This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule H

for the current year.

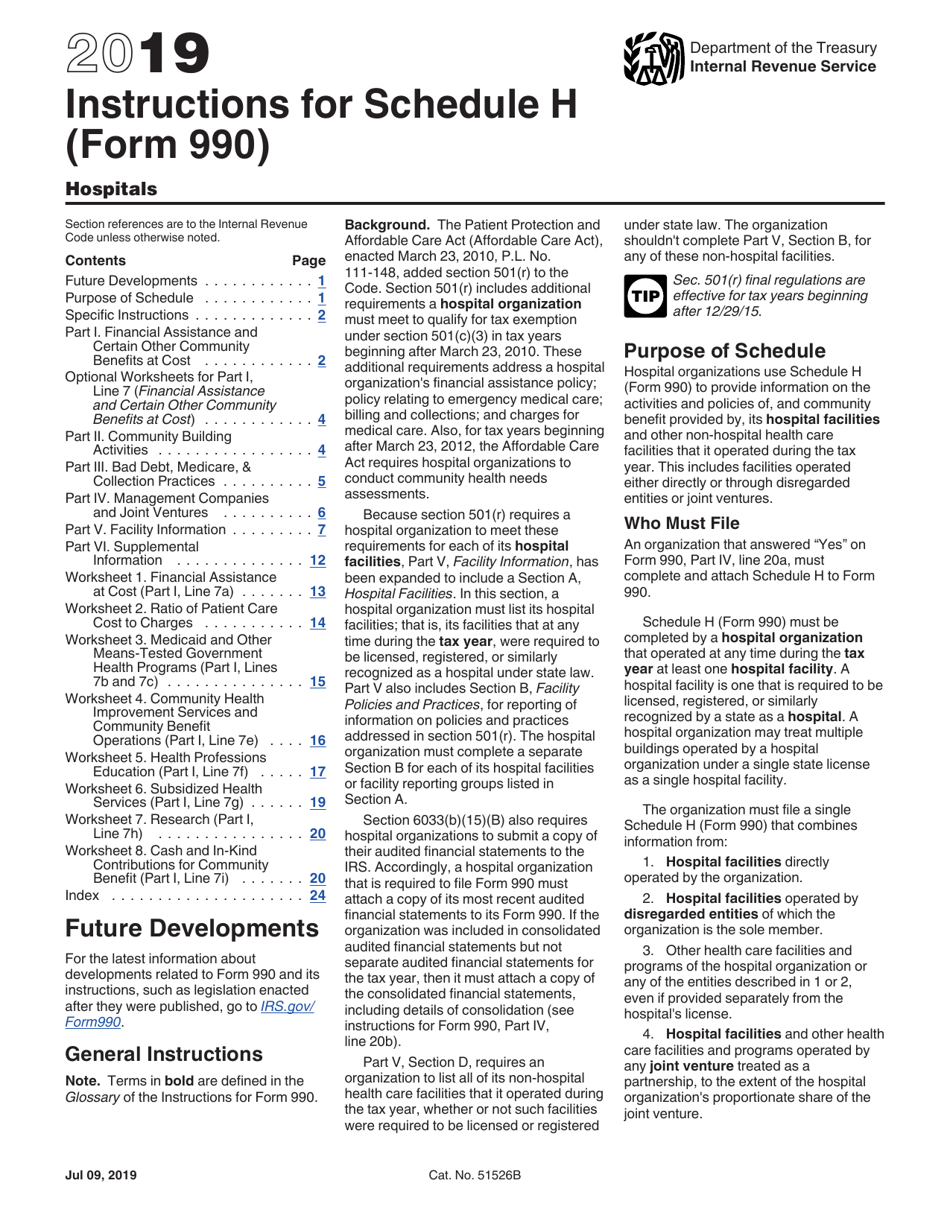

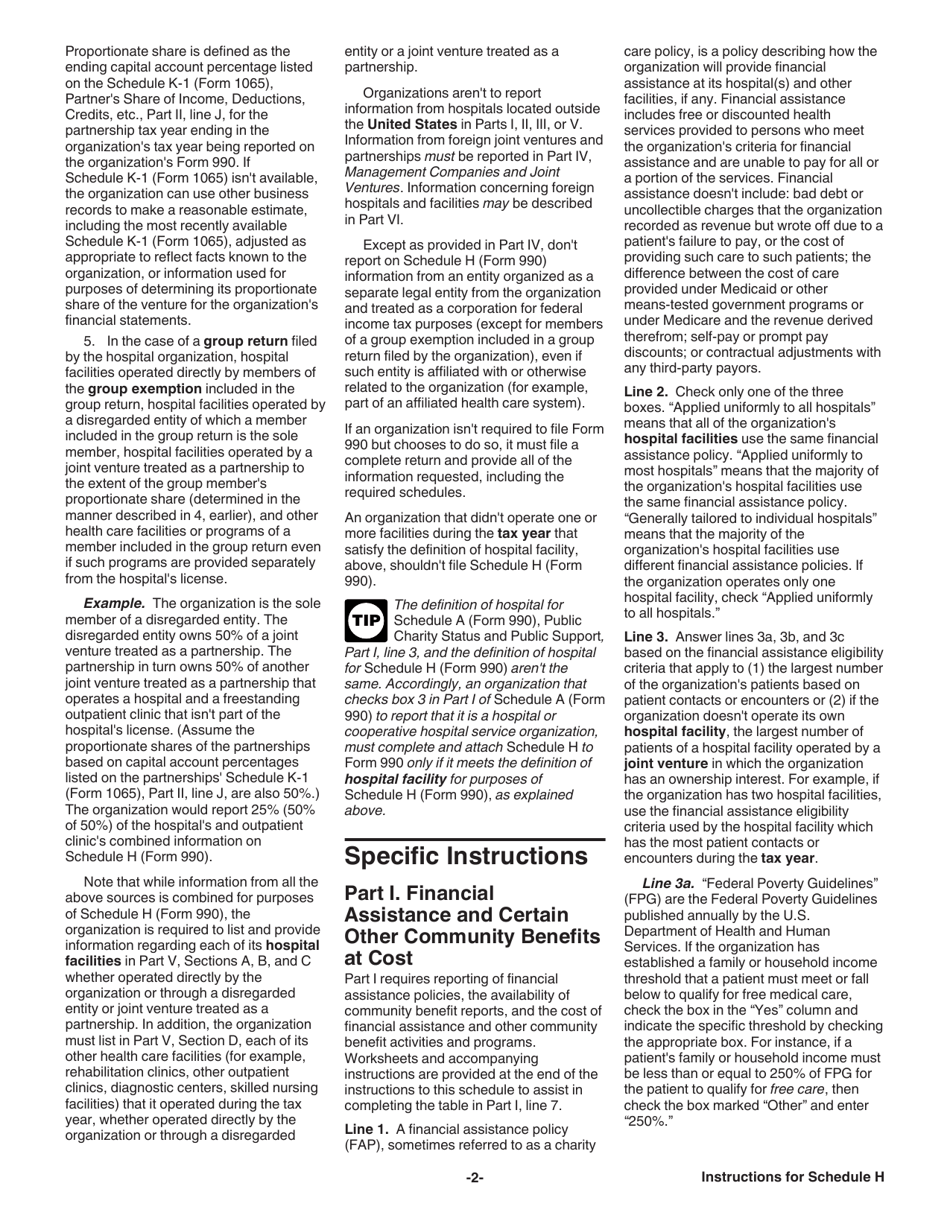

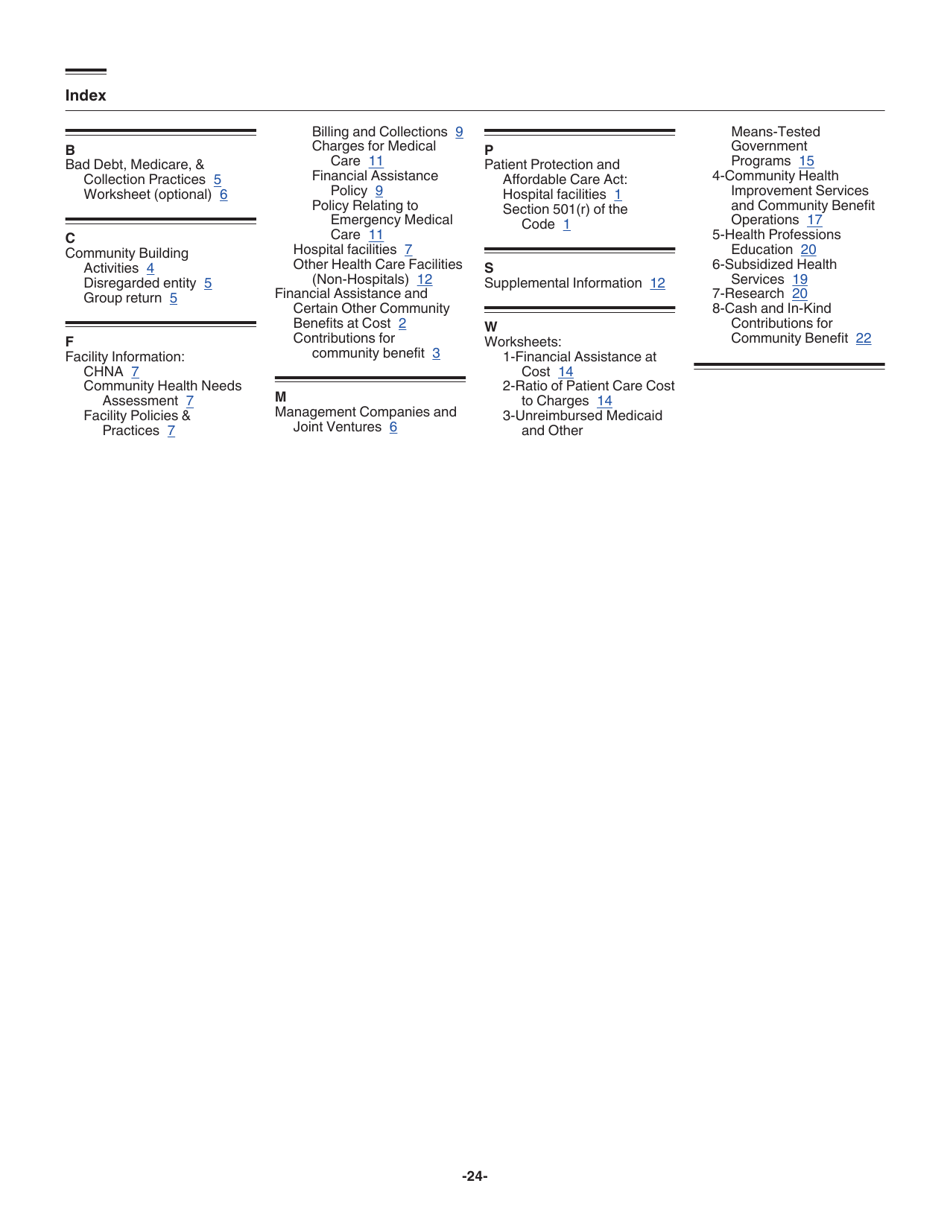

Instructions for IRS Form 990 Schedule H Hospitals

This document contains official instructions for IRS Form 990 Schedule H, Hospitals - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule H is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule H?

A: IRS Form 990 Schedule H is a form that hospitals must file as part of their annual return.

Q: Who needs to file IRS Form 990 Schedule H?

A: Hospitals that are recognized as tax-exempt organizations under section 501(c)(3) of the Internal Revenue Code must file IRS Form 990 Schedule H.

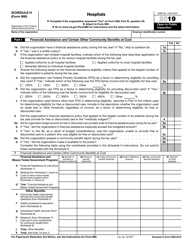

Q: What information does IRS Form 990 Schedule H require?

