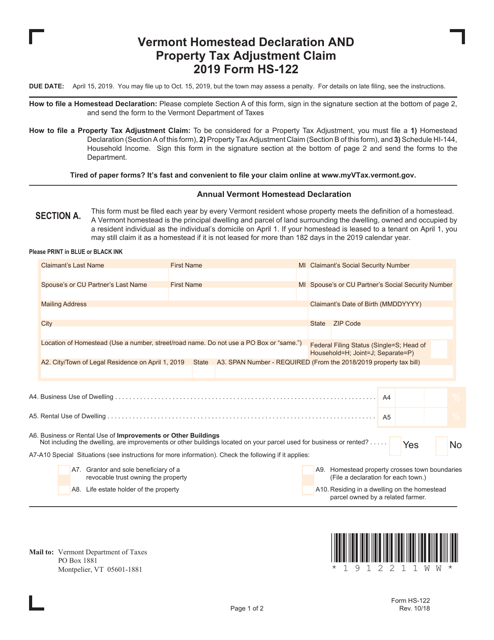

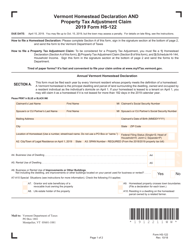

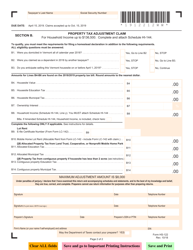

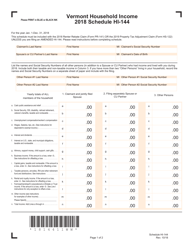

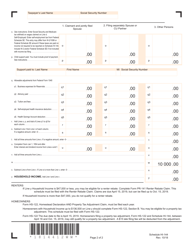

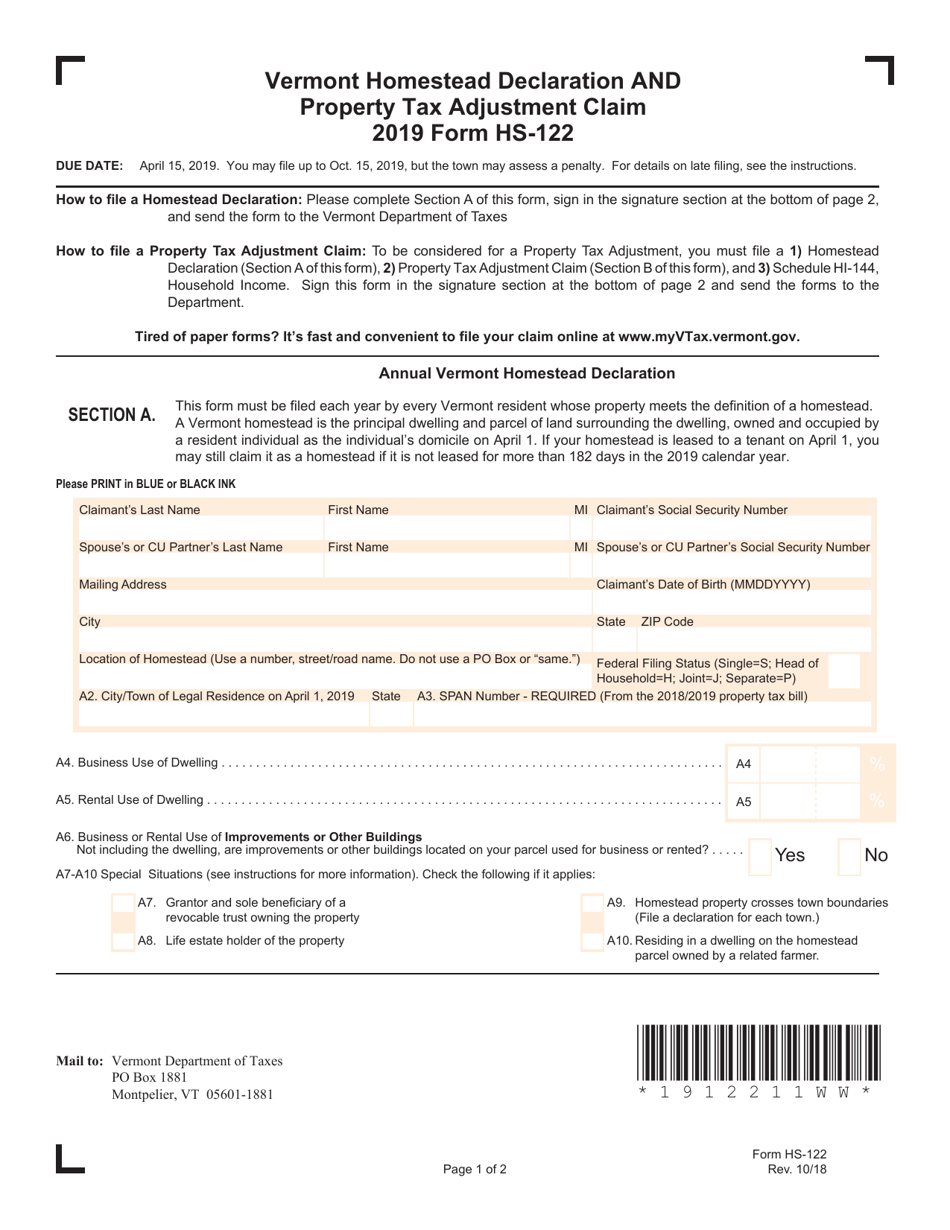

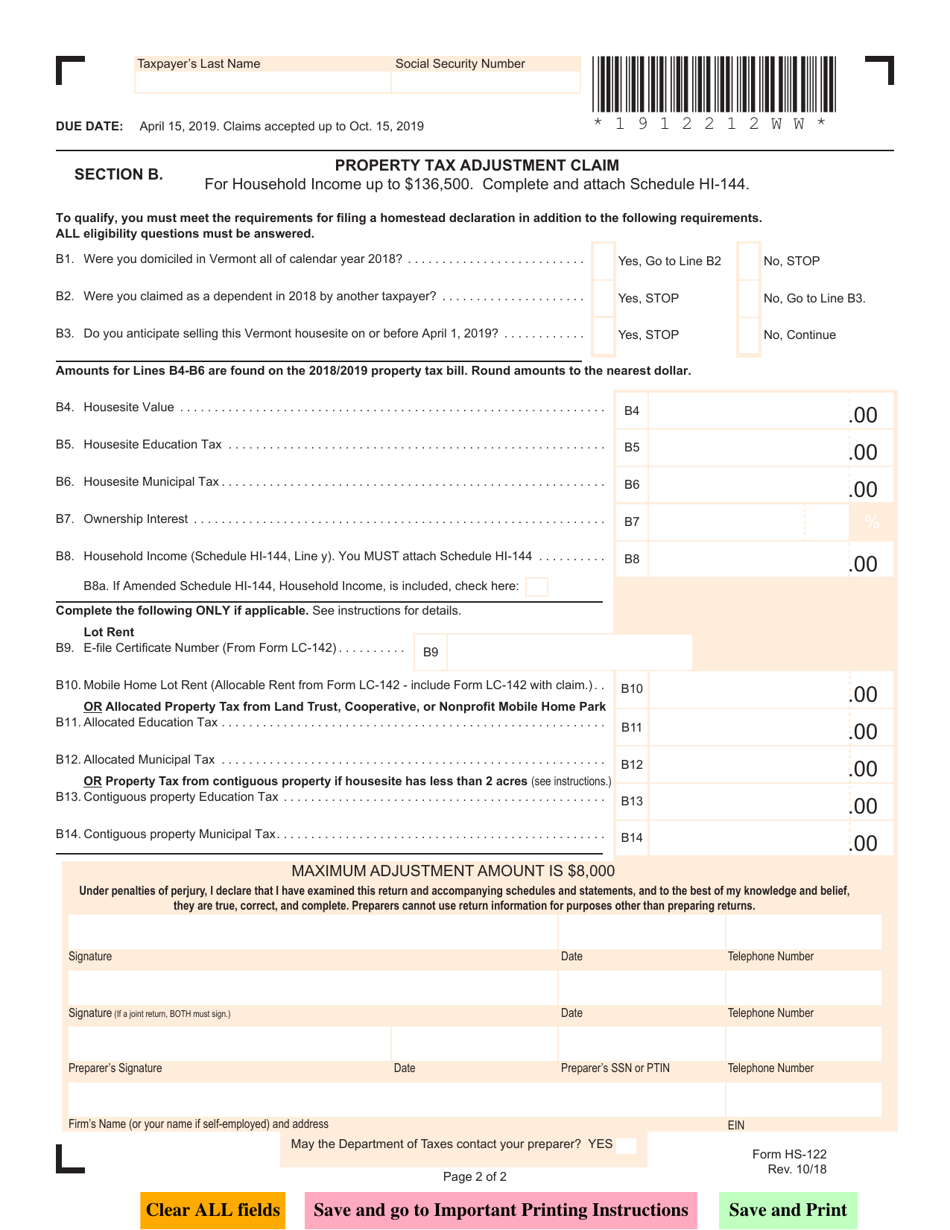

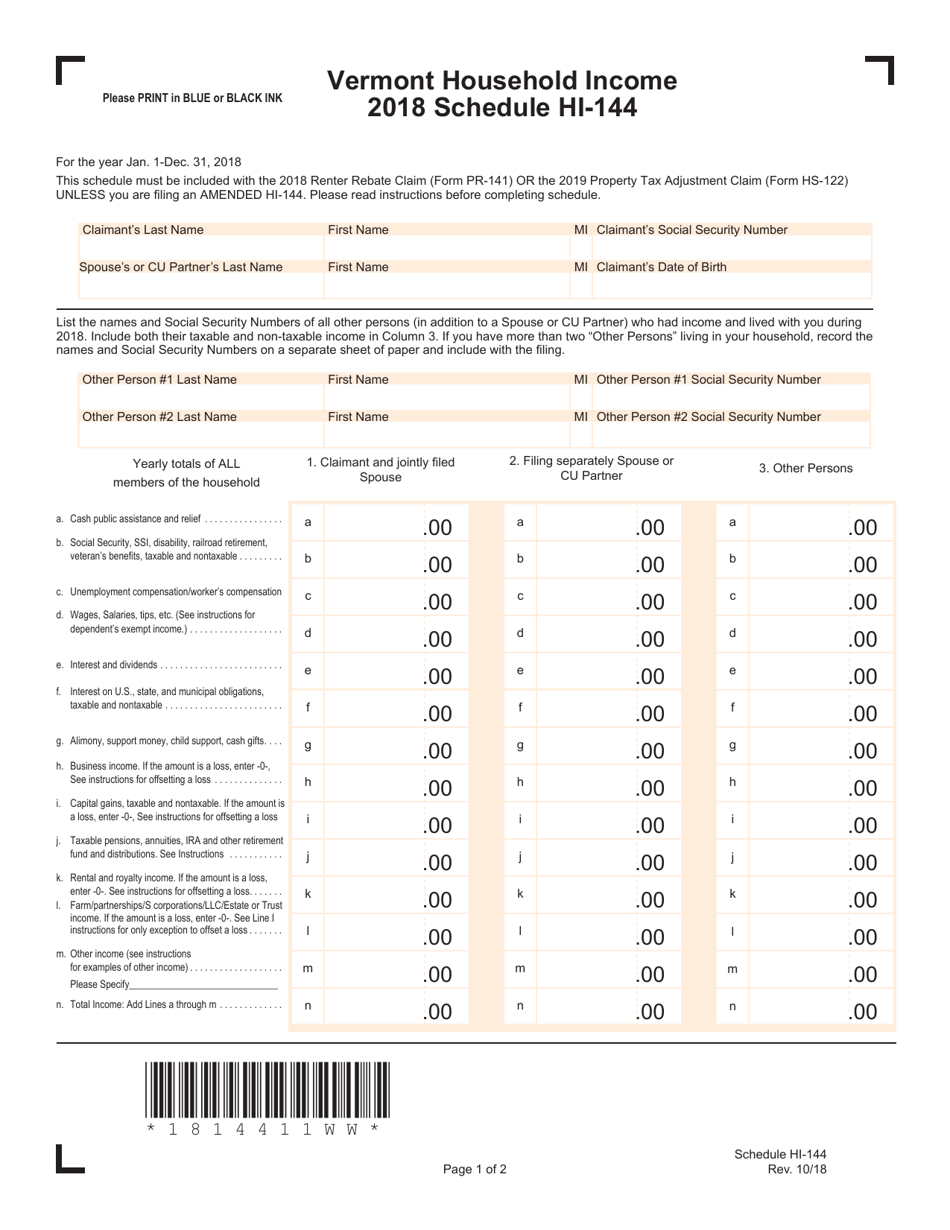

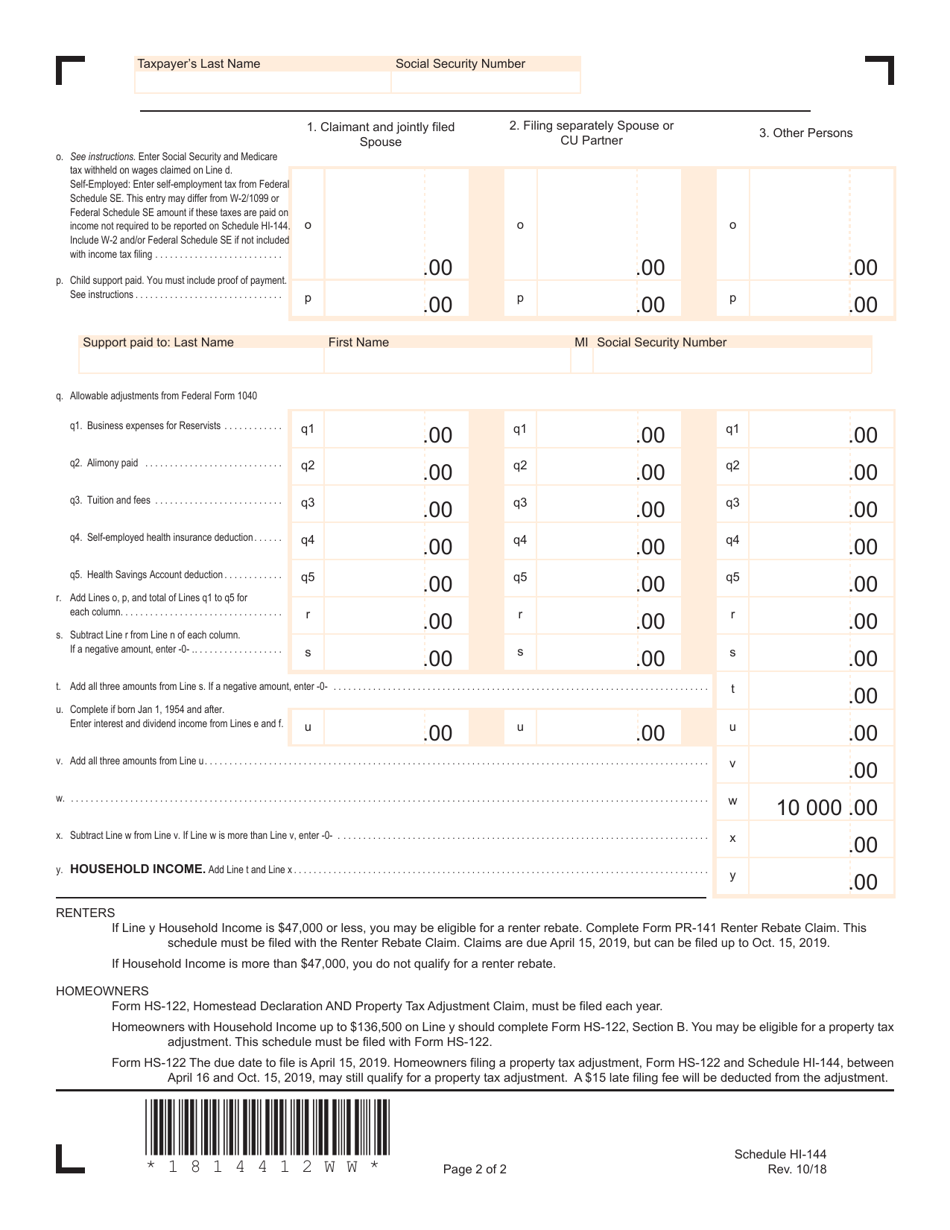

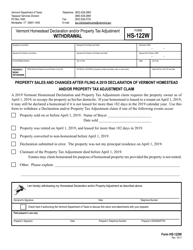

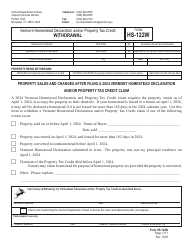

VT Form HS-122 Vermont Homestead Declaration and Property Tax Adjustment Claim - Vermont

