This version of the form is not currently in use and is provided for reference only. Download this version of

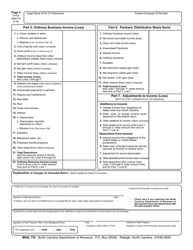

Form D-403

for the current year.

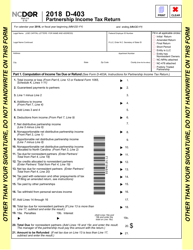

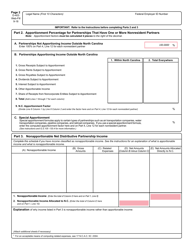

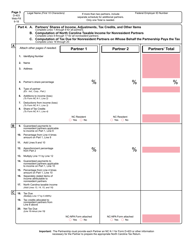

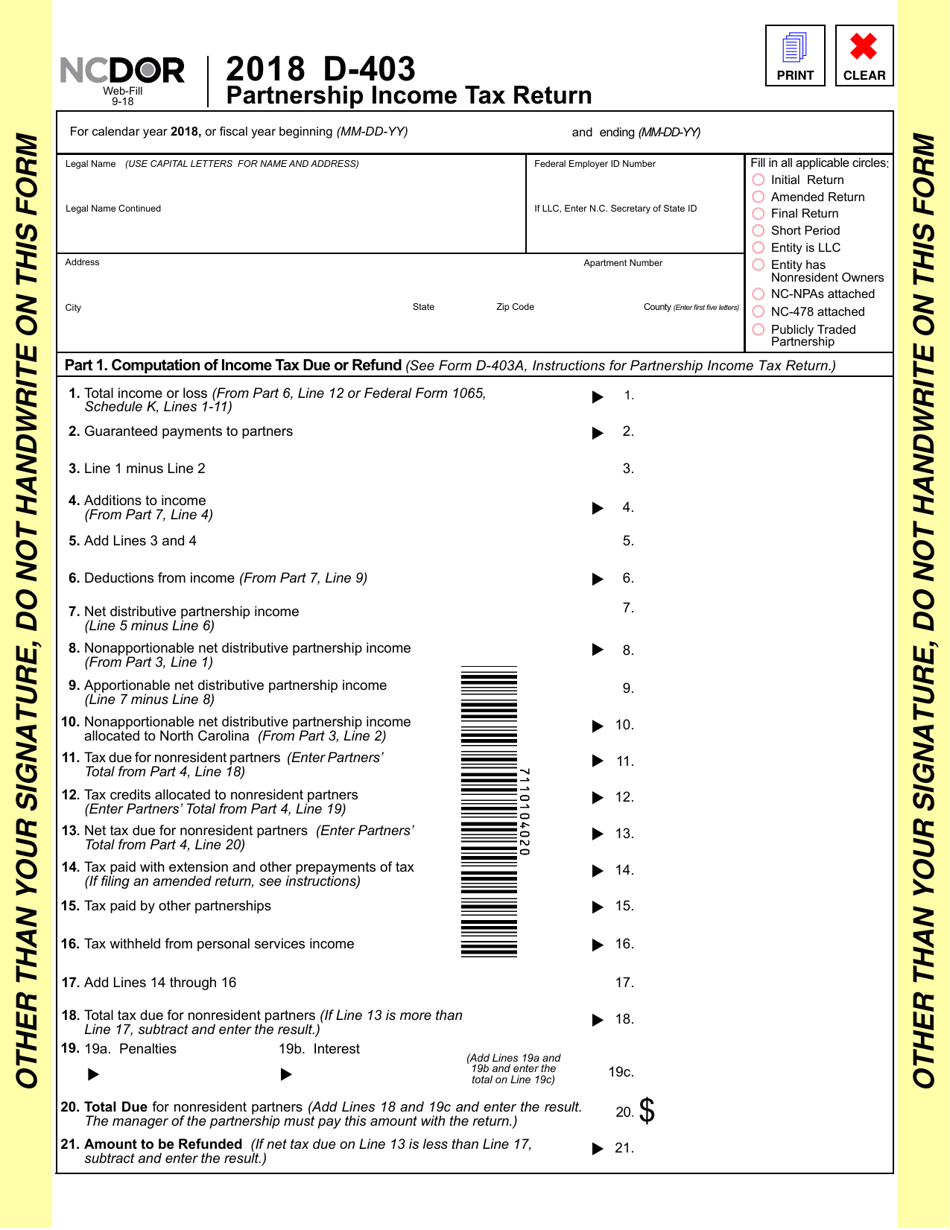

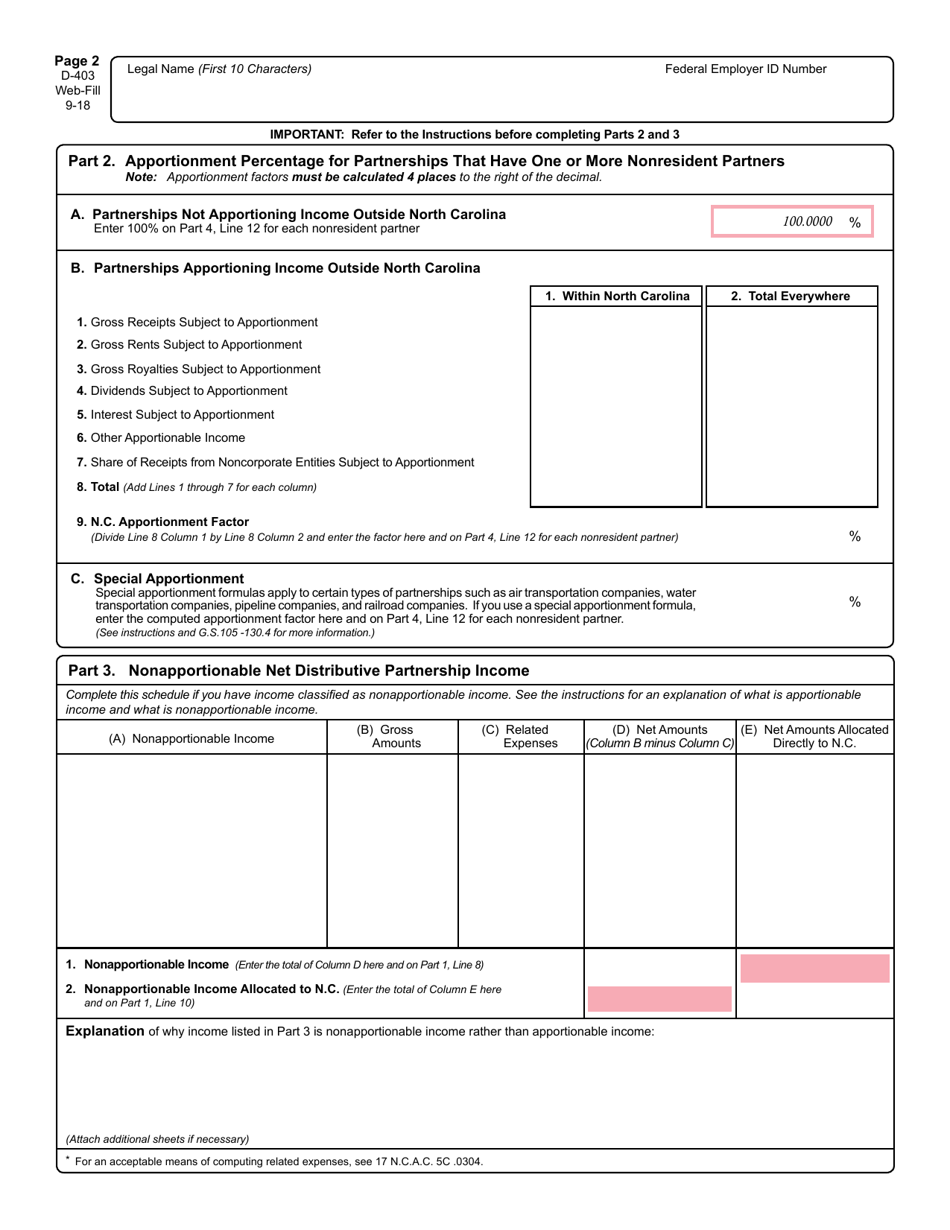

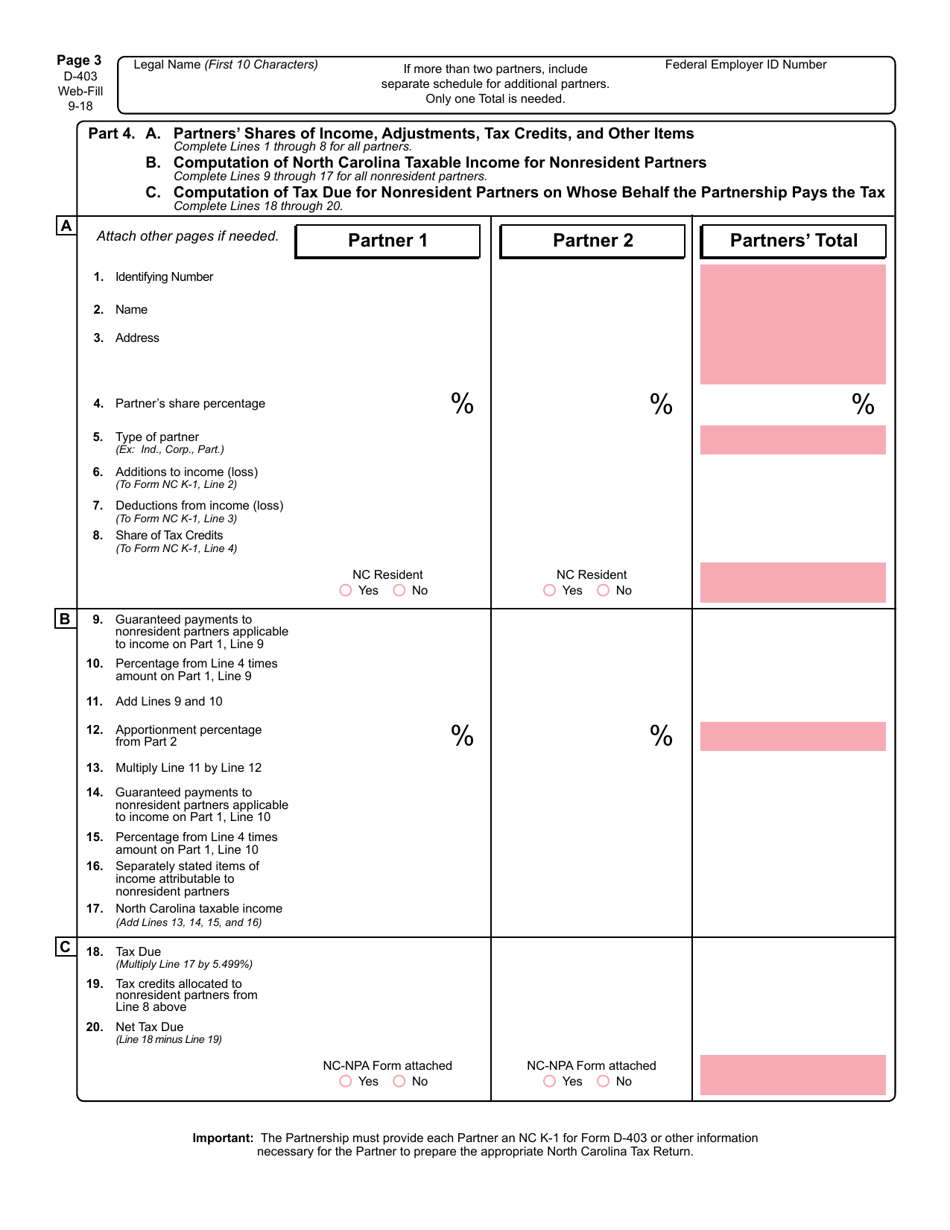

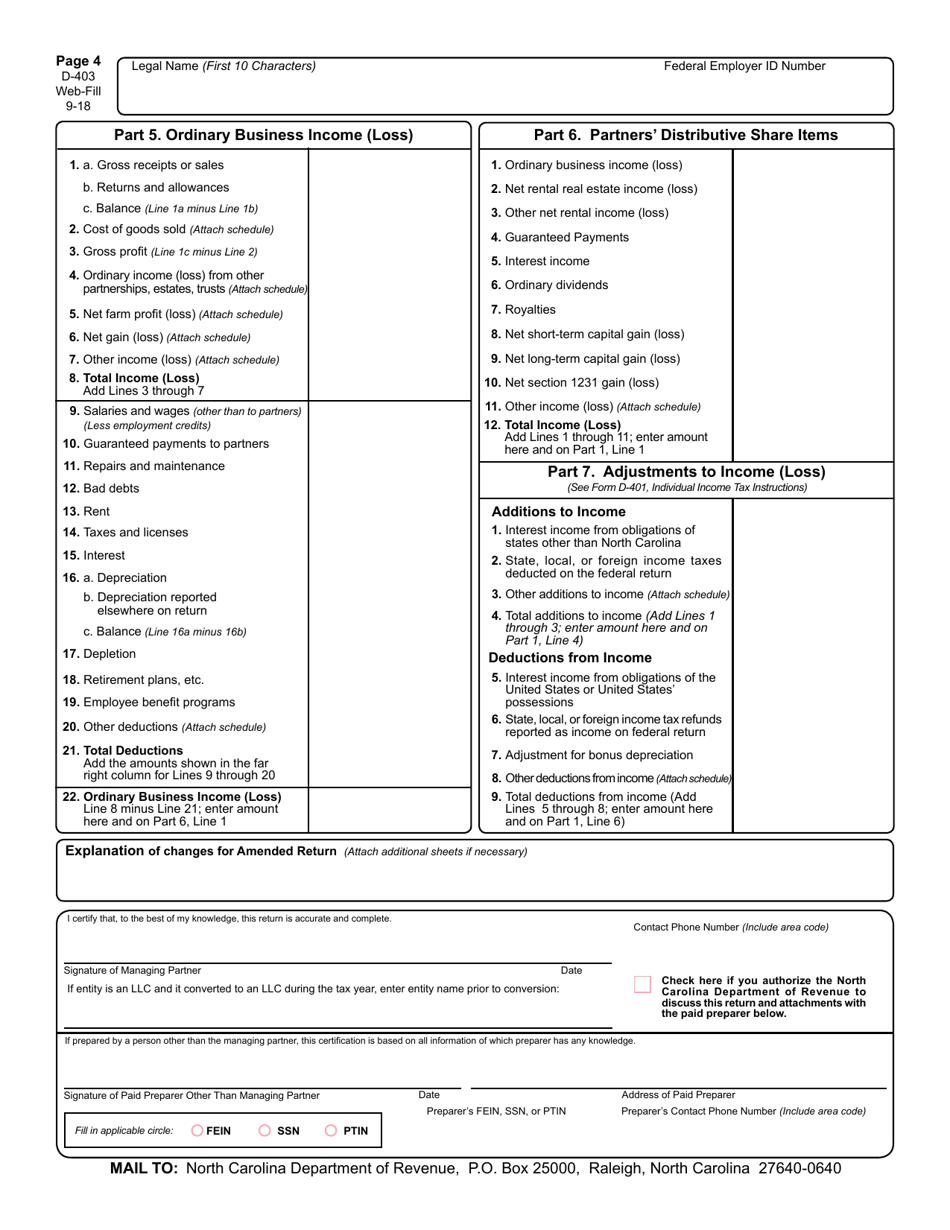

Form D-403 Partnership Income Tax Return - North Carolina

What Is Form D-403?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form D-403?

A: Form D-403 is the Partnership Income Tax Return for the state of North Carolina.

Q: Who needs to file Form D-403?

A: Partnerships in North Carolina need to file Form D-403.

Q: What is the purpose of Form D-403?

A: Form D-403 is used to report partnership income and calculate taxes owed to the state of North Carolina.

Q: What are the filing deadlines for Form D-403?

A: The due date for filing Form D-403 is the 15th day of the fourth month following the end of the partnership's taxable year.

Q: Are there any penalties for late filing of Form D-403?

A: Yes, there are penalties for late filing of Form D-403. It is important to file the return on time to avoid these penalties.

Q: Is there a separate form for partnership income tax in North Carolina?

A: Yes, Form D-403 is the separate form for partnership income tax in North Carolina.

Q: Can I e-file Form D-403?

A: Yes, you can e-file Form D-403 if you meet the requirements set by the North Carolina Department of Revenue.

Q: What supporting documents do I need to attach to Form D-403?

A: You may need to attach federal partnership tax returns and other supporting documents as required by the instructions of Form D-403.

Q: Who can I contact for further assistance regarding Form D-403?

