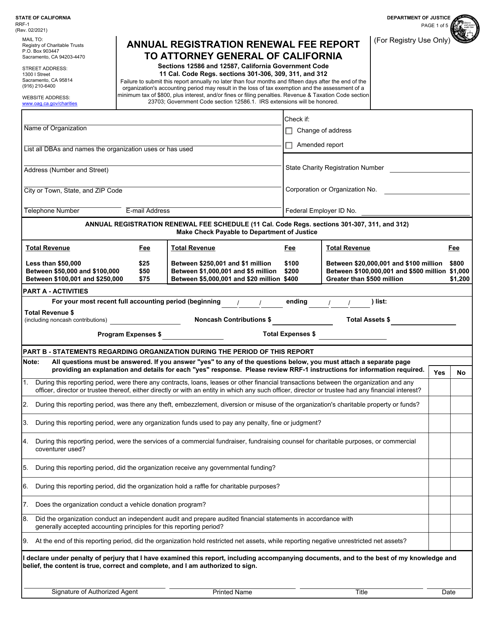

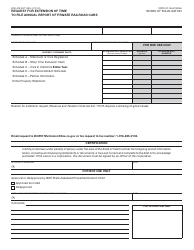

Form RRF-1 Annual Registration Renewal Fee Report to Attorney General of California - California

What Is the RRF-1 Form?

