This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 706-GS(T)

for the current year.

Instructions for IRS Form 706-GS(T) Generation-Skipping Transfer Tax Return for Terminations

This document contains official instructions for IRS Form 706-GS(T) , Generation-Skipping Transfer Tax Return for Terminations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 706-GS(T) is available for download through this link.

FAQ

Q: What is the purpose of Form 706-GS(T)?

A: Form 706-GS(T) is used to report and calculate the Generation-Skipping Transfer (GST) tax on certain trust terminations.

Q: When is Form 706-GS(T) due?

A: Form 706-GS(T) is generally due nine months after the trust termination date.

Q: Who should file Form 706-GS(T)?

A: Form 706-GS(T) should be filed by the trustee or executor of the trust upon its termination.

Q: What information is required on Form 706-GS(T)?

A: Form 706-GS(T) requires information about the trust, the termination date, the beneficiaries, and the value of trust assets.

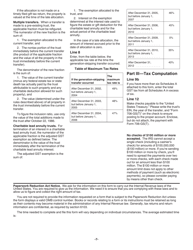

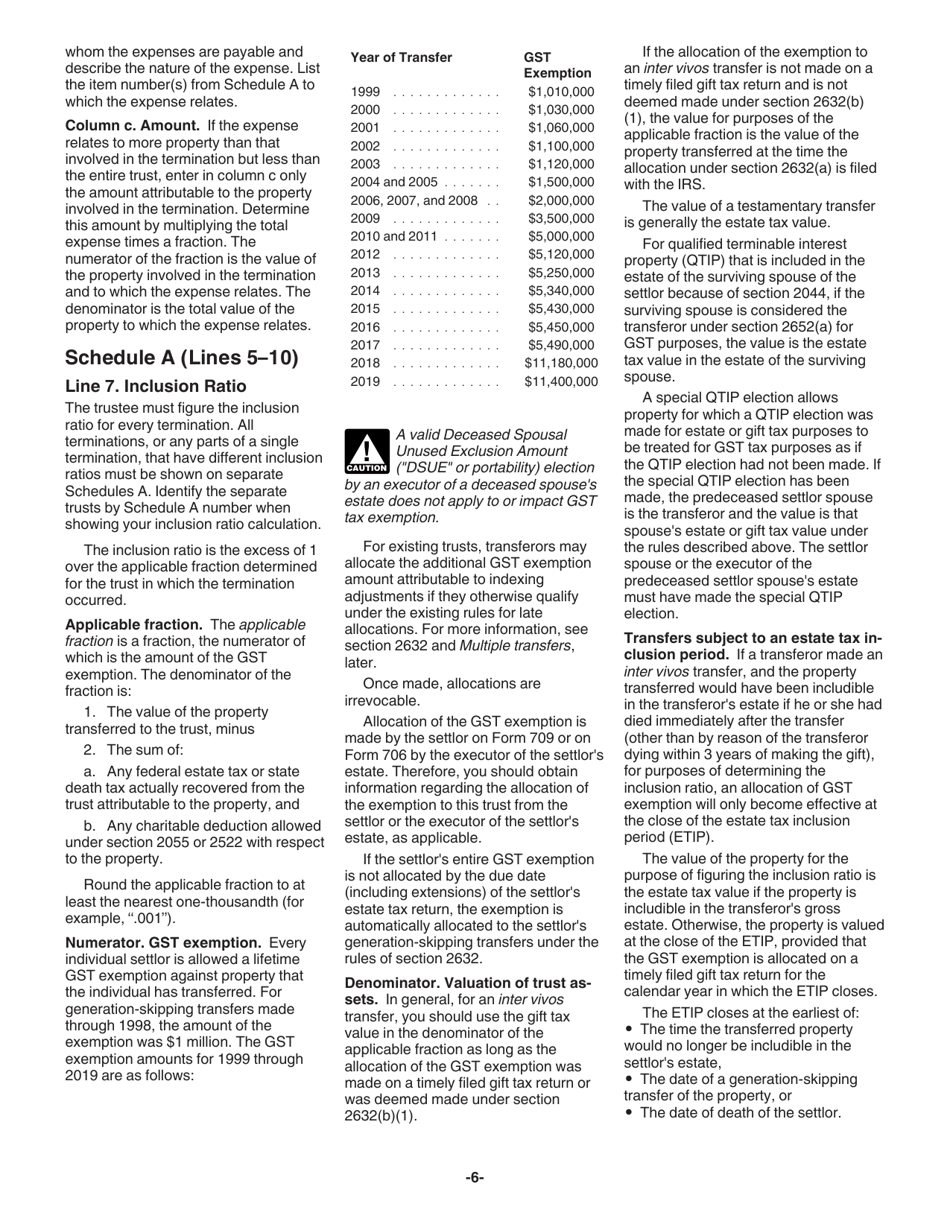

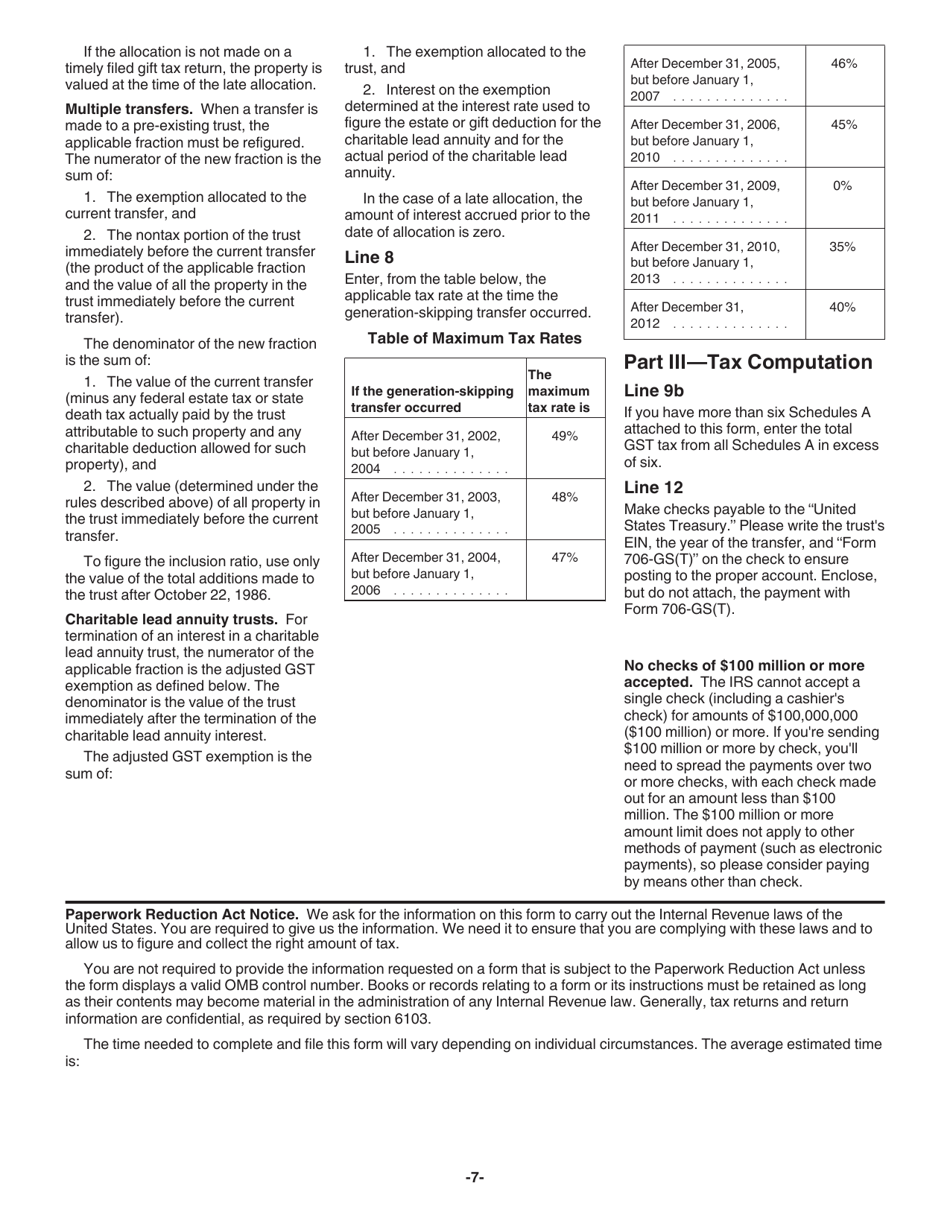

Q: How is the Generation-Skipping Transfer (GST) tax calculated?

