This version of the form is not currently in use and is provided for reference only. Download this version of

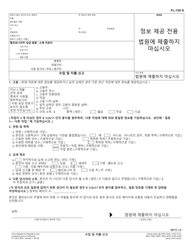

Form FL-150

for the current year.

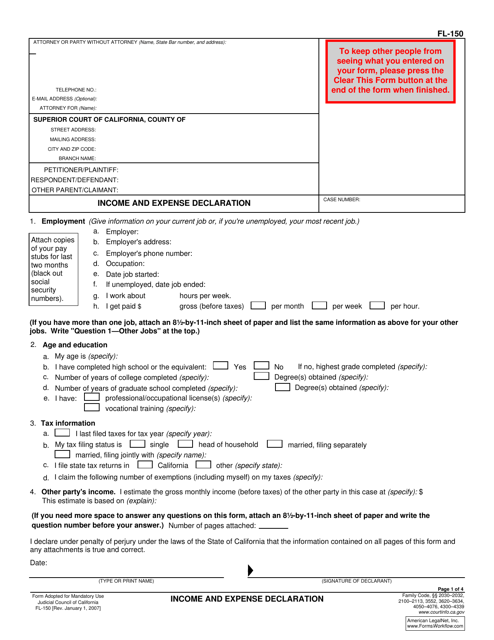

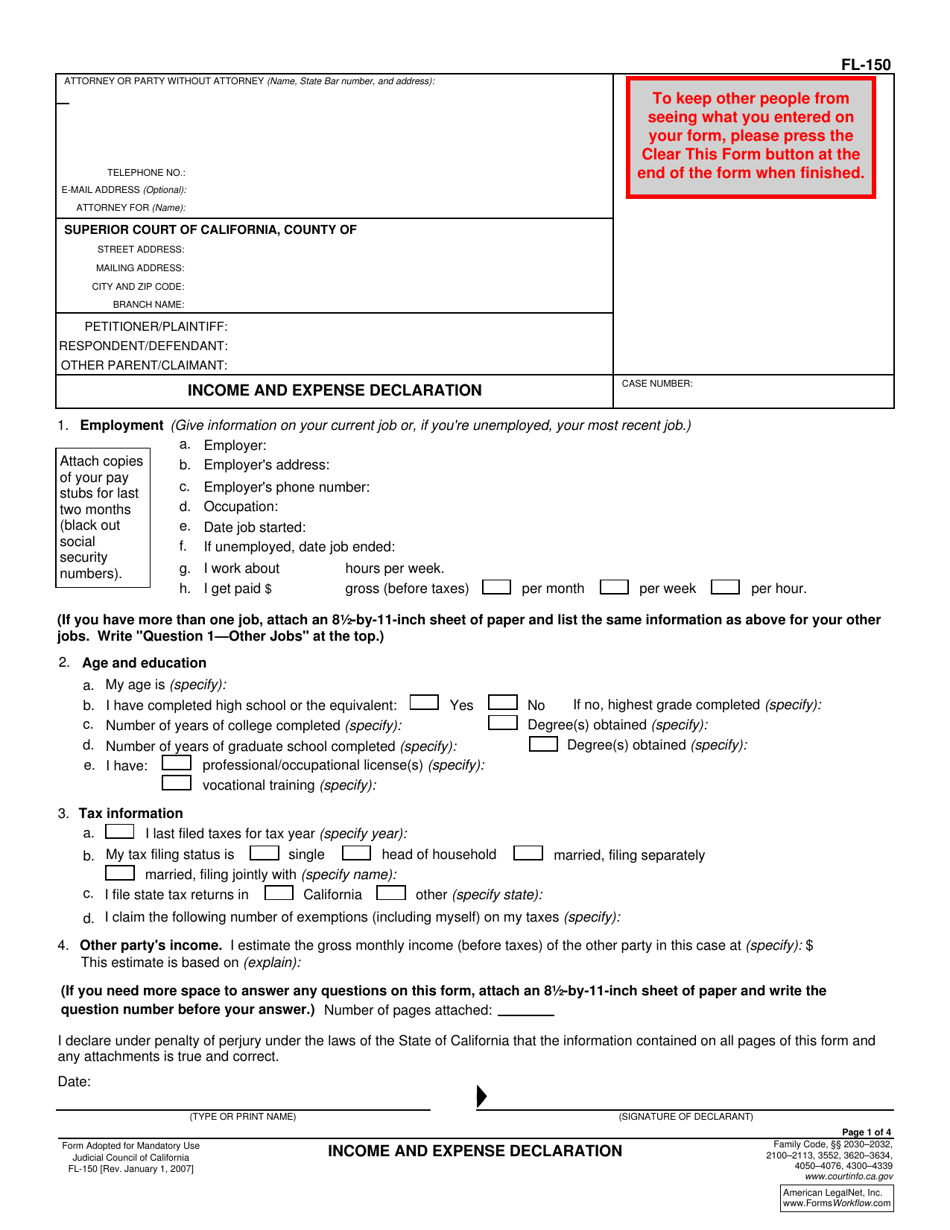

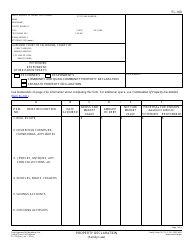

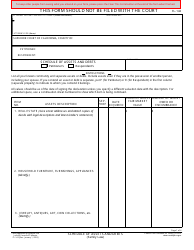

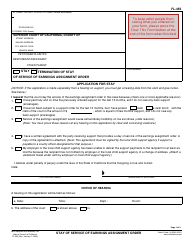

Form FL-150 Income and Expense Declaration - California

What Is Form FL-150?

Form FL-150, Income and Expense Declaration , is a document that should be reported by spouses seeking a divorce in the state of California. This form includes information about their financial situation: the income of the declarants from all sources, and their expenses as well. This information is used by California's divorce courts in order to make a fair resolution.

Alternate Name:

- California Income and Expense Declaration.

The California Income and Expense Declaration should be filed by each party in legal cases involving requests for money such as a child support order or attorney fees. It is also used in true default divorce cases. This form was released by the California Judicial Council with the latest version issued on January 1, 2007 . A fillable Form FL-150 is available for download below.

Form FL-150 Instructions

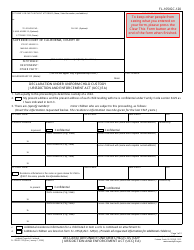

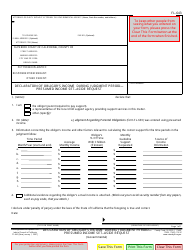

Form FL-150 must be filled in as follows:

- Information about the attorney, superior court, and the case number should be indicated in the table.

- The declarant should provide information on their current or recent job, including the address and phone number of the employer, wages, and the number of working hours in "Employment."

- The declarant should specify their age, the number of years of college and school completed, degree(s) obtained, and information about their occupational licenses in "Age and Education."

- Enter information about your taxes.