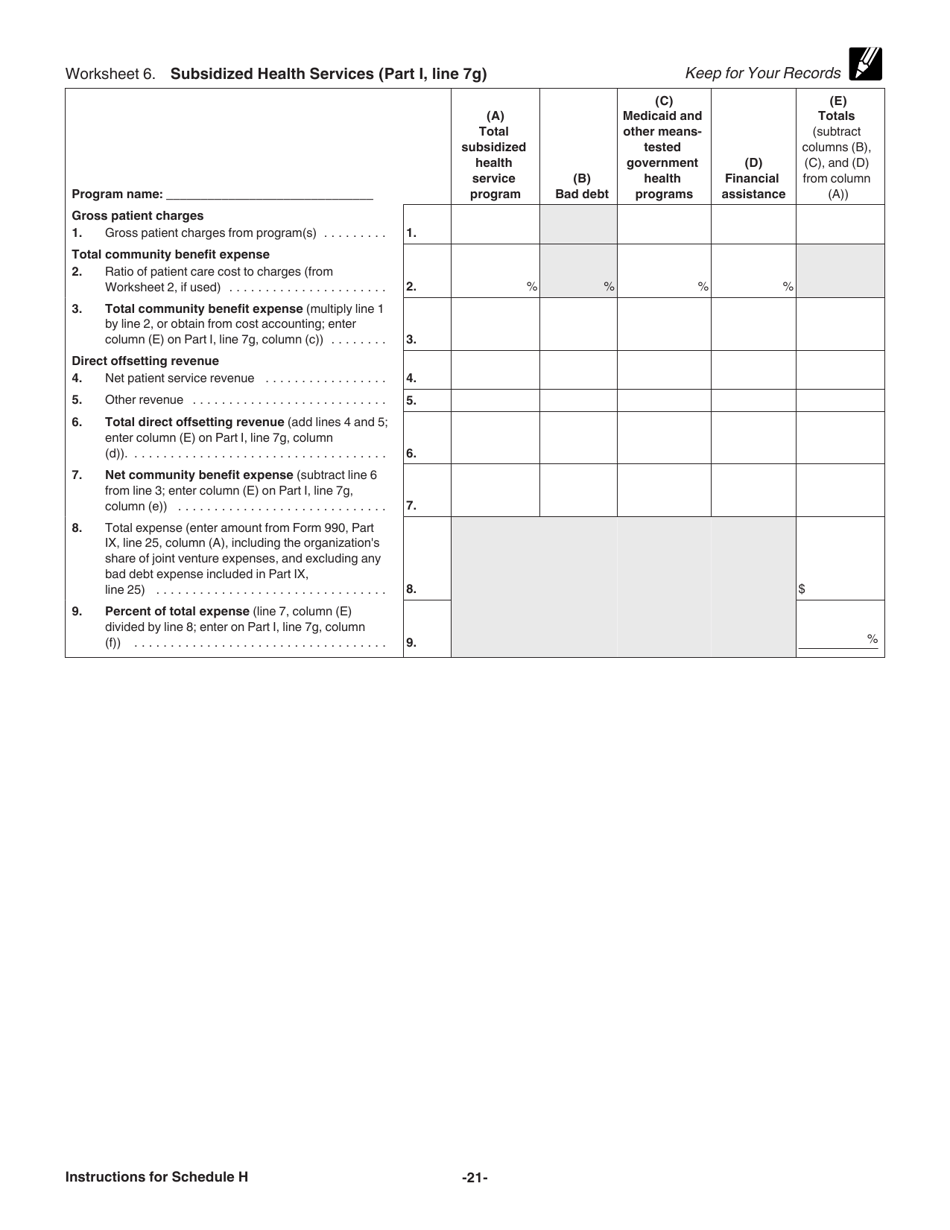

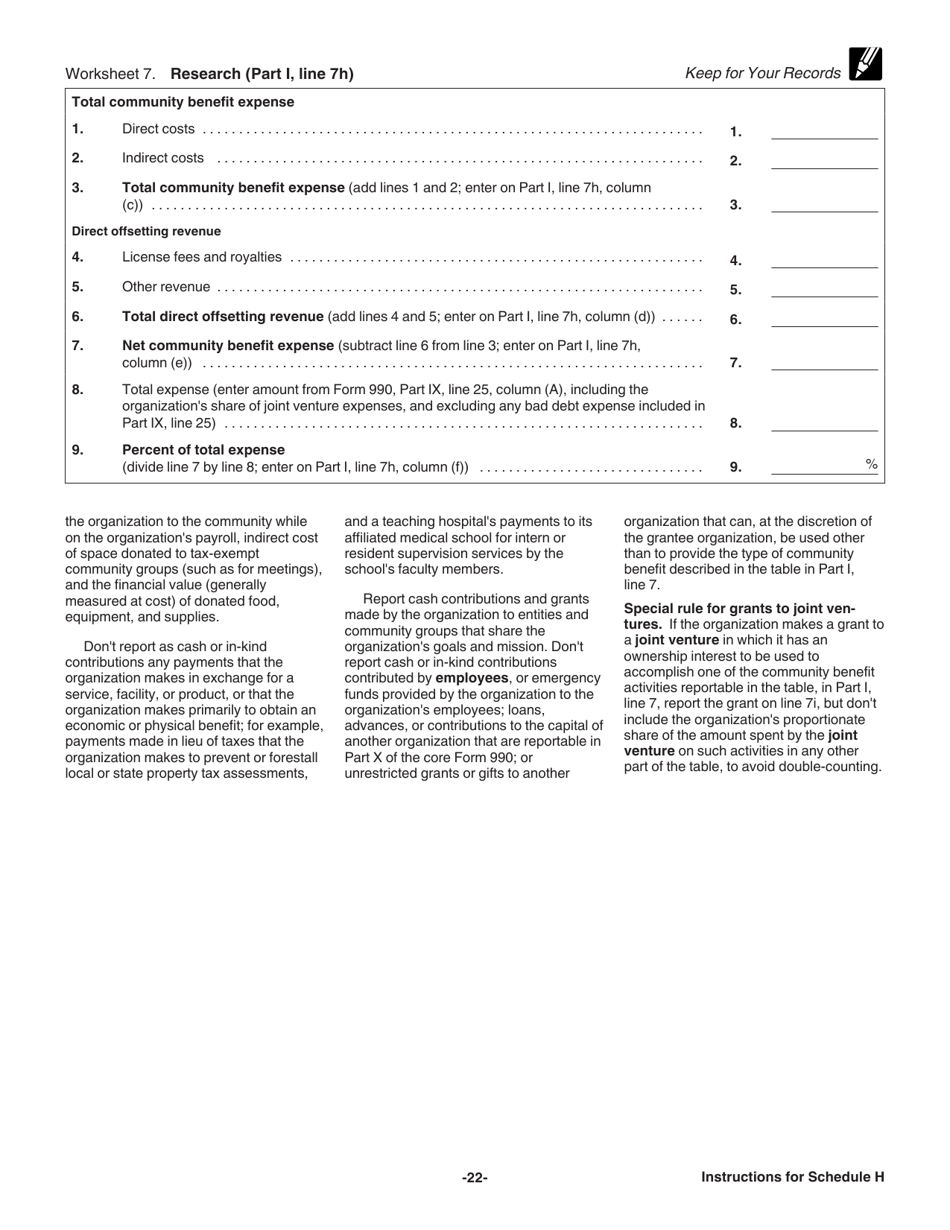

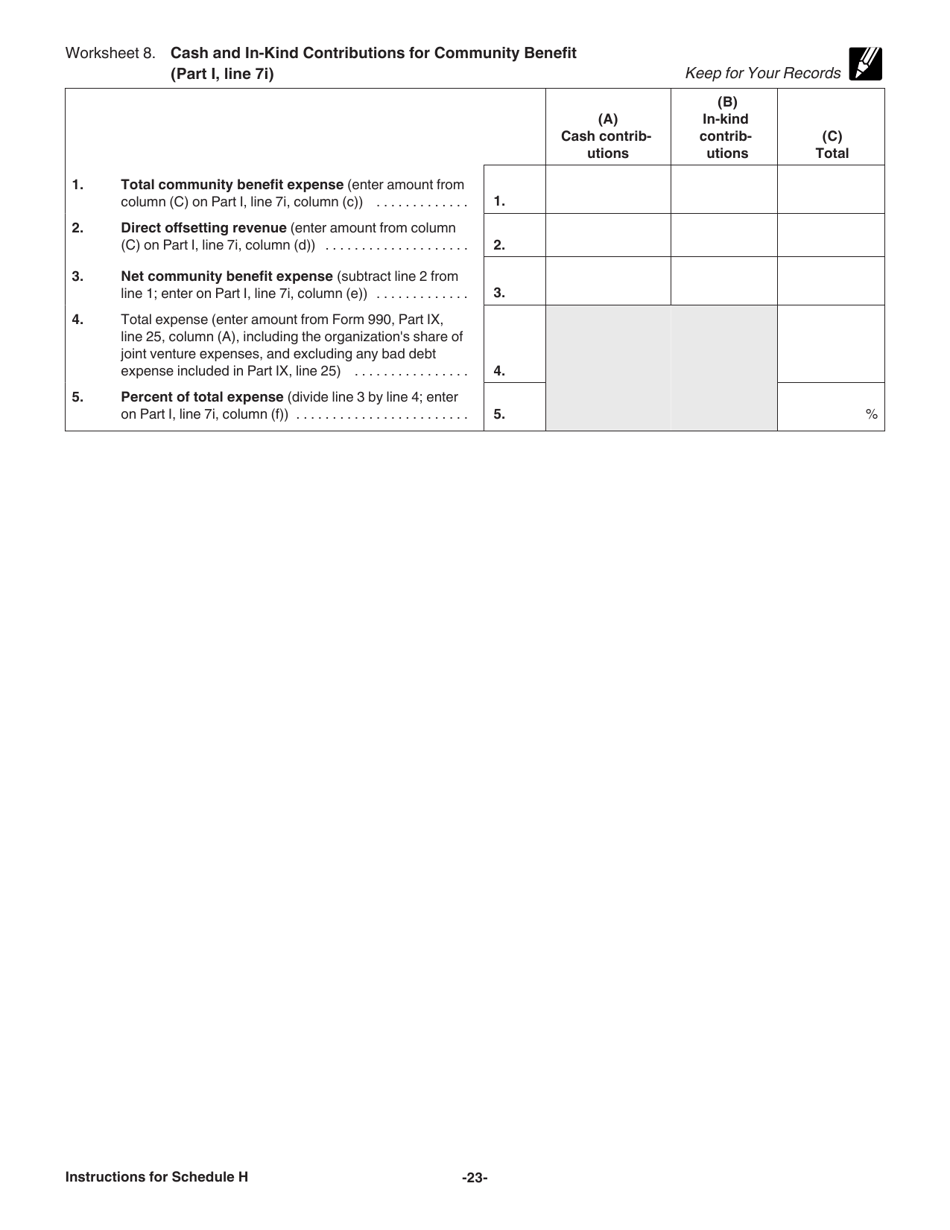

A: IRS Form 990 Schedule H requires hospitals to report information about their community benefit activities, such as the provision of charity care and community health improvement programs.

Q: When is IRS Form 990 Schedule H due?

A: IRS Form 990 Schedule H is due on the same day as the hospital's annual tax return, which is usually the 15th day of the fifth month after the end of the hospital's fiscal year.

Q: Is there a penalty for not filing IRS Form 990 Schedule H?

A: Yes, there may be penalties for not filing IRS Form 990 Schedule H or for filing it late. It's important for hospitals to comply with the filing requirements to avoid these penalties.

Instruction Details:

- This 24-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.