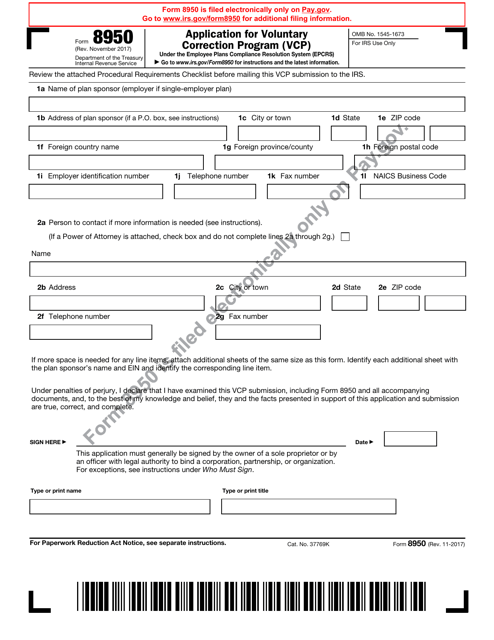

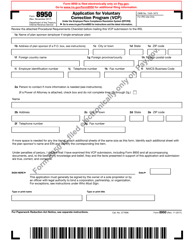

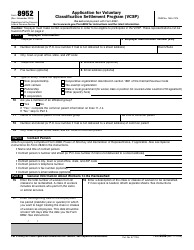

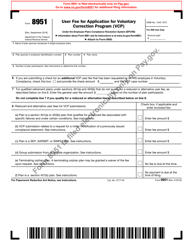

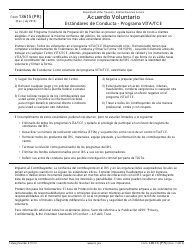

IRS Form 8950 Application for Voluntary Correction Program (Vcp)

What Is IRS Form 8950?