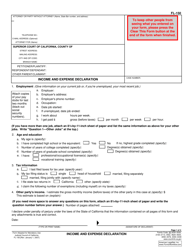

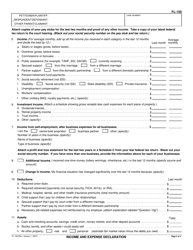

- The declarant should estimate the gross monthly income

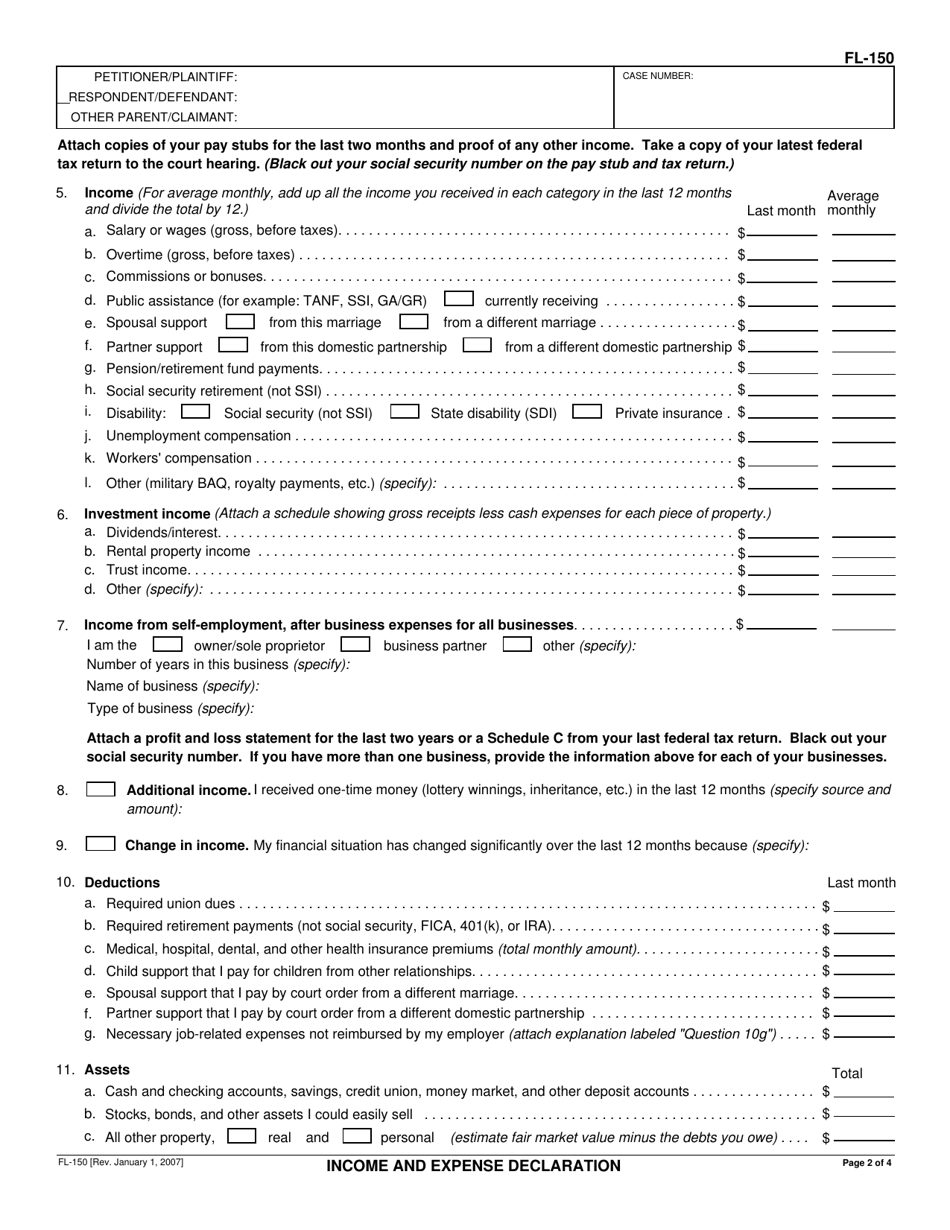

- All the income received in each category listed in the last 12 months must be indicated in "Income." The declarant must specify separately the income for the last month, and the average monthly income.

- Investment income, including dividends, rental property income, and trust income should be indicated.

- The declarant must specify information about their business, including their position (owner or business partner), number of years in this business, and its type (in "Income From Self-Employment"). A profit or loss statement for the last two years should be attached. If the declarant has several businesses, information for each of them should be provided.

- The section titled "Additional Income" contains information about one-time money received in the last 12 months.

- The section titled "Change in Income" requires explaining changes in the financial situation of the declarant over the last 12 months if there were any.

- Enter information about retirement payments, medical fees, and child support payments from other relationships in "Deductions."

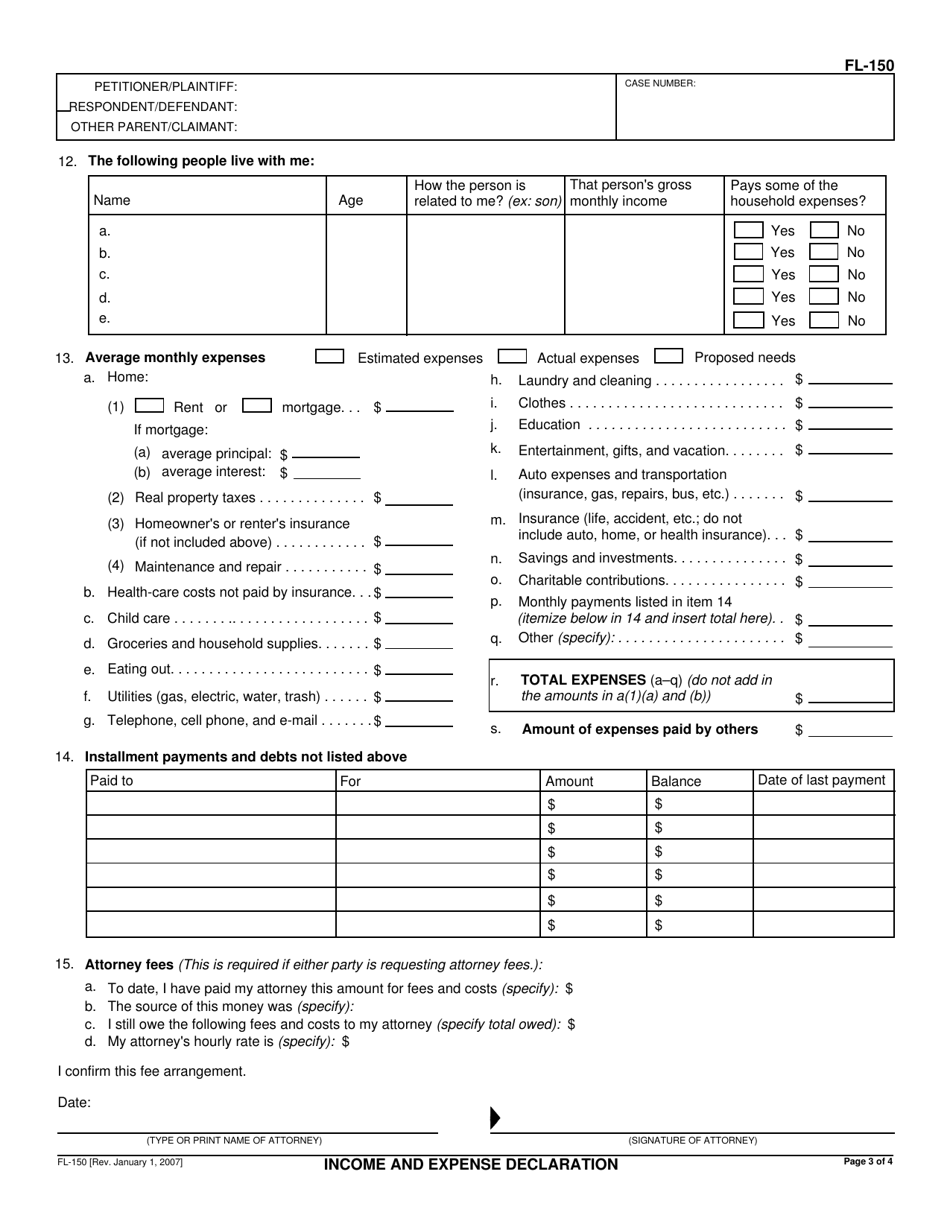

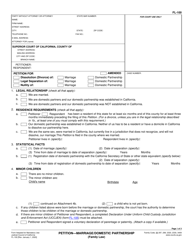

- Specify information about deposit accounts, savings, stocks, bonds, and property in "Assets." People who live with a spouse should be indicated in this section, including their names, ages, their relationship to the spouse, and their gross monthly income. Average monthly expenses such as health-care costs, child care, education, auto expenses should be outlined separately and in total. Installment payments and debts should be indicated in the table. Attorney fees should be specified.

