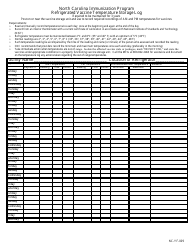

This version of the form is not currently in use and is provided for reference only. Download this version of

Form NC-478

for the current year.

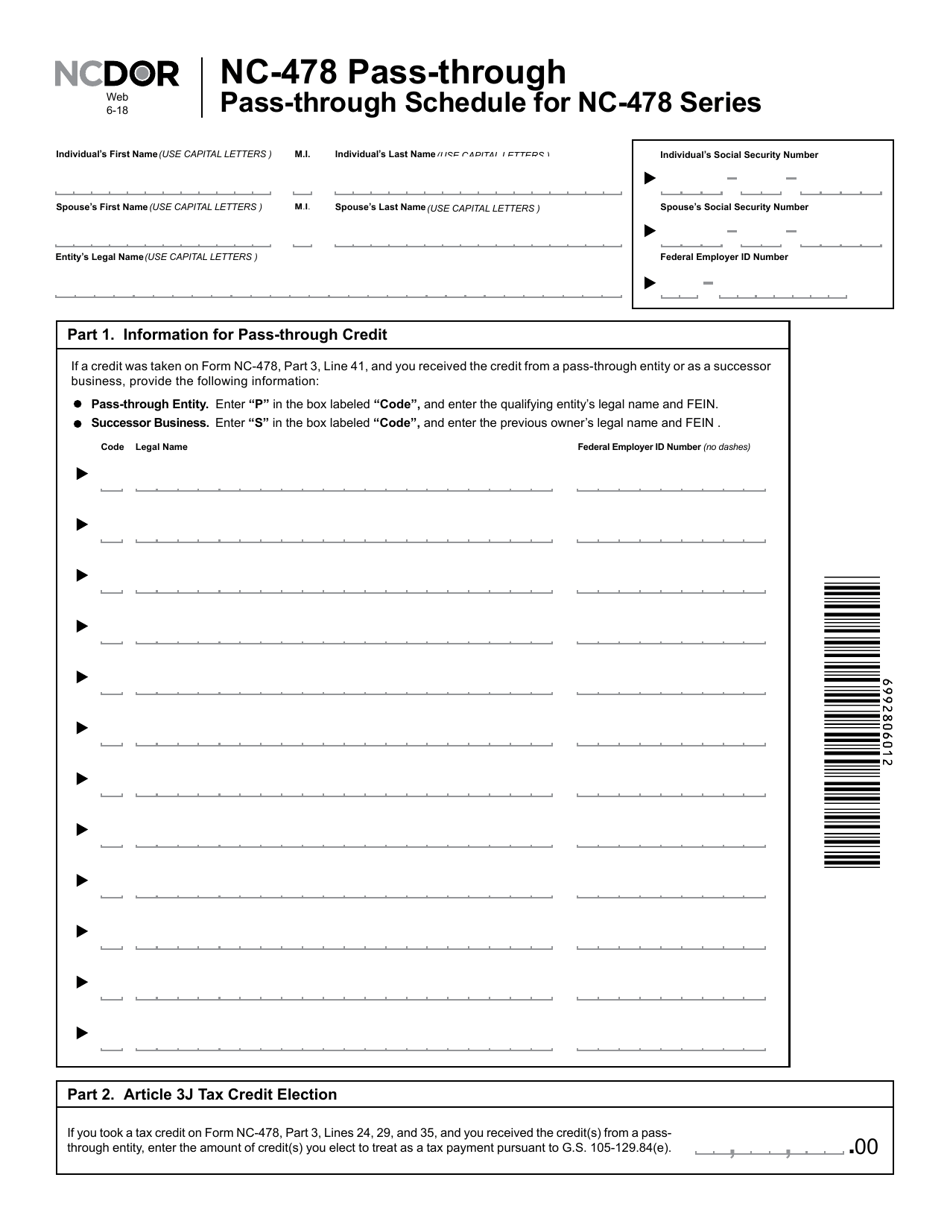

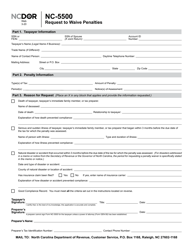

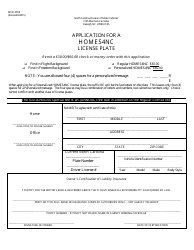

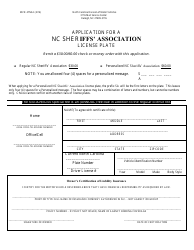

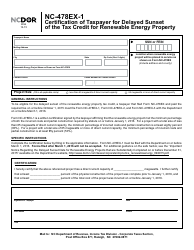

Form NC-478 Pass-Through Schedule for Nc-478 Series - North Carolina

What Is Form NC-478?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NC-478?

A: Form NC-478 is the Pass-Through Schedule for Nc-478 Series in North Carolina.

Q: Who needs to file Form NC-478?

A: Individuals or entities who have income or loss from a partnership, S corporation, estate, or trust.

Q: What is the purpose of Form NC-478?

A: The purpose of Form NC-478 is to report pass-through income and deductions to North Carolina.

Q: What information is required to complete Form NC-478?

A: You will need to provide information on the partnership, S corporation, estate, or trust, including income, deductions, and allocation of income to partners or shareholders.

