This version of the form is not currently in use and is provided for reference only. Download this version of

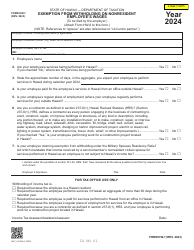

Form HW-4

for the current year.

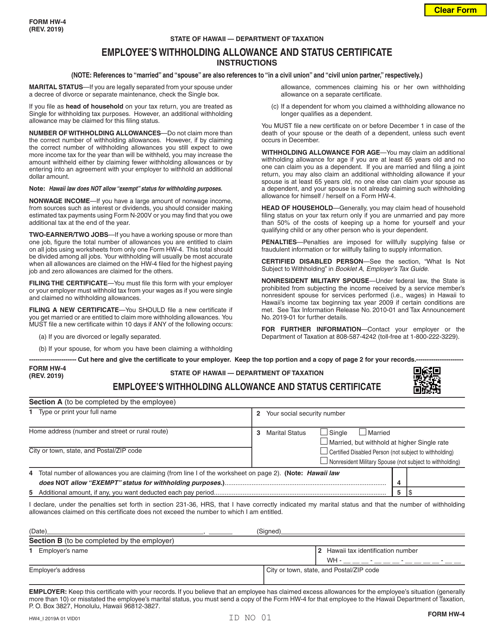

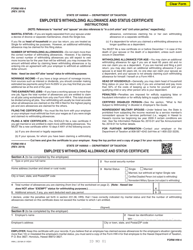

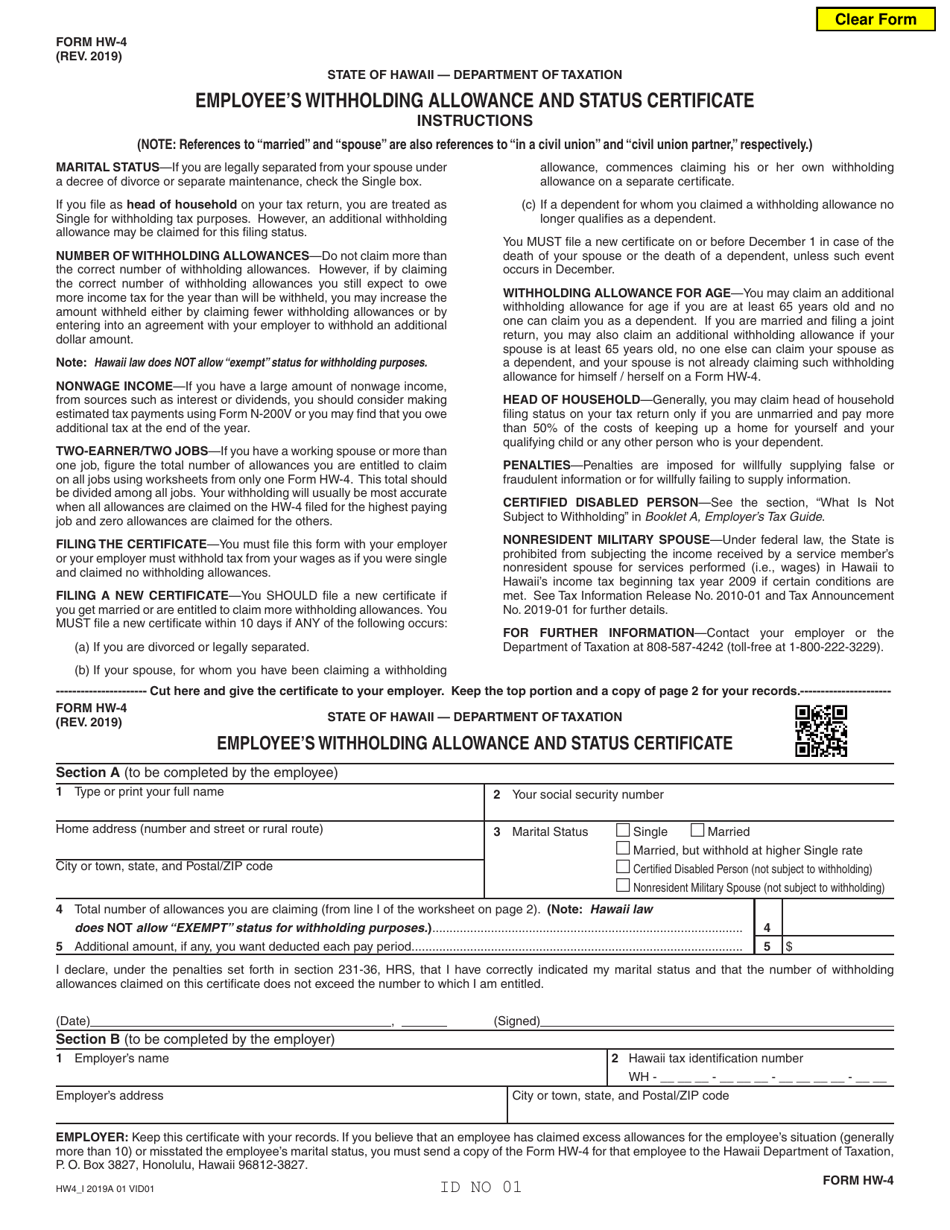

Form HW-4 Employee's Withholding Allowance and Status Certificate - Hawaii

What Is Form HW-4?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the HW-4 form?