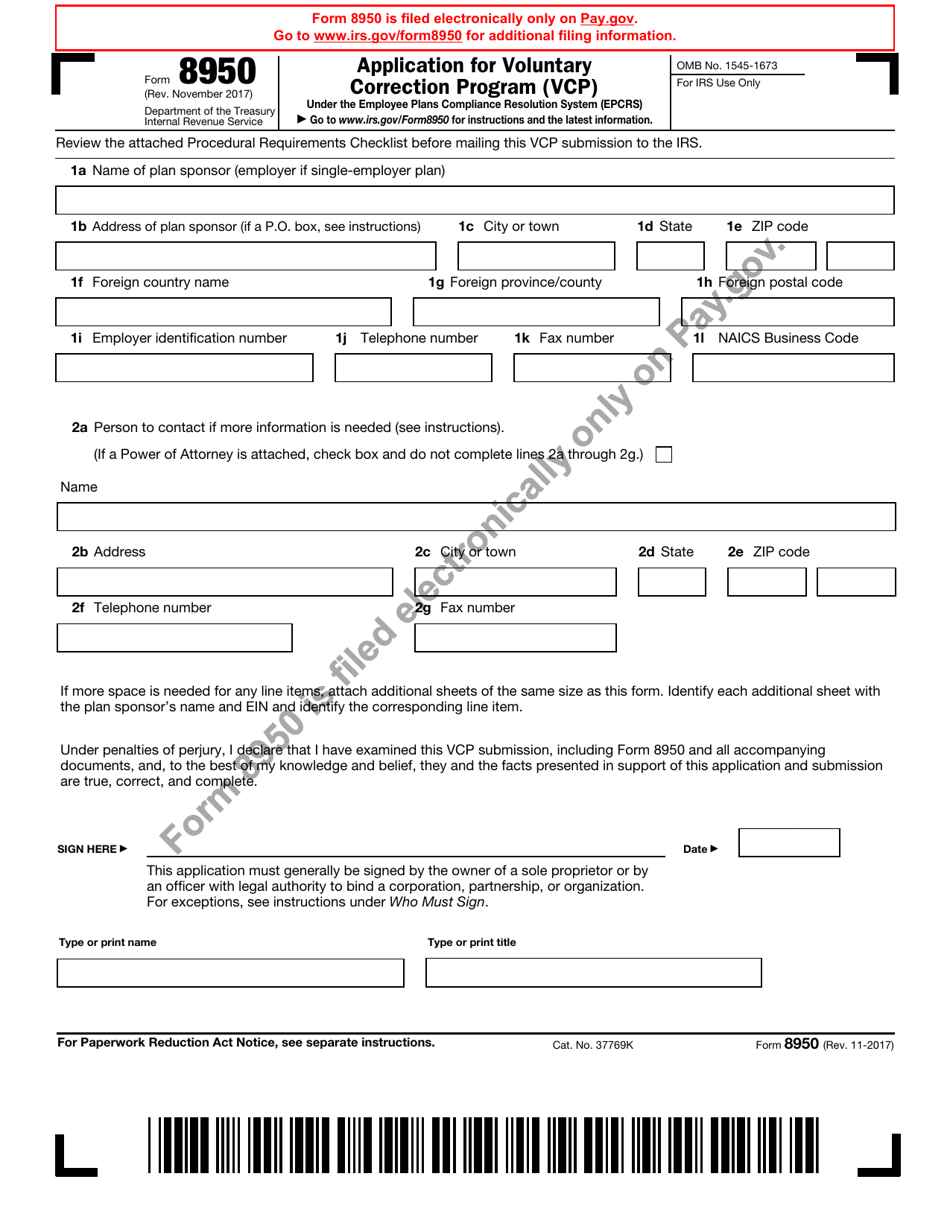

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8950?

A: IRS Form 8950 is the Application for Voluntary Correction Program (VCP).

Q: What is the purpose of IRS Form 8950?

A: The purpose of IRS Form 8950 is to apply for the Voluntary Correction Program (VCP) to correct retirement plan errors.

Q: Who should use IRS Form 8950?

A: Individuals, plan sponsors, or plan administrators who need to correct retirement plan errors should use IRS Form 8950.