Q: When is the deadline to file Form NC-478?

A: Form NC-478 is due on or before the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing of Form NC-478?

A: Yes, there may be penalties for late filing or failure to file Form NC-478, so it is important to meet the deadline.

Q: Can Form NC-478 be filed electronically?

A: Yes, Form NC-478 can be filed electronically using the North Carolina Department of Revenue's eFile system.

Q: Is there a fee to file Form NC-478?

A: There is no fee to file Form NC-478, it is a free form.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

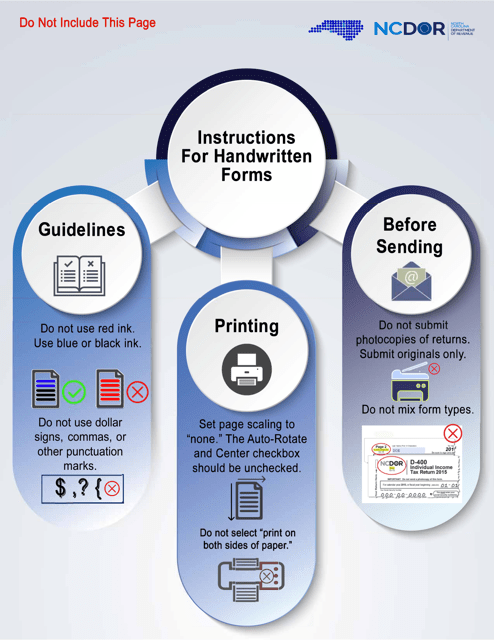

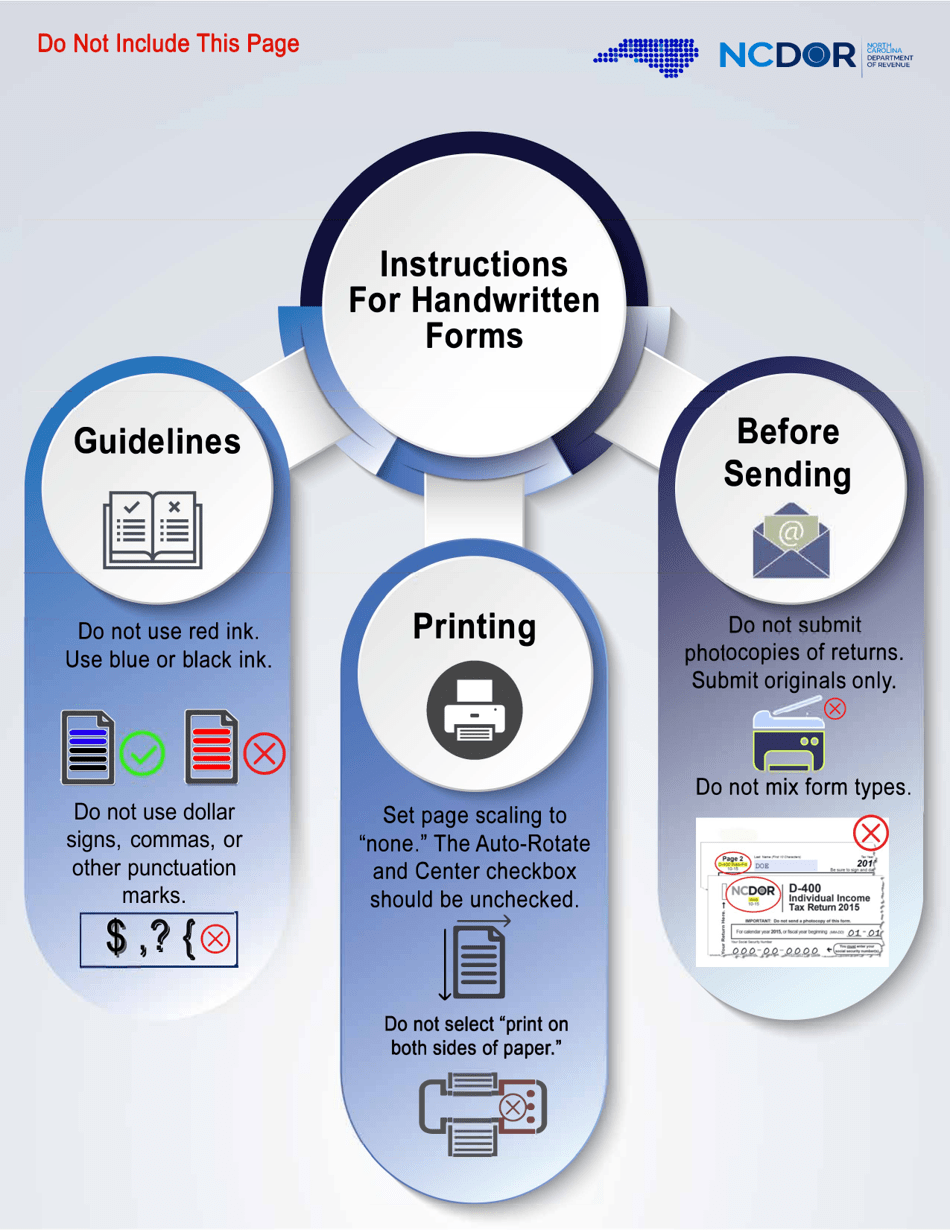

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-478 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.