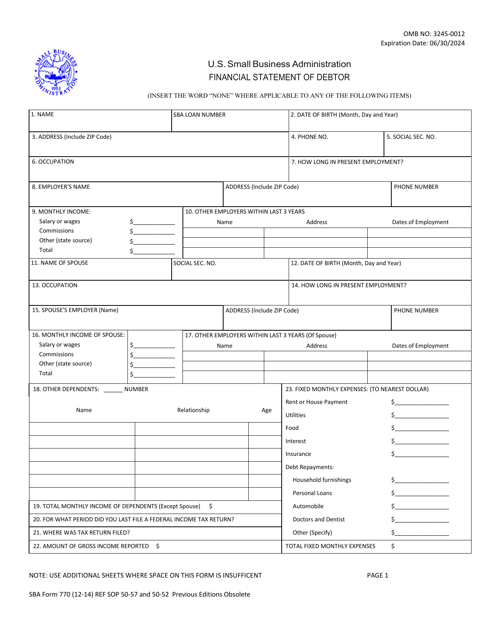

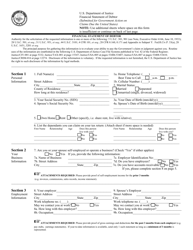

SBA Form 770 Financial Statement of Debtor

What Is SBA Form 770?

SBA Form 770, Financial Statement of Debtor is a document used to collect information about the status of the finances of a Debtor applying for an Offer in Compromise (OIC). This form helps the Small Business Administration (SBA) to determine the Debtor's ability to repay the loan and find the appropriate payment plan. All types of income and all of the Debtor's assets have to be recorded on the SBA 770 Form.

The latest version of the form was released by the SBA on December 1, 2014 , with all previous editions obsolete. An up-to-date SBA Form 770 fillable version is available for download and digital filing below.

SBA Form 770 and 1150

SBA Form 1150, Offer in Compromise, is a form submitted by Debtors that are unable to repay the loan fully and allows them to settle the debt for a lesser amount. Both the forms are used to apply for an OIC.

A current and complete SBA Form 770 with a sworn statement of income and expenses must be attached to the SBA 1150 before submittal to the SBA. The DOJ Form DJ-35 (Financial Statement of Debtor) may be used instead of the SBA 770 if the Debtor is referred for the OIC by the Department of Justice.

