This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form HS-122

for the current year.

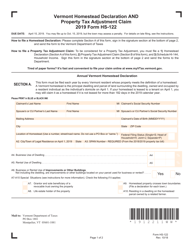

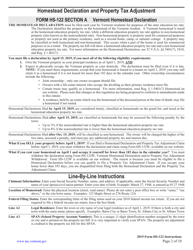

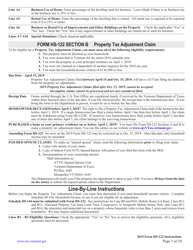

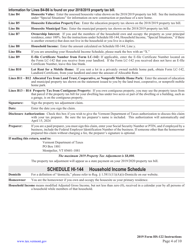

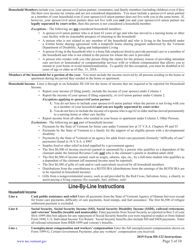

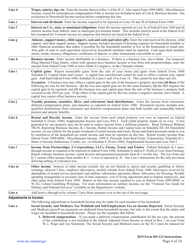

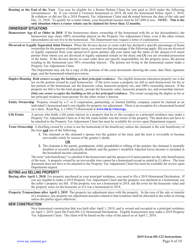

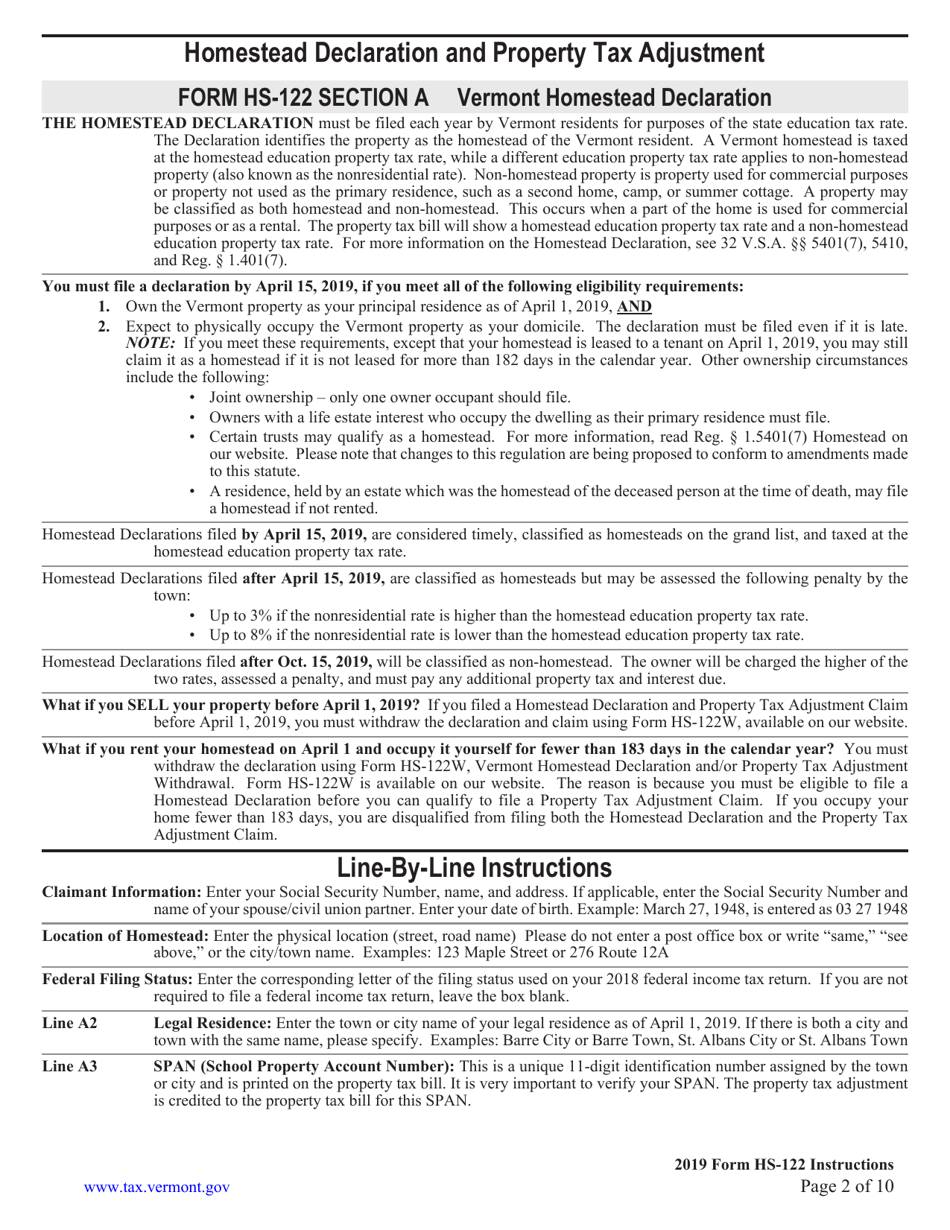

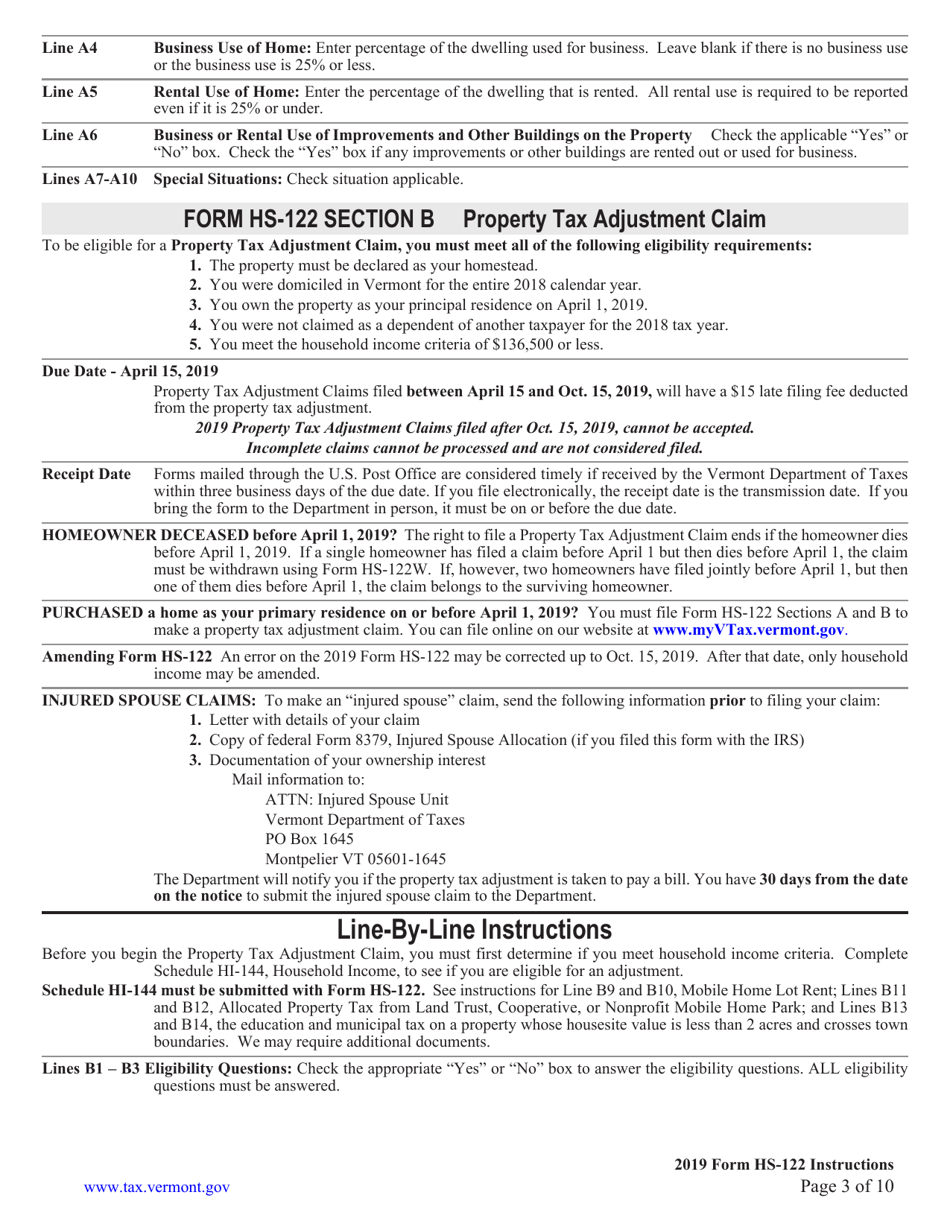

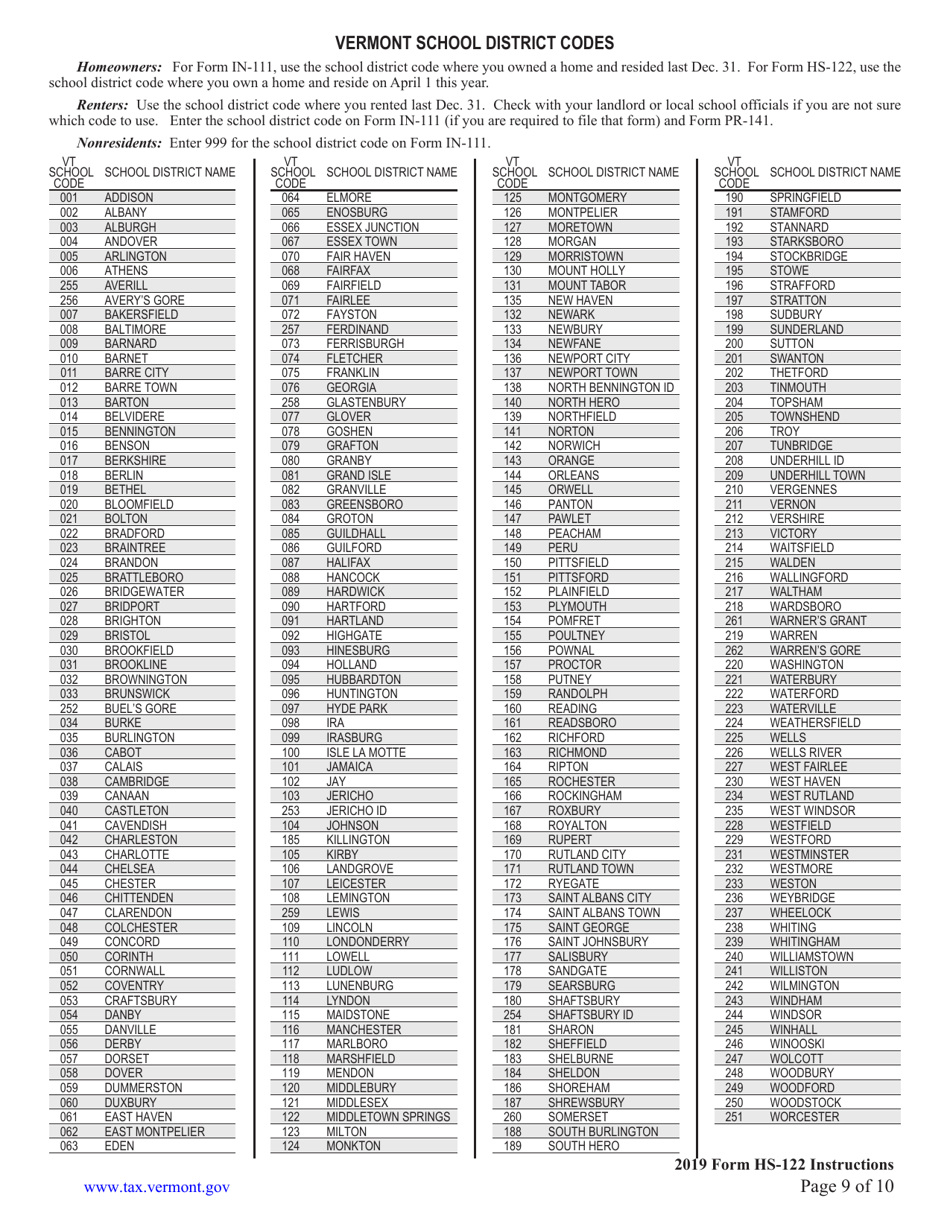

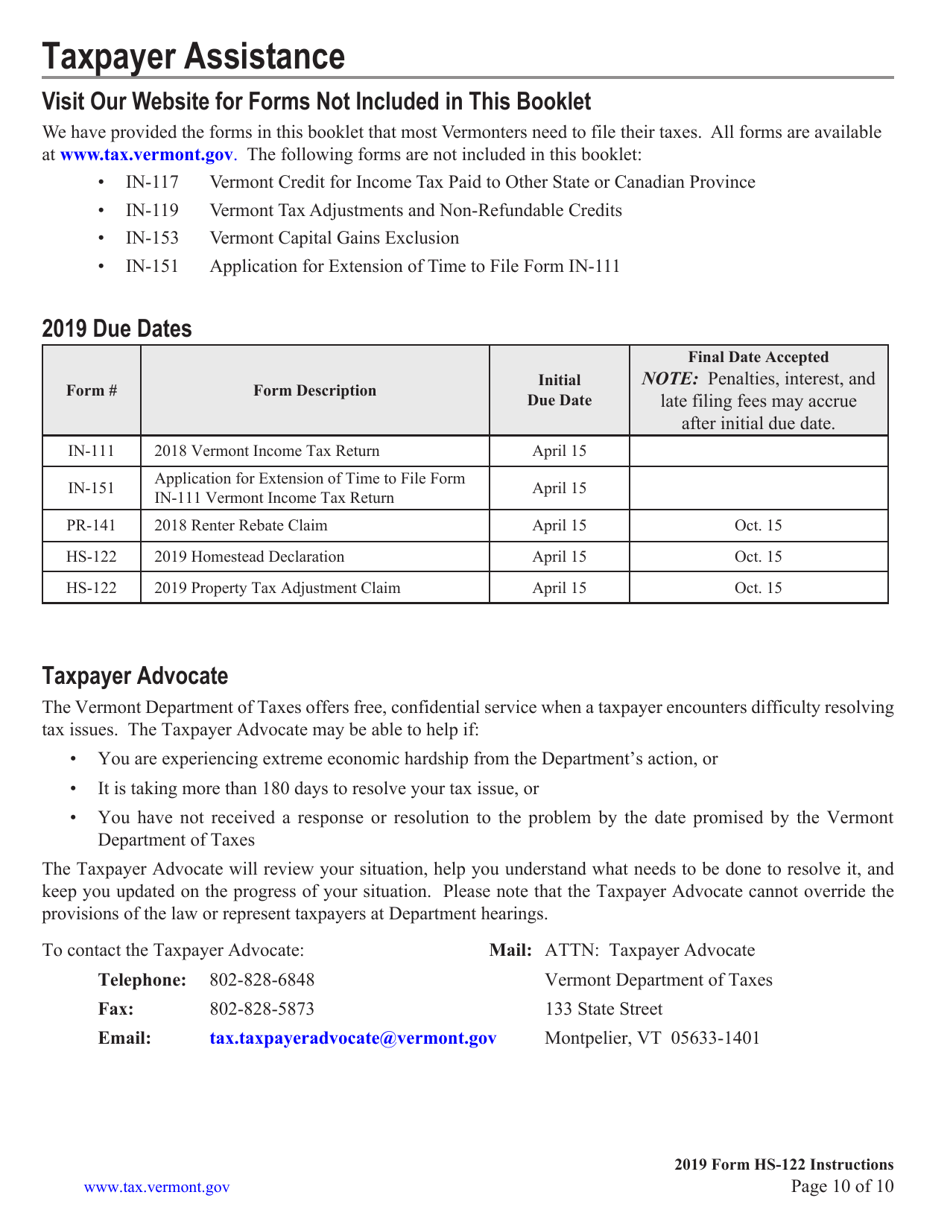

