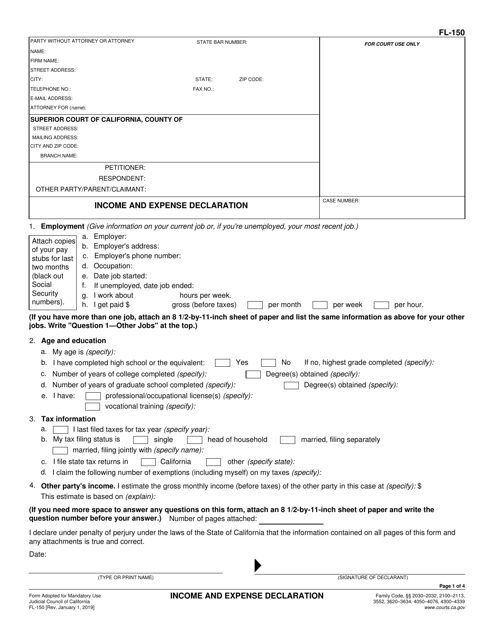

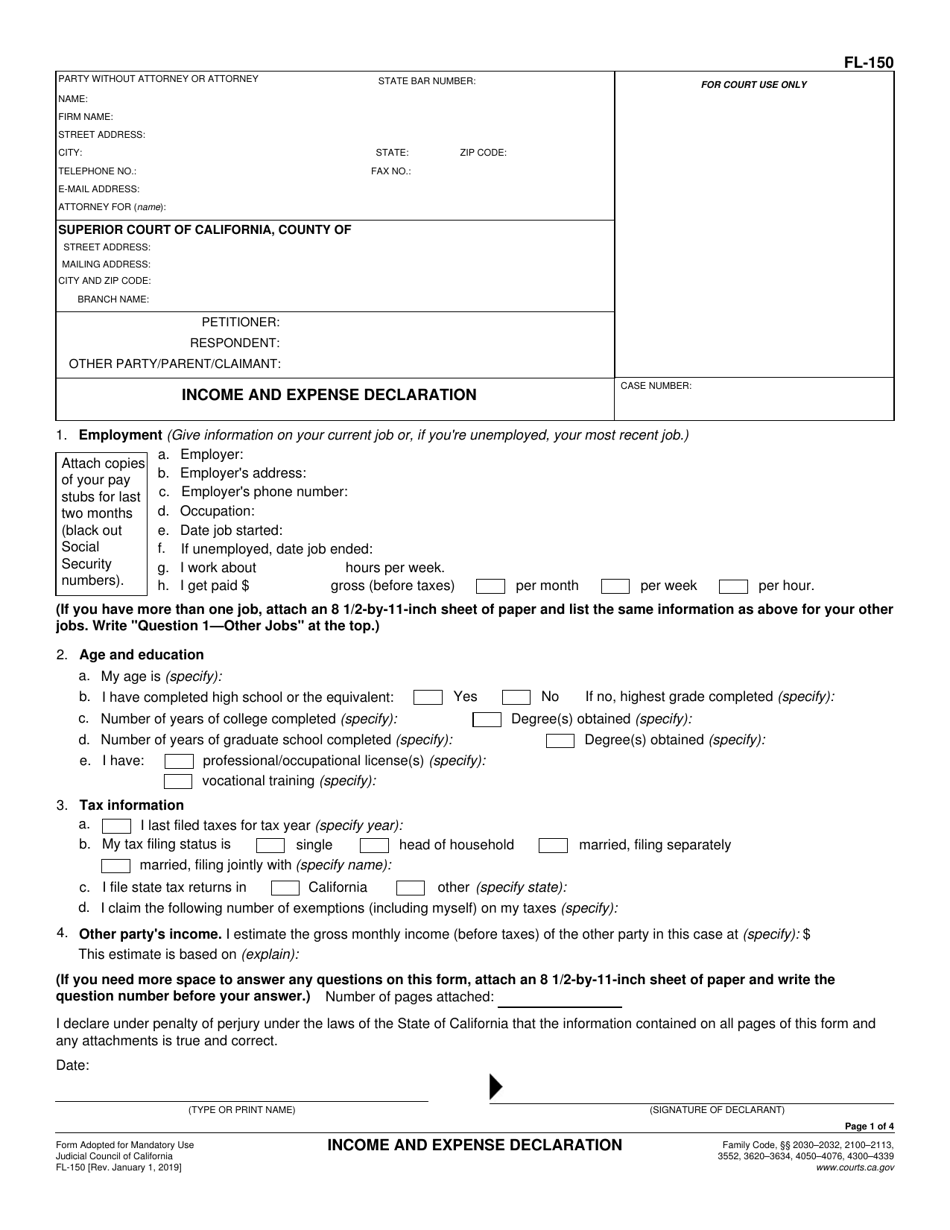

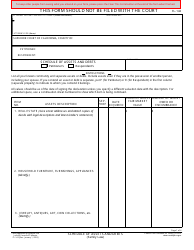

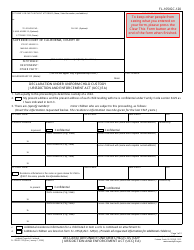

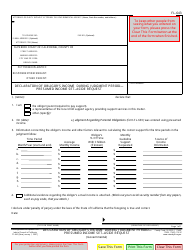

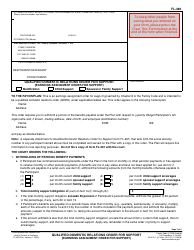

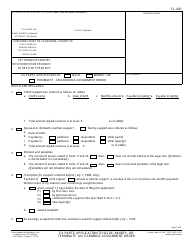

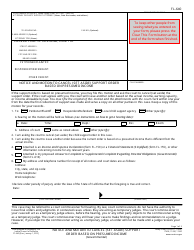

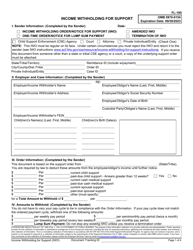

Form FL-150 Income and Expense Declaration - California

What Is Form FL-150?

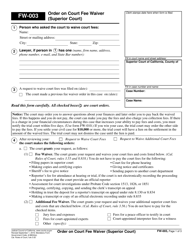

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

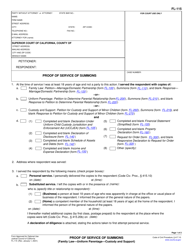

