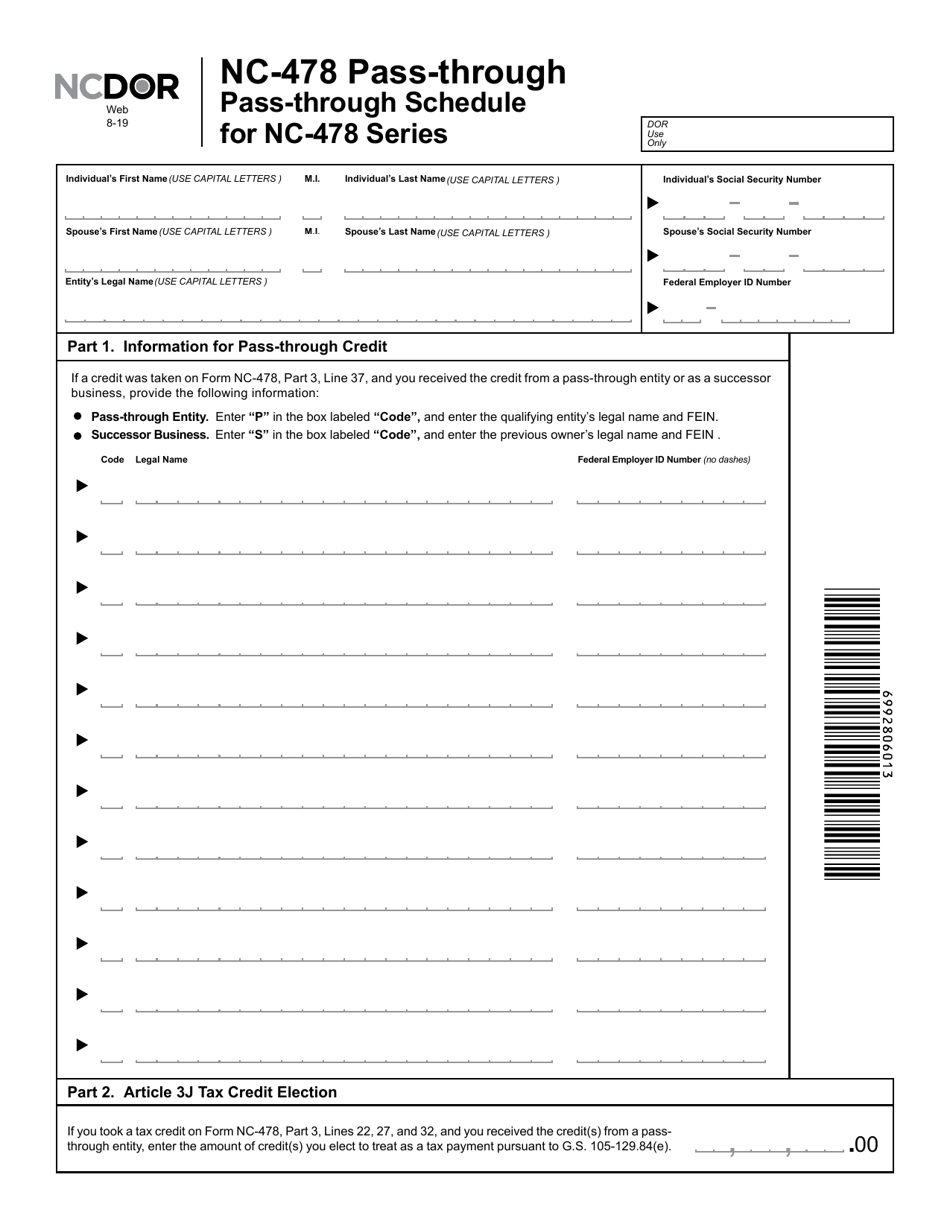

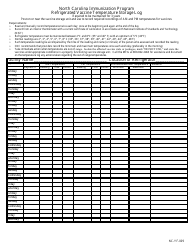

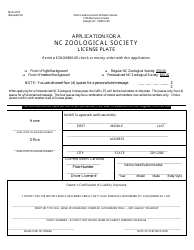

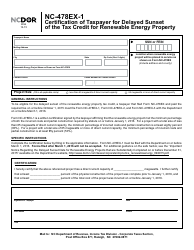

Form NC-478 Pass-Through Schedule for Nc-478 Series - North Carolina

What Is Form NC-478?