SBA Form 770 Instructions

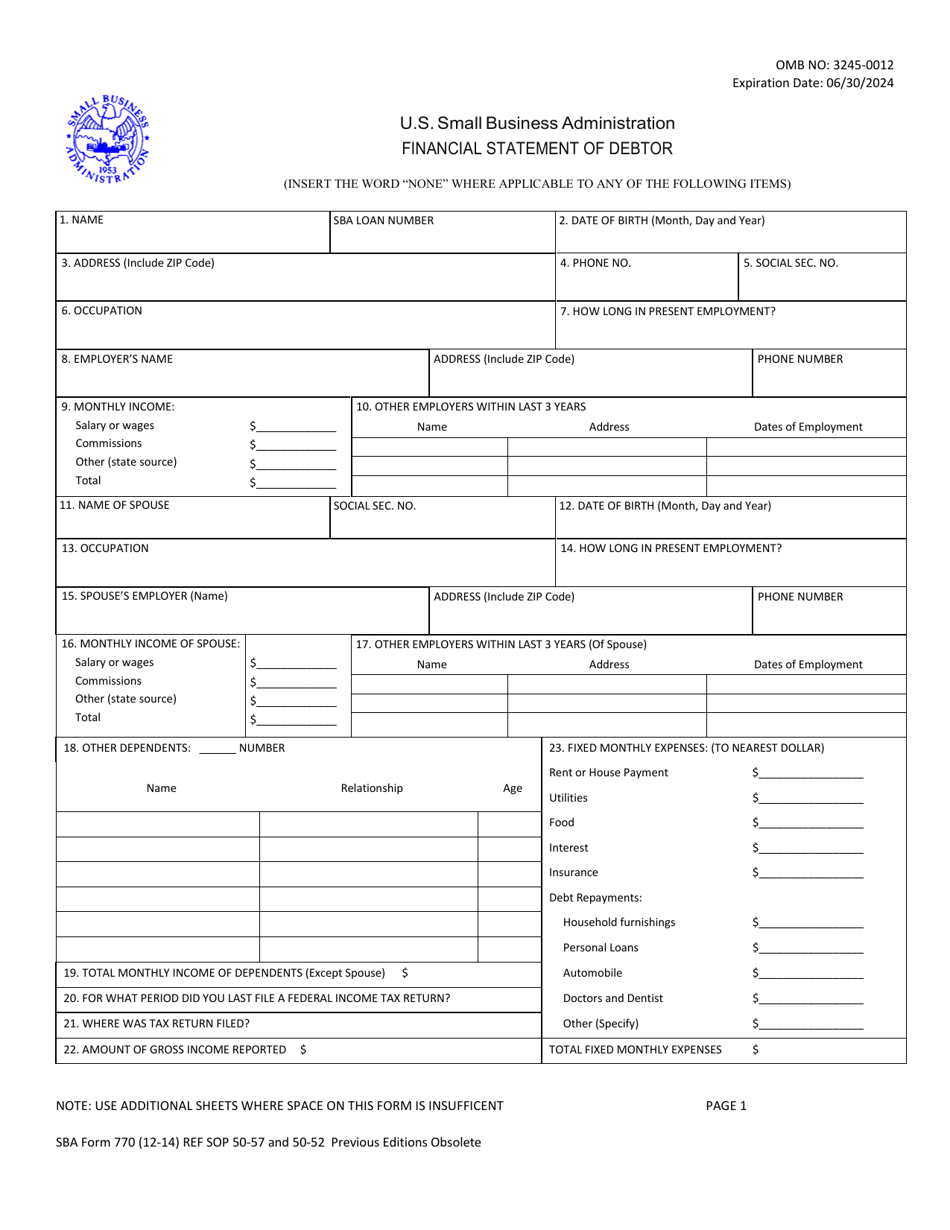

The form consists of 35 questions and is distributed without any SBA-provided instructions. The word NONE should be entered for any question that is not applicable.

- Items 1 through 23 require providing the Debtor's personal data. The required information includes the Debtor's name, SBA loan number, date of birth, address, employment information, a list of income sources, a list of fixed monthly expenses and information about any dependents the Debtor has.

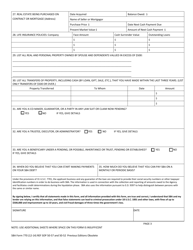

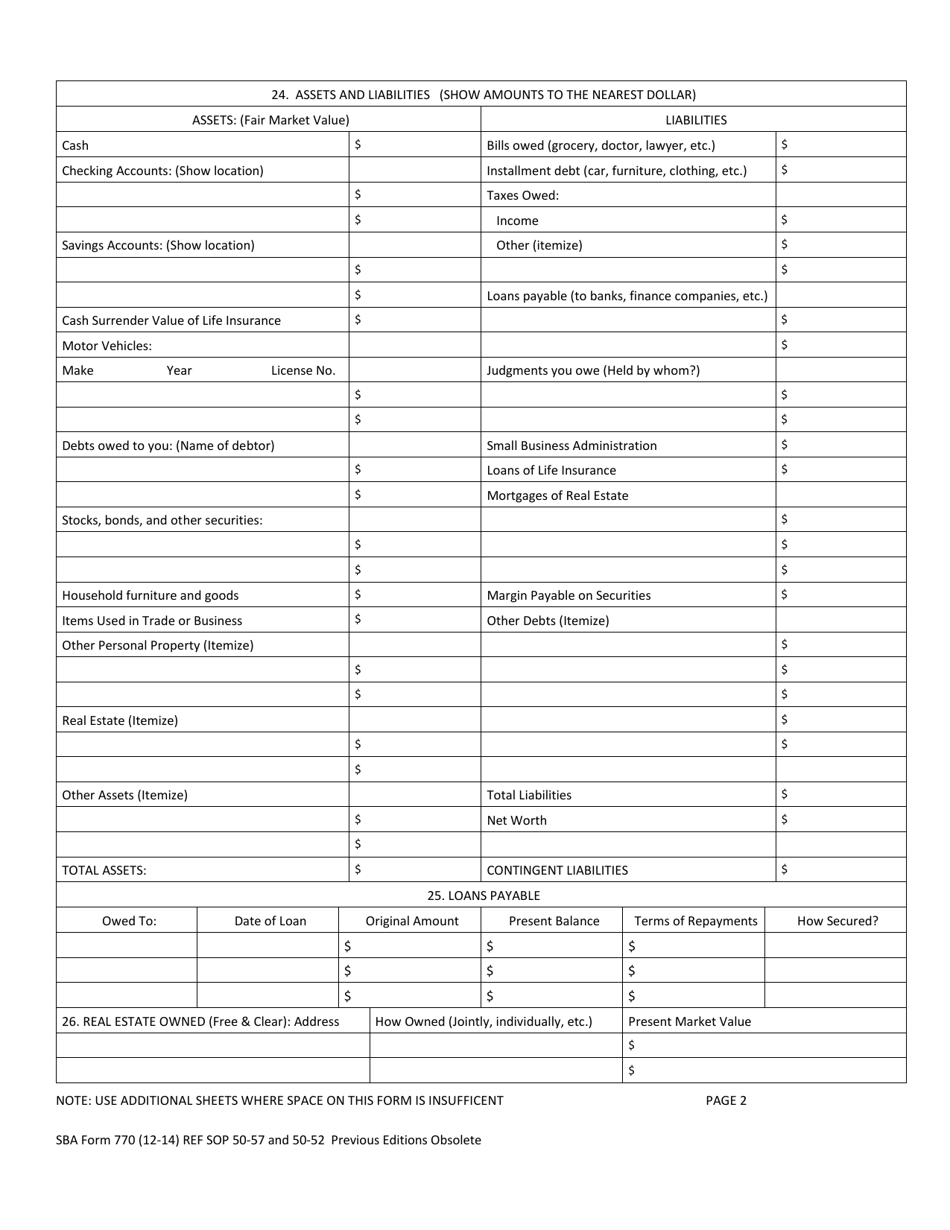

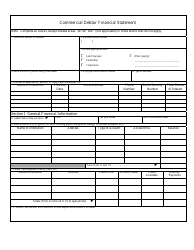

- Item 24 provides a detailed list of all possible assets and liabilities. The cost of all assets should be estimated at fair market value and rounded up to the nearest dollar.

