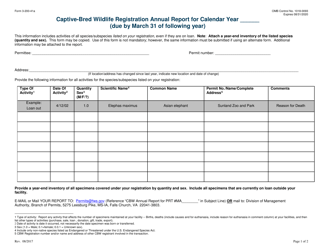

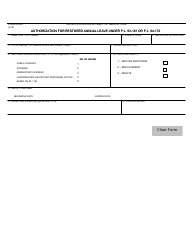

This version of the form is not currently in use and is provided for reference only. Download this version of

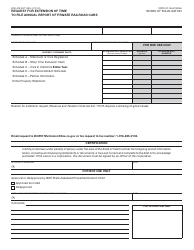

Form RRF-1

for the current year.

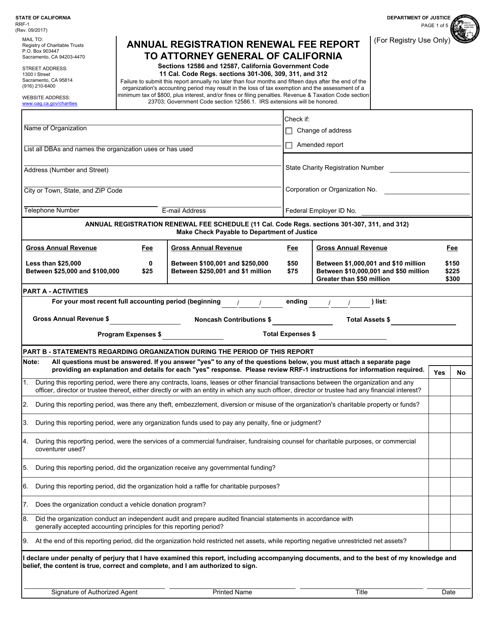

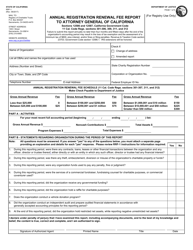

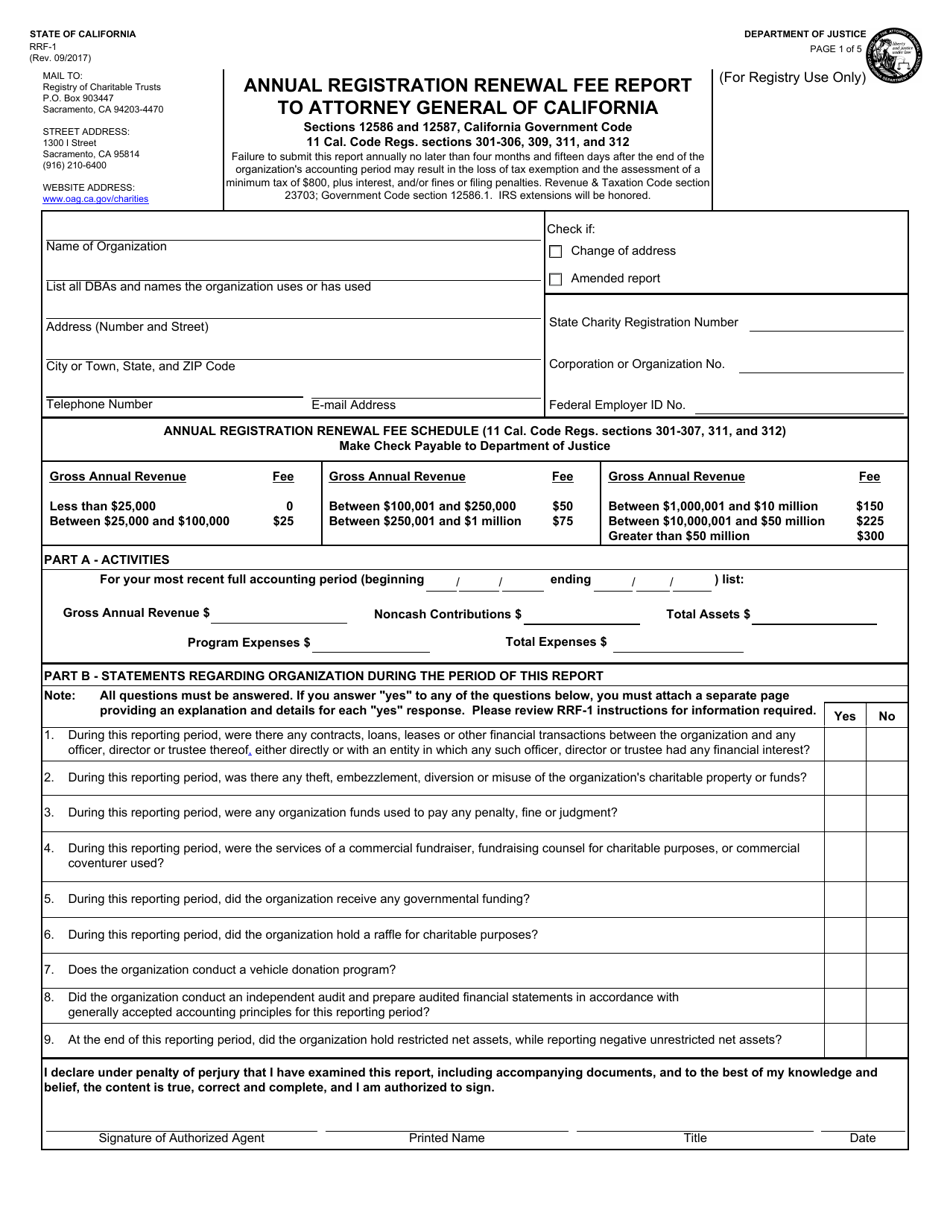

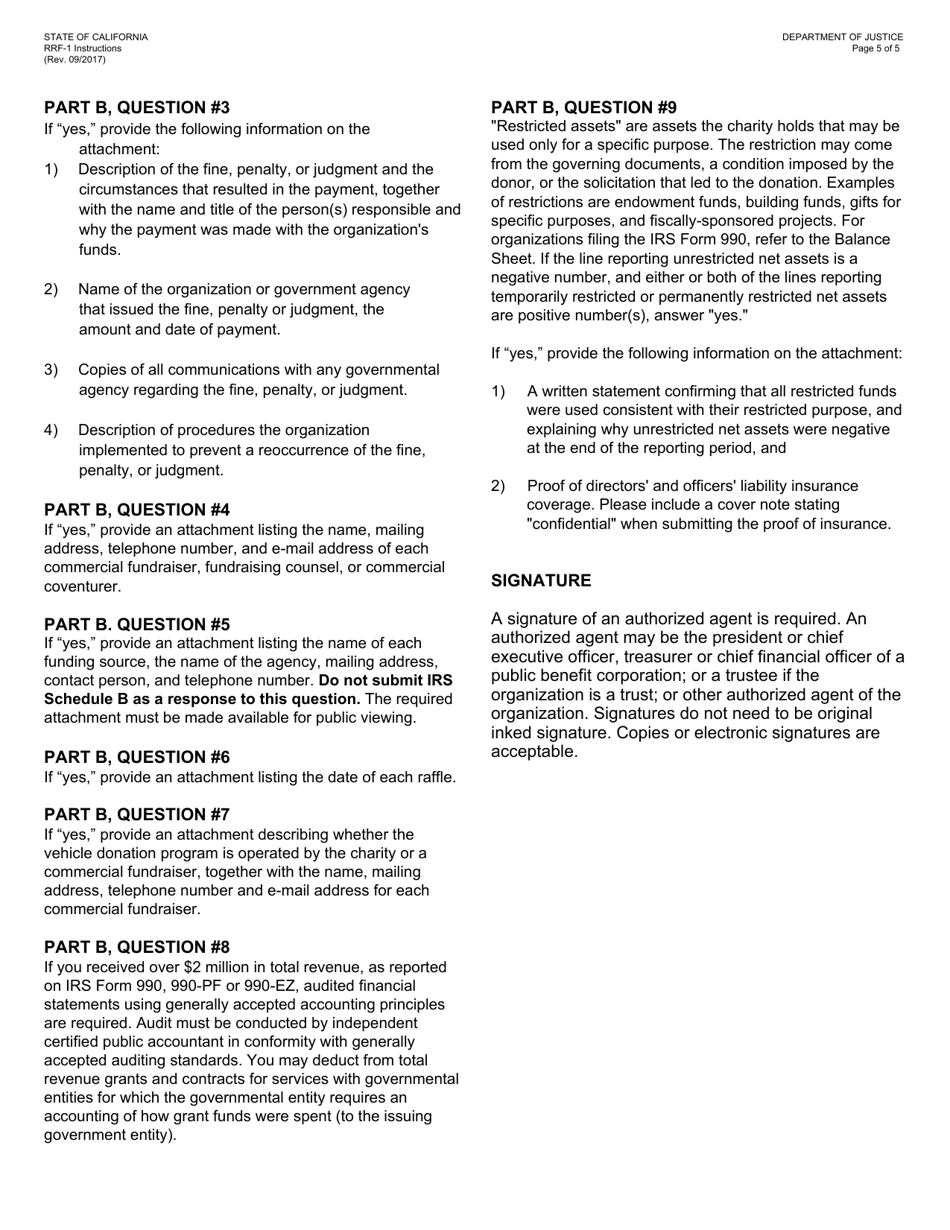

Form RRF-1 Annual Registration Renewal Fee Report to Attorney General of California - California

What Is Form RRF-1?