A: The HW-4 form is the Employee's Withholding Allowance and Status Certificate for Hawaii.

Q: What is the purpose of the HW-4 form?

A: The HW-4 form is used by employees to determine the amount of state income tax to withhold from their paychecks.

Q: Who needs to fill out the HW-4 form?

A: All employees in Hawaii need to fill out the HW-4 form.

Q: How often do I need to fill out the HW-4 form?

A: You need to fill out the HW-4 form whenever you start a new job or whenever your withholding allowances change.

Q: What information do I need to fill out the HW-4 form?

A: You will need to provide your name, Social Security Number, filing status, and the number of withholding allowances you are claiming.

Q: What is the filing status on the HW-4 form?

A: The filing status on the HW-4 form refers to whether you are single, married, or can be claimed as a dependent on someone else's tax return.

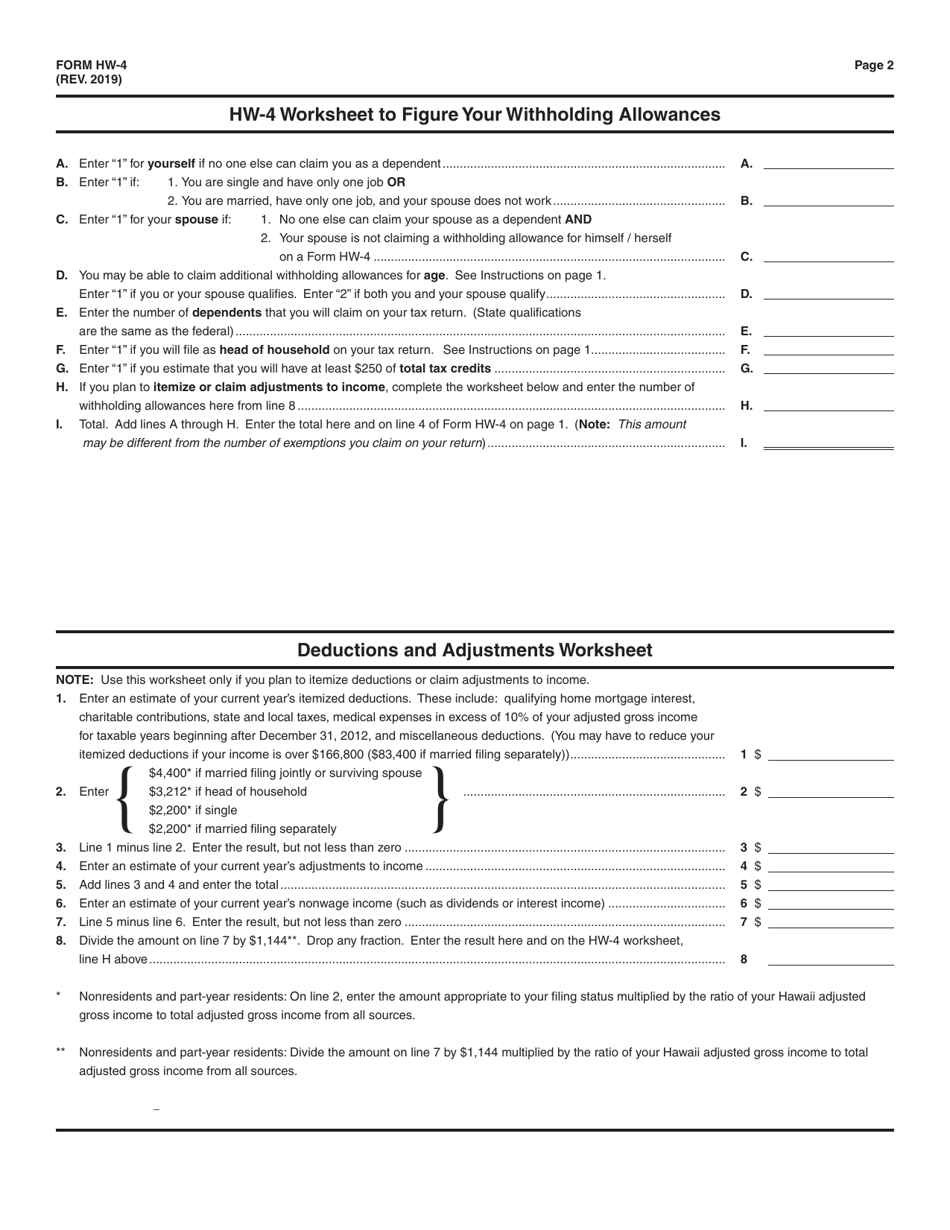

Q: How do I know how many withholding allowances to claim?

A: You can refer to the instructions on the HW-4 form or use the withholding calculator provided by the Hawaii Department of Taxation.

Q: What happens if I don't fill out the HW-4 form?

A: If you don't fill out the HW-4 form, your employer will withhold taxes based on the default filing status of single with zero allowances.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HW-4 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.