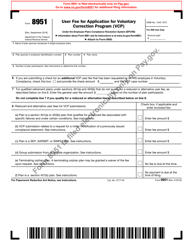

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8950

for the current year.

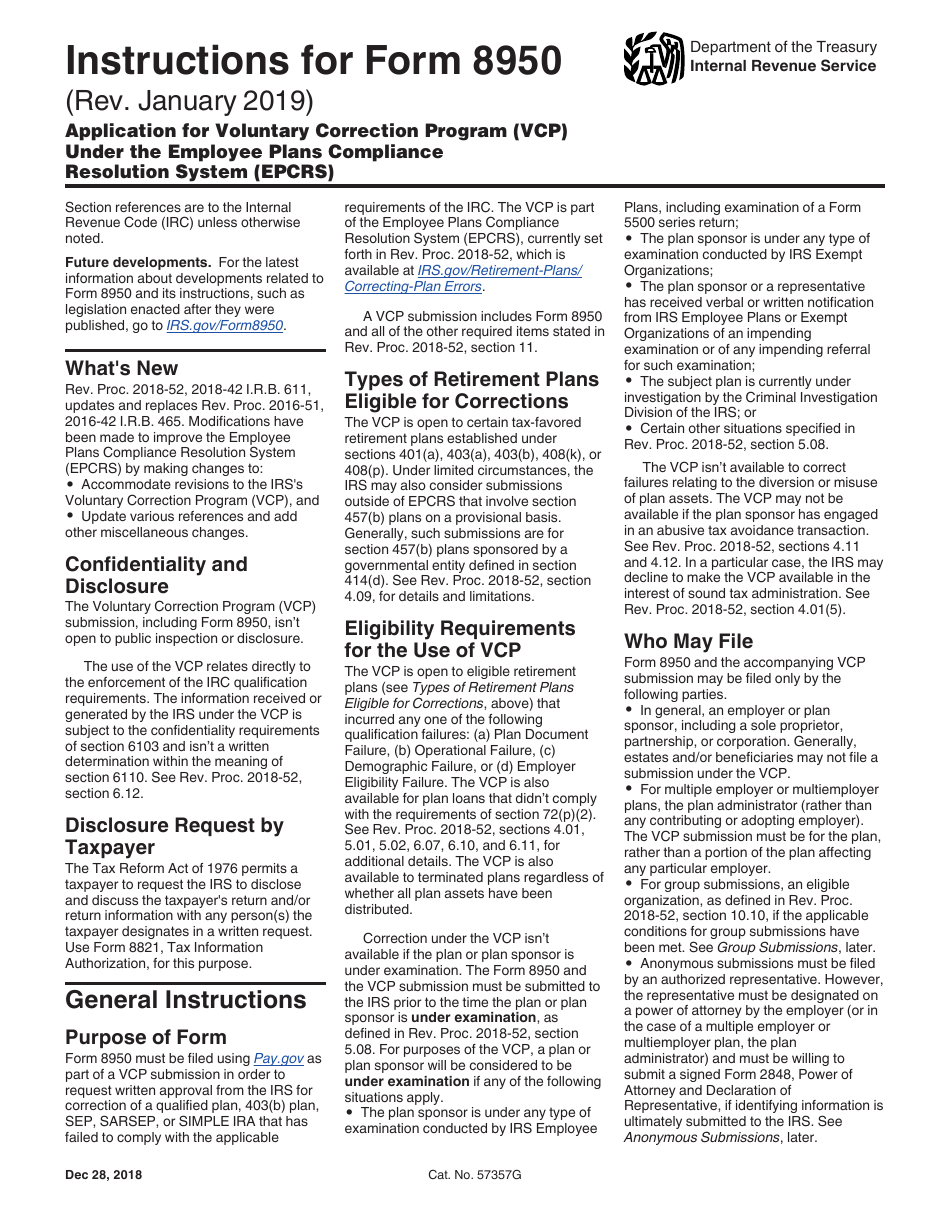

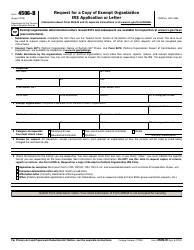

Instructions for IRS Form 8950 Application for Voluntary Correction Program (Vcp) Under the Employee Plans Compliance Resolution System (Epcrs)

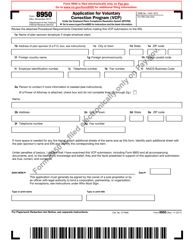

This document contains official instructions for IRS Form 8950 , Application for Voluntary Correction Program (Vcp) Under the Employee Plans Compliance Resolution System (Epcrs) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8950 is available for download through this link.

FAQ

Q: What is IRS Form 8950?

A: IRS Form 8950 is an application for the Voluntary Correction Program (VCP) under the Employee Plans Compliance Resolution System (EPCRS).

Q: What is the VCP?

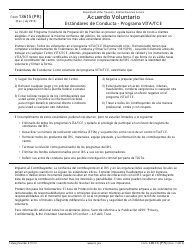

A: The Voluntary Correction Program (VCP) allows plan sponsors to correct plan errors and retain the plan's tax-favored status.

Q: What is the EPCRS?

