IRS Form 990 Schedule H is a tax form used by hospitals to report information about their community benefit activities.

Q: Which hospitals are required to file IRS Form 990 Schedule H?

A: Non-profit hospitals are required to file IRS Form 990 Schedule H.

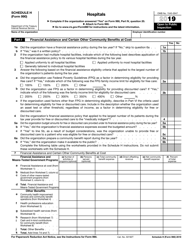

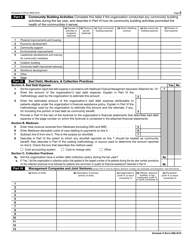

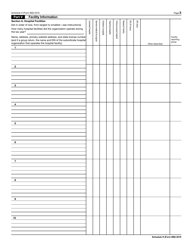

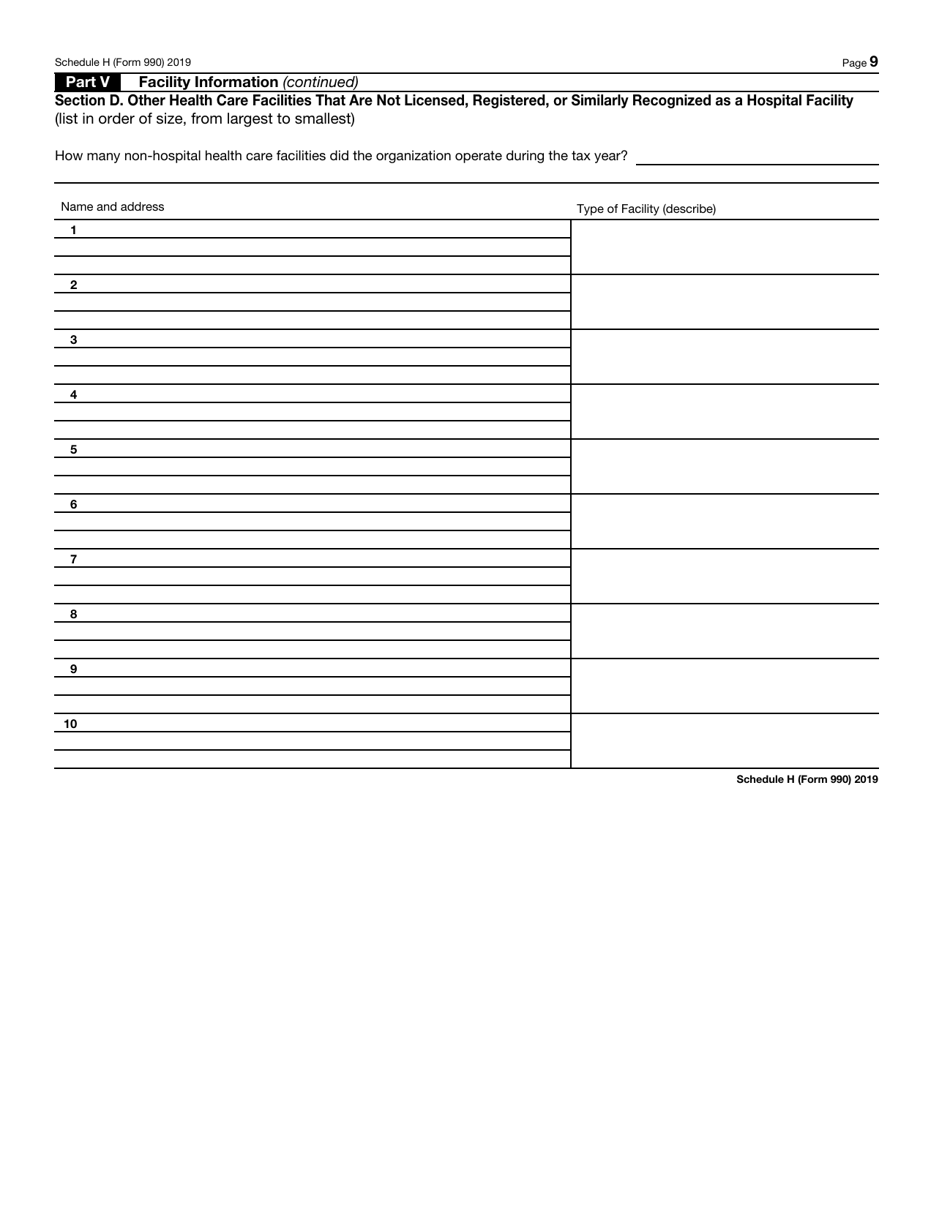

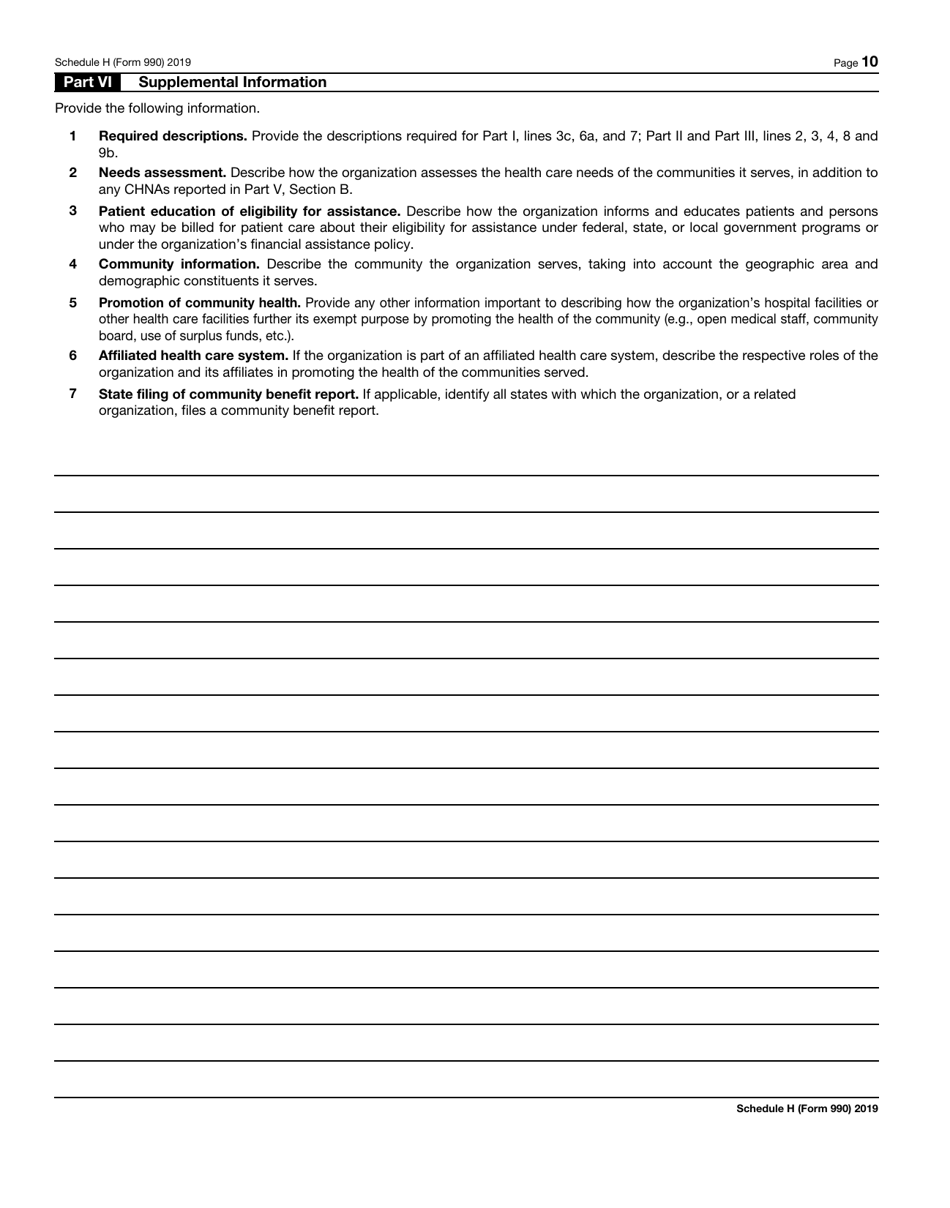

Q: What information is reported on IRS Form 990 Schedule H?

A: IRS Form 990 Schedule H requires hospitals to report on their charity care, community health improvement activities, and other community benefit programs.

Q: Why is IRS Form 990 Schedule H important?

A: IRS Form 990 Schedule H allows the public and government agencies to track and assess the community benefit activities of non-profit hospitals.

Form Details:

- A 10-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule H through the link below or browse more documents in our library of IRS Forms.