This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form W-7

for the current year.

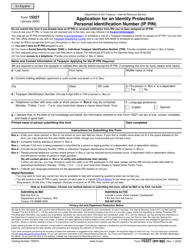

Instructions for IRS Form W-7 Application for IRS Individual Taxpayer Identification Number

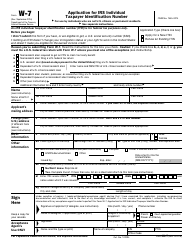

This document contains official instructions for IRS Form W-7 , Application for IRS Individual Taxpayer Identification Number - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form W-7 is available for download through this link.

FAQ

Q: What is Form W-7?

A: Form W-7 is the IRS form used to apply for an Individual Taxpayer Identification Number (ITIN).

Q: Who needs to file Form W-7?

A: Individuals who do not have a Social Security Number (SSN) but need to file a federal tax return or claim certain tax benefits.

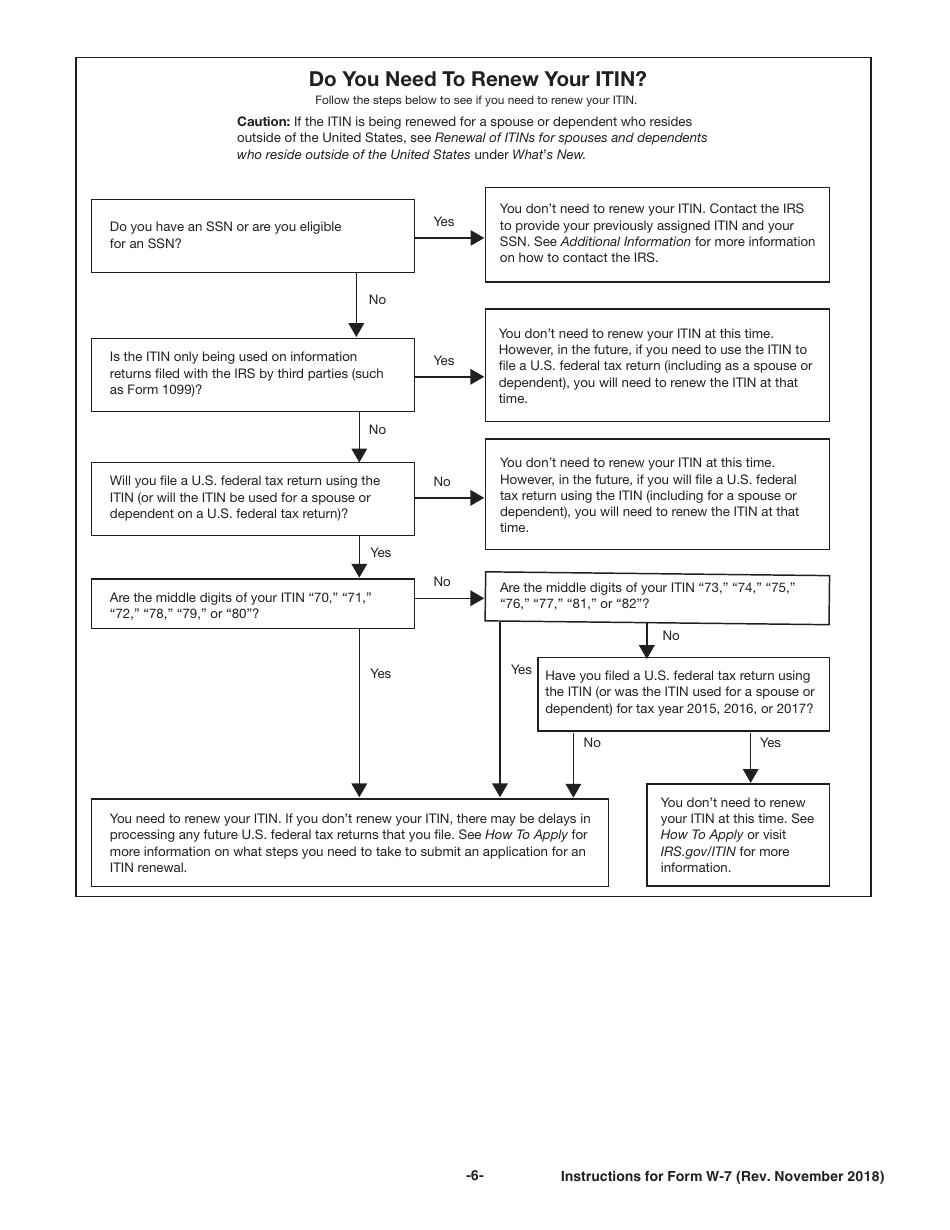

Q: How do I apply for an ITIN?

A: You can apply for an ITIN by completing Form W-7 and submitting it to the IRS along with the required documentation.

