This version of the form is not currently in use and is provided for reference only. Download this version of

SBA Form 770

for the current year.

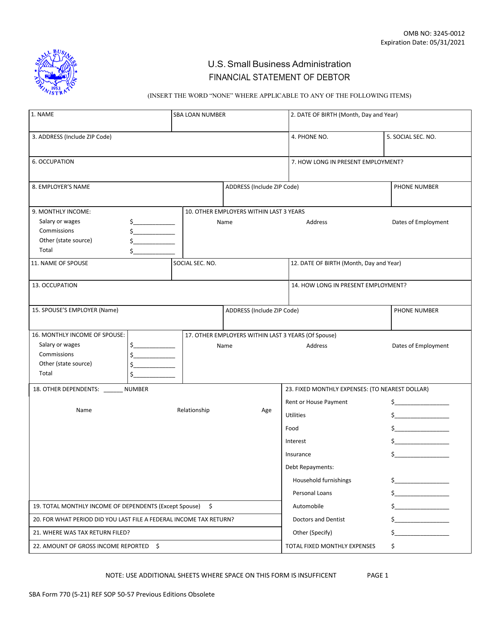

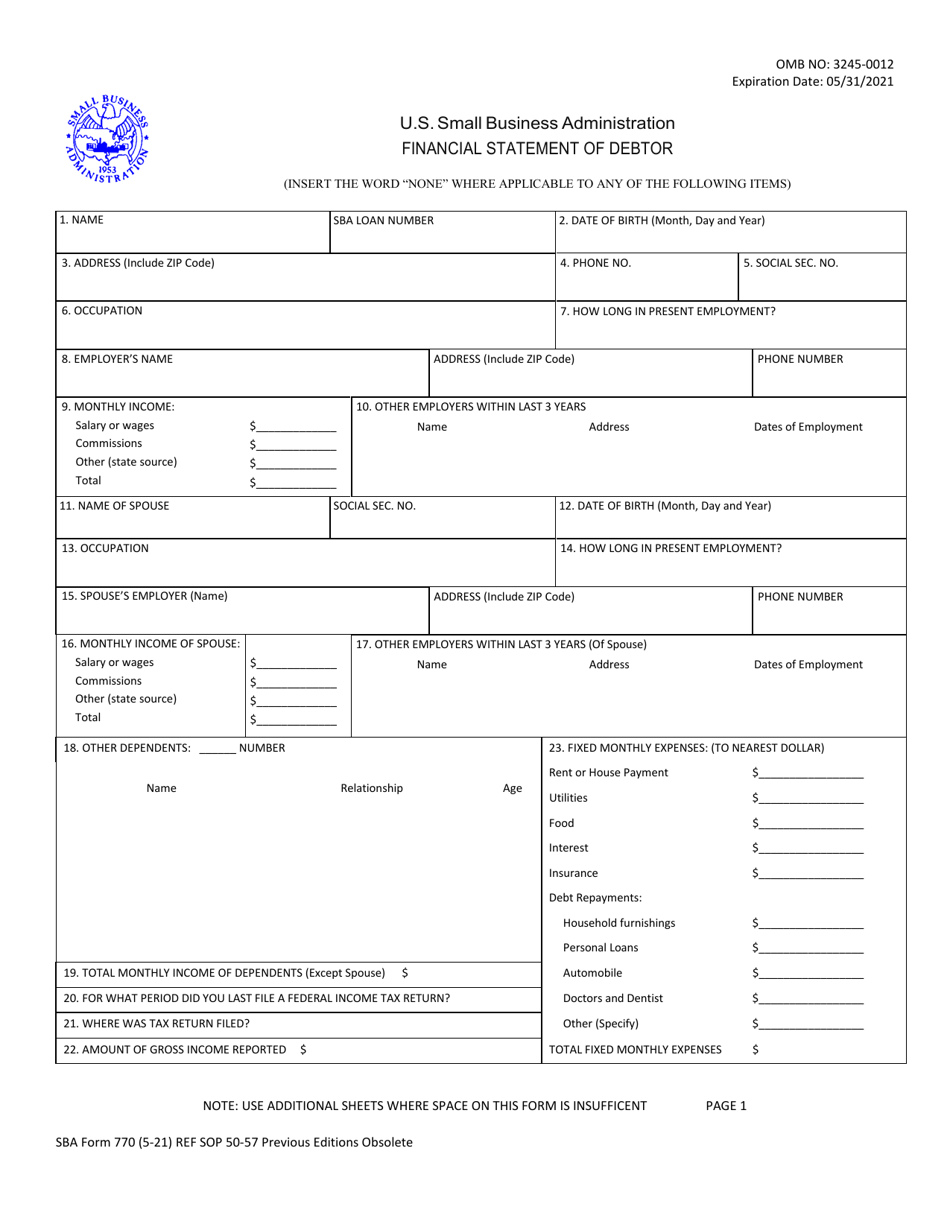

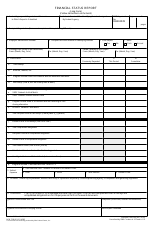

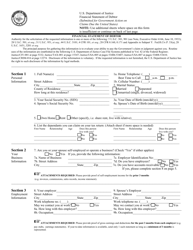

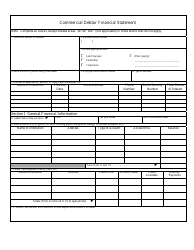

SBA Form 770 Financial Statement of Debtor

What Is SBA Form 770?

