This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1096

for the current year.

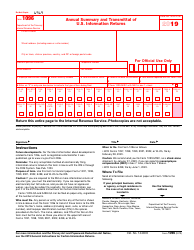

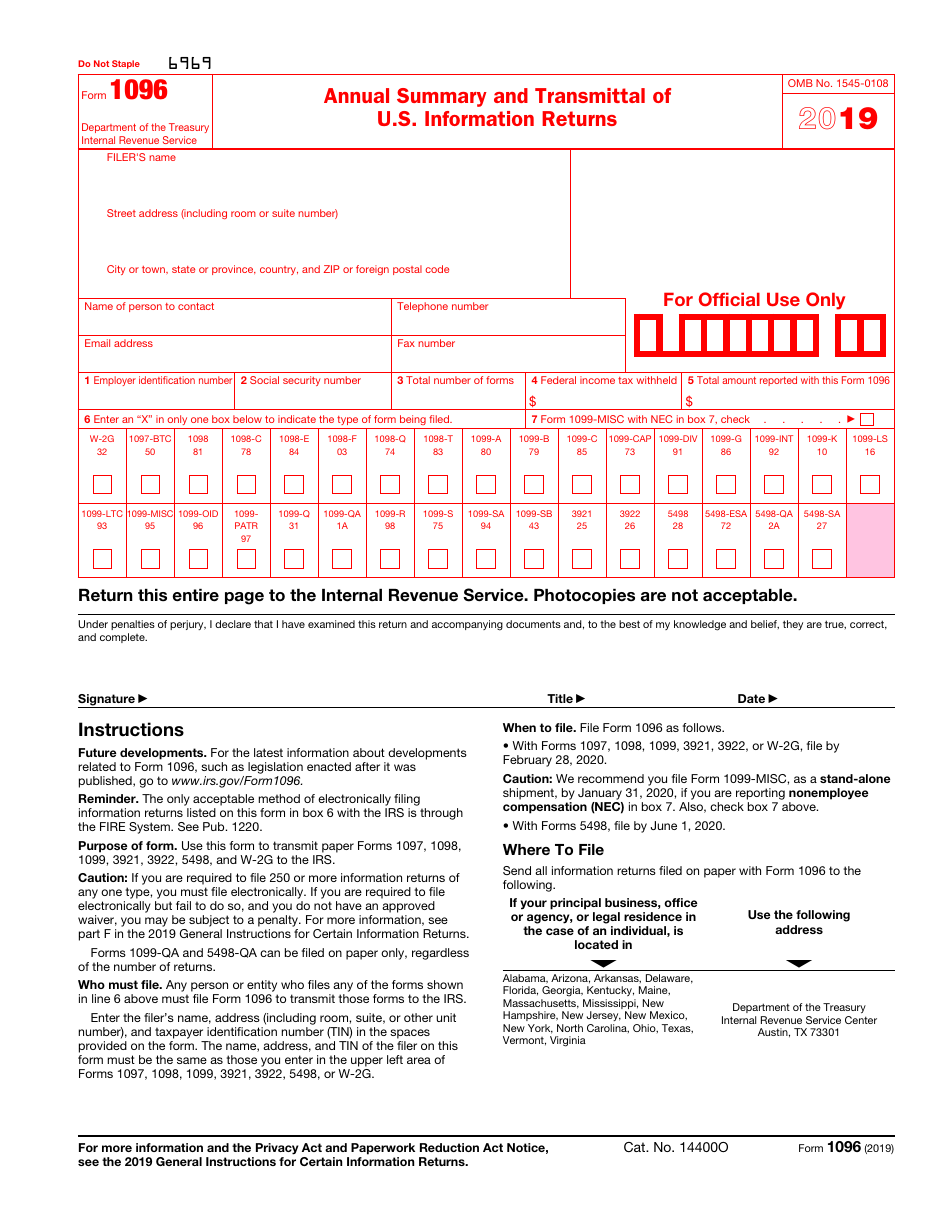

IRS Form 1096 Annual Summary and Transmittal of U.S. Information Returns

What Is Form 1096?

IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns is a document used as a summary or a compilation sheet of information returns physically submitted to the Internal Revenue Service (IRS) .

The form is used solely to transmit paper Forms 1097-BTC, 1098, 1099, 3921, 3922, 5498, and W-2G to the IRS. It is only needed if you are physically filing the forms with the IRS. If you opt to file the forms electronically, you are not required to submit Form 1096 with the returns.

The form - commonly referred to as the "1096 Transmittal Form" - is updated annually. As of today, no fillable Form 1096 copies can be found online. The latest printable copy of the form is available for download through the link below. You can download the form, print it, fill it out manually and then send it to the IRS. The IRS also provides an official set of instructions for filing this year's transmittal form.

When Is Form 1096 Due?

The IRS Form 1096 due date depends on the accompanying forms:

- The last day of January for the previous calendar year - for Form 1099-MISC;

- The last day of February, or the last day of March, if you are filing electronically, for the previous calendar year - for Forms 1097, 1098, 1099, 3921, 3922, or W-2G;

- The last day of May - for 5498 Forms.

You may be fined if you:

- Fail to file by the due date;

- Include incorrect information;

- Fail to include all required information;

- File on paper when it is obligatory to file electronically;

- Report an incorrect taxpayer identification number (TIN) or fail to report a TIN;

- File a form that the machines cannot detect.

Penalties are as follows:

- $50 per form if you correctly file after 30 days of the due date;

- $110 per form if you correctly file more than 30 days after the due date but before the first day of August;

- $270 per form if you file after the first day of August or if you do not file the forms at all;

- The maximum penalty is $3,339,000 per year ($1,113,000 for small businesses).