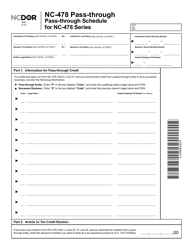

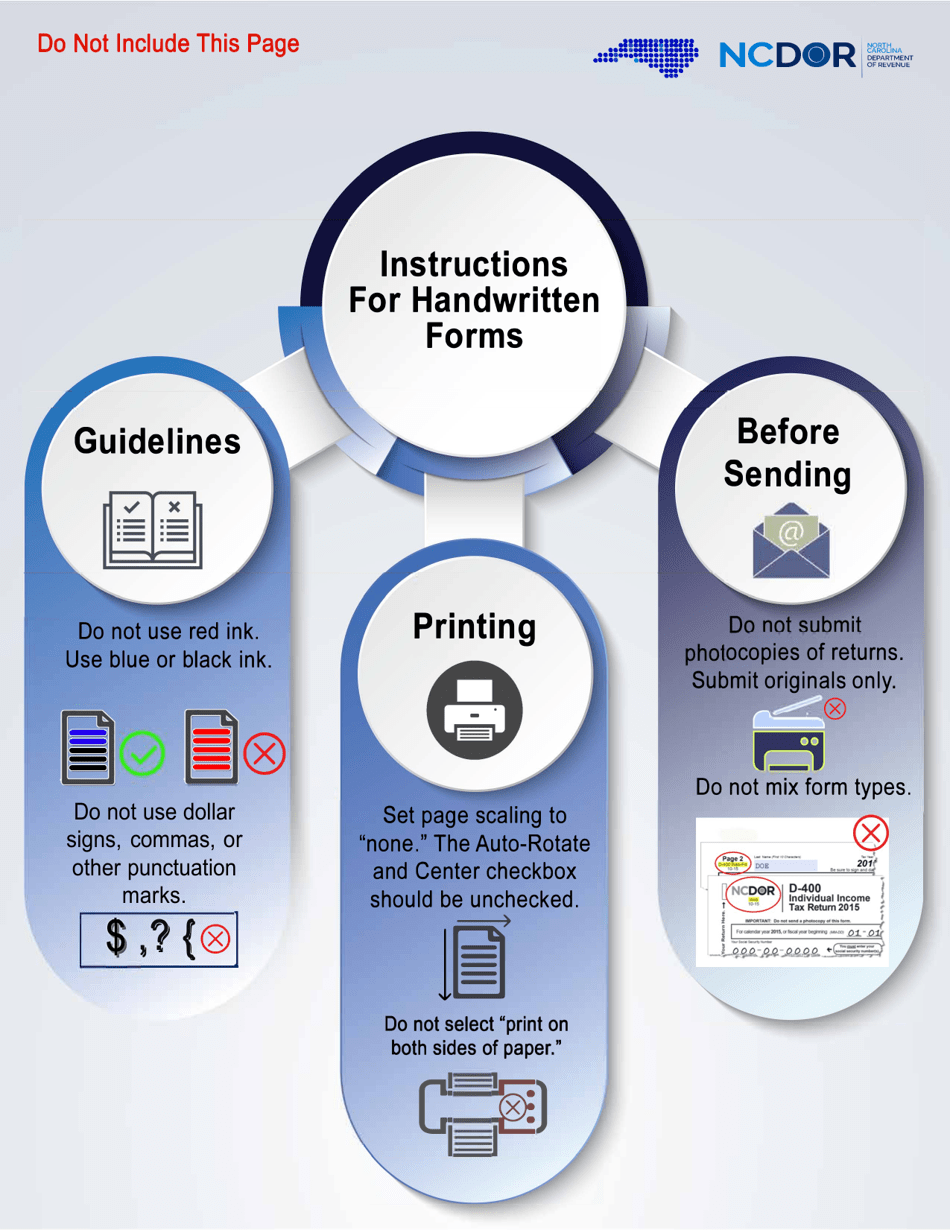

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NC-478?A: Form NC-478 is the Pass-Through Schedule for Nc-478 Series in North Carolina.

Q: What is the purpose of Form NC-478?A: The purpose of Form NC-478 is to report pass-through entity withholding information in North Carolina.

Q: Who needs to file Form NC-478?A: Any pass-through entities that have withholding obligations in North Carolina need to file Form NC-478.

Q: When is the due date for filing Form NC-478?A: The due date for filing Form NC-478 is on or before the 15th day of the 4th month following the close of the entity's taxable year.

Q: Is Form NC-478 accompanied by any other forms?A: Yes, Form NC-478 must be accompanied by copies of the corresponding federal schedules and forms that report the pass-through entity's federal taxable income.

Q: Are there any penalties for late or incorrect filing of Form NC-478?A: Yes, there are penalties for late or incorrect filing of Form NC-478, including possible interest charges and penalties for non-compliance.