A: For further assistance regarding Form D-403, you can contact the North Carolina Department of Revenue.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

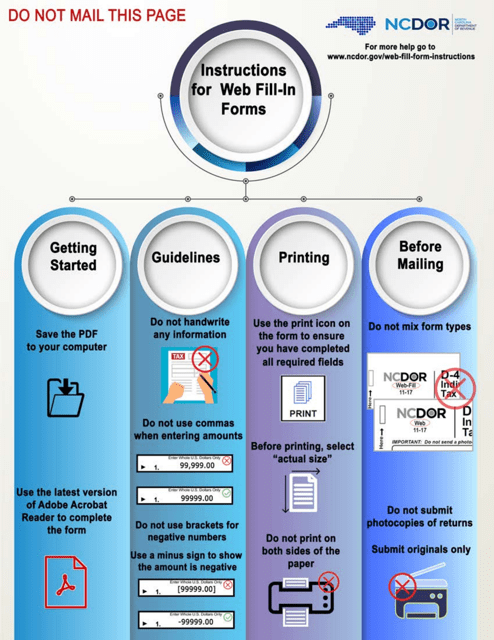

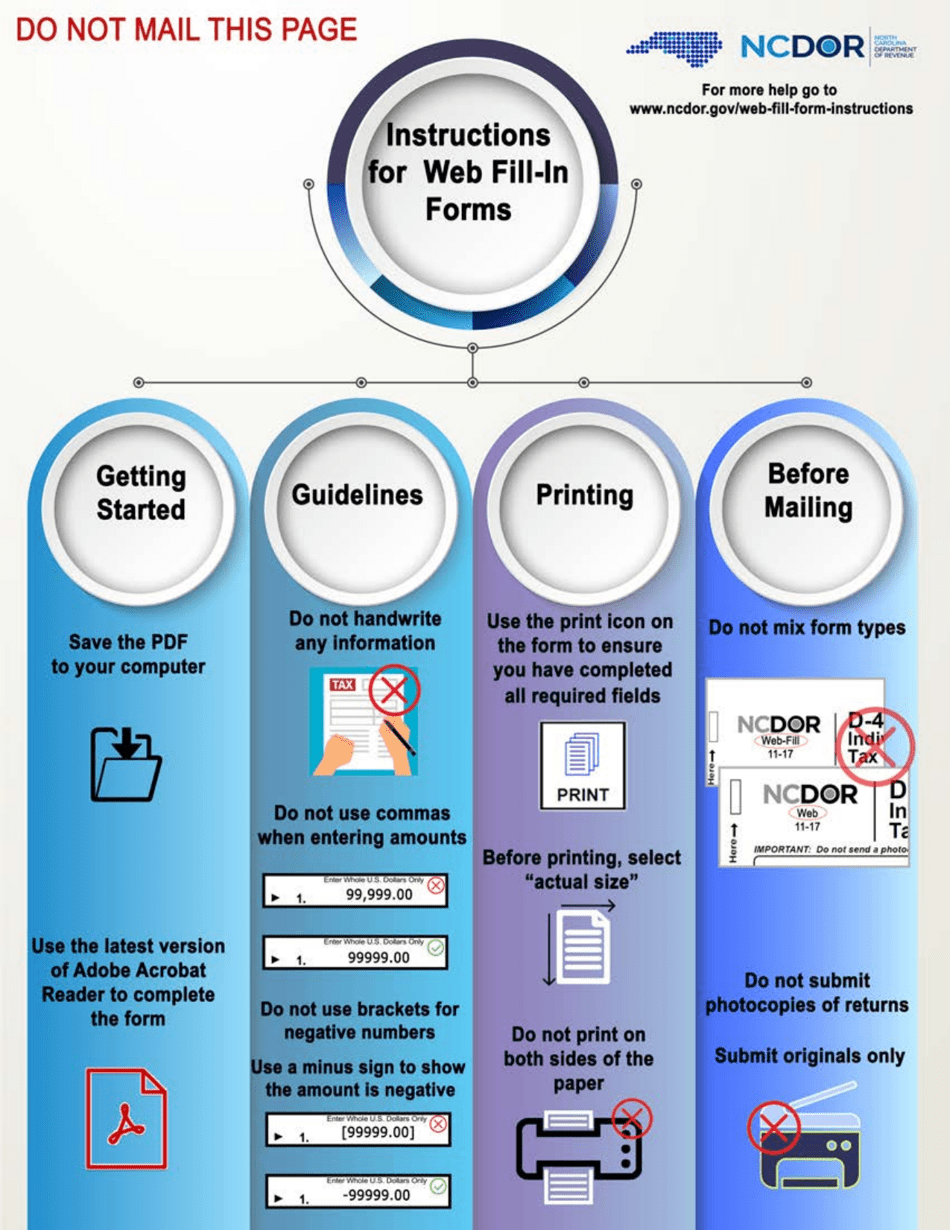

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-403 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.