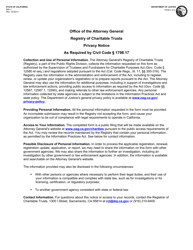

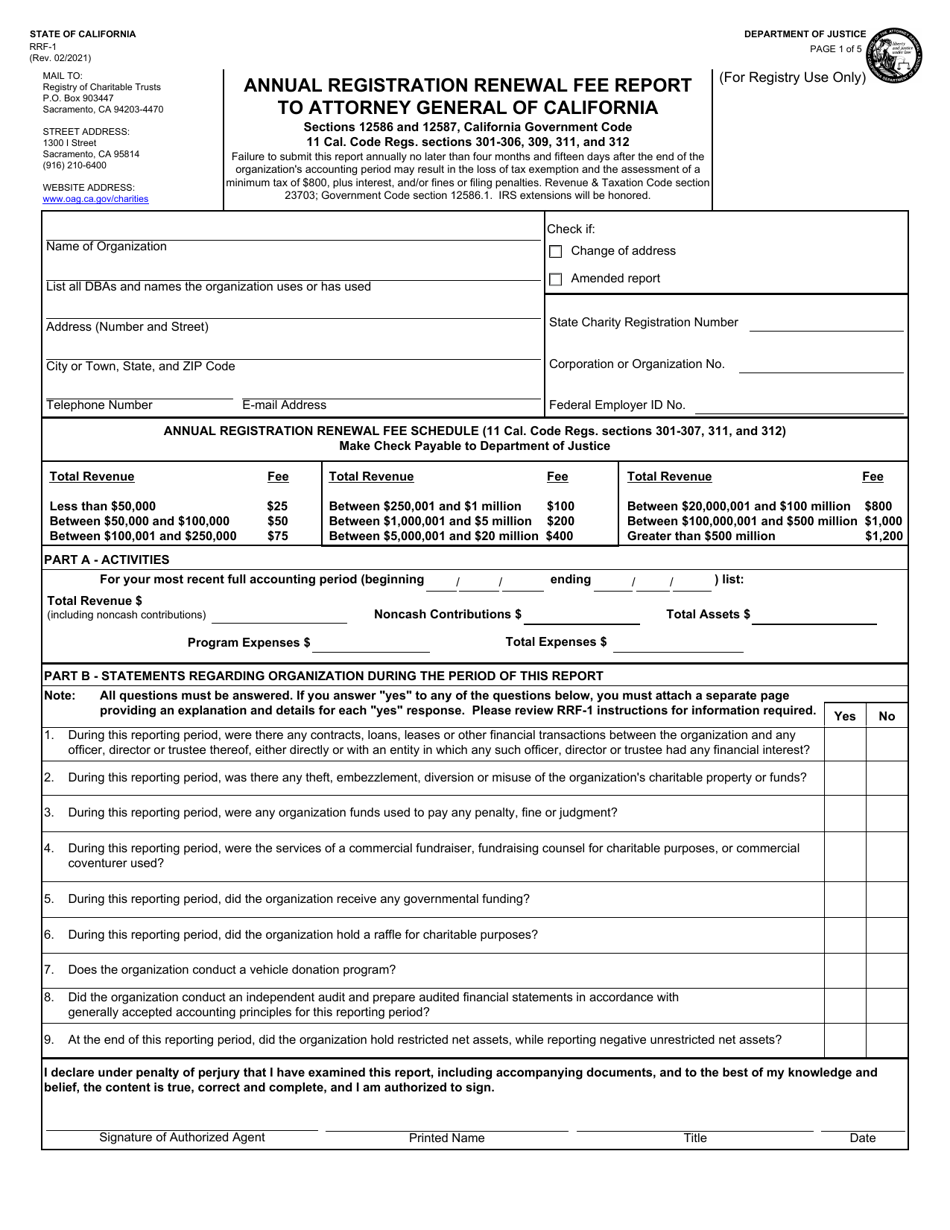

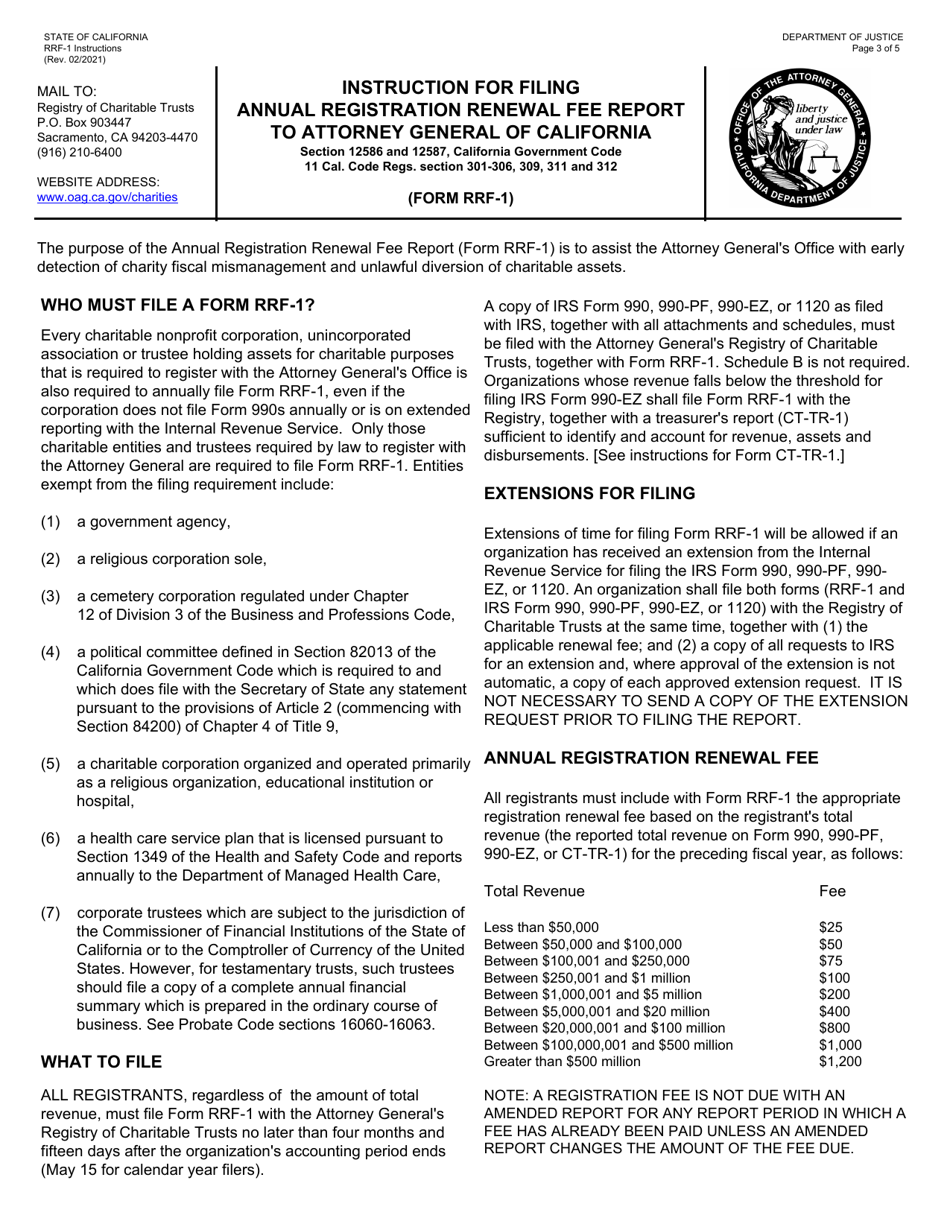

Form RRF-1, Annual Registration Renewal Fee Report to the Attorney General of California , is an application issued by the California Department of Justice and last revised on February 1, 2021 . The document was developed to help the Attorney General's Office with the early detection of any unlawful diversion of charitable assets. An RRF-1 fillable form is available for download below.

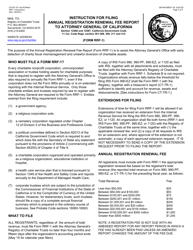

Who Must File Form RRF-1?

According to the instructions on how to complete the application, if an organization is required to register with the Attorney General's Office, they are also required to file Form RRF-1. Such organizations can be:

- Unincorporated association;

- Charitable nonprofit corporation;

- Trustee holding assets for charitable purposes.

The form is supposed to be submitted every year.

Form RRF-1 Instructions

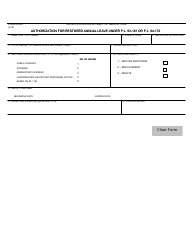

California Form RRF-1 can be divided into three parts that an entity is supposed to fill in.