A: The Employee Plans Compliance Resolution System (EPCRS) is a system created by the IRS to help plan sponsors correct retirement plan errors.

Q: Who should use IRS Form 8950?

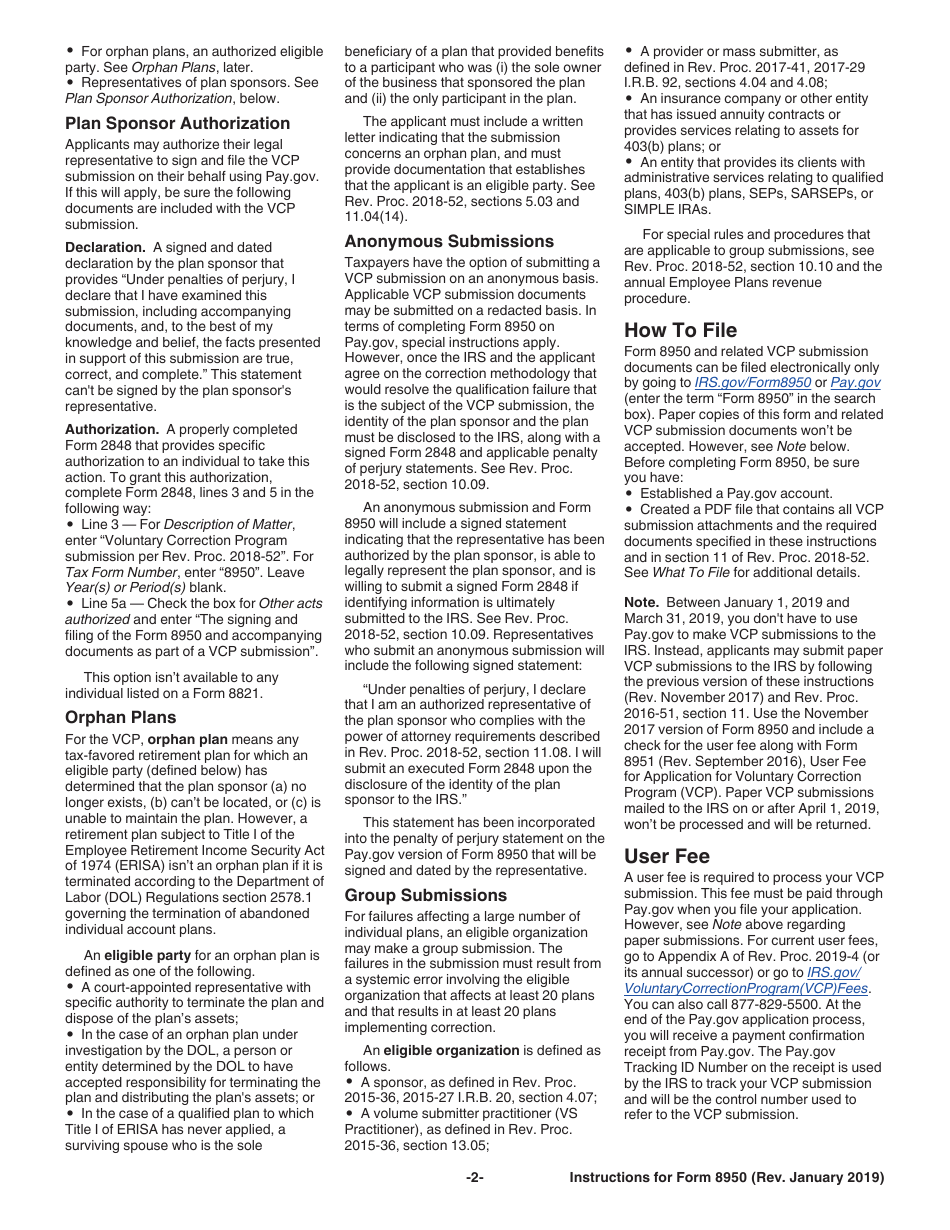

A: Plan sponsors who want to participate in the Voluntary Correction Program (VCP) should use IRS Form 8950.

Q: What type of errors can be corrected using VCP?

A: VCP allows correction of various errors in retirement plans, including plan document failures, operational failures, and demographic failures.

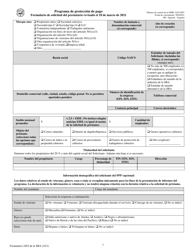

Q: Are there any fees associated with using VCP?

A: Yes, there are user fees associated with submitting IRS Form 8950 as part of the Voluntary Correction Program (VCP). The fees depend on the plan's assets and the proposed correction method.

Q: Is participation in VCP mandatory?

A: Participation in the Voluntary Correction Program (VCP) is voluntary. However, it can be beneficial for plan sponsors to correct plan errors and avoid potential penalties.

Q: Can I use VCP to correct errors in all types of retirement plans?

A: Yes, VCP can be used to correct errors in various types of retirement plans, including 401(k) plans, profit-sharing plans, and employee stock ownership plans (ESOPs).

Q: Can I amend my plan while using VCP?

A: Yes, plan sponsors can make plan amendments while participating in the Voluntary Correction Program (VCP), as long as the amendments are consistent with the correction being made.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.