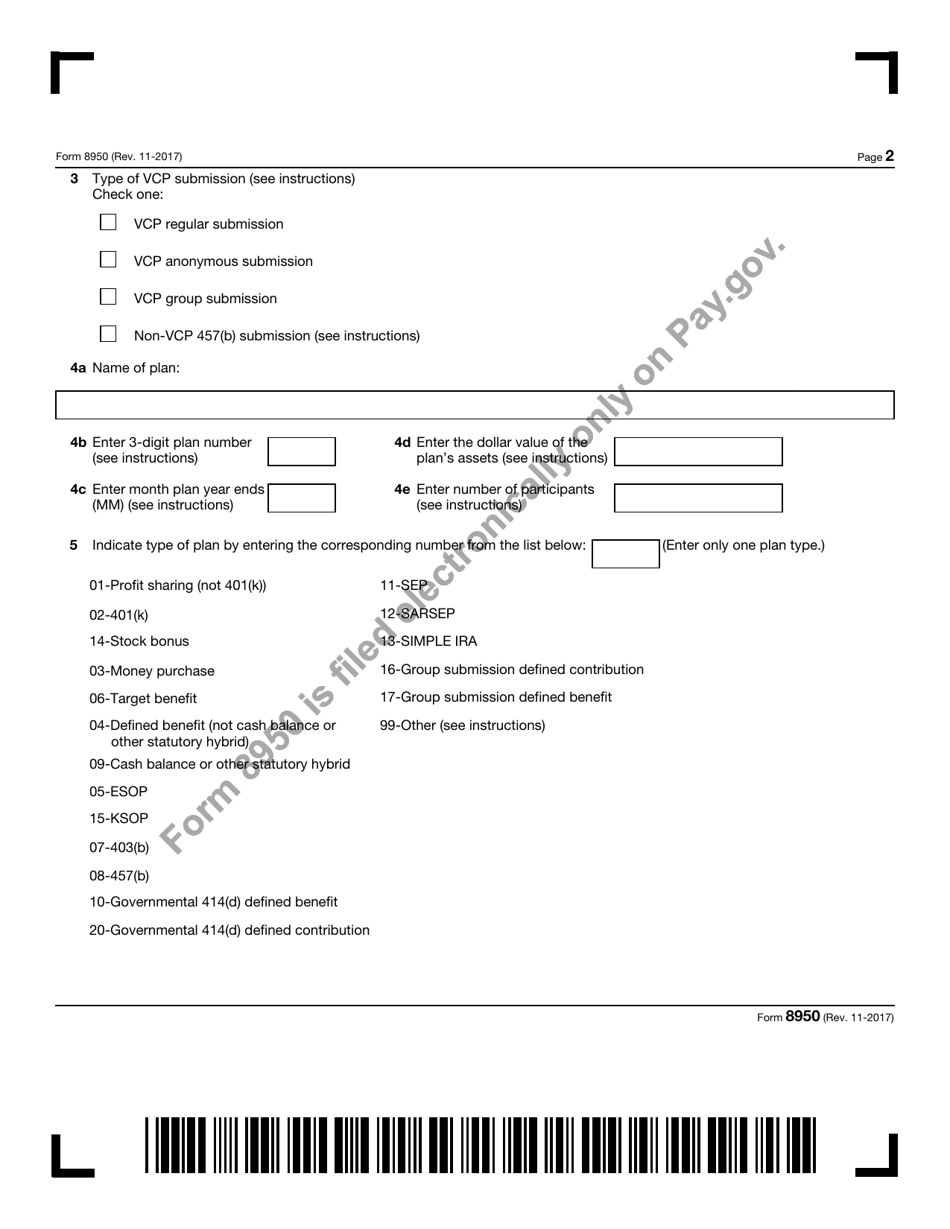

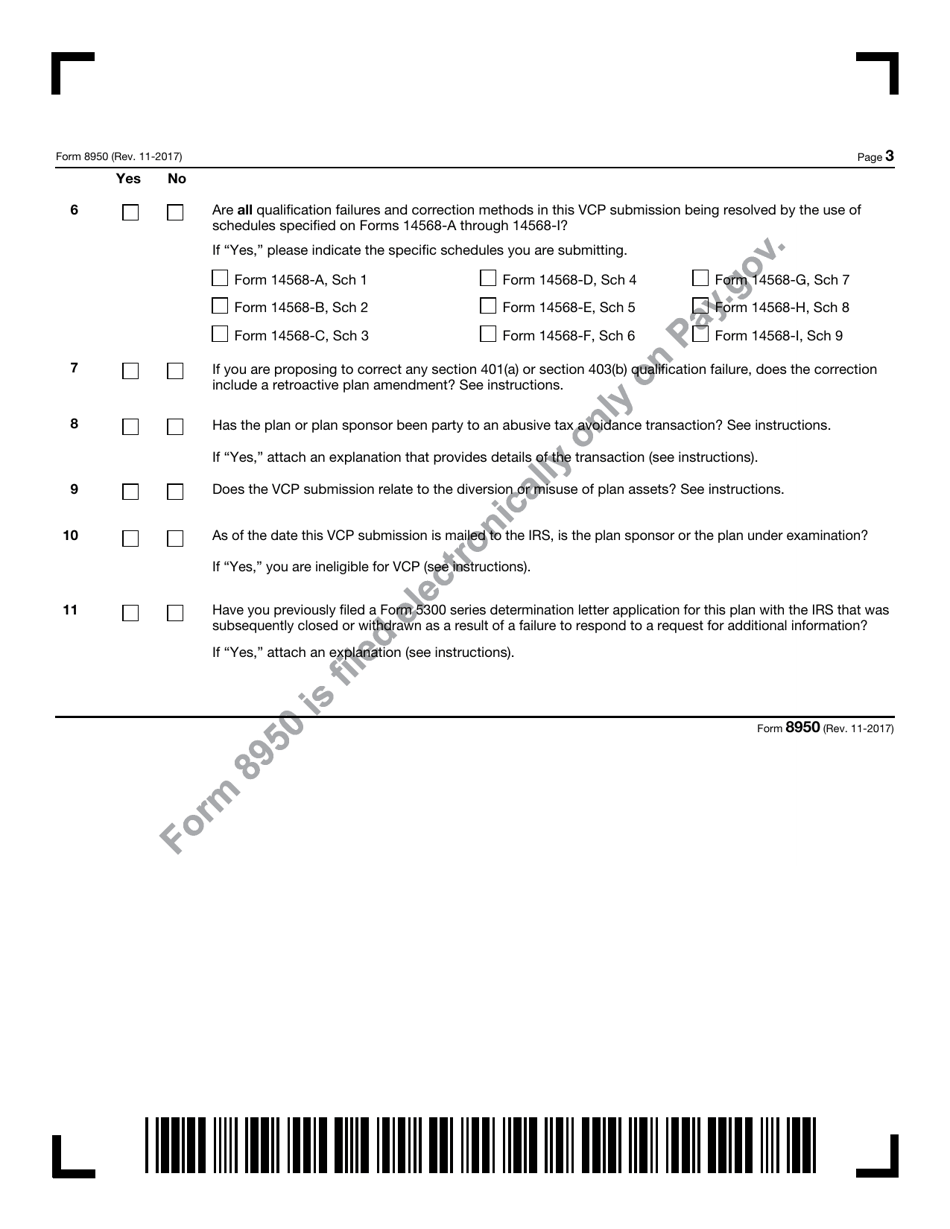

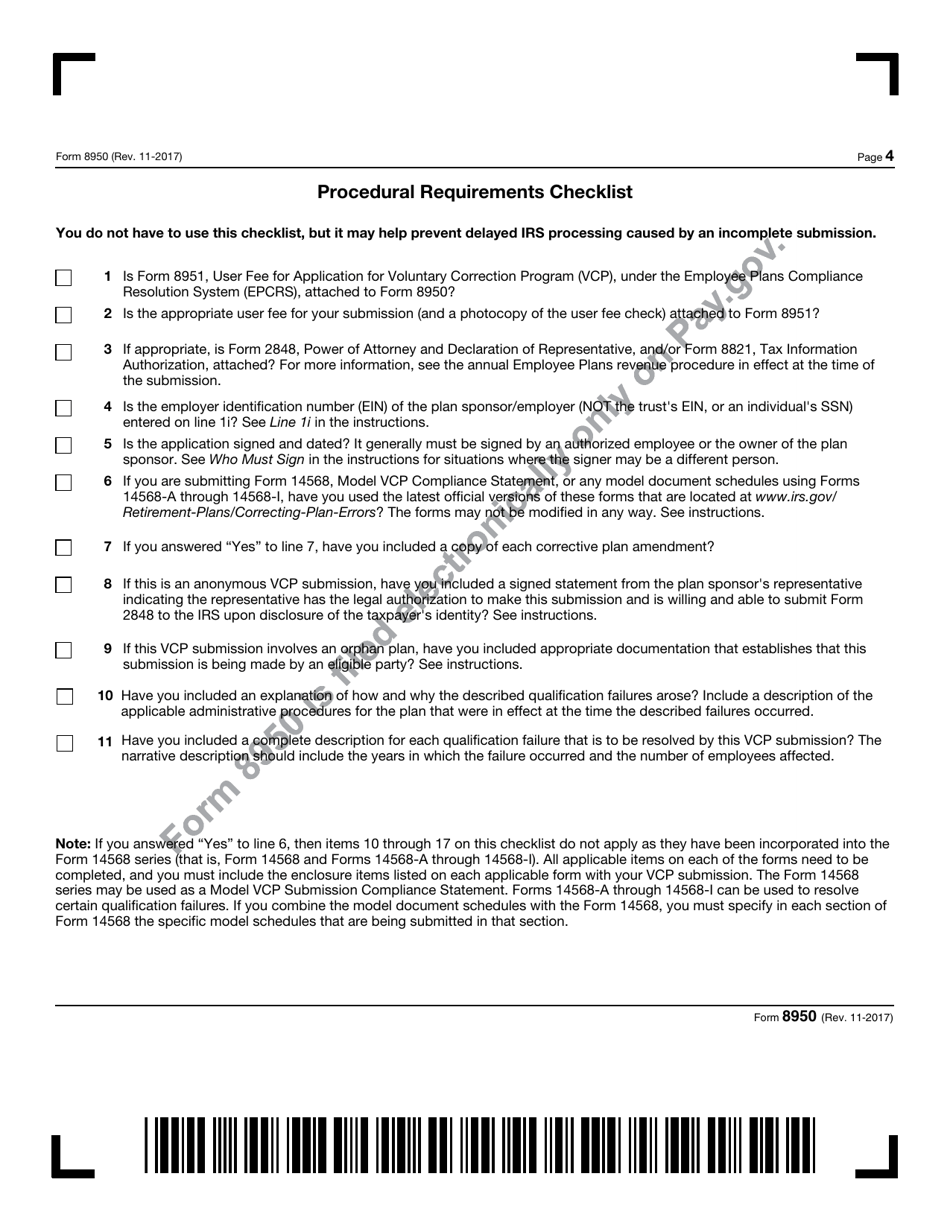

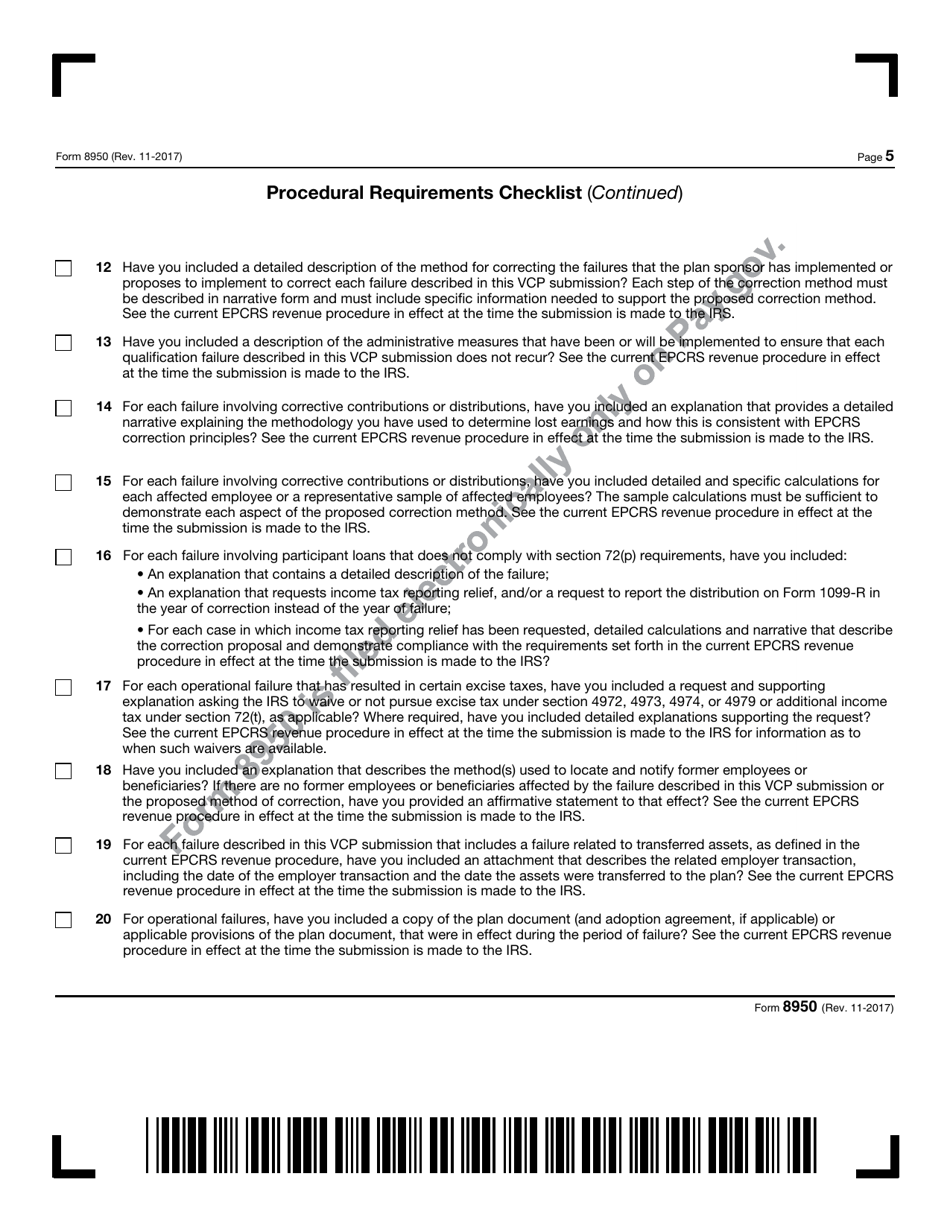

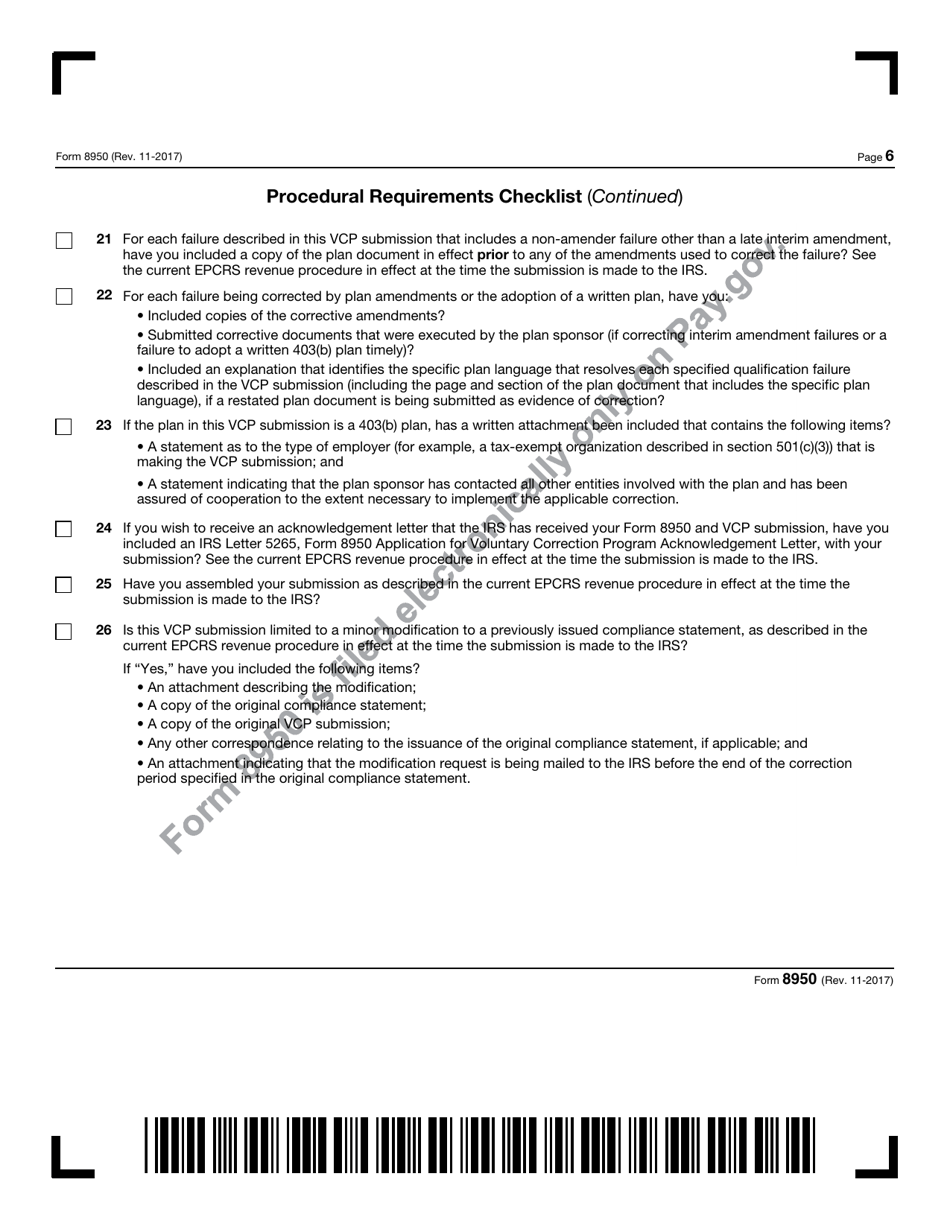

Q: What information is required on IRS Form 8950?

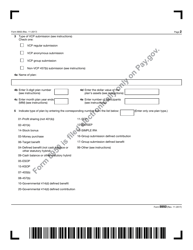

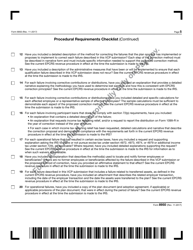

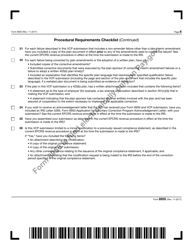

A: IRS Form 8950 requires information such as plan details, description of the errors, and proposed correction methods.

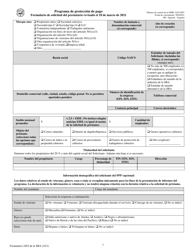

Q: Are there any fees associated with filing IRS Form 8950?

A: Yes, there are fees associated with filing IRS Form 8950. The fee amount depends on the plan's total assets and the type of submission being made.

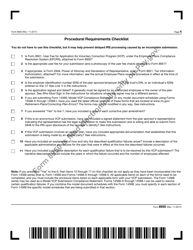

Q: What happens after I submit IRS Form 8950?

A: After submitting IRS Form 8950, the IRS will review the application and determine whether to accept or reject the proposed corrections.

Q: Can I e-file IRS Form 8950?

A: No, IRS Form 8950 cannot be e-filed. It must be mailed to the correct IRS submission address.

Form Details:

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a printable version of IRS Form 8950 through the link below or browse more documents in our library of IRS Forms.