- Item 25 lists all current payable loans with their dates, original amounts and present balance.

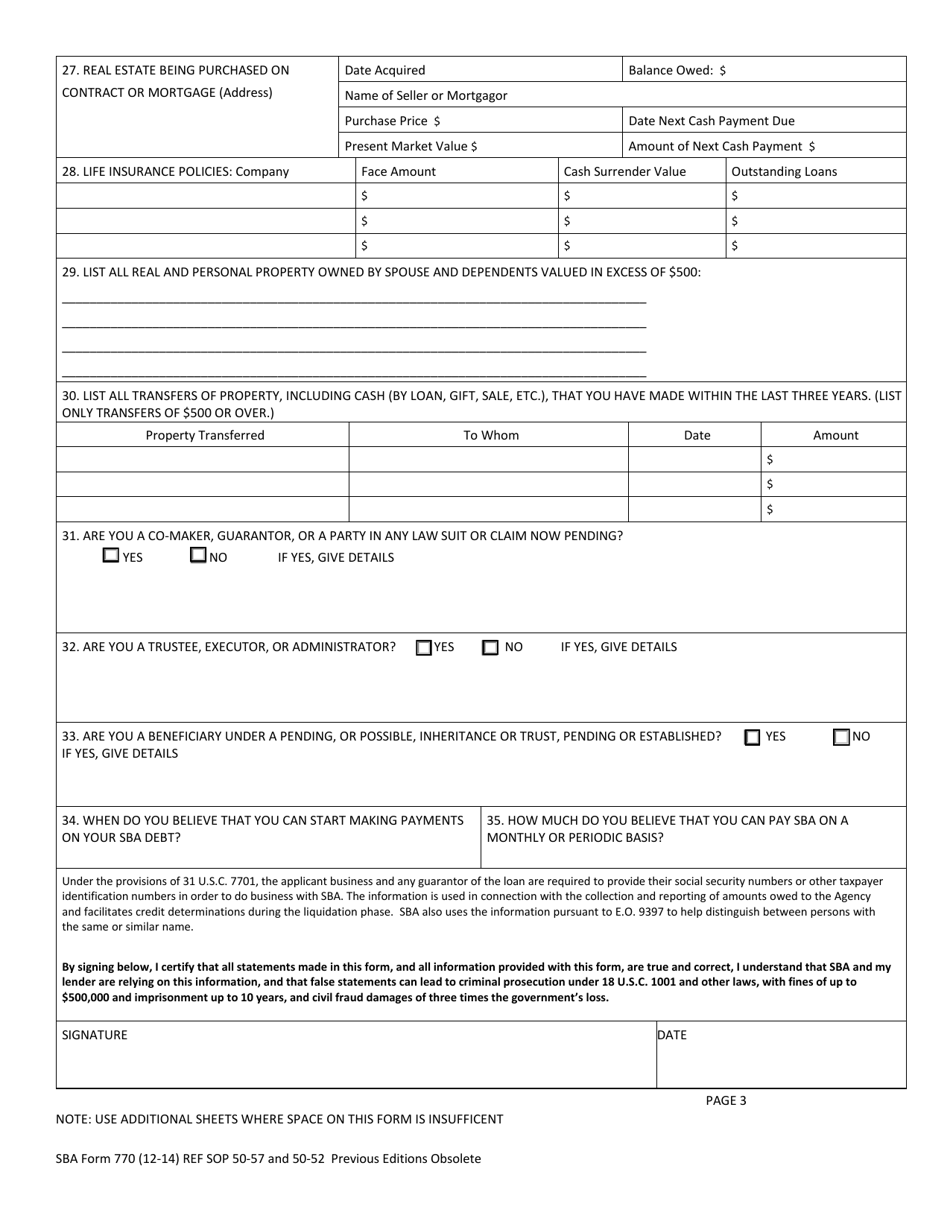

- Items 26 and 27 are used for providing information about any real estate that the Debtor owns.

- Item 28 lists the Debtor's life insurance policies.

- Item 29 is for listing all real estate and personal property owned by the Debtor's dependents and spouse.

- Item 30 is used to list all transfers of property and cash made by the Debtor over the previous three years.

- Items 31 through 33 are filled out if the Debtor is a participant in a lawsuit, a trustee, executor, an administrator or a beneficiary under an inheritance or trust.

- Items 34 and 35 specify the date when the Debtor will be able to start making payments to the SBA and the amount they will be able to pay out monthly.

After completing the form, the Debtor has to carefully read the information at the bottom of the form before signing and dating it.