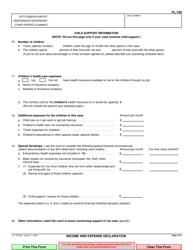

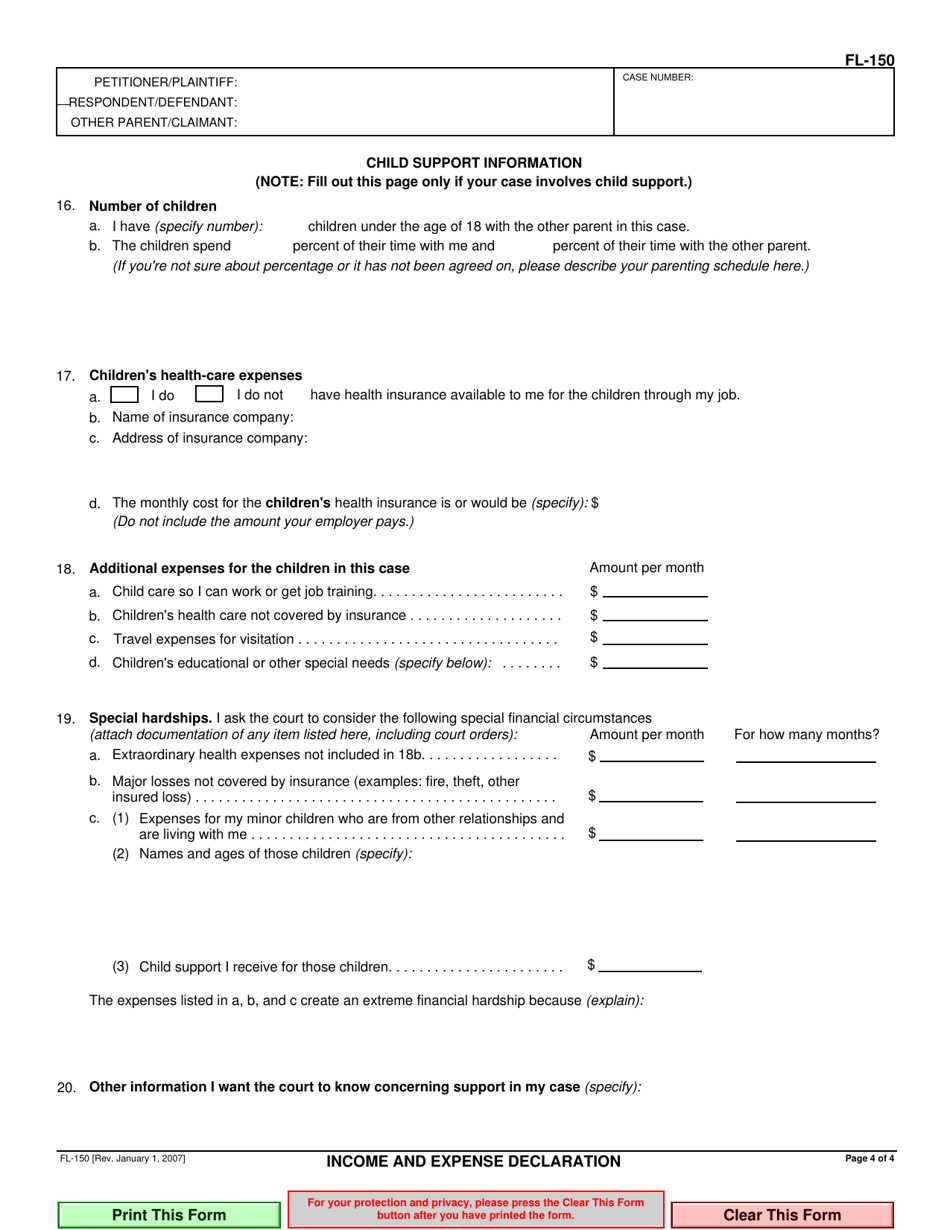

- Child support information should be provided only if the case involves child support.

- The declarant must enter the number of their children under the age of 18, information about children's health care, travel and educational expenses, special hardships, and financial circumstances of the spouse.

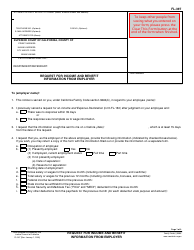

Still looking for a particular form? Take a look at these related forms below:

- Form MC-025, Attachment to Judicial Council Form;

- Form INT-001, Semiannual Report to the Judicial Council on the Use of Noncertified or Nonregistered Interpreters;

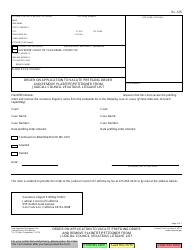

- Form VL-125, Order on Application to Vacate Prefiling Order and Remove Plaintiff/Petitioner From Judicial Council Vexatious Litigant List.