-

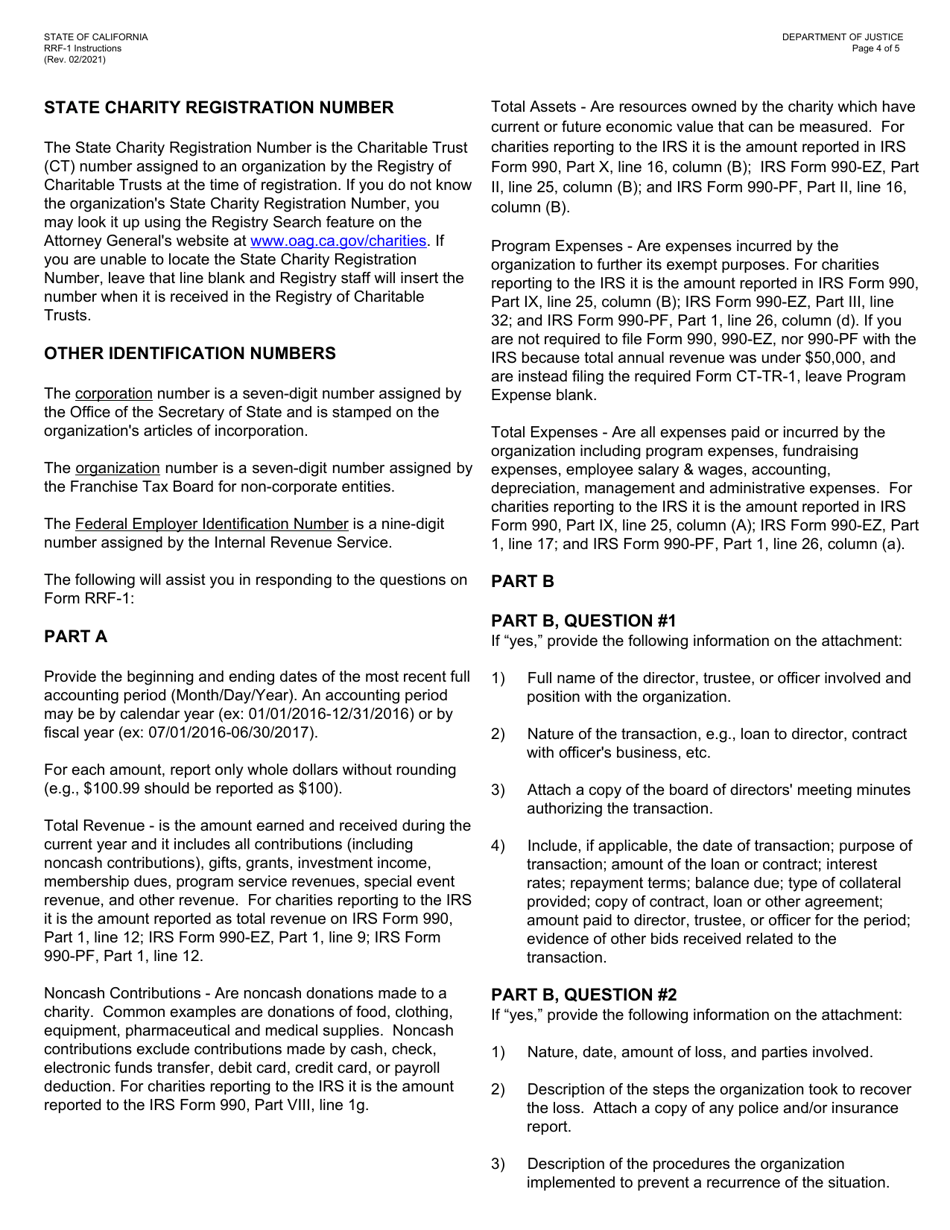

In the first part, the filer must enter their name (name of organization), address, telephone number, email address, etc. The filer must also indicate the beginning and the ending of the most recent full accounting period, which may be by the calendar year or fiscal year.

-

The second part of the form is dedicated to assets and expenses, such as:

- Gross Annual Revenue. This is the amount received and earned during the current year and it includes all gifts, contributions, investment income, grants, investment income, membership dues, program service revenues, and other revenue.

- -Noncash Contributions. They include noncash donations made to a charity, such as food, clothing, equipment, pharmaceutical, and medical supplies. Noncash contributions exclude contributions made by check, debit card, cash, electronic funds transfer, credit card, or payroll deduction.

- Total Assets. These are resources that have economic value that can be measured.

- Program Expenses. These are expenses incurred by the organization to further its exempt purposes.

- Total Expenses. They include all expenses paid or incurred by the organization including program expenses, depreciation, fundraising expenses, accounting, employee salary, management, and administrative expenses.

