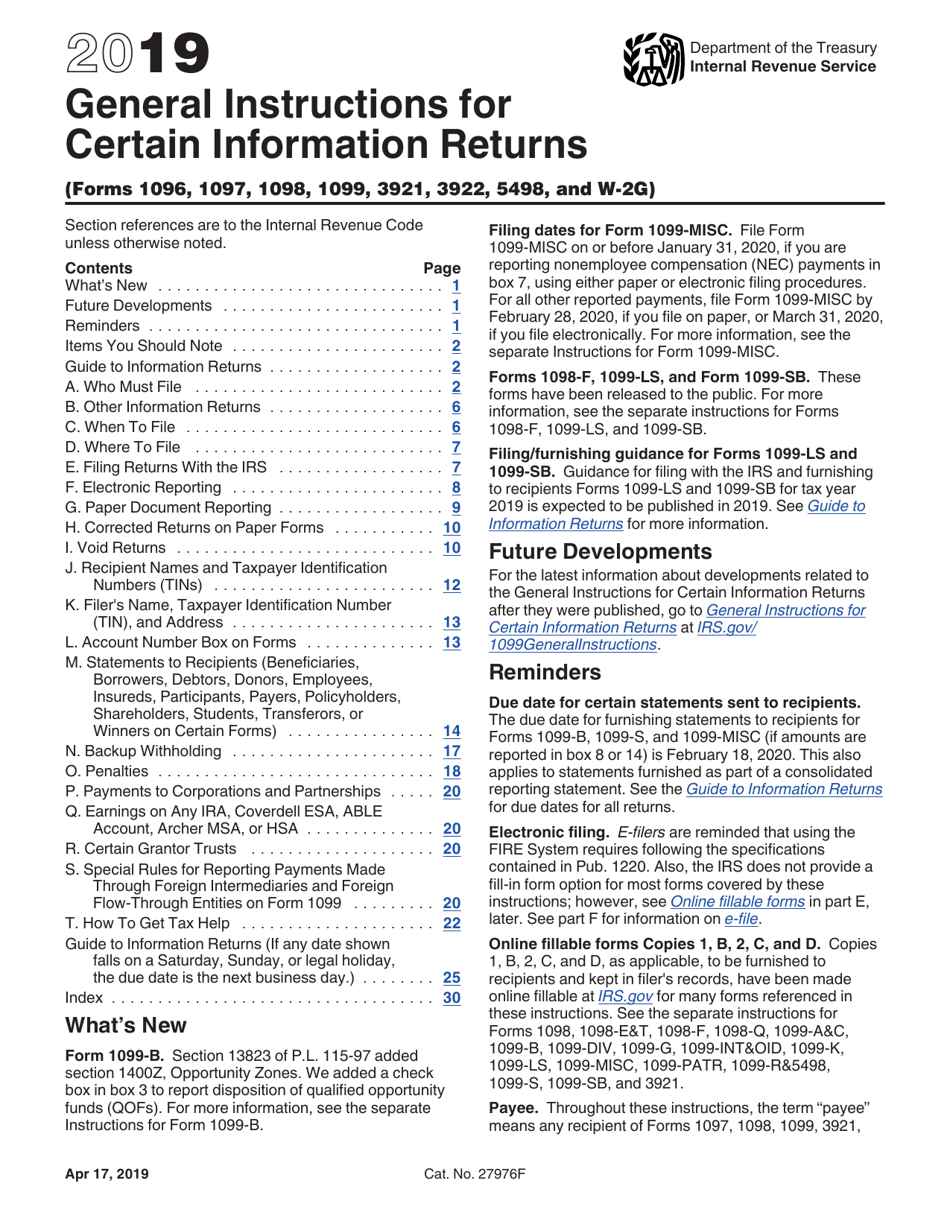

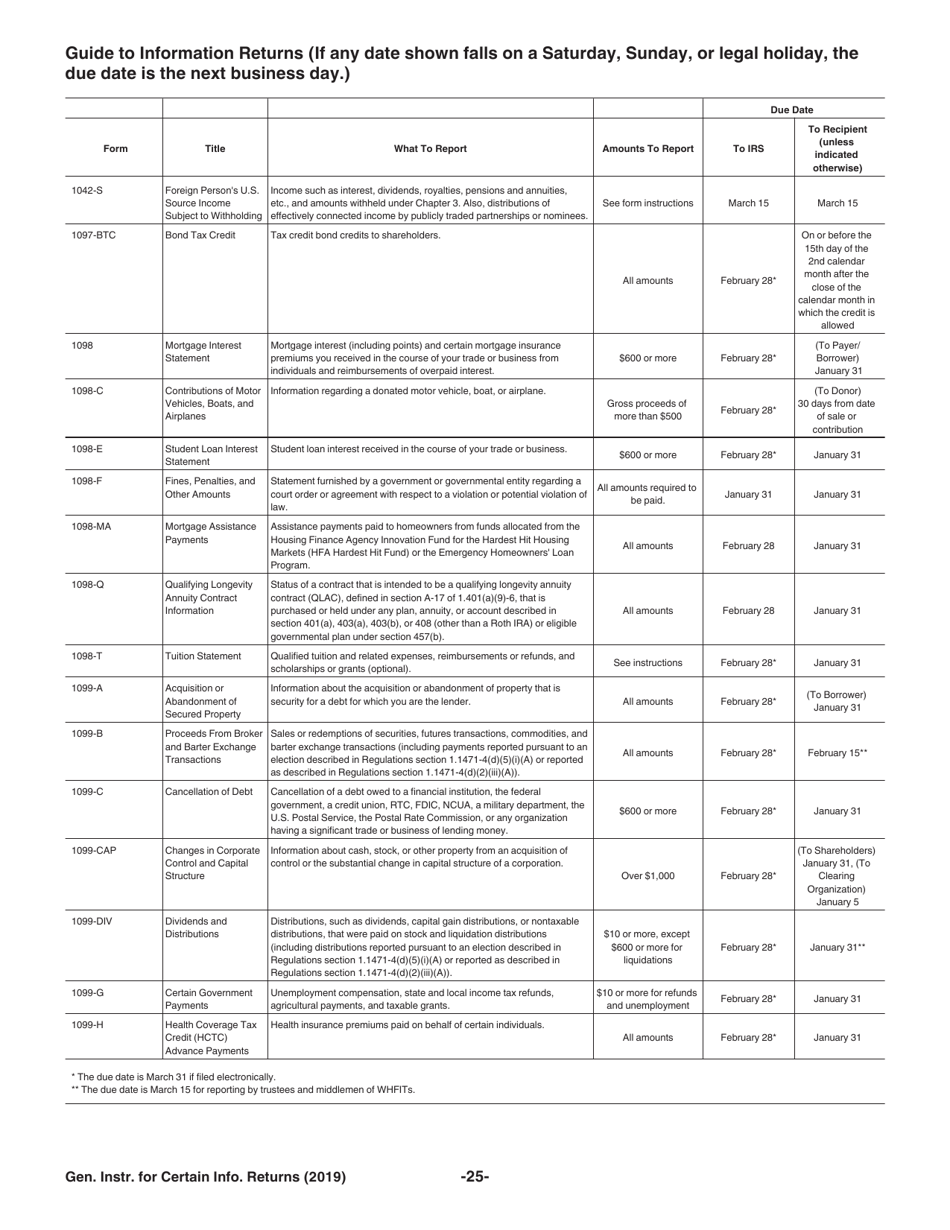

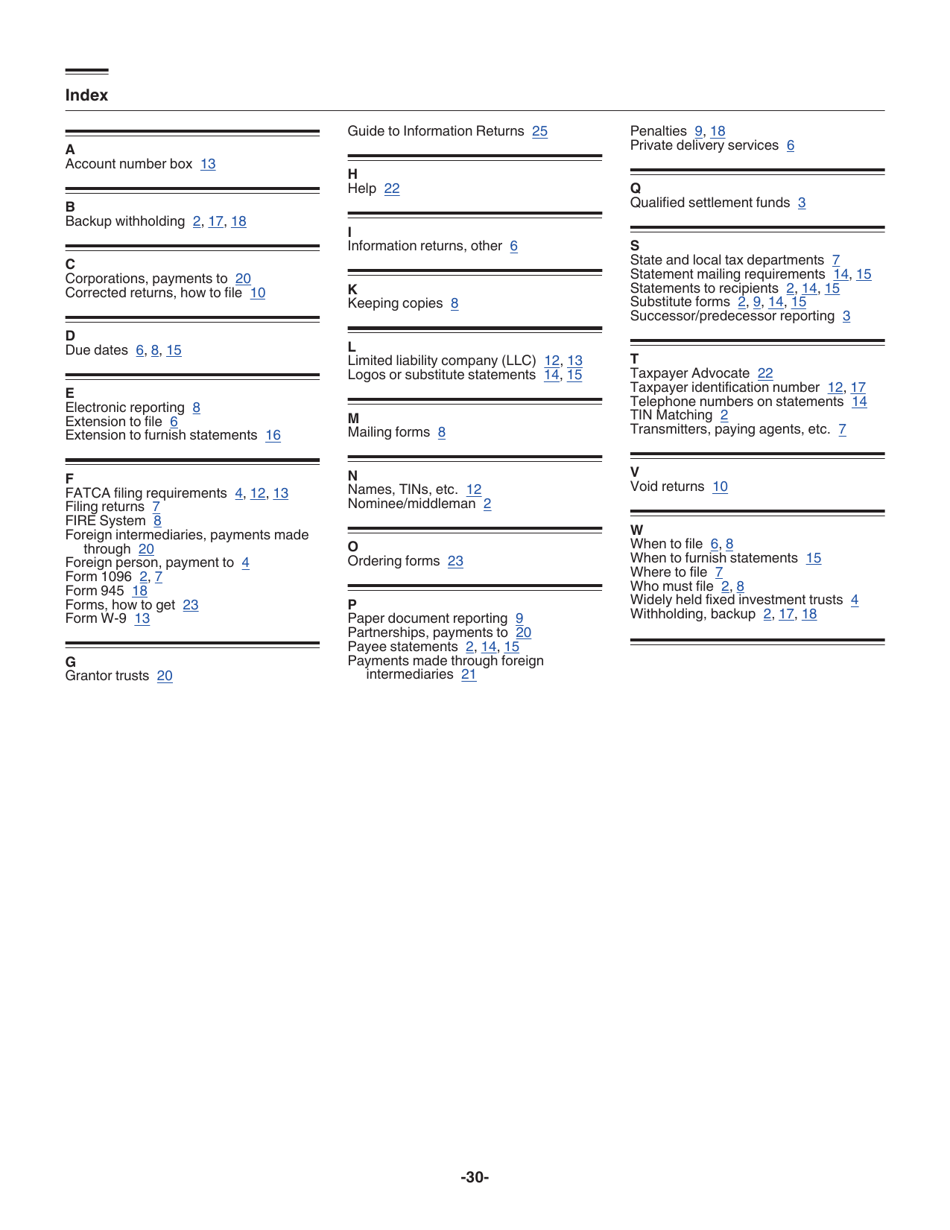

Instructions for IRS Form 1096, 1097, 1098, 1099, 3921, 3922, 5948, W-2G

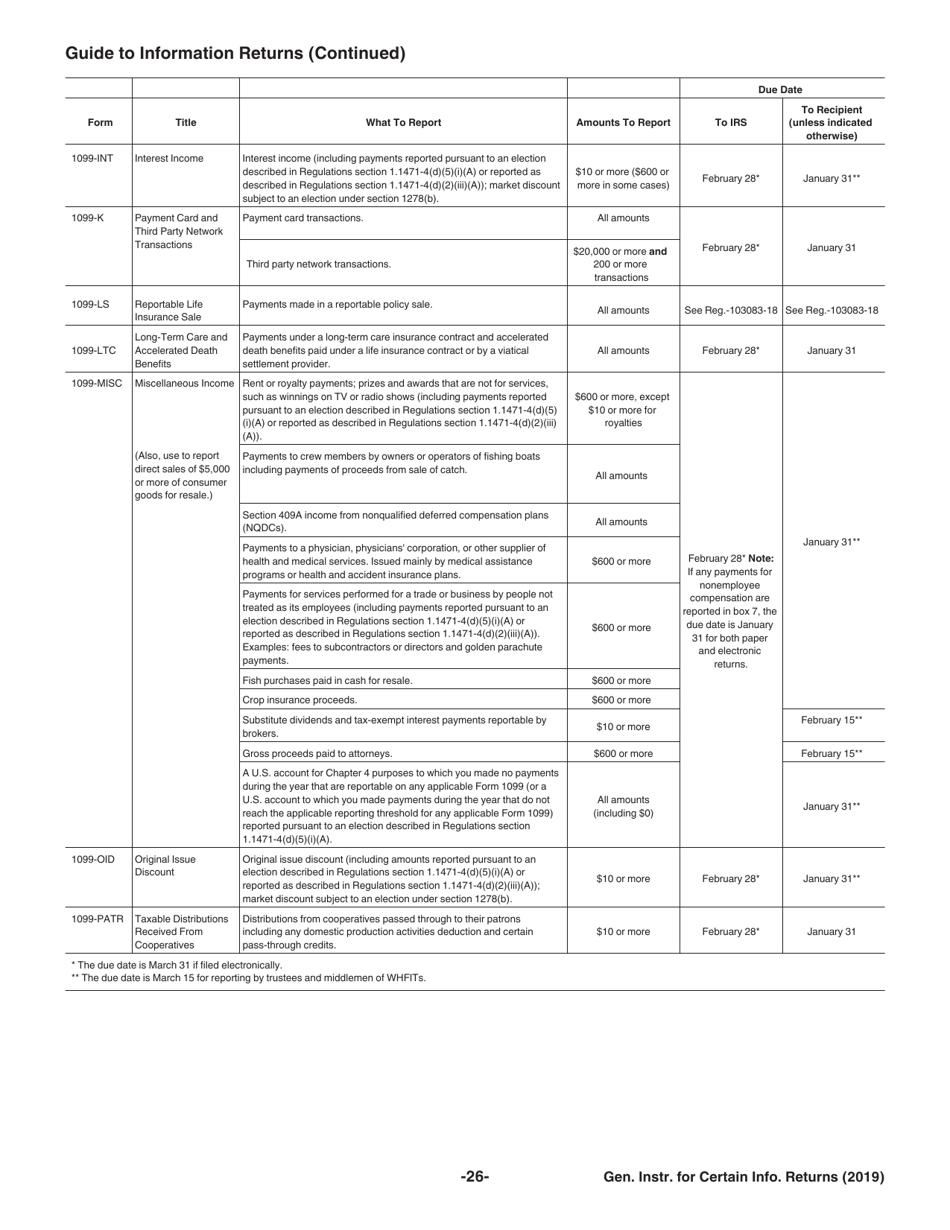

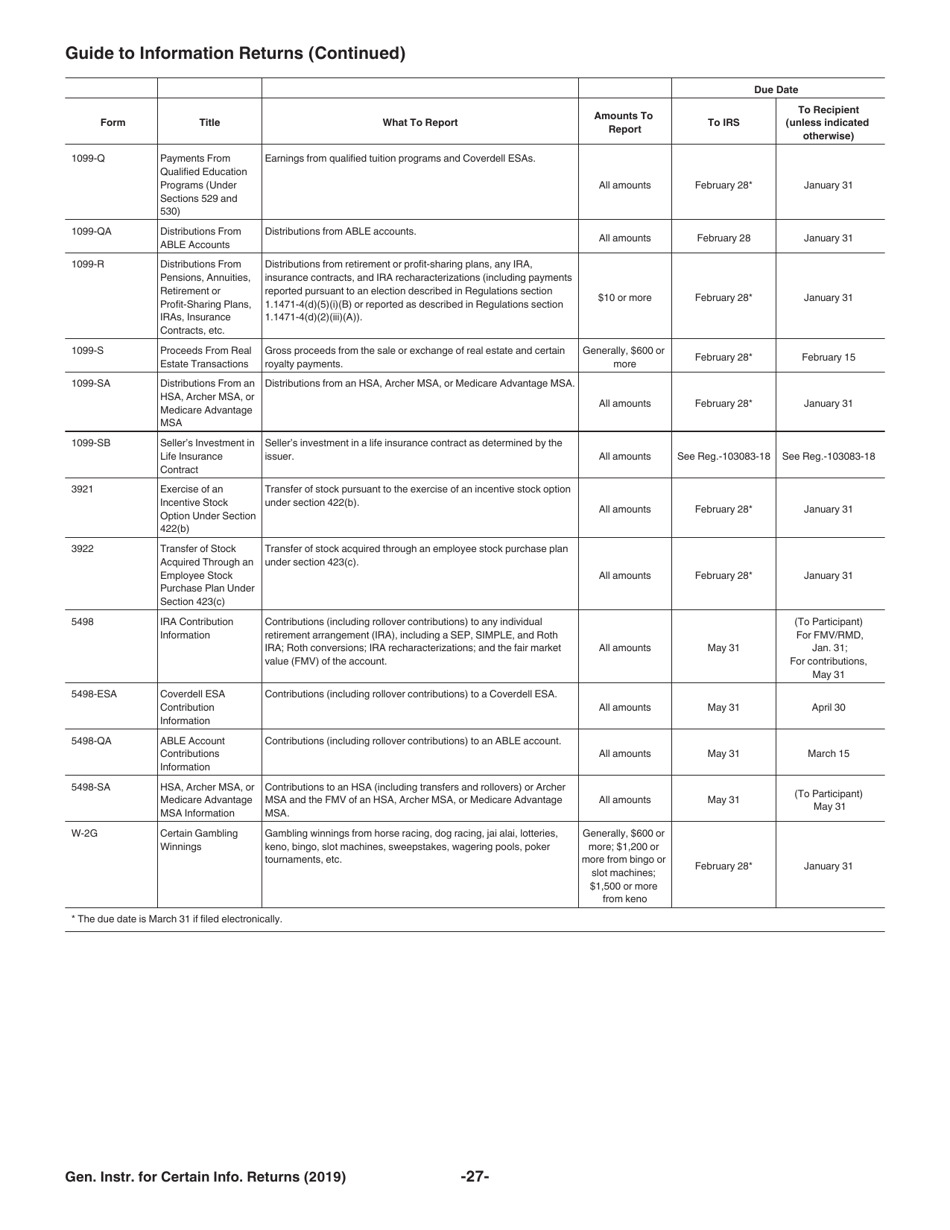