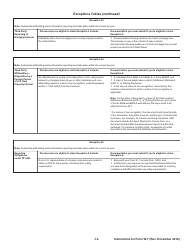

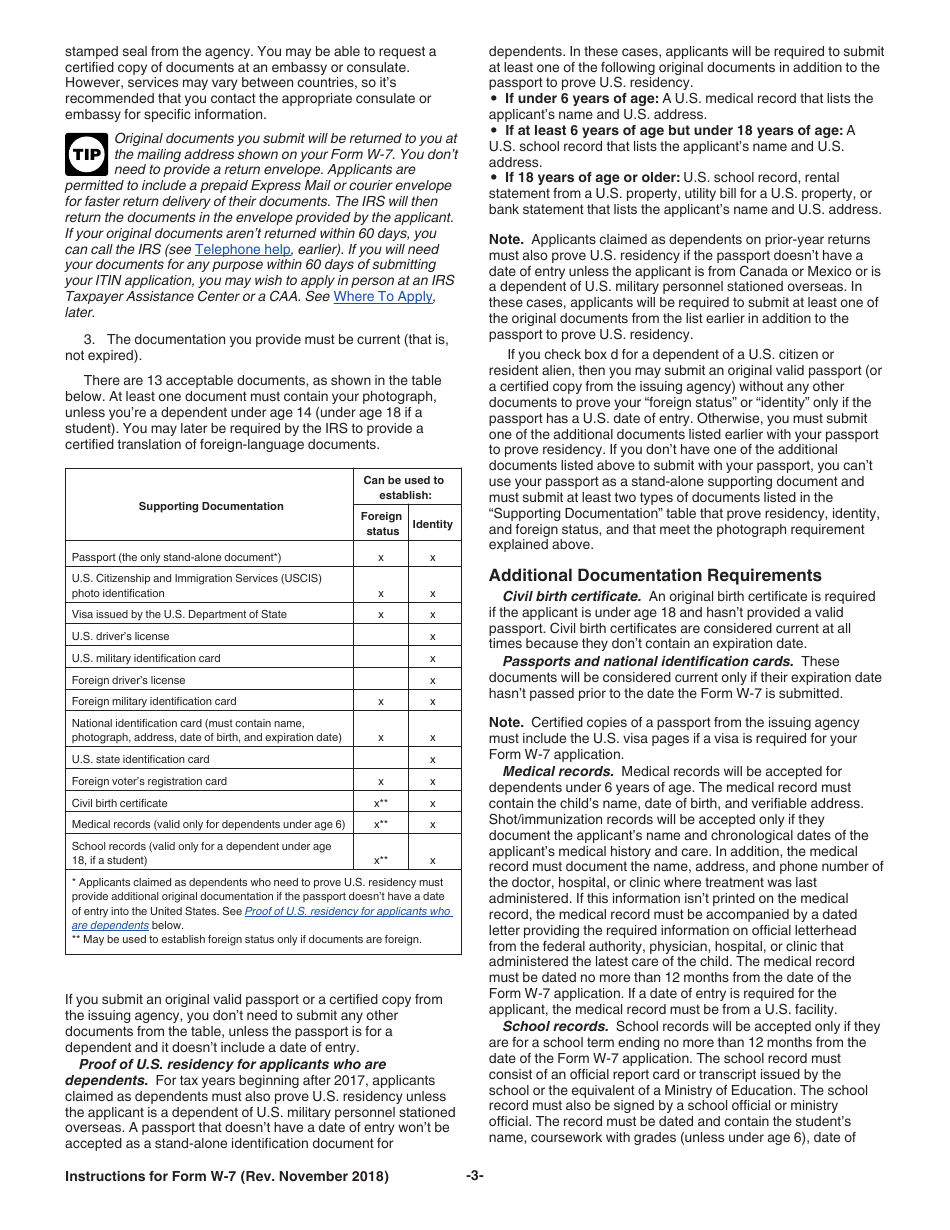

Q: What documentation is required with Form W-7?

A: You will need to provide proof of your identity and foreign status, such as a passport or birth certificate.

Q: How long does it take to process a Form W-7?

A: It can take up to 11 weeks for the IRS to process your Form W-7 and issue an ITIN.

Q: Can I e-file Form W-7?

A: No, Form W-7 cannot be e-filed. It must be submitted by mail or in person.

Q: Are there any fees associated with filing Form W-7?

A: No, there are no fees to apply for an ITIN using Form W-7.

Q: Can I use an ITIN to work legally in the United States?

A: No, an ITIN is for tax purposes only and does not provide work authorization.

Q: Is an ITIN the same as a Social Security Number?

A: No, an ITIN is a tax processing number issued by the IRS, while a Social Security Number is issued by the Social Security Administration.

Instruction Details:

- This 14-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.