What Is VT Form HS-122?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is HS-122 form?

A: HS-122 form is the Vermont Homestead Declaration and Property Tax Adjustment Claim form.

Q: What is the purpose of the HS-122 form?

A: The purpose of the HS-122 form is to claim a property tax adjustment for your Vermont homestead.

Q: Who can use the HS-122 form?

A: Vermont residents who own and occupy a property as their primary residence can use the HS-122 form.

Q: When should the HS-122 form be filed?

A: The HS-122 form should be filed annually between January 1 and April 1.

Q: What documents do I need to complete the HS-122 form?

A: You will need your property tax bill, income information, and other supporting documents to complete the HS-122 form.

Q: How do I file the HS-122 form?

A: You can file the HS-122 form electronically through myVTax, or you can mail it to the Vermont Department of Taxes.

Q: What is the deadline for filing the HS-122 form?

A: The deadline for filing the HS-122 form is April 1.

Q: What happens if I don't file the HS-122 form?

A: If you don't file the HS-122 form, you may not be eligible for a property tax adjustment.

Q: Can I make changes to the HS-122 form after filing?

A: Yes, you can make changes to the HS-122 form within 60 days of the original filing date.

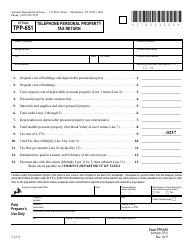

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form HS-122 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.