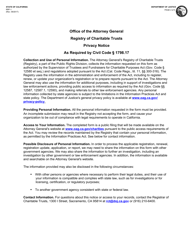

This is a legal form that was released by the California Department of Justice - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RRF-1?

A: Form RRF-1 is the Annual Registration Renewal Fee Report.

Q: Who is the recipient of Form RRF-1?

A: The recipient of Form RRF-1 is the Attorney General of California.

Q: What is the purpose of Form RRF-1?

A: The purpose of Form RRF-1 is to report and renew the registration of charitable organizations in California.

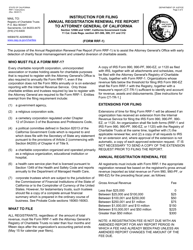

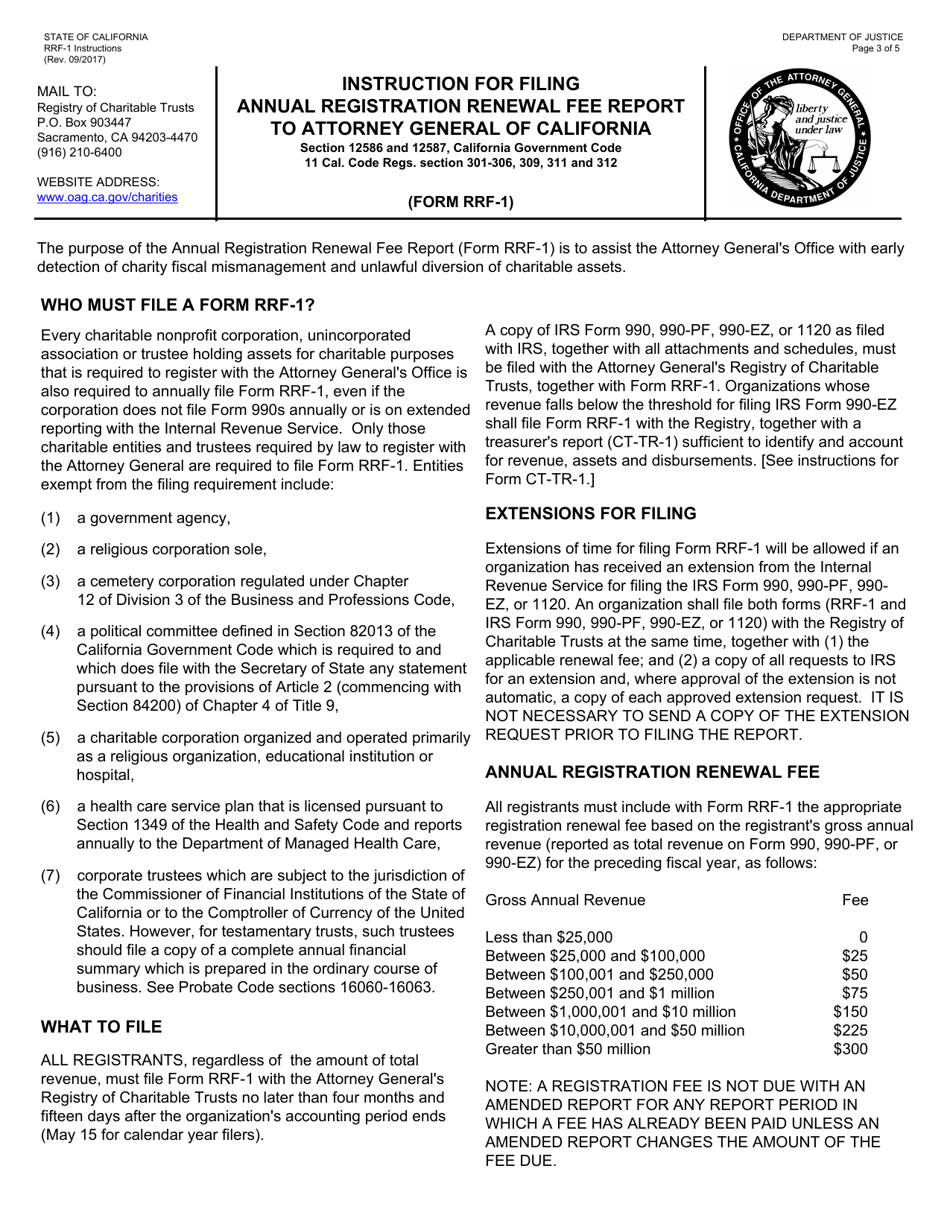

Q: Who is required to submit Form RRF-1?