How to Fill Out Form 1096?

- State the full name, the street address, the telephone number, the email address, and the name of the person to contact;

- Write down the TIN, the employer identification number; if you are not in business or trade, you must submit your social security number;

- Enter the number of forms you are going to transmit with this form. You have to write down the number of forms, not the number of pages;

- State the total federal income tax withheld in accordance with the forms transmitted with Form 1096;

- Enter the total amount reported with the form;

- Choose the appropriate box to indicate the type of form you are filing.

IRS Form 1096 Instructions

- Every form requires a separate Form 1096. For example, if you have to file Forms 1098 and 1099-A, submit one Form 1096 to transmit Form 1098 and another Form 1096 to transmit Form 1099-A;

- IRS Form 1096 and 1099 forms are related - a summary tax form must show the totals from the information returns, and you have to submit them together. A transmittal form is necessary for all types of 1099 forms, for example, Form 1099-MISC, Miscellaneous Income, which is used by independent contractors and other non-employees to file reports to the IRS;

- If you must submit 250 or more forms of any type, you have to file electronically. If you fail to do so, your information returns will not be accepted, and you might be fined for this;

- It is recommended to keep copies of the forms for several years;

- Make sure you do not send the same information to the IRS more than once;

- Use decimal points to show the omitted dollars and cents.

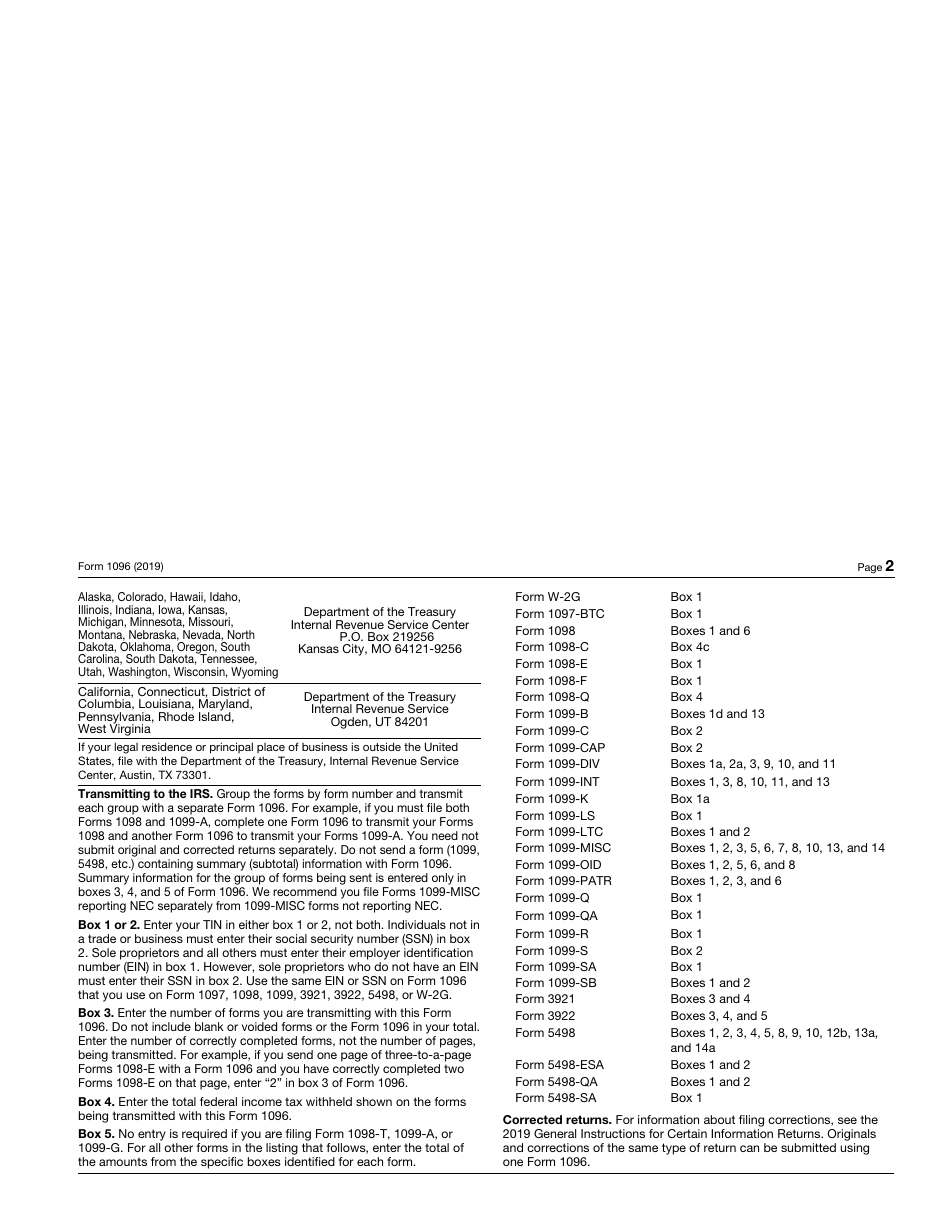

Where to Mail Form 1096?

The mailing address depends on the location of the business or the legal residence:

- Department of the Treasury Internal Revenue Service Center Austin, TX 73301 - for Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia, and foreign countries;

- Department of the Treasury Internal Revenue Service Center P.O. Box 219256 Kansas City, MO 64121-9256 - for Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming;

- Department of the Treasury Internal Revenue Service Ogden, UT 84201 - for California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia.