This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form D-403

for the current year.

Instructions for Form D-403 Partnership Income Tax Return - North Carolina

This document contains official instructions for Form D-403 , Partnership Income Tax Return - a form released and collected by the North Carolina Department of Revenue. An up-to-date fillable Form D-403 is available for download through this link.

FAQ

Q: What is Form D-403?

A: Form D-403 is the Partnership Income Tax Return for North Carolina.

Q: Who should file Form D-403?

A: Partnerships doing business in North Carolina with at least one member who is a North Carolina resident, or any partnership deriving income from North Carolina sources, should file Form D-403.

Q: When is the deadline to file Form D-403?

A: Form D-403 must be filed by the 15th day of the fourth month following the close of the partnership's tax year, which is typically April 15th for calendar year partnerships.

Q: Are there any filing fees for Form D-403?

A: No, there are no filing fees for Form D-403.

Q: Are there any penalties for late filing of Form D-403?

A: Yes, there may be penalties for late filing, failure to file, or underpayment of tax. It is important to file Form D-403 by the deadline to avoid penalties.

Q: What are some common attachments to Form D-403?

A: Some common attachments to Form D-403 include Schedule K-1 for each partner, schedules detailing income and deductions, and any other supporting documentation as required.

Q: How can I pay any taxes owed with Form D-403?

A: Taxes owed with Form D-403 can be paid electronically, by check or money order, or through an electronic funds transfer.

Q: Can Form D-403 be filed electronically?

A: Yes, Form D-403 can be filed electronically using the North Carolina Department of Revenue's eFile system.

Q: Is Form D-403 the only form required for partnership taxes in North Carolina?

A: No, in addition to Form D-403, partnerships may also need to file other forms and schedules depending on their specific circumstances. It is always best to consult the North Carolina Department of Revenue or a tax professional for guidance.

Instruction Details:

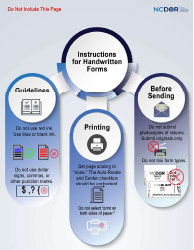

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.