A: Charitable organizations operating in California are required to submit Form RRF-1.

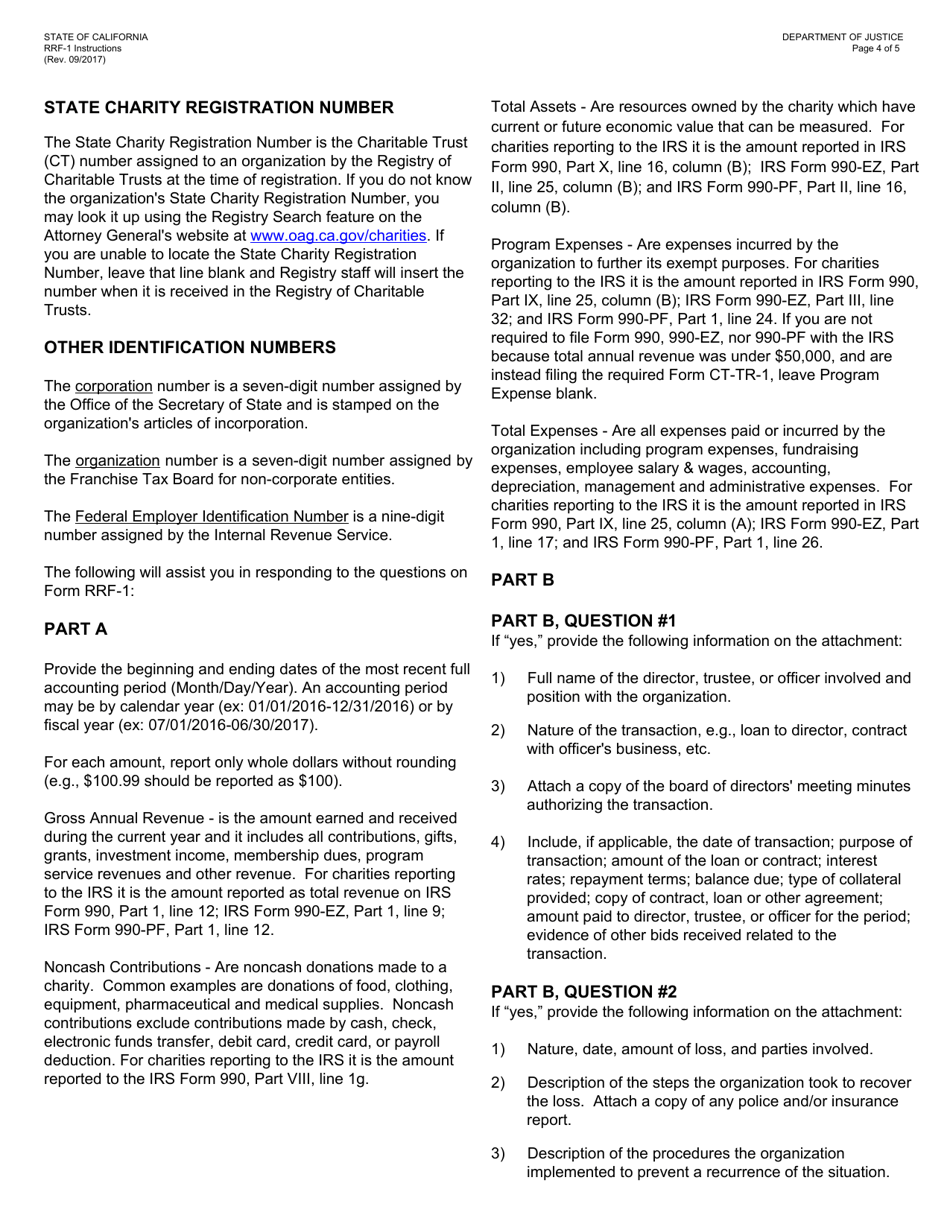

Q: What information is required in Form RRF-1?

A: Form RRF-1 requires information such as organization details, financial information, fundraising activities, and governance.

Q: When is Form RRF-1 due?

A: Form RRF-1 is due on or before the fifteenth day of the fifth month following the close of the organization's accounting period.

Q: Are there any fees associated with Form RRF-1?

A: Yes, there is an annual registration renewal fee that needs to be paid along with the submission of Form RRF-1.

Q: Is Form RRF-1 confidential?

A: No, Form RRF-1 is not confidential and can be accessed by the public upon request.

Q: Are there any penalties for late submission of Form RRF-1?

A: Yes, late submission of Form RRF-1 may result in penalties and the organization may lose its registration status.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RRF-1 by clicking the link below or browse more documents and templates provided by the California Department of Justice.