Q: What is Form FL-150?A: Form FL-150 is the Income and Expense Declaration form used in California family law cases.

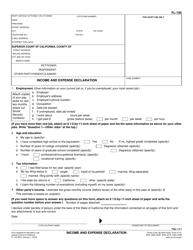

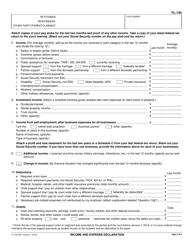

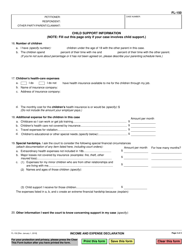

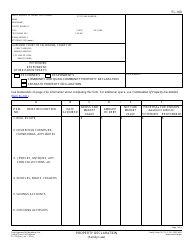

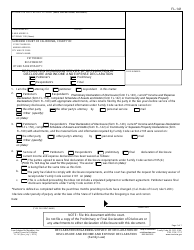

Q: What is the purpose of Form FL-150?A: The purpose of Form FL-150 is to disclose your income, expenses, assets, and debts in family law cases.

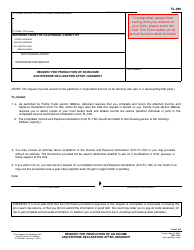

Q: Who needs to file Form FL-150?A: Both parties in a family law case usually need to file a Form FL-150.