Instructions for Form HS-122 Homestead Declaration and Property Tax Adjustment Claim - Vermont

This document contains official instructions for Form HS-122 , Homestead Declaration and Property Tax Adjustment Claim - a form released and collected by the Vermont Department of Taxes. An up-to-date fillable VT Form HS-122 is available for download through this link.

FAQ

Q: What is form HS-122?

A: Form HS-122 is the Homestead Declaration and Property Tax Adjustment Claim form in Vermont.

Q: What is the purpose of form HS-122?

A: The purpose of form HS-122 is to declare your property as a homestead and to claim property tax adjustment in Vermont.

Q: Who needs to file form HS-122?

A: Any Vermont resident who owns and occupies a property as their primary residence needs to file form HS-122.

Q: When do I need to file form HS-122?

A: Form HS-122 needs to be filed annually by April 15th.

Q: What is a homestead declaration?

A: A homestead declaration is a legal document that designates a property as a primary residence, qualifying for certain tax benefits and protections.

Q: What is a property tax adjustment claim?

A: A property tax adjustment claim is a request for a reduction in property taxes based on one's income and property value.

Q: What documents do I need to include with form HS-122?

A: You may need to include copies of your federal tax return, income documentation, and property tax bills with form HS-122.

Q: How long does it take to process form HS-122?

A: It generally takes 8-12 weeks to process form HS-122.

Q: What happens if I don't file form HS-122?

A: Failure to file form HS-122 may result in losing property tax benefits and protections in Vermont.

Instruction Details:

- This 10-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.