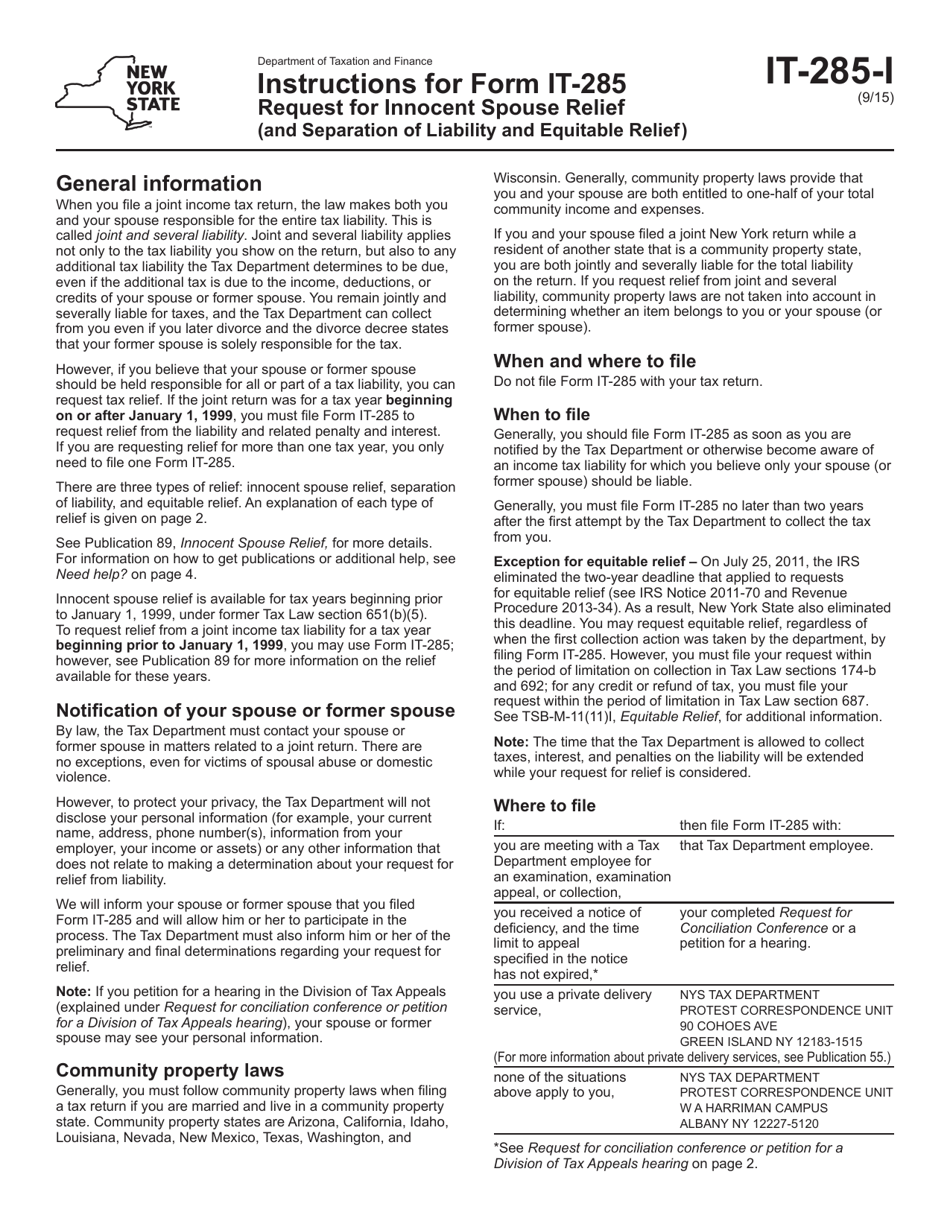

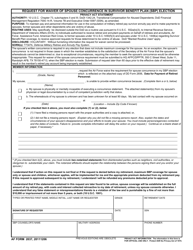

Instructions for Form IT-285 Request for Innocent Spouse Relief (And Separation of Liability and Equitable Relief) - New York

This document contains official instructions for Form IT-285 , Request for Innocent Spouse Relief (And Separation of Liability and Equitable Relief) - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-285 is available for download through this link.

FAQ

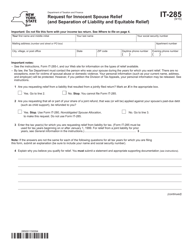

Q: What is Form IT-285?

A: Form IT-285 is a document used to request Innocent Spouse Relief, Separation of Liability, or Equitable Relief in the state of New York.

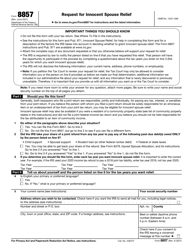

Q: What is Innocent Spouse Relief?

A: Innocent Spouse Relief is a type of tax relief that provides relief from joint tax liabilities when one spouse or former spouse believes they should not be held responsible for the other spouse's share of tax debts.

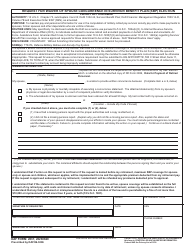

Q: What is Separation of Liability?

A: Separation of Liability is a type of tax relief that allows the allocation of an understatement of tax to the spouse or former spouse who is actually responsible for the liability.

Q: What is Equitable Relief?

A: Equitable Relief is a type of tax relief that provides relief from underpayment of tax or understatement of tax liability when specific requirements are met.

Q: Who can request Innocent Spouse Relief?

A: Either spouse or former spouse who filed a joint tax return may request Innocent Spouse Relief.

Q: Are there any eligibility requirements to qualify for Innocent Spouse Relief?

A: Yes, there are certain eligibility requirements that must be met to qualify for Innocent Spouse Relief. These requirements include showing that you didn't know about the understatement of tax when you signed the joint return, among others.

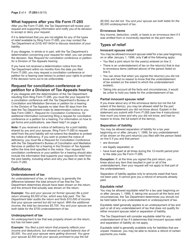

Q: What is the purpose of Form IT-285?

A: The purpose of Form IT-285 is to request Innocent Spouse Relief, Separation of Liability, or Equitable Relief in the state of New York.

Q: Is there a deadline to submit Form IT-285?

A: Yes, Form IT-285 must be filed within two years from the date the New York State Department of Taxation and Finance first attempts to collect the tax from you.

Q: Can I request Innocent Spouse Relief if I am currently married?

A: Yes, you can request Innocent Spouse Relief even if you are currently married.

Q: What supporting documents are required to be submitted with Form IT-285?

A: You will need to submit copies of your federal and state tax returns, as well as any other relevant documents that support your request for relief.

Instruction Details:

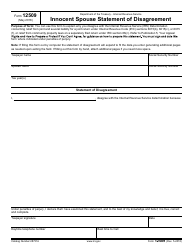

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.