A: The GST tax is calculated based on the taxable amount and the GST tax rate in effect at the time of the trust termination.

Q: Are there any exceptions to filing Form 706-GS(T)?

A: Yes, certain smaller trusts may be exempt from filing Form 706-GS(T). Consult the instructions for more information.

Instruction Details:

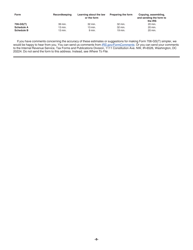

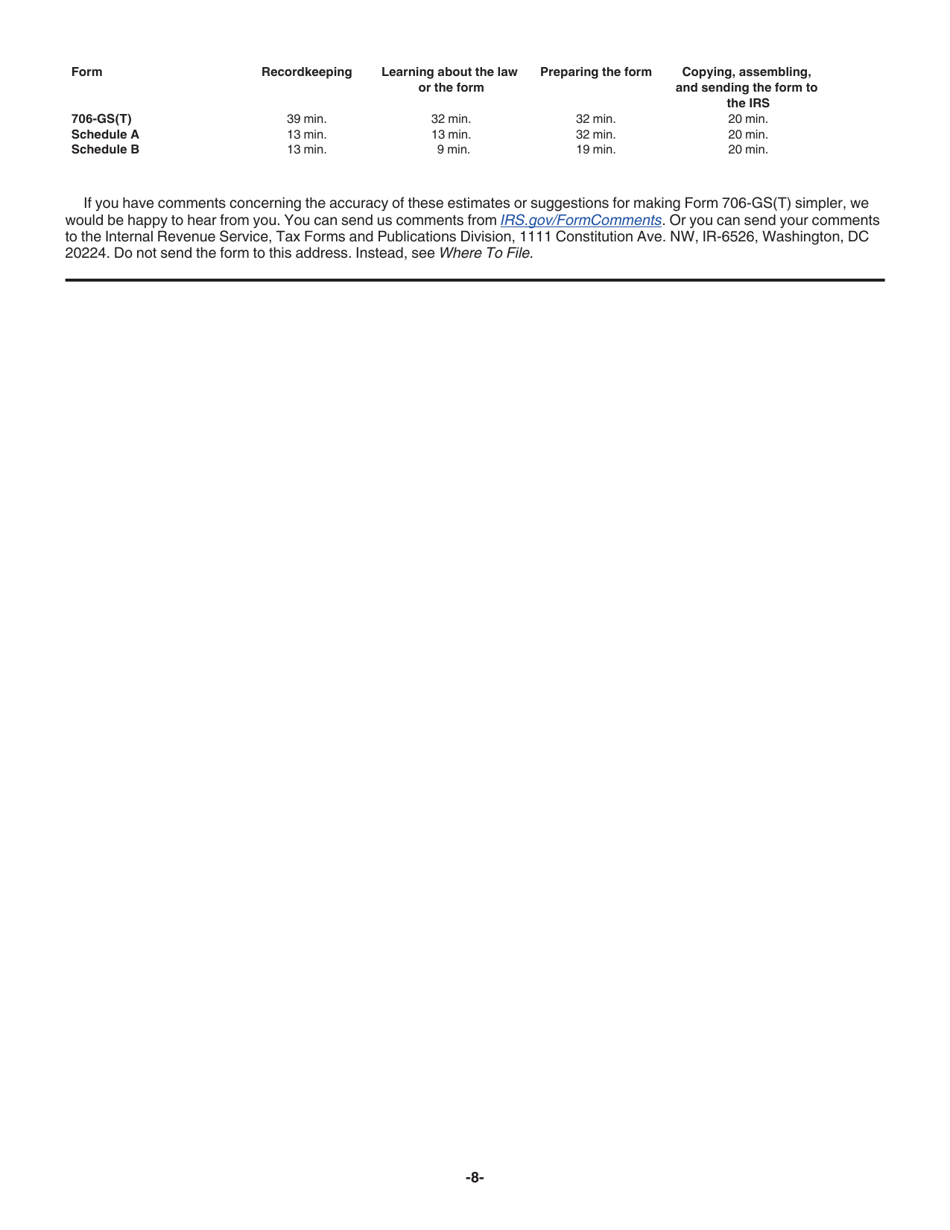

- This 8-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.