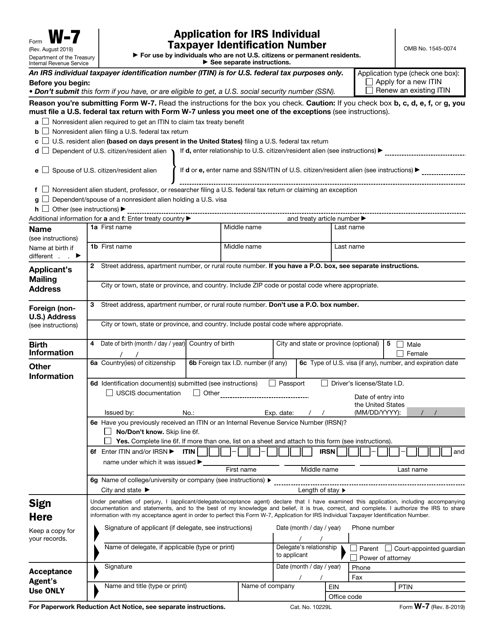

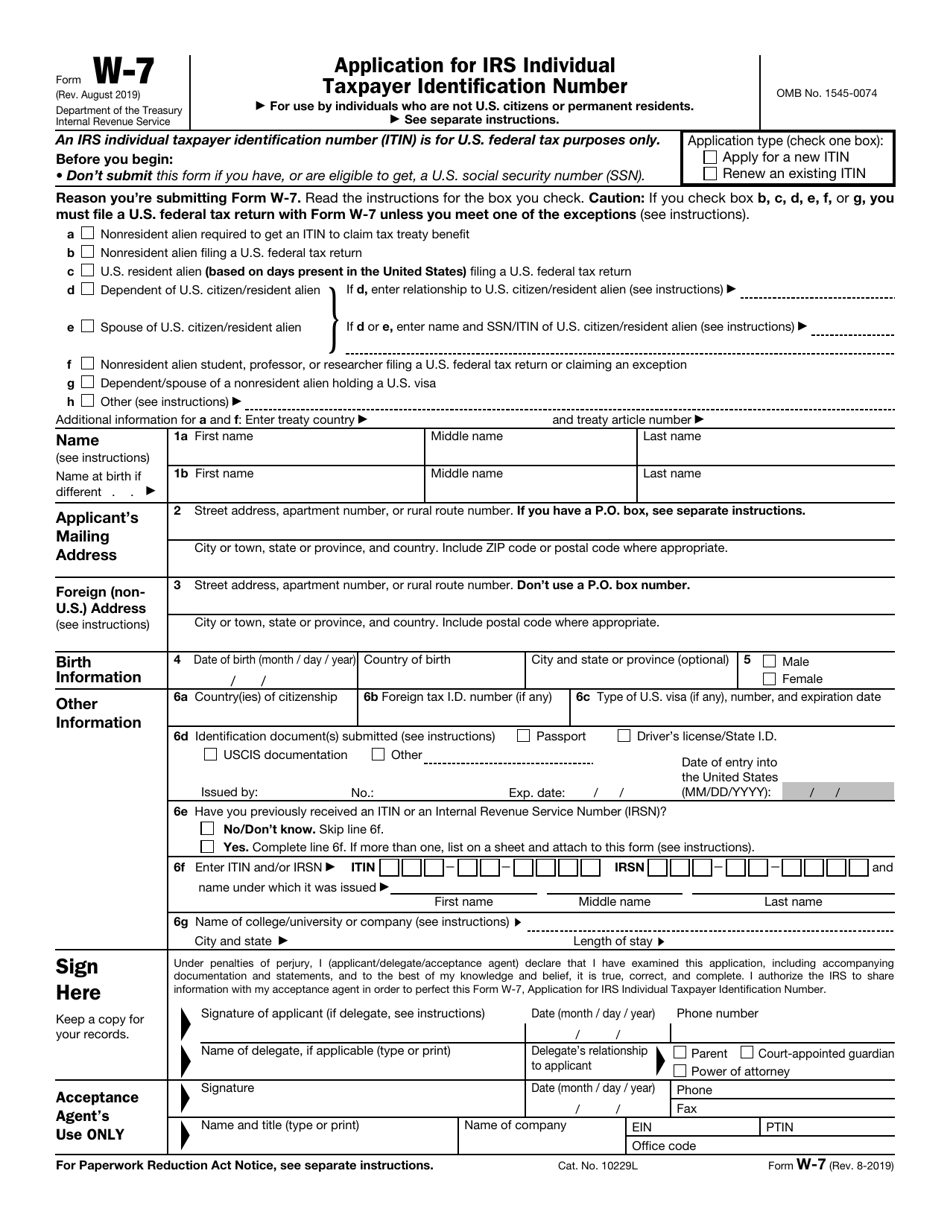

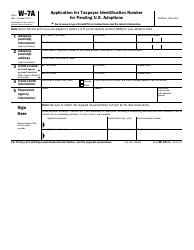

IRS Form W-7 Application for IRS Individual Taxpayer Identification Number

What Is IRS Form W-7?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form W-7?

A: IRS Form W-7 is an application form used to apply for an Individual Taxpayer Identification Number (ITIN) from the Internal Revenue Service (IRS).

Q: Who needs to file IRS Form W-7?

A: Individuals who are not eligible for a Social Security Number but have a requirement to file a federal tax return, or meet other tax obligations, may need to file IRS Form W-7 to obtain an Individual Taxpayer Identification Number (ITIN).

Q: How do I fill out IRS Form W-7?

A: You can fill out IRS Form W-7 by providing your personal information, including your name, address, and birthdate. You will also need to provide supporting documentation, such as a valid passport or birth certificate, to prove your identity and foreign status.

Q: What is an ITIN?

A: An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the IRS to individuals who are not eligible for a Social Security Number but need to fulfill tax obligations in the United States.

Q: How long does it take to get an ITIN?

A: It typically takes about 7 weeks for the IRS to process an application for an Individual Taxpayer Identification Number (ITIN).

Q: Is there a fee to apply for an ITIN?

A: There is no fee to apply for an Individual Taxpayer Identification Number (ITIN) using IRS Form W-7.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form W-7 through the link below or browse more documents in our library of IRS Forms.