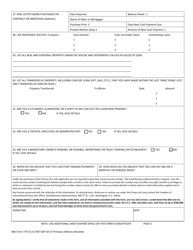

This is a legal form that was released by the U.S. Small Business Administration and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 770?

A: SBA Form 770 is the Financial Statement of Debtor form.

Q: Who needs to fill out SBA Form 770?

A: SBA Form 770 should be filled out by debtors who owe money to the Small Business Administration (SBA).

Q: Why do I need to fill out SBA Form 770?

A: You need to fill out SBA Form 770 to provide accurate financial information to the SBA regarding your ability to repay the debt.

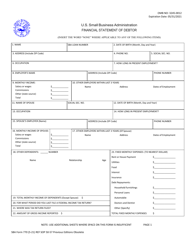

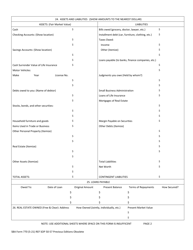

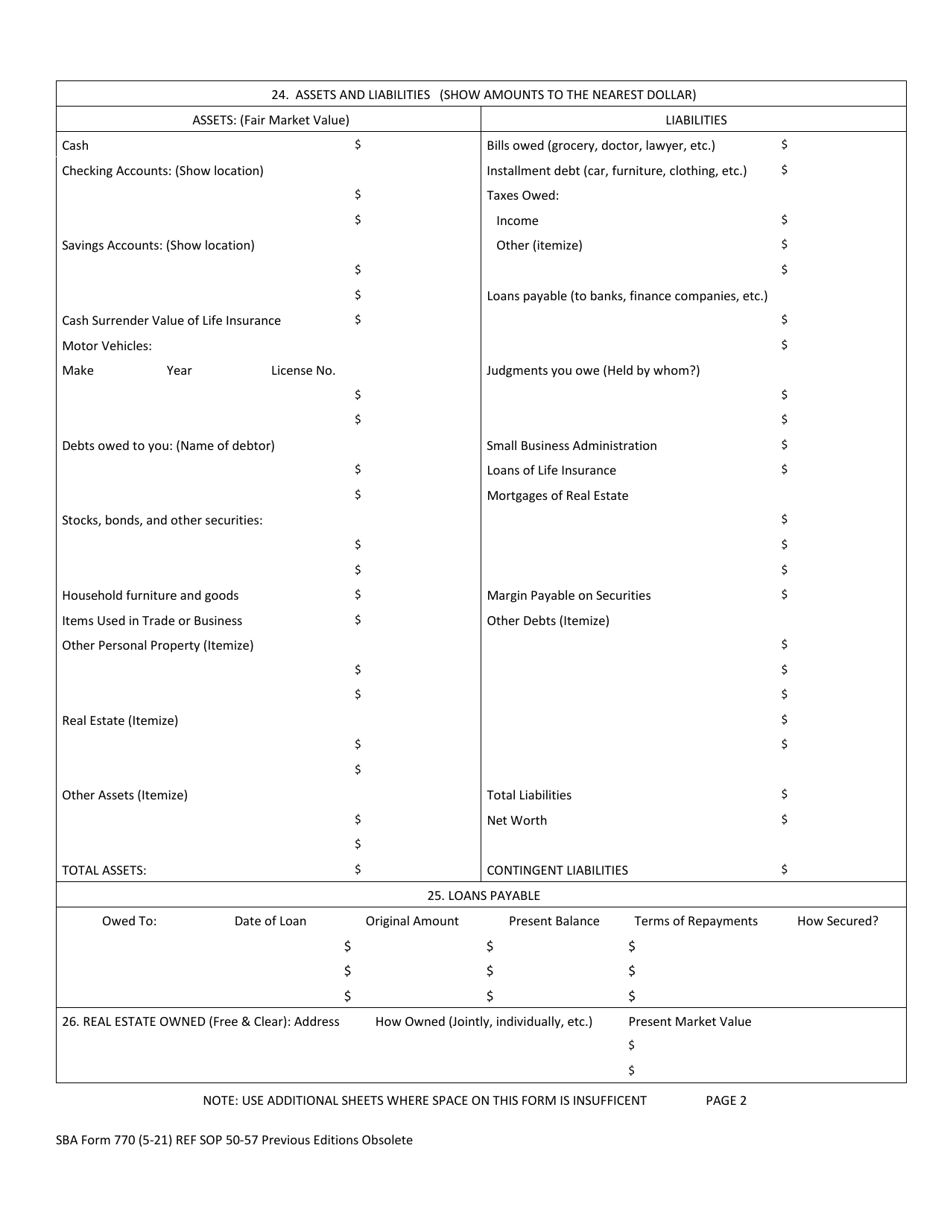

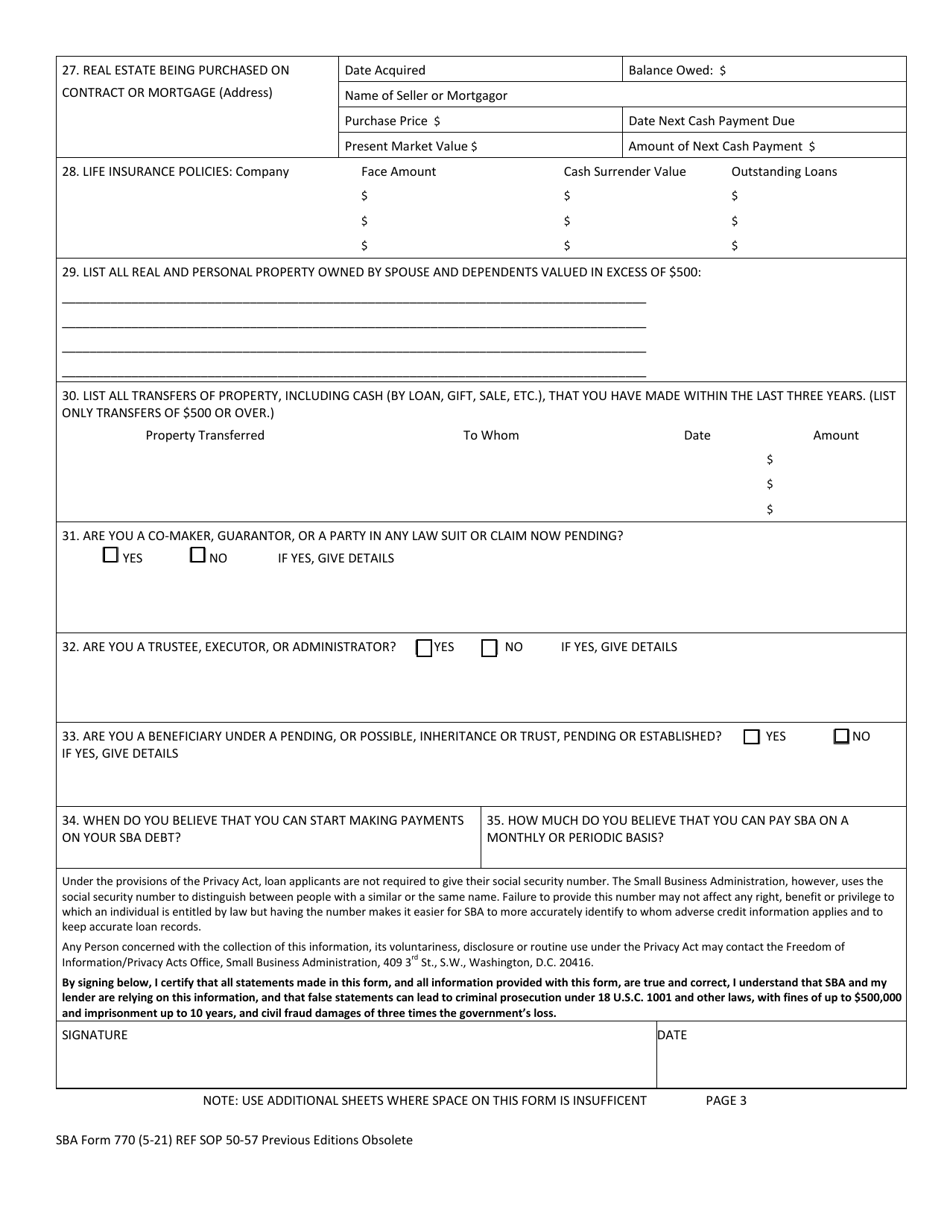

Q: What financial information is required in SBA Form 770?

A: SBA Form 770 requires you to provide details about your assets, liabilities, income, and expenses.

Q: Are there any fees associated with submitting SBA Form 770?

A: No, there are no fees associated with submitting SBA Form 770.

Q: What happens after I submit SBA Form 770?

A: After you submit SBA Form 770, the SBA will review your financial information to assess your repayment ability and determine the next steps.

Q: Is SBA Form 770 confidential?

A: Yes, the information provided in SBA Form 770 is treated as confidential and is protected by the Privacy Act.

Form Details:

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 770 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.