-

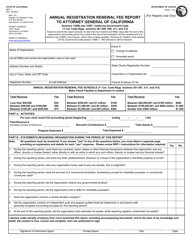

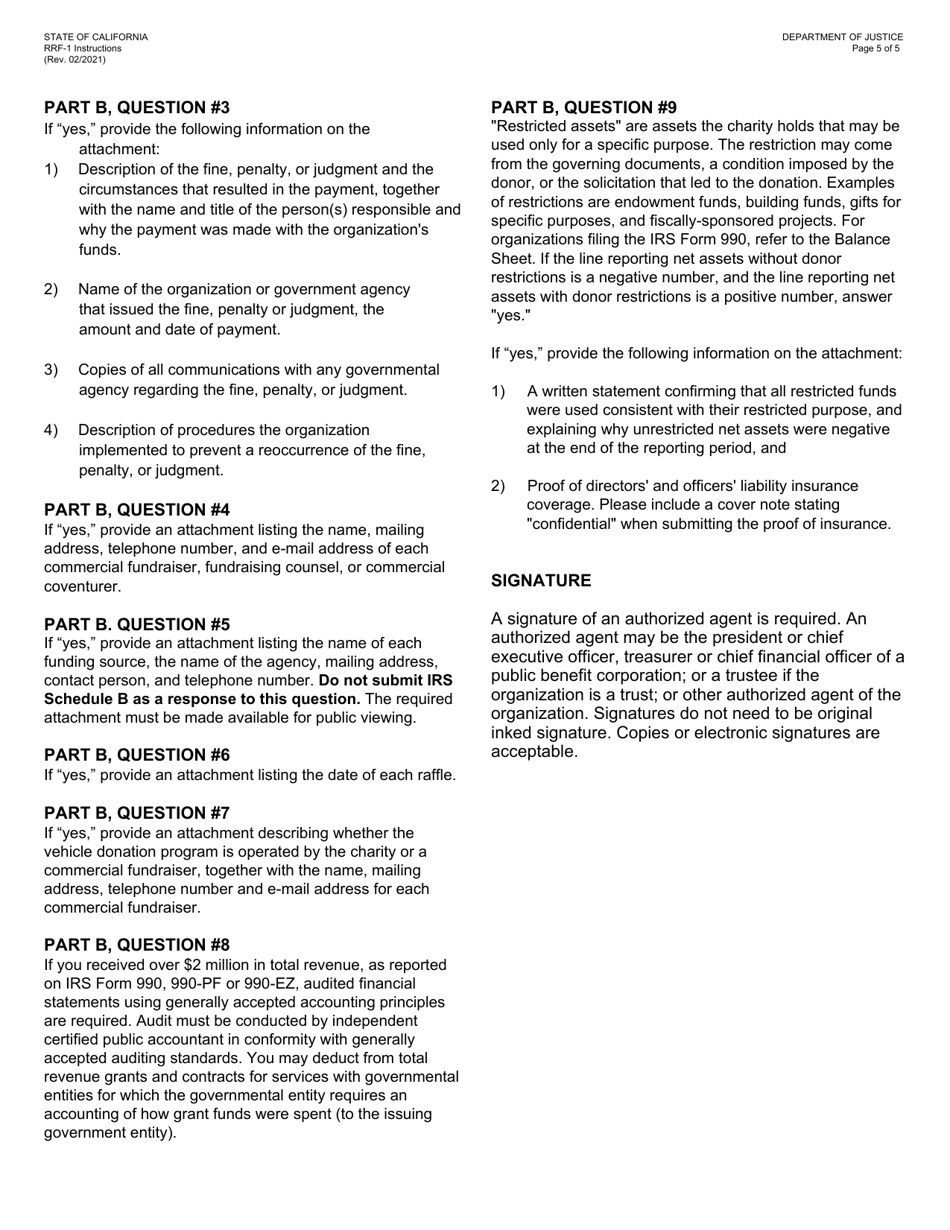

The third part of the Registry of Charitable Trusts Form RRF-1 consists of nine lines, upon which the filer must answer "yes" or "no." If the filer answers "yes" to any of the questions in the form, they must provide additional information on that subject with details. It applies to every "yes" response. The questions include (but not limited to):

- Were the services of a commercial fundraiser, fundraising counsel for charitable purposes, or commercial coventurer used? If the filer answers "yes" to this question, then they must attach a document to the form, where they will provide additional information, such as name, telephone number, mailing address, and email address of each commercial fundraiser, fundraising counsel, or commercial coventurer.

- Did the organization receive any governmental funding? If the organization did receive governmental funding, then an applicant must attach a document where they list every funding source, including the name of the agency, phone number, etc.

- Did the organization hold a raffle for charitable purposes? If the answer to this question is "yes," then the filer must provide a document, where they will detail the dates of every raffle.

- Does the organization conduct a vehicle donation program? If the organization does conduct a vehicle donation program, then the filer must attach to the form a document where they will indicate who is operating the program, as well as all the contact information of each fundraiser.