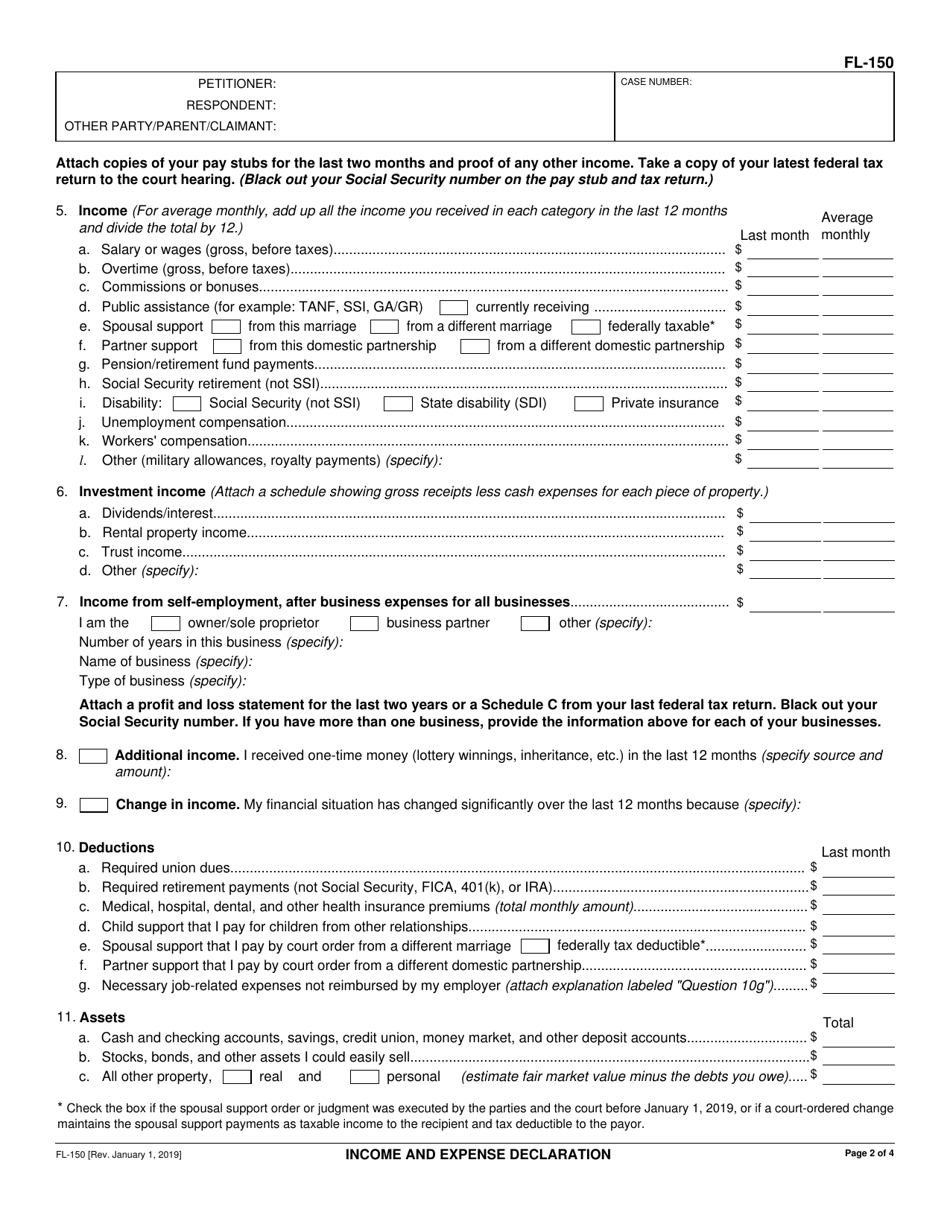

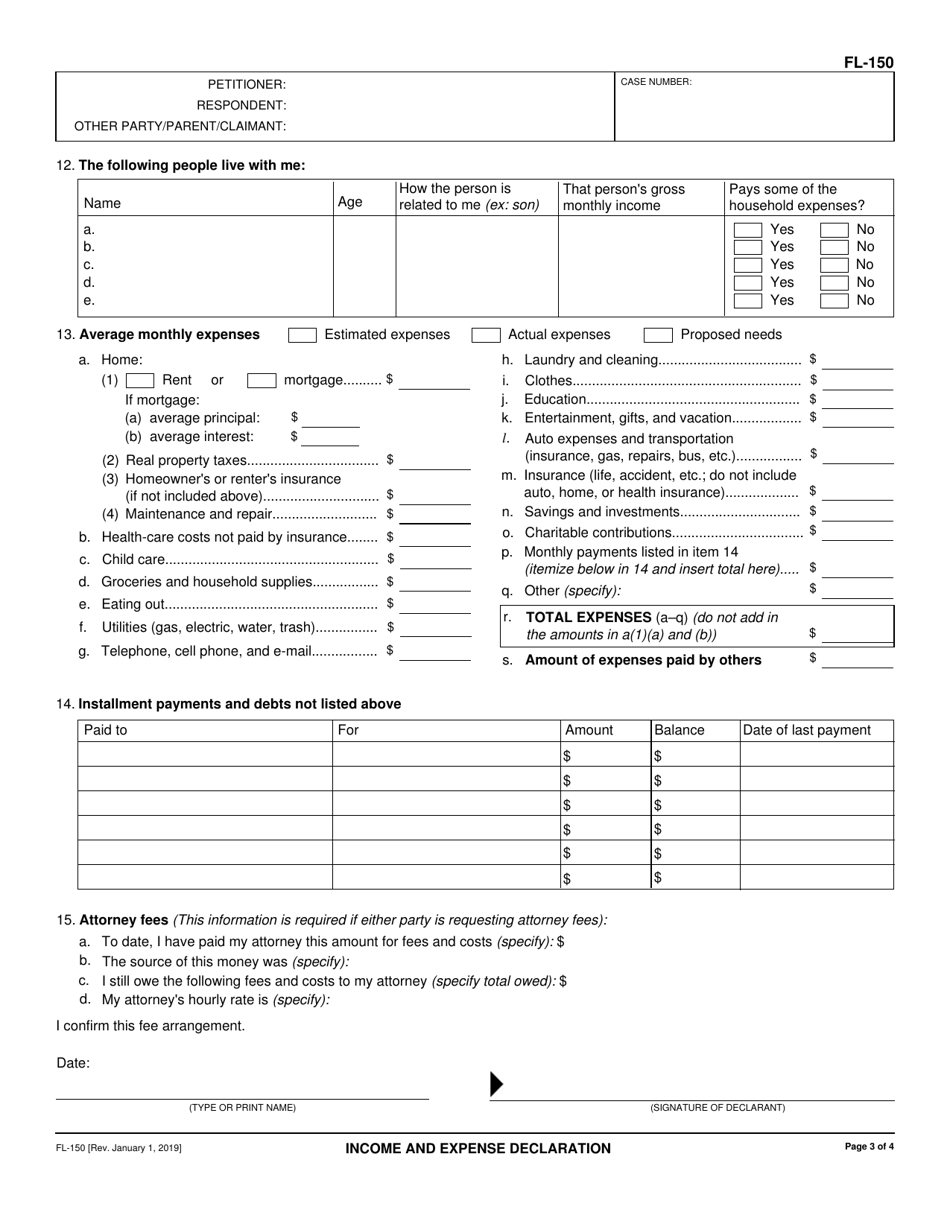

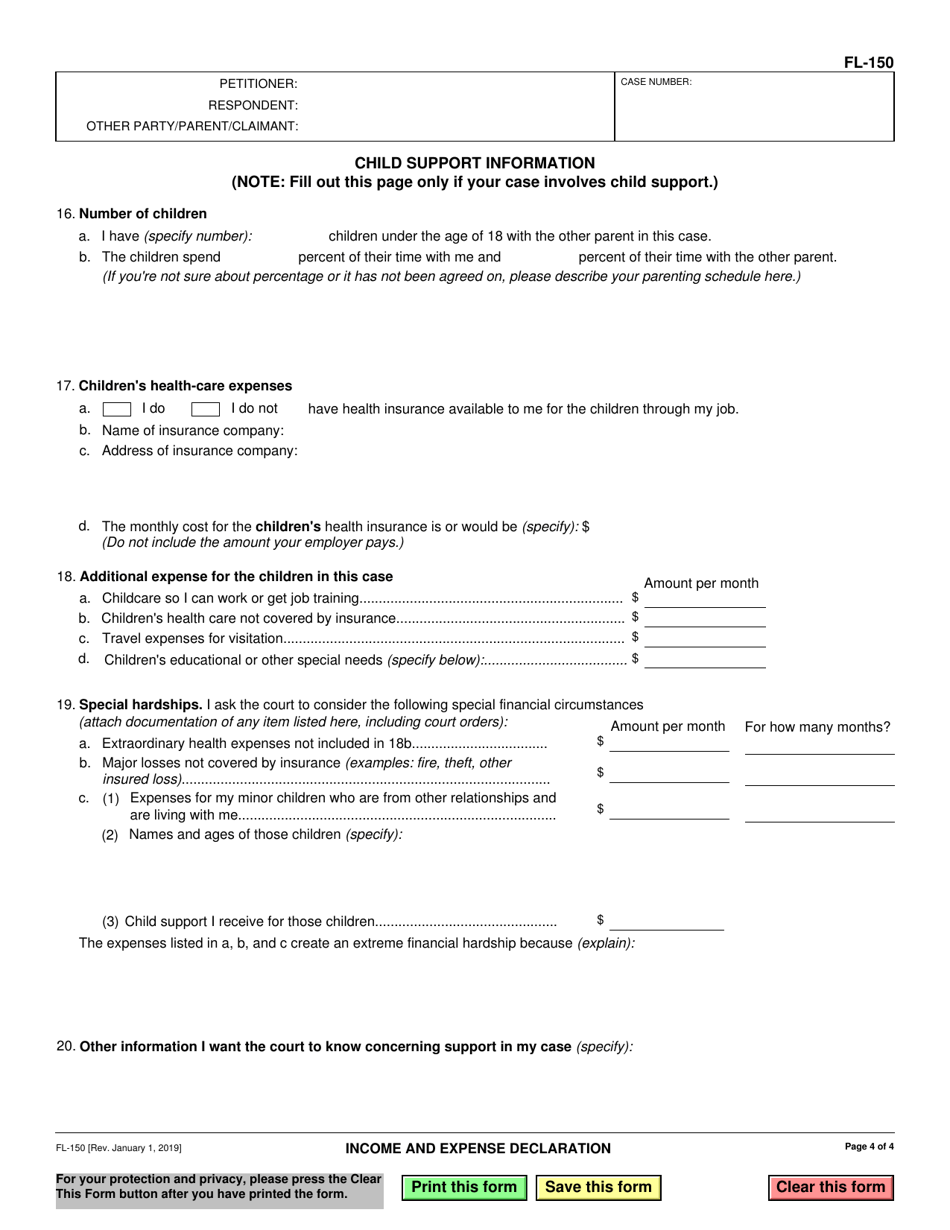

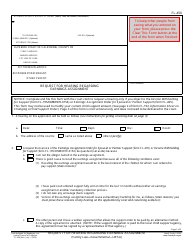

Q: What information do I need to provide on Form FL-150?A: You need to provide information about your income, expenses, assets, and debts on Form FL-150.

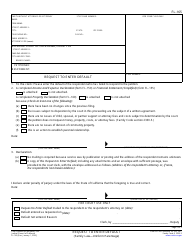

Q: When do I need to file Form FL-150?A: You usually need to file Form FL-150 within a certain time frame specified by the court.

Q: Do I need to attach any documents to Form FL-150?A: You may need to attach supporting documents, such as pay stubs or tax returns, to Form FL-150.

Q: What should I do if my financial situation changes after filing Form FL-150?A: If your financial situation changes, you may need to file an updated Form FL-150 with the court.

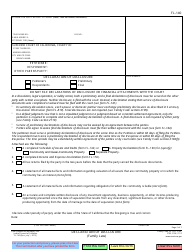

Q: Can I modify the information on Form FL-150 after filing it?A: In some cases, you may be able to request a modification of the information on Form FL-150, such as if there is a significant change in circumstances.