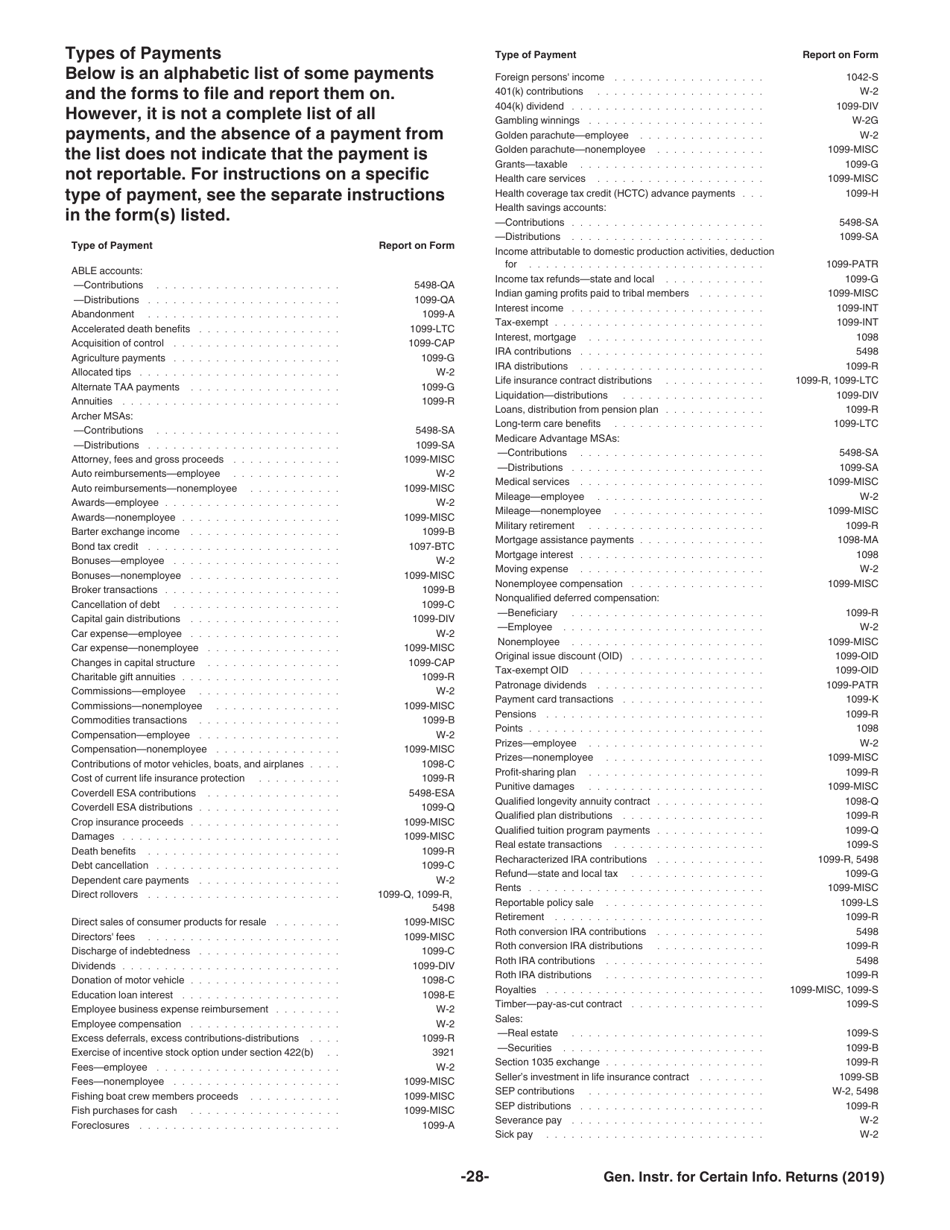

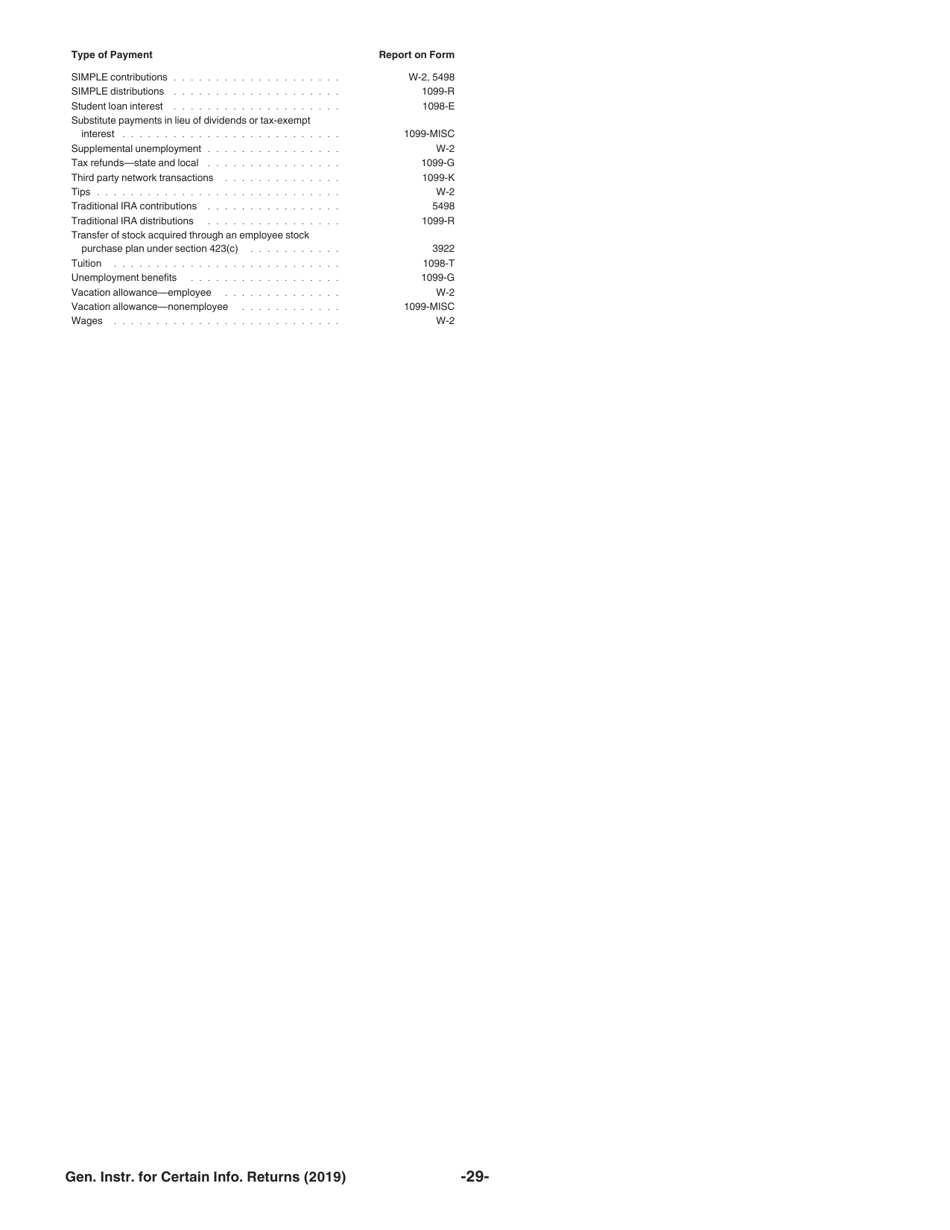

This document contains official instructions for IRS Form 1096 , IRS Form 1097 , IRS Form 1098 , IRS Form 1099 , IRS Form 3921 , IRS Form 3922 , IRS Form 5948 , and IRS Form W-2G . All forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1096 is available for download through this link. The latest available IRS Form 1098 can be downloaded through this link. IRS Form W-2G can be found here.

FAQ

Q: What is IRS Form 1096?

A: IRS Form 1096 is used to summarize and transmit paper copies of certain information returns to the IRS.

Q: What is IRS Form 1097?

A: IRS Form 1097 is used to report financial transactions that involve payments of mortgage interest.

Q: What is IRS Form 1098?

A: IRS Form 1098 is used to report mortgage interest, student loan interest, and other types of interest payments.

Q: What is IRS Form 1099?

A: IRS Form 1099 is used to report various types of income, such as interest, dividends, and self-employment income.

Q: What is IRS Form 3921?

A: IRS Form 3921 is used to report exercises of incentive stock options.

Q: What is IRS Form 3922?

A: IRS Form 3922 is used to report transfers of stock acquired through an employee stock purchase plan.

Q: What is IRS Form 5948?

A: IRS Form 5948 is used to report the tentative tax on certain investment income of trusts and estates.

Q: What is IRS Form W-2G?

A: IRS Form W-2G is used to report certain types of gambling winnings.

